5.3 Income Insurances

[1]As you have learned, assets such as a home or car should be protected from the risk of a loss of value, because assets store wealth, so a loss of value is a loss of wealth.

Your health is also valuable, and the costs of repairing it in the case of accident or illness are significant enough that it also requires insurance coverage. In addition, however, you may have an accident or illness that leaves you permanently impaired or even dead. In either case, your ability to earn income will be restricted or gone. Thus, your income should be insured, especially if you have dependents who would bear the consequences of losing your income. Disability insurance and life insurance are ways of insuring your income against some limitations.

Disability Insurance

Disability insurance is designed to insure your income should you survive an injury or illness impaired. The definition of “disability” is a variable feature of most policies. Some define it as being unable to pursue your regular work, while others define it more narrowly as being unable to pursue any work. Some plans pay partial benefits if you return to work part-time, and some do not. As always, you should understand the limits of your plan’s coverage.

The costs of disability insurance are determined by the features and/or conditions of the plan, including the following:

- Waiting period

- Amount of benefits

- Duration of benefits

- Cause of disability

- Payments for loss of vision, hearing, speech, or use of limbs

- Inflation-adjusted benefits

- Guaranteed renewal or noncancelable clause

In general, the greater the number of these features or conditions that apply, the higher your premium.

All plans have a waiting period from the time of disability to the collection of benefits. Most are between 30 and 90 days, but some are as long as 180 days. The longer the waiting period is, generally, the less the premium.

Plans also vary in the amount and duration of benefits. Benefits are usually offered as a percent of your current wages or salary. The more the benefits or the longer the insurance pays out, the higher the premium. Some plans offer lifetime benefits, while others end benefits at age sixty-five (the age of Medicare eligibility).

In addition, some plans offer benefits in the following cases, all of which carry higher premiums:

- Disability due to accident or illness

- Loss of vision, hearing, speech, or the use of limbs, regardless of disability

- Benefits that automatically increase with the rate of inflation

- Guaranteed renewal, which insures against losing your coverage if your health deteriorates

You may already have some disability insurance through your employer, although in many cases the coverage is minimal. You may also be eligible for Social Security benefits from the federal government or workers’ compensation benefit from your state if the disability is due to an on-the-job accident. Other providers of disability benefits include the following:

- The Veterans’ Administration (if you are a veteran)

- Automobile insurance (if the disability is due to a car accident)

- Labor unions (if you are a member)

- Civil service provisions (if you are a government employee)

You should know the coverage available to you and if you find it’s not adequate, supplement it with private disability insurance.

Life Insurance

Life insurance is a way of insuring that your income will continue after your death. If you have a spouse, children, parents, or siblings who are dependent on your income or care, your death would create new financial burdens for them. To avoid that, you can insure your dependents against your loss, at least financially.

There are many kinds of life insurance policies. Before purchasing one, you should determine what it is you want the insurance to accomplish for your survivors. What do you want it to do?

- Pay off the mortgage?

- Put your kids through college?

- Provide income so that your spouse can be home with the kids and not be forced out into the workplace?

- Provide alternative care for your elderly parents or dependent siblings?

- Cover the costs of your medical expenses and funeral?

- Avoid estate taxes?

These are uses of life insurance. Your goals for your life insurance will determine how much benefit you need and what kind of policy you need. Weighed against that are its costs—the amount of premium that you pay and how that fits into your current budget.

Sam and Maggie have two children, ages three and five. Maggie works as a credit analyst in a bank. Sam looks after the household and the children and Maggie’s elderly mother, who lives a couple of blocks away. He does her grocery shopping, cleans her apartment, does her laundry, and runs any errands that she may need done. Sam and Maggie live in a condo they bought, financed with a mortgage. They have established college savings accounts for each child, and they try to save regularly.

Sam and Maggie need to insure both their lives, because the loss of either would cause the survivors financial hardship. With Maggie’s death, her earnings would be gone, which is how they pay the mortgage and save for their children’s education. Insurance on her life should be enough to pay off the mortgage and fund their children’s college educations, while providing for the family’s living expenses, unless Sam returns to the workforce. With Sam’s death, Maggie would have to hire someone to keep house and care for their children, and also someone to keep her mother’s house and provide care for her. Insurance on Sam’s life should be enough to maintain everyone’s quality of living.

Term Insurance

Maggie’s income provides for three expenditures: the mortgage, education savings, and living expenses. While living expenses are an ongoing or permanent need, the mortgage payment and the education savings are not: eventually, the mortgage will be paid off and the children educated. To cover permanent needs, Maggie and Sam should consider permanent insurance, also known as whole life, straight life, or cash value insurance. To insure those two temporary goals of paying the mortgage and college tuitions, Maggie and Sam could consider temporary or term insurance.

Term insurance is insurance for a limited time period, usually one, five, ten, or twenty years. After that period, the coverage stops. It is used to cover financial needs for a limited time period—for example, to cover the balance due on a mortgage, or education costs. Premiums are lower for term insurance, because the coverage is limited. The premium is based on the amount of coverage and the length of the time period covered.

A term insurance policy may have a renewability option, so that you can renew the policy at the end of its term, or it may have a conversion option, so that you can convert it to a whole life policy and pay a higher premium. If it is multiyear level term or straight term, the premium will remain the same over the term of coverage.

Decreasing term insurance pays a decreasing benefit as the term progresses, which may make sense in covering the balance due on a mortgage, which also decreases with payments over time. On the other hand, you could simply buy a one-year term policy with a smaller benefit each year and have more flexibility should you decide to make a change.

A return-of-premium (ROP) term policy will return the premiums you have paid if you outlive the term of the policy. On the other hand, the premiums on such policies are higher, and you may do better by simply buying the regular term policy and saving the difference between the premiums.

Term insurance is a more affordable way to insure against a specific risk for a specific time. It is pure insurance, in that it provides risk shifting for a period of time, but unlike whole life, it does not also provide a way to save or invest.

Whole Life Insurance

Whole life insurance is permanent insurance. That is, you pay a specified premium until you die, at which time your specified benefit is paid to your beneficiary. The amount of the premium is determined by the amount of your benefit and your age and life expectancy when the policy is purchased.

Unlike term insurance, where your premiums simply pay for your coverage or risk shifting, a whole life insurance policy has a cash surrender value or cash value that is the value you would receive if you canceled the policy before you die. You can “cash out” the policy and receive that cash value before you die. In that way, the whole life policy is also an investment vehicle; your premiums are a way of saving and investing, using the insurance company as your investment manager. Whole life premiums are more than term life premiums because you are paying not only to shift risk but also for investment management.

A variable life insurance policy has a minimum death benefit guaranteed, but the actual death benefit can be higher depending on the investment returns that the policy has earned. In that case, you are shifting some risk, but also assuming some risk of the investment performance.

An adjustable life policy is one where you can adjust the amount of your benefit, and your premium, as your needs change.

A universal life policy offers flexible premiums and benefits. The benefit can be increased or decreased without canceling the policy and getting a new one (and thus losing the cash value, as in a basic whole life policy). Premiums are added to the policy’s cash value, as are investment returns, while the insurer deducts the cost of insurance (COI) and any other policy fees.

When purchased, universal life policies may be offered with a single premium payment, a fixed (and regular) premium payment until you die, or a flexible premium where you can determine the amount of each premium, so long as the cash value in the account can cover the insurer’s COI.

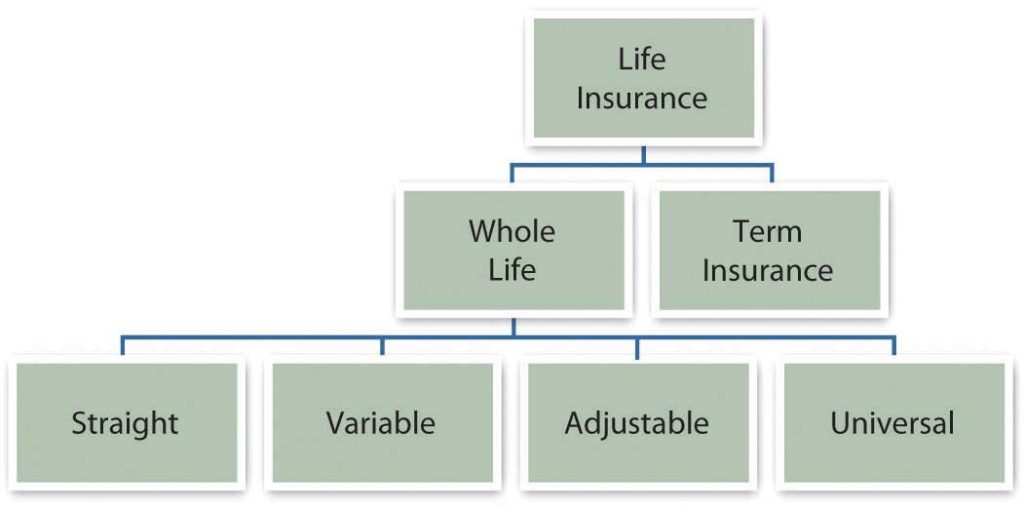

Figure 5.3.1 shows the life insurance options.

So, is it term or whole life? When you purchase a term life policy, you purchase and pay for the insurance only. When you purchase a whole life policy, you purchase insurance plus investment management. You pay more for that additional service, so its value should be greater than its cost (in additional premiums). Whole life policies take some analysis to figure out the real investment returns and fees, and the insurer is valuable to you only if it is a better investment manager than you could have otherwise. There are many choices for investment management. Thus, the additional cost of a whole life policy must be weighed against your choices among investment vehicles. If it’s better than your other choices, then you should buy the whole life. If not, then buy term life and save or invest the difference in the premiums.

Choosing a Policy

All life insurance policies have basic features, which then can be customized with a rider—a clause that adds benefits under certain conditions. The standard features include provisions that protect the insured and beneficiaries in cases of missed premium payments, fraud, or suicide. There are also loan provisions granted, so that you can borrow against the cash value of a whole life policy.

Riders are actually extra insurance that you can purchase to cover less common circumstances. Commonly offered riders include

- a waiver of premium payment if the insured becomes completely disabled,

- a double benefit for accidental death,

- guaranteed insurability allowing you to increase your benefit without proof of good health,

- cost of living protection that protects your benefit from inflation,

- accelerated benefits that allow you to spend your benefit before your death if you need to finance long-term care.

Finally, you need to consider the settlement options offered by the policy: the ways that the benefit is paid out to your beneficiaries. The three common options are

- as a lump sum, paid out all at once;

- in installments, paid out over a specified period;

- as interest payments, so that a series of interest payments is made to the beneficiaries until a specified time when the benefit itself is paid out.

You would choose the various options depending on your beneficiaries and their anticipated needs. Understanding these features, riders, and options can help you to identify the appropriate insurance product for your situation. As with any purchase, once you have identified the product, you need to identify the market and the financing.

Many insurers offer many insurance products, usually sold through brokers or agents. Agents are paid on commission, based on the amount of insurance they sell. A captive agent sells the insurance of only one company, while an independent agent sells policies from many insurers. You want a licensed agent that is responsive and will answer questions patiently and professionally. If you die, this may be the person on whom your survivors will have to depend to help them receive their benefits in a troubling time.

You will have to submit an application for a policy and may be required to have a physical exam or release medical records to verify your physical condition. Factors that influence your riskiness are your family medical history, age and weight, and lifestyle choices such as smoking, drinking, and drug use. Your risks will influence the amount of your premiums.

Having analyzed the product and the market, you need to be sure that the premium payments are sustainable for you, that you can add the expense in your operating budget without creating a budget deficit.

AccuQuote Life Insurance: Types of Life Insurance Explained

Life Insurance as a Financial Planning Decision

Unlike insuring property and health, life insurance can combine two financial planning functions: shifting risk and saving to build wealth. The decision to buy life insurance involves thinking about your choices for both and your opportunity cost in doing so.

Life insurance is about insuring your earnings even after your death. You can create earnings during your lifetime by selling labor or capital. Your death precludes your selling labor or earning income from salary or wages, but if you have assets that can also earn income, they may be able to generate some or even enough income to insure the continued comfort of your dependents, even without your salary or wages.

In other words, the larger your accumulated asset base, the greater its earnings, and the less dependent you are on your own labor for financial support. In that case, you will need less income protection and less life insurance. Besides life insurance, another way to protect your beneficiaries is to accumulate a large enough asset base with a large enough earning potential.

If you can afford the life insurance premiums, then the money that you will pay in premiums is currently part of your budget surplus and is being saved somehow. If it is currently contributing to your children’s education savings or to your retirement plan, you will have to weigh the value of protecting current income against insuring your children’s education or your future income in retirement. Or that surplus could be used toward generating that larger asset base.

These are tough decisions to weigh because life is risky. If you never have an accident or illness and simply go through life earning plenty and paying off your mortgage and saving for retirement and educating your children, then are all those insurance premiums just wasted? No. Since your financial strategy includes accumulating assets and earning income to satisfy your needs now or in the future, you need to protect those assets and income, at least by shifting the risk of losing them through a chance accident. At the same time, you must make risk-shifting decisions in the context of your other financial goals and decisions.

- Adapted from 10.3 Insuring Your Income in Personal Finance by Lumen Learning shared under a CC BY-NC-SA 4.0 license. ↵

Insurance to protect the insured against the risk of being unable to earn wages or salary as a result of injury or illness.

Insurance to compensate beneficiaries against the financial consequences of the death of the insured.

Life insurance providing coverage until the insured’s death; it can also be used as an investment instrument.

Life insurance providing coverage for a specified period of time.

The value of a whole life policy—the cash available for the policyholder—if the policy is canceled before the death of the insured.

Life insurance that provides a guaranteed minimum benefit with potential to be greater depending on investment performance.

Benefits and premium can be adjusted without cancellation of the policy.

Benefits and premiums are flexible, in terms of both timing and amounts.

A clause to a policy that adds specific benefits under specific conditions.