1 Introduction to Entrepreneurship

Learning Objectives

After completing this chapter you will be able to

- Examine the challenges associated with defining the concepts of entrepreneur and entrepreneurship

- Discuss how the evolution of entrepreneurship thought has influenced how we view the concept of entrepreneurship today

- Discuss how the list of basic questions in entrepreneurship research can be expanded to include research inquiries that are important in today’s world

- Discuss how the concepts of entrepreneurial uniqueness, entrepreneurial personality traits, and entrepreneurial cognitions can help society improve its support for entrepreneurship

- Apply the general venturing script to the study of entrepreneurship

The business world is often equated to an ecosystem: the environment is comprised of interacting organizations and individuals much like the biological ecosystem (Moore, 1993). Entrepreneurship is no different, as it can be thought of as its own ecosystem, with new ventures being created, maturing, needing to adapt, or becoming extinct. Much like the biological ecosystem, in the entrepreneurial ecosystem, change occurs and gives rise to opportunity or presents challenges. It is important to consider the various levels of the ecosystem when evaluating the entrepreneurial environment. For example, the ecosystems can be analyzed at a macro level such as the terrestrial ecosystem in biology or the national economy in entrepreneurship. Additionally, ecosystems can be analyzed at more micro levels like the rain forest ecosystem in biology or the firm level in entrepreneurship.

Whilst there is no universally accepted definition of entrepreneurship, it is fair to say that it is multi-dimensional. It involves analyzing people and their actions together with the ways in which they interact with their environments, be these social, economic, or political, and the institutional, policy, and legal frameworks that help define and legitimize human activities. [1]

It is complex, chaotic, and lacks any notion of linearity. As educators, we have the responsibility to develop our students’ discovery, reasoning, and implementation skills so they may excel in highly uncertain environments. [2]

Overview

This chapter provides you with an overview of entrepreneurship and of the language of entrepreneurship. The challenges associated with defining entrepreneur and entrepreneurship are explored, as is an overview of how entrepreneurship can be studied.

The objective is to enable you to apply current concepts in entrepreneurship to the evaluation of entrepreneurs, their ventures, and the venturing environment. You will develop skills, including the capability to add value in the new venture sector of the economy. You will acquire and practice evaluation skills useful in consulting, advising, and making new venture decisions.

Entrepreneurs and Entrepreneurship

Considerations Influencing Definitions of Entrepreneur and Entrepreneurship

It is necessary to be able to determine exactly who entrepreneurs are before we can, among other things, study them, count them, provide special loans for them, and calculate how and how much they contribute to our economy.

- Does someone need to start a business from scratch to be called an entrepreneur?

- Can we call someone an entrepreneur if they bought an ongoing business from someone else or took over the operations of a family business from their parents?

- If someone starts a small business and never needs to hire employees, can they be called an entrepreneur?

- If someone buys a business but hires professional managers to run it so they don’t have to be involved in the operations, are they an entrepreneur?

- Is someone an entrepreneur if they buy into a franchise so they can follow a well-established formula for running the operation?

- Is someone an entrepreneur because of what they do or because of how they think?

- Can someone be an entrepreneur without owning their own business?

- Can a person be an entrepreneur because of the nature of the work that they do within a large corporation?

It is also necessary to fully understand what we mean by entrepreneurship before we can study the concept.

Gartner[3] identified 90 attributes that showed up in definitions of entrepreneurs and entrepreneurship provided by entrepreneurs and other experts in the field. The following are a few of these attributes:

- Innovation – Does a person need to be innovative to be considered an entrepreneur? Can an activity be considered to be entrepreneurial if it is not innovative?

- Activities – What activities does a person need to do to be considered an entrepreneur?

- Creation of a new business – Does someone need to start a new business to be considered to be an entrepreneur, or can someone who buys a business, buys into a franchise, or takes over an existing family business be considered an entrepreneur?

- Starts an innovative venture within an established organization – Can someone who works within an existing organization that they don’t own be considered an entrepreneur if they start an innovative venture for their organization?

- Creation of a not-for-profit business – Can a venture be considered to be entrepreneurial if it is a not-for-profit, or should only for-profit businesses be considered entrepreneurial?

After identifying the 90 attributes, Gartner[4]went back to the entrepreneurs and other experts for help in clustering the attributes into themes that would help summarize what people concerned with entrepreneurship thought about the concept. He ended up with the following eight entrepreneurship themes:

1. The Entrepreneur – The entrepreneur theme is the idea that entrepreneurship involves individuals with unique personality characteristics and abilities (e.g., risk-taking, locus of control, autonomy, perseverance, commitment, vision, creativity). Almost 50% of the respondents rated these characteristics as not important to a definition of entrepreneurship.[5]

“The question that needs to be addressed is: Does entrepreneurship involve entrepreneurs (individuals with unique characteristics)?”[6]

2. Innovation – The innovation theme is characterized as doing something new as an idea, product, service, market, or technology in a new or established organization. The innovation theme suggests that innovation is not limited to new ventures, but recognized as something which older and/or larger organizations may undertake as well (Gartner, 1990, p. 25). Some of the experts Gartner questioned believed that it was important to include innovation in definitions of entrepreneurship and others did not think it was as important.

“Does entrepreneurship involve innovation?”[7]

3. Organization Creation – The organization creation theme describes the behaviors involved in creating organizations. This theme described acquiring and integrating resource attributes (e.g., Brings resources to bear, integrates opportunities with resources, mobilizes resources, gathers resources) and attributes that described creating organizations (new venture development and the creation of a business that adds value).[8]

“Does entrepreneurship involve resource acquisition and integration (new venture creation activities)?”[9]

4. Creating Value – This theme articulated the idea that entrepreneurship creates value. The attributes in this factor indicated that value creation might be represented by transforming a business, creating a new business growing a business, creating wealth, or destroying the status quo.

“Does entrepreneurship involve creating value?”[10]

5. Profit or Nonprofit

“Does entrepreneurship involve profit-making organizations only?” [11]

6. Growth

Should a focus on growth be a characteristic of entrepreneurship?

7. Uniqueness – This theme suggested that entrepreneurship must involve uniqueness. Uniqueness was characterized by attributes such as a special way of thinking, a vision of accomplishment, ability to see situations in terms of unmet needs, and creates a unique combination.

“Does entrepreneurship involve uniqueness?”[12]

8. The Owner-Manager – Some of the respondents questioned by Gartner did not believe that small mom-and-pop types of businesses should be considered to be entrepreneurial. Some respondents felt that an important element of a definition of entrepreneurship was that a venture be owner-managed.

To be entrepreneurial, does a venture need to be owner-managed?

Examples of Definitions of Entrepreneur

An entrepreneur can be described as “one who creates a new business in the face of risk and uncertainty for the purpose of achieving profit and growth by identifying significant opportunities and assembling the necessary resources to capitalize on them”. [13]

An entrepreneur is “one who organizes, manages, and assumes the risks of a business or enterprise”.[14]

Examples of Definitions of Entrepreneurship

Entrepreneurship can be defined as a field of business that “seeks to understand how opportunities to create something new (e.g., new products or services, new markets, new production processes or raw materials, new ways of organizing existing technologies) arise and are discovered or created by specific persons, who then use various means to exploit or develop them, thus producing a wide range of effects”[15]

A concise definition of entrepreneurship “is that it is the process of pursuing opportunities without limitation by resources currently in hand”[16] and “the process of doing something new and something different for the purpose of creating wealth for the individual and adding value to society”[17]

The Evolution of Entrepreneurship Thought

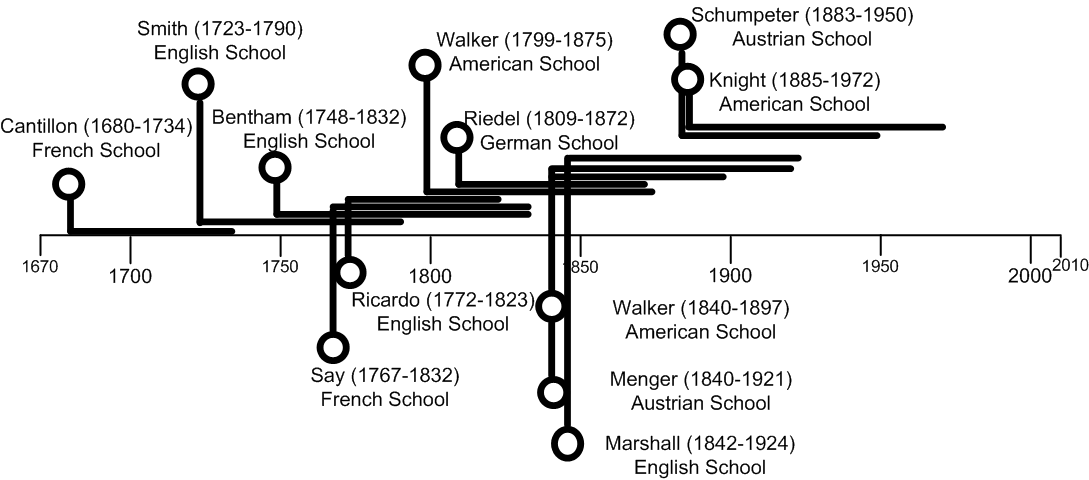

This section includes an overview of how entrepreneurship has evolved to the present day. The following timeline shows some of the most influential entrepreneurship scholars and the schools of thought (French, English, American, German, and Austrian) their perspectives helped influence and from which their ideas evolved. Schools of thought are essentially groups of people who might or might not have personally known each other, but who shared common beliefs or philosophies.

The Earliest Entrepreneurship

The function, if not the name, of the entrepreneur is probably as old as the institutions of barter and exchange. But only after economic markets became an intrusive element of society did the concept take on pivotal importance. Many economists have recognized the pivotal role of the entrepreneur in a market economy. Yet despite his central importance in economic activity, the entrepreneur has been a shadowy and elusive figure in the history of economic theory.[18]

Historically those who acted similarly to the ways we associate with modern day entrepreneurs – namely those who strategically assume risks to seek economic (or other) gains – were military leaders, royalty, or merchants. Military leaders planned their campaigns and battles while assuming significant risks, but by doing so they also stood to gain economic benefits if their strategies were successful. Merchants, like Marco Polo who sailed out of Venice in the late 1200s to search for a trade route to the Orient, also assumed substantial risks in the hope of becoming wealthy. [19]

The entrepreneur, who was also called adventurer, projector, and undertaker during the eighteenth century, was not always viewed in a positive light. [20]

Development of Entrepreneurship as a Concept

Risk and Uncertainty

Richard Cantillon (1680-1734) was born in France and belonged to the French School of thought although he was an Irish economist. He appears to be the person who introduced the term entrepreneur to the world. “According to Cantillon, the entrepreneur is a specialist in taking on risk, ‘insuring’ workers by buying their output for resale before consumers have indicated how much they are willing to pay for it”. [21] The workers’ incomes are mostly stable, but the entrepreneur risks a loss if market prices fluctuate.

Cantillon distinguished entrepreneurs from two other classes of economic agents; landowners, who were financially independent, and hirelings (employees) who did not partake in the decision-making in exchange for relatively stable incomes through employment contracts. He was the first writer to provide a relatively refined meaning for the term entrepreneurship. Cantillon described entrepreneurs as individuals who generated profits through exchanges. In the face of uncertainty, particularly over future prices, they exercise business judgment. They purchase resources at one price and sell their product at a price that is uncertain, with the difference representing their profit.[22]

Farmers were the most prominent entrepreneurs during Cantillon’s lifetime, and they interacted with “arbitrageurs” – or middlemen between farmers and the end consumers – who also faced uncertain incomes, and who were also, therefore, entrepreneurs. These intermediaries facilitated the movement of products from the farms to the cities where more than half of the farm output was consumed. Cantillon observed that consumers were willing to pay a higher price per unit to be able to purchase products in the smaller quantities they wanted, which created the opportunities for the intermediaries to make profits. Profits were the rewards for assuming the risks arising from uncertain conditions. The markets in which profits were earned were characterized by incomplete information.[23]

Adolph Reidel (1809-1872), form the German School of thought, picked up on Cantillon’s notion of uncertainty and extended it to theorize that entrepreneurs take on uncertainty so others, namely income earners, do not have to be subject to the same uncertainty. Entrepreneurs provide a service to risk-averse income earners by assuming risk on their behalf. In exchange, entrepreneurs are rewarded when they can foresee the impacts of the uncertainty and sell their products at a price that exceeds their input costs (including the fixed costs of the wages they commit to paying).[24]

Frank Knight (1885-1972) founded the Chicago School of Economics and belonged to the American School of thought. He refined Cantillon’s perspective on entrepreneurs and risk by distinguishing insurable risk as something that is separate from uncertainty, which is not insurable. Some risks can be insurable because they have occurred enough times in the past that the expected loss from such risks can be calculated. Uncertainty, on the other hand, is not subject to probability calculations. According to Knight, entrepreneurs can’t share the risk of loss by insuring themselves against uncertain events, so they bear these kinds of risks themselves, and profit is the reward that entrepreneurs get from assuming uninsurable risks.[25]

Distinction Between Entrepreneur and Manager

Jean-Baptiste Say (1767-1832), also from the French School, advanced Cantillon’s work, but added that entrepreneurship was essentially a form of management. Say “put the entrepreneur at the core of the entire process of production and distribution” (Hebert & Link, 2009, p. 17). Say’s work resulted in something similar to a general theory of entrepreneurship with three distinct functions; “scientific knowledge of the product; entrepreneurial industry – the application of knowledge to useful purpose; and productive industry – the manufacture of the item by manual labour.”[26]

Frank Knight made several contributions to entrepreneurship theory, but another of note is how he distinguished an entrepreneur from a manager. He suggested that a manager crosses the line to become an entrepreneur “when the exercise of his/her judgment is liable to error and s/he assumes the responsibility for its correctness” (Chell, 2008, p. 33). Knight said that entrepreneurs calculate the risks associated with uncertain business situations and make informed judgments and decisions with the expectation that – if they assessed the situation and made the correct decisions – they would be rewarded by earning a profit. Those who elect to avoid taking these risks choose the relative security of being employees.[27]

Alfred Marshall (1842-1924), from the English School of thought, was one of the founders of neoclassical economics. His research involved distinguishing between the terms capitalist, entrepreneur, and manager. Marshall saw capitalists as individuals who “committed themselves to the capacity and honesty of others, when he by himself had incurred the risks for having contributed with the capital”.[28] An entrepreneur took control of money provided by capitalists in an effort to leverage it to create more money; but would lose less if something went wrong then would the capitalists. An entrepreneur, however, risked his own reputation and the other gains he could have made by pursuing a different opportunity.

Let us suppose that two men are carrying on smaller businesses, the one working with his own, the other chiefly with borrowed capital. There is one set of risks which is common to both; which may be described as the trade risks of the particular business … But there is another set of risks, the burden of which has to be borne by the man working with borrowed capital, and not by the other; and we may call them personal risks.[29]

Marshall recognized that the reward capitalists received for contributing capital was interest income and the reward entrepreneurs earned was profits. Managers received a salary and, according to Marshall, fulfilled a different function than either capitalists or entrepreneurs – although in some cases, particularly in smaller firms, one person might be both an entrepreneur and a manager. Managers “were more inclined to avoid challenges, innovations and what Schumpeter called the ‘perennial torment of creative destruction’ in favour of a more tranquil life”. [30]The main risks they faced from firm failure were to their reputations or to their employment status. Managers had little incentive to strive to maximize profits .footnote](Zaratiegui & Rabade, 2005).[/footnote]

Amasa Walker (1799-1875) and his son Francis Walker (1840-1897) were from the American School of thought, and they helped shape an American perspective of entrepreneurship following the Civil War of 1861-1865. These scholars claimed that entrepreneurs created wealth, and thus played a different role than capitalists. They believed that entrepreneurs had the power of foresight and leadership qualities that enabled them to organize resources and inject energy into activities that create wealth.[31]

Entrepreneurship versus Entrepreneur

Adam Smith (1723-1790), from the English School of thought, published An Inquiry into the Nature and Causes of the Wealth of Nations in 1776. In a departure from the previous thought into entrepreneurship and economics, Smith did not dwell on a particular class of individual. He was concerned with studying how all people fit into the economic system. Smith contended that the economy was driven by self-interest in the marketplace.[32]

Also from the English School, David Ricardo (1772-1823) was influenced by Smith, Say, and others. His work focused on how the capitalist system worked. He explained how manufacturers must invest their capital in response to the demand for the products they produce. If demand decreases, manufacturers should borrow less and reduce their workforces. When demand is high, they should do the reverse. [33].

Carl Menger (1840-1921), from the Austrian School of thought, ranked goods according to their causal connections to human satisfaction. Lower order goods include items like bread that directly satisfy a human want or need like hunger. Higher order goods are those more removed from satisfying a human need. A second order good is the flour that was used to make the bread. The grain used to make the flour is an even higher order good. Entrepreneurs coordinate these factors of production to turn higher order goods into lower order goods that more directly satisfy human wants and needs. [34]

Menger[35] established that entrepreneurial activity includes: (a) obtaining information about the economic situation, (b) economic calculation – all the various computations that must be made if a production process is to be efficient, (c) the act of will by which goods of higher order are assigned to a particular production process, and (d) supervising the execution of the production plan so that it may be carried through as economically as possible.[36]

Entrepreneurship and Innovation

Jeremy Bentham (1748-1832), from the English School of thought, considered entrepreneurs to be innovators. They “depart from routine, discover new markets, find new sources of supply, improve existing products and lower the costs of production”.[37]

Joseph Schumpeter’s (1883-1950) parents were Austrian, he studied at the University of Vienna, conducted research at the University of Graz, served as Austria’s Minister of Finance, and was the president of a bank in the country. Because of the rise of Hitler in Europe, he went to the United States and conducted research at Harvard until he retired in 1949. Because of this, he is sometimes associated with the American School of thought on entrepreneurship.[38]

Whereas Menger saw entrepreneurship as occurring because of economic progress, Schumpeter took the opposite stance. Schumpeter saw economic activity as leading to economic development.[39] Entrepreneurs play a central role in Schumpeter’s theory of economic development, and economic development can occur when the factors of production are assembled in new combinations.

Schumpeter (1934) viewed innovation as arising from new combinations of materials and forces. He provided the following five cases of new combinations.

- The introduction of a new good – that is one with which consumers are not yet familiar – or of a new quality of good.

- The introduction of a new method of production, that is one not yet tested by experience in the branch of manufacture concerned, which need by no means be founded upon a discovery scientifically new, and can also exist in a new way of handling a commodity commercially.

- The opening of a new market, that is a market into which the particular branch of manufacture of the country in question has not previously entered, whether or not this market has existed before.

- The conquest of a new source of supply of raw materials or half-manufactured goods, again irrespective of whether this source already exists or whether it has first to be created.

- The carrying out of the new organisation of any industry, like the creation of a monopoly position … or the breaking up of a monopoly position (Schumpeter, 1934, p. 66).

Another concept popularized by Schumpeter – in addition to the notion of new combinations – was creative destruction. This was meant to indicate that the existing ways of doing things need to be dismantled – to be destroyed – to enable a transformation through innovation to a new way of doing things. Entrepreneurs use innovation to disrupt how things are done and to establish a better way of doing those things.

Basic Questions in Entrepreneurship Research

According to Baron[40], there are three basic questions of interest in the field of entrepreneurship:

- Why do some persons but not others choose to become entrepreneurs?

- Why do some persons but not others recognize opportunities for new products or services that can be profitably exploited?

- Why are some entrepreneurs so much more successful than others?[41]

To understand where these foundational research questions came from and what their relevance is today, it is useful to study what entrepreneurship research has uncovered so far.

Entrepreneurial Uniqueness

Efforts to teach entrepreneurship have included descriptions of entrepreneurial uniqueness based on personality, behavioural, and cognitive traits.[42]

- Personality characteristics

- Three personality characteristics of entrepreneurs that are often cited are:

- Need for achievement

- Internal locus of control (a belief by an individual that they are in control of their own destiny)

- Risk-taking propensity

- Three personality characteristics of entrepreneurs that are often cited are:

- Behavioural traits

- Cognitive skills of successful entrepreneurs

Past studies of personality characteristics and behavioural traits have not been overly successful at identifying entrepreneurial uniqueness.

As it turned out, years of painstaking research along this line has not borne significant fruit. It appears that there are simply not any personality characteristics that are either essential to, or defining of, entrepreneurs that differ systematically from non-entrepreneurs…. Again, investigators proposed a number of behavioural candidates as emblematic of entrepreneurs. Unfortunately, this line of research also resulted in a series of dead ends as examples of successful entrepreneurial behaviours had equal counterparts among samples of non-entrepreneurs. As with the personality characteristic school of thought before it, the behavioural trait school of thought became increasingly difficult to support.[43]

This shed doubt on the value of trying to change personality characteristics or implant new entrepreneurial behaviours through educational programs in an effort to promote entrepreneurship.

New research, however, has resurrected the idea that there might be some value in revisiting personality traits as a topic of study. Additionally, Duening and has suggested that an important approach to teaching and learning about entrepreneurship is to focus on the “cognitive skills that successful entrepreneurs seem uniquely to possess and deploy”.[44]In the next sections we consider the new research on entrepreneurial personality traits and on entrepreneurial cognitions.

Entrepreneurial Personality Traits

While acknowledging that research had yet to validate the value of considering personality and behaviour traits as ways to distinguish entrepreneurs from non-entrepreneurs or unsuccessful ones, Chell suggested that researchers turn their attention to new sets of traits including: “the proactive personality, entrepreneurial self-efficacy, perseverance and intuitive decision-making style. Other traits that require further work include social competence and the need for independence”. [45]

In more recent years scholars have considered how the Big Five personality traits – extraversion, agreeableness, conscientiousness, neuroticism (sometimes presented as emotional stability), and openness to experience (sometimes referred to as intellect) – might be used to better understand entrepreneurs. It appears that the Big Five traits might be of some use in predicting entrepreneurial success. Research is ongoing in this area, but in one example, Caliendo, Fossen, and Kritikos[46] studied whether personality constructs might “influence entrepreneurial decisions at different points in time”[47], and found that “high values in three factors of the Big Five approach—openness to experience, extraversion, and emotional stability (the latter only when we do not control for further personality characteristics)—increase the probability of entry into self-employment”.[48]. They also found “that some specific personality characteristics, namely risk tolerance, locus of control, and trust, have strong partial effects on the entry decision”.[49]They also found that people who scored higher on agreeableness were more likely to exit their businesses, possibly meaning that people with lower agreeableness scores might prevail longer as entrepreneurs. When it came to specific personality traits, their conclusions indicated that those with an external locus of control were more likely to stop being self-employed after they had run their businesses for a while. There are several implications for research like this, including the potential to better understand why some entrepreneurs behave as they do based upon their personality types and the chance to improve entrepreneurship education and support services.

Entrepreneurial Cognitions

It is only fairly recently that entrepreneurship scholars have focused on cognitive skills as a primary factor that differentiates successful entrepreneurs from non-entrepreneurs and less successful entrepreneurs. This approach deals with how entrepreneurs think differently than non-entrepreneurs. [50]

Entrepreneurial cognitions are the knowledge structures that people use to make assessments, judgments or decisions involving opportunity evaluation and venture creation and growth. In other words, research in entrepreneurial cognition is about understanding how entrepreneurs use simplifying mental models to piece together previously unconnected information that helps them to identify and invent new products or services, and to assemble the necessary resources to start and grow businesses.[51]

Mitchell, Smith, et al.[52] provided the example of how the decision to create a new venture (dependent variable) was influenced by three sets of cognitions (independent variables). They described these cognitions as follows:

Arrangements cognitions are the mental maps about the contacts, relationships, resources, and assets necessary to engage in entrepreneurial activity; willingness cognitions are the mental maps that support commitment to venturing and receptivity to the idea of starting a venture; ability cognitions consist of the knowledge structures or scripts[53] that individuals have to support the capabilities, skills, norms, and attitudes required to create a venture.[54] These variables draw on the idea that cognitions are structured in the minds of individuals[55], and that these knowledge structures act as “scripts” that are the antecedents of decision making.[56]

Cognitive Perspective to Understanding Entrepreneurship

According to Baron, by taking a cognitive perspective, we might better understand entrepreneurs and the role they play in the entrepreneurial process.

The cognitive perspective emphasizes the fact that everything we think, say, or do is influenced by mental processes—the cognitive mechanisms through which we acquire store, transform, and use information. It is suggested here that this perspective can be highly useful to the field of entrepreneurship. Specifically, it can assist the field in answering three basic questions it has long addressed: (1) Why do some persons but not others choose to become entrepreneurs? (2) Why do some persons but not others recognize opportunities for new products or services that can be profitably exploited? And (3) Why are some entrepreneurs so much more successful than others?[57]

Baron[58] illustrated how cognitive differences between people might explain why some people end up pursuing entrepreneurial pursuits and others do not. For example, prospect theory[59] and other decision-making or behavioural theories might be useful in this regard. Research into cognitive biases might also help explain why some people become entrepreneurs.

Baron (2004a) also revealed ways in which cognitive concepts like signal detection theory, regulation theory, and entrepreneurial might help explain why some people are better at entrepreneurial opportunity recognition. He also illustrated how some cognitive models and theories – like risk perception, counterfactual thinking, processing style, and susceptibility to cognitive errors – might help explain why some entrepreneurs are more successful than others.

Cognitive Perspective and the Three Questions

- Why do some and not others choose to become entrepreneurs?

- Prospect Theory

- Cognitive Biases

- Why are some people better at recognizing entrepreneurial opportunities?

- Signal Detection Theory

- Regulation Theory

- Entrepreneurial Alertness

- Why are some people more successful at entrepreneurship than others?

- Risk Perception

- Counterfactual Thinking

- Processing Style

- Susceptibility to Cognitive Errors

Entrepreneurial Scripts

- Why do some people, or groups of people, achieve high performance economic results while others do not? Is there a relationship between the attainment of high performance economic results and transaction cognitions (a type of economic thought pattern)?

- “Cognition has emerged as an important theoretical perspective for understanding and explaining human behavior and action”.[60]

- Cognitions are all processes by which sensory input is transformed, reduced, elaborated, stored, recovered, and used.[61]

- Cognitions lead to the acquisition of knowledge, and involve human information processing.

- Knowledge structure/script:

- Is a mental model, or information processing short-cut that can give information form and meaning, and enable subsequent interpretation and action.

- The subsequent interpretation and actions can result in expert performance … they can also result in thinking errors.

- Entrepreneurial scripting exercises are critical to giving learners an explicit understanding of:

- the processes that transfer expertise, and

- the actual expertise itself.

- The structure of scripts[62]

- Scripts are generally framed as a linear sequence of steps, usually with feedback loops, that can explain how to achieve a particular task – perhaps like developing a business plan.

- Sometimes scripts can be embedded within other scripts. For example, within a general venturing script that outlines the sequences of activities that can lead to a successful business launch, there will probably be sub-scripts describing how entrepreneurs can search for ideas, screen those ideas until one is selected, plan how to launch a sustainable business based upon that idea and including securing the needed financial resources, setting up the business, starting it, effectively managing its ongoing operations, and managing the venture such that that entrepreneur can extract the value that they desire from the enterprise at the times and in the ways they want it.

- The most effective scripts include an indication of the norms that outline performance standards and indicate how to determine when any step in the sequence has been properly completed.

General Venturing Script

Generally, entrepreneurship is considered to consist of the following elements, or subscripts (Brooks, 2009; Mitchell, 2000).

- Searching

- Idea Screening

- Planning and Financing

- Set-Up

- Start-Up

- Ongoing Operations

- Harvest

Searching (also called idea formulation or opportunity recognition)

- This script begins when a person decides they might be a potential entrepreneur (or when an existing entrepreneur decides they need more ideas in their idea pool).

- This script ends when there are a sufficient number of ideas in the idea pool.

- The scripting process involves a logical flow of steps (including feedback loops, actions which must occur in sequence, and actions which can be implemented at the same time as other actions) designed to:

- overcome mental blockages to creativity which might hinder this person’s ability to identify viable ideas;

- implement steps to identify a sufficient number of ideas (most likely 5 or more) which the person is interested in investigating to determine whether they might be viable given general criteria such as this person’s personal interests and capabilities;

Idea Screening (also called concept development)

- This script begins when the person with the idea pool is no longer focusing on adding new ideas to it; but is instead taking steps to choose the best idea for them given a full range of specific criteria.

- This script ends when one idea is chosen from among those in the idea pool.

- The scripting process involves a logical flow of steps to assess the current situation and the trends in the following areas. The right tools must be used for each level of analysis.

- Do the current societal-level factors indicate that a particular idea should be considered for implementation? Do the trends in these societal-level factors indicate that the idea will be viable and sustainable into the future?

- Evaluate the political, economic, social, technological, environmental, and legal climates

- Do the current industry/market-level factors indicate an idea is viable? Are the trends in these factors supportive of the idea?

- Evaluate the degree of competitiveness in the industry, the threat of substitutes emerging, the threat of new entrants to the industry, the degree of bargaining power of buyers, and the degree of bargaining power of suppliers.

- Do a market profile analysis to assess the attractiveness of the position within the industry that the potential venture will occupy.

- Do the current firm-level factors support the pursuit of the idea?

- Formulate and evaluate potential strategies to leverage organizational strengths, overcome/minimize weaknesses, take advantage of opportunities, and overcome/minimize threats;

- Complete financial projections and analyze them to evaluate financial attractiveness;

- Assess the founder fit with the ideas;

- Evaluate the core competencies of the organization relative to the idea;

- Assess advice solicited from trusted advisers

- Do the current societal-level factors indicate that a particular idea should be considered for implementation? Do the trends in these societal-level factors indicate that the idea will be viable and sustainable into the future?

Planning and Financing (also called resource determination and acquisition)

- This script begins when the idea screening script ends and when the person begins making the plans to implement the single idea chosen from the idea pool, which is done in concert with securing financing to implement the venture idea.

- This script ends when sufficient business planning has been done and when adequate financing has been arranged.

- The scripting process involves a logical flow of steps to develop a business plan and secure adequate financing to start the business.

Set-Up (also called launch)

- This script begins when the planning and financing script ends and when the person begins implementing the plans needed to start the business.

- This script ends when the business is ready to start-up.

- The scripting process involves a logical flow of steps, including purchasing and installing equipment, securing the venture location and finishing all the needed renovations, recruiting and hiring any staff needed for start-up, and the many other steps needed to prepare for start-up.

- Start-Up (also called launch)

- This script begins when the set-up script ends and when the business opens and begins making sales.

- This script ends when the business has moved beyond the point where the entrepreneur must continually fight for the business’s survival and persistence. It ends when the entrepreneur can instead shift emphasis toward business growth or maintaining the venture’s stability.

- The scripting process involves a logical flow of steps needed to establish a new venture.

Ongoing Operations (also called venture growth)

- This script begins when the start-up script ends and when the business has established persistence and is implementing growth (or maintenance) strategies.

- This script ends when the entrepreneur chooses to harvest the value they generated with the venture.

- The scripting process involves a logical flow of steps needed to grow (or maintain) a venture.

Studying Entrepreneurship

The following quotations from two preeminent entrepreneurship and entrepreneurship education researchers indicate the growing interest in studies in this field.

Entrepreneurship has emerged over the last two decades as arguably the most potent economic force the world has ever experienced. With that expansion has come a similar increase in the field of entrepreneurship education. The recent growth and development in the curricula and programs devoted to entrepreneurship and new-venture creation have been remarkable. The number of colleges and universities that offer courses related to entrepreneurship has grown from a handful in the 1970s to over 1,600 in 2005. [63]

Interest in entrepreneurship has heightened in recent years, especially in business schools. Much of this interest is driven by student demand for courses in entrepreneurship, either because of genuine interest in the subject, or because students see entrepreneurship education as a useful hedge given uncertain corporate careers. [64]

Approaches to Studying Entrepreneurship

Entrepreneurship is a discipline, which means an individual can learn about it, and about how to be an effective entrepreneur. It is a myth that people are born entrepreneurs and that others cannot learn to become entrepreneurs.[65]Kuratko (2005) asserted that the belief previously held by some that entrepreneurship cannot be taught has been debunked, and the focus has shifted to what topics should be taught and how they should be covered.

Solomon[66] summarized some of the research on what should be covered in entrepreneurship courses, and how it should be taught. While the initial focus was on actions like developing business plans and being exposed to real entrepreneurs, more recently this approach has been supplemented by an emphasis on technical, industry, and personal experience. “It requires critical thinking and ethical assessment and is based on the premise that successful entrepreneurial activities are a function of human, venture and environmental conditions”.[67]Another approach “calls for courses to be structured around a series of strategic development challenges including opportunity identification and feasibility analysis; new venture planning, financing and operating; new market development and expansion strategies; and institutionalizing innovation”. [68] This involves having students interact with entrepreneurs by interviewing them, having them act as mentors, and learning about their experiences and approaches through class discussions.

Sources of Information for Studying Entrepreneurship

According to Kuratko “three major sources of information supply the data related to the entrepreneurial process or perspective”[69]

- Publications (both research-based and those written for the general public)

- Research-based publications:

- Academic journals like Entrepreneurship Theory and Practice, Journal of Business Venturing, and Journal of Small Business Management

- Proceedings of conferences like Proceedings of the Academy of Management and Proceedings of the Administrative Sciences Association of Canada

- Publications written for practitioners and the general public

- Textbooks on entrepreneurship

- Books about entrepreneurship

- Biographies or autobiographies of entrepreneurs

- News periodicals like Canadian Business and Profit

- Trade periodicals like Entrepreneur and Family Business

- Government publications available through sources like the Enterprise Saskatchewan and Canada-Saskatchewan Business Service Centre (CSBSC) websites and through various government resource centres

- Research-based publications:

- Direct observation and interaction with practising entrepreneurs

- Data might be collected from entrepreneurs and about entrepreneurs through surveys, interviews, or other methods applied by researchers.

- Speeches and presentations by practising entrepreneurs

- – Blackburn (2011, p. xiii) ↵

- – Neck and Greene (2011, p. 55) ↵

- (1990) ↵

- Ibid. ↵

- (Gartner, 1990, p. 21, 24). ↵

- (Gartner, 1990, p. 25). ↵

- (Gartner, 1990, p. 25). ↵

- (Gartner, 1990, p. 25) ↵

- Gartner, 1990, p. 25) ↵

- (Gartner, 1990, p. 25). ↵

- Gartner, 1990, p. 25 ↵

- (Gartner, 1990, p. 26). ↵

- (Zimmerer & Scarborough, 2008, p. 5). ↵

- (Entrepreneur, n.d.). ↵

- (Baron, Shane, & Reuber, 2008, p. 4) ↵

- (Brooks, 2009, p. 3) ↵

- (Kao, 1993, p. 70) ↵

- (Hebert & Link, 2009, p. 1). ↵

- (Hebert & Link, 2009). ↵

- (Hebert & Link, 2009). ↵

- (Casson & Godley, 2005p. 26). ↵

- (Chell, 2008; Hebert & Link, 2009). ↵

- (Chell, 2008; Hebert & Link, 2009). ↵

- (Hebert & Link, 2009). ↵

- (Casson & Godley, 2005). ↵

- (Chell, 2008, p. 20). ↵

- (Chell, 2008). ↵

- Zaratiegui & Rabade, 2005, p. 775). ↵

- Marshall, 1961, p. 590; Zaratiegui & Rabade, 2005, p. 776). ↵

- (Zaratiegui & Rabade, 2005, p. 781). ↵

- (Chell, 2008). ↵

- (Chell, 2008). ↵

- (Chell, 2008) ↵

- (Hebert & Link, 2009). ↵

- (1950 [1871], p. 160) ↵

- (Hebert & Link, 2009, p. 43). ↵

- (Chell, 2008). ↵

- (Chell, 2008). ↵

- (Hebert & Link, 2009). ↵

- (2004a) ↵

- (Baron, 2004a, p. 221 ↵

- (Chell, 2008; Duening, 2010). ↵

- (Duening, 2010, p. 4-5). ↵

- Duening 2010 (p. 2). ↵

- (2008 p. 140). ↵

- (2014) ↵

- (p. 807) ↵

- (p. 807) ↵

- (p. 807). ↵

- (Duening, 2010; Mitchell et al., 2007). ↵

- (Mitchell, Busenitz, et al., 2002, p. 97). ↵

- Enter your footnote content here. ↵

- (Glaser, 1984) ↵

- (Mitchell et al., 2000) ↵

- (Read, 1987) ↵

- (Leddo & Abelson, 1986, p. 121; Mitchell, Smith, et al., 2002, p. 10) ↵

- (Baron, 2004a, p. 221-222)? ↵

- (2004a ↵

- (Kahneman & Tversky, 1977) ↵

- (Dutta & Thornhill, 2008, p. 309). ↵

- (Neisser, 1976). ↵

- (based upon Mitchell (2000) ↵

- (Kuratko, 2005, p. 577). ↵

- (Venkataraman, 1997, p. 119). ↵

- (Drucker, 1985). ↵

- (2007) ↵

- (p. 172). ↵

- (p. 172). ↵

- p. 579). ↵