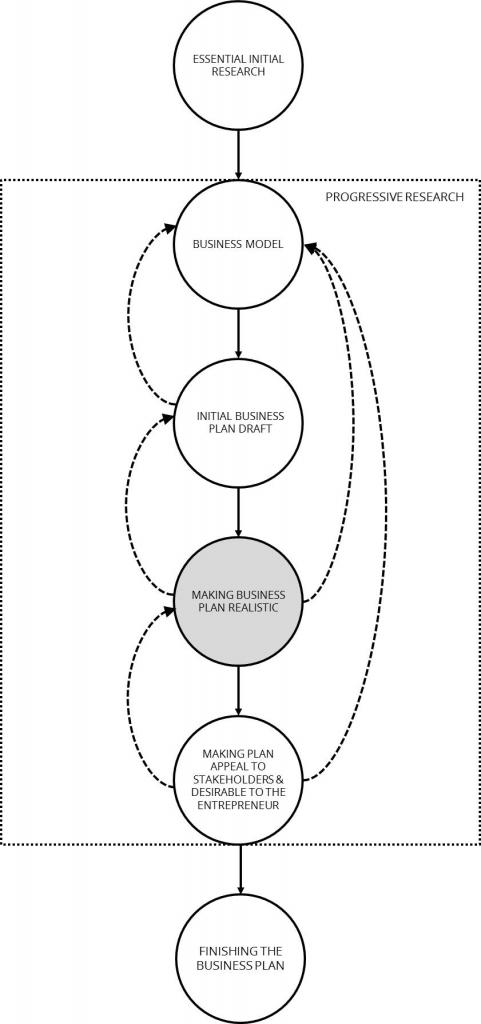

6 Making the Business Plan Realistic

Learning Objectives

After completing this chapter, you will be able to

- Develop the second draft of the business plan by applying revision methods to improve the realism of the first draft

Overview

A first draft of a business plan will inevitably be unrealistic for a host of reasons. It is likely to include contradictions between sections of the written part. The financial and written parts will most likely not align, even though they must tell the same story, but in different terms. The sales projections might be unrealistic. The cash flow projections will probably be far from accurate. In general, work will be required to convert the first draft of the business plan into a realistic second draft.

How to Make the Plan Realistic

Replace Assumptions with Factual and Expert Information

A first step is to replace the assumptions you included in your business plan and flagged with the distinct colored font (review the Writing the Draft Business Plan section) with information you got from a valid source. Of course, to establish your and your business plan’s credibility, always include the references to the sources you used.

Review and Revise Sales Projections

Business plan writers should critically review and revise their sales projections while using the strategies below to improve the realism of the projected financial statements.

When reviewing, and possibly revising sales projections, business plan writers should consider both the sales projection model they used and the assumptions they fed into the model to generate the monthly sales figures. Additionally, it is important to compare the resulting projected sales with industry norms and any available comparative data with similar companies.

Adjust Strategies to Make Projected Financial Statements Realistic

If you used the financial spreadsheet templates as they are meant to be used, you will not have typed a single number into your projected cash flow statements, your projected income statement, and your projected balance sheet. You should have entered all of your numbers into a set of schedules that, in turn, automatically transfer the relevant numbers to the projected statements through formulas.

The cash flow statement estimates all of the money flowing in and out of the venture in each month. The cash inflows include cash collected from cash sales during the month and accounts receivable collections resulting from sales made in previous months. They also include proceeds from any assets you sell, loan proceeds, and other cash investments made into your business.

The cash outflows occur whenever something is purchased, an expense is paid (including loan payments and taxes), and cash is invested somewhere such that it is no longer available to be used to pay current obligations.

The cash available at the end of each month is the previous month’s cash balance plus all cash inflows minus all cash outflows (the exception might be the first month when the initial investments—and, possibly, initial sales—are made, and possibly some expenses are incurred or purchases made). When you complete your first business plan draft, you will inevitably have unrealistic cash balances at the end of some, if not all months.

You can never have a negative cash balance at the end of a month. If you are projecting negative balances, your planned venture cannot survive unless you do things like implement strategies to increase projected sales, seek new investments in your business, and reduce planned operating expenses.

Likewise, an overly high end-of-month cash balance is a signal of possible poor cash management strategies or overly optimistic sales forecasting. Another consideration if your month ending cash balances are high is whether you have applied realistic assumptions. After all, it is very rare to stumble upon a business opportunity that generates high amounts of excess cash. If such an opportunity existed, other entrepreneurs would have or will be poised to enter the market and reduce the appeal of the perceived opportunity.

To eliminate negative cash balances and to manage cash so you don’t have negative or overly positive end-of-month cash balances,

- Determine what range of end-of-month cash balances is realistic for your type of business. For example, you might decide that, for your type of business, they should always be between $8,000 and $12,000.

- Work forward from the first month that the ending balance falls out of that range. To do that, decide how to best manage your cash. You have several options, including the following (but be certain to make your changes in the schedules rather than on the projected statements in your financial spreadsheet templates):

- If you are short of cash, you might be able to increase cash inflows. For example, you could implement strategies (and, of course, include these in the written part of your plan) to increased projected sales at close to current planned prices, maintain projected sales levels while increasing prices, attract new investors to inject some cash in the business, use cash reserves to increase available cash, or to sell an asset that is no longer needed. Of course, you must be aware of the possible consequences from taking those actions. For example, increasing prices will lead to lower sales, and if the amount of the price increase is more than counterbalanced by the drop in sales, you might actually reduce the amount of cash you generate.

- As just noted, new investors can inject cash into the business. For this stage of business plan development, it is often best to focus on making the business plan realistic without worrying too much about where to secure the investments you need to start your business beyond the funding you are reasonably certain that you can get through personal money and from friends, family, and other ready sources (see the section on Starting Capital). Use this stage of development to help you determine the amount of money that you will need to secure from other sources, but adjust your plans and strategies to ensure that the amount of additional financing that you will need is realistic. It is in the next stage of business development that you will more seriously consider from what sources you can get the financing that you determined that you needed while in this stage of development.

- If you are short of cash, you might be able to decrease cash outflows by implementing cost-reduction strategies or reducing or deferring purchases. Again, all of these actions have consequences you must be aware of. For example, if you reduce your advertising expenses, you might suffer a large enough decline in sales to worsen your cash shortfall situation.

- If your projections show high cash balances in some projected high-sales months, some of that cash can be transferred to a cash reserve, used to pay down loans, used to purchase needed assets or to acquire resources to benefit the business, used to prepay expenses, and paid to investors as dividends.

- If projections show cash balances that are higher than is realistic, you should review your sales projections and your projected expenses and make any necessary adjustments to make them more realistic.

If your projected financial spreadsheet templates are set up effectively, your schedules should feed your numbers into your projected cash flow statement. From there, your projected cash flow statements should automatically populate your projected income statement and balance sheet.

Test the Realism of Projected Statements Using Financial Analysis Methods

The first steps to improving overall realism is to make your projected cash flow statement more realistic by (1) replacing as many assumed numbers in your schedules as possible with actual numbers; (2) improving the realism of your planned strategies and sales and other projections, and (3) adjusting your strategies and plans such that all month-end cash balances are within a target range. After that, you need to apply financial analysis methods, like ratio analysis, on the numbers in all of your financial statements to assess the realism of your numbers against industry standards and similar companies for which financial statements are available. That analysis should lead to further strategy adjustments to improve the realism of the planned financial positions for your venture during its first five years of business.

Synchronize the Written and Financial Parts of the Plan

Finally, you will need to rewrite parts of your operations, human resources, and marketing plans—and possibly the written introduction to your financial plan—to reflect all of the changes you made and to ensure that the written part of your business plan tells exactly the same story as does the financial part.

Chapter Summary

This chapter addressed the issue of making the first draft of the business plan realistic. To do so, replace as many of your assumptions as possible with factual and expert information, all properly referenced from valid sources to build and maintain your and your plan’s credibility. After that, review and revise the original sales projections to make them more realistic as informed by industry data and available numbers from companies similar to what you want your venture to be. Revise your strategies until all of the monthly closing balances in your cash flow statement fall within a realistic, reasonable, and predetermined target range. Perform financial analysis techniques to test the realism of your projected financial situation. Finally, rewrite your business plan so that the written and financial sections tell exactly the same story—one using words and the other using numbers.