Solutions: Case Study – Beer or Cancer?

- What is the opportunity cost of conducting cancer research? Break this into implicit and explicit costs.

We are given the information that the government provides $50,000/year for the department to conduct cancer research, and the costs of operating the research lab is $30,000. Philips offers $70,000/year to do beer research, but researching beer would increase costs by $5,000.

The best way to find our cost breakdown is to put this information into a table, where we can make a side by side comparison of the two options. In the cancer research column, we have a total revenue of $50,000 from government funding, minus explicit operating costs of $30,000. This leaves us with accounting profits of $20,000.

Likewise, in the beer research column, we have total revenue of $70,000 from Philips, minus $30,000 + $5,000, or $35,000 in explicit operating costs. This leaves us with accounting profits of $35,000.

Since we are looking at the opportunity costs of cancer research, we don’t have to worry yet about which option the department will choose. Since we know opportunity cost is explicit + implicit costs, all we need is the implicit cost of the next best option. In this case, when we conduct cancer research we forgo $35,000 of profits. This means:

-

- Explicit Costs (lab operating costs): $30,000

- Implicit Costs (forgone profits from Philips): $35,000

- Opportunity Costs (Implicit + Explicit): $65,000

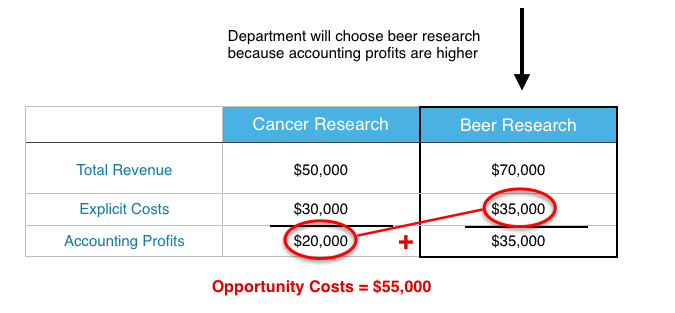

- What option will the department choose? What are the opportunity costs of this choice?

Since we have already calculated the accounting profits and know that Cancer research gives $20,000 of profits, whereas beer provides $35,000, we know that the department will choose beer research.

Finding opportunity costs is the same process as before, except now our explicit costs are the operating costs of the beer lab, and our implicit costs are the forgone profits from cancer research.

-

- Explicit Costs (lab operating costs): $35,000

- Implicit Costs (forgone profits from Cancer research): $20,000

- Opportunity Costs (Implicit + Explicit): $55,000

- What is the total economic profits from this choice?

Economic profits are the difference between total revenue and all the costs of an action, implicit and explicit. With a total revenue of $70,000 from Philips, our economic profits are equal to $70,000 minus our previously calculated opportunity costs. Since $70,000 – $55,000 = $15,000, our economic profits from beer research are $15,000.

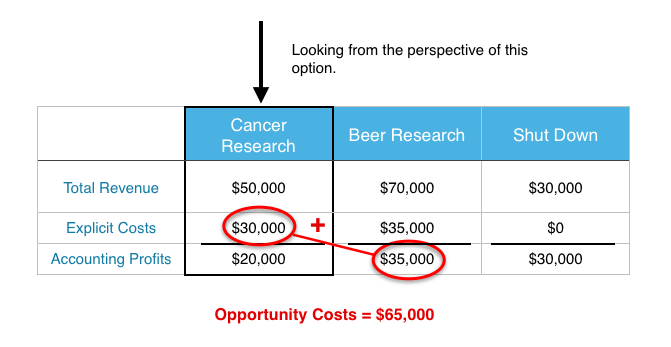

- If the cancer lab was offered $30,000 to shut down what would be the opportunity cost?

If the department was offered $30,000 to shut down, this just creates another option. Remember that opportunity cost includes the implicit costs of the next best alternative. This means we must determine whether is is better for the lab to shut down, or to work with Philips.

We know that the accounting profits from a partnership with Philips are equal to $35,000. Since shutting down has no explicit costs, the accounting profits are only $30,000. This means that partnering with Philips is still our next best alternative. Opportunity costs will therefore be the same as in question 1 and equal to $65,000.

- What is the minimum amount the government would have to provide for the department to conduct cancer research?

If the government wants the department to continue to conduct cancer research, they have to pay them enough so that the accounting profits of either types of research are the same. Working backwards, we know that beer research provides $35,000 in accounting profits. This means that

-

- Total Revenue from Cancer Research – $30,000 must equal $35,000 to ensure that the department is indifferent.

- To cover the explicit ($30,000) and implicit ($35,000) costs of cancer research, the government would have to pay $65,000 (an additional $15,000 to the original $50,000).

- Why must the government pay the lab more money for the same work as before? What does this show us about how opportunities effect compensation?

The answer to question 5 gives us an interesting insight about how opportunity costs can affect compensation. Whereas before the department may have been content accepting $50,000 in funding, now, knowing they can earn more elsewhere, will require more. This can result in funding being increased with no change to the actual quality of work.

- All else equal, how much will you have to pay each professor to entice them to teach?

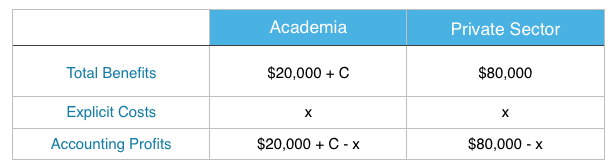

With the information given, we are told that an Economics prof could be making $80,000 in the private sector, and a business prof that could be making $100,000. Like in question 5, we know that to entice them to academia, the accounting profits must be equal. We also know that academia comes with an added prestige factor of $20,000. Putting the economist in our table:

Notice that explicit costs are denoted by ‘x’ to represent that, while we don’t know how much they are, they are assumed to be the same. This cost would represent the cost of living associated with either job.

We know that for the economist to be indifferent, accounting profits must be equal. This means that

-

- $20,000 + C – x = $80,000 – x

- Solving for C we find C = $60,000. This means that the economist would need to be paid $60,000 to join academia.

Doing the same process for the business prof, we would find they would have to be paid $80,000 to join academia. This can help explain why profs from different departments can have very different compensation. Ultimately, it depends on the job prospects they would have outside of the academic sphere.