MODULE 9: BRANDING

9.1 Why It Matters: Branding

Awe, J.C. (2013, February 7). Coffee art in 3D [Photograph]. CC BY 2.0 Flickr. https://www.flickr.com/photos/qqjawe/8452733327/

9.2 Elements of Brand

Reading: Elements of Brand

Coca-Cola. Provided by: BBC. Located at: https://youtu.be/C_7tMOusVYo. License: CC BY-NC-ND: Attribution-NonCommercial-NoDerivatives

Couleur. (2016, February 24). Coca Cola crown corks [Photograph]. CCO Pixabay. https://pixabay.com/photos/coca-cola-crown-corks-red-1218688/

JerryUnderscore. (2017, January 11). Starbucks Coffee sign [Photograph]. CCO Pixabay. https://pixabay.com/photos/starbucks-coffee-sign-city-urban-1972319/

Kirakirameister. (n.d.). Dunkin Donuts [Photograph]. CC BY-SA 4.0 Wikimedia. https://commons.wikimedia.org/wiki/File:Dunkin%27_Donuts_Myeongdong.JPG

MikesPhotos. (2015, September 29). Mercedes Benz [Photograph]. CCO Pixabay. https://pixabay.com/photos/car-mercedes-transport-auto-motor-1506922/

Robertson, G. (2020, February 9). Tim Horton’s fixing everything except what is hurting the brand. Beloved Brands. https://beloved-brands.com/2020/02/09/tim-hortons/

Video: REI Builds Brand by Closing on Black Friday

REI Closing on Black Friday. Provided by: BBC. Located at: https://youtu.be/eEiDcAkEs6I. License: CC BY-NC-ND: Attribution-NonCommercial-NoDerivatives

Reading: Types of Brands

Burnett, J. (2011). Marketing in global markets. Introducing marketing (pp.134-146). CC BY 3.0 http://solr.bccampus.ca:8001/bcc/file/ddbe3343-9796-4801-a0cb- 7af7b02e3191/1/Core%20Concepts%20of%20Marketing.pdf

9.3 Brand Equity

Reading: Brand Equity

Aaker, D. (1995). Measuring brand equity across products and markets. California Management Review 38 (3). https://pdfs.semanticscholar.org/2b5e/3d71de80248b1ca35728bc349536da99cc7a.pdf

Give and Take Rewards. Provided by: BBC. Located at: https://youtu.be/yB5Dep1a4Eo. License: CC BY-NC-ND: Attribution-NonCommercial-NoDerivatives

Jarski, V. (2013, August 6). Surprising facts about customer loyalty marketing [Infographic]. MarketingProfs. http://www.marketingprofs.com/chirp/2013/11338/surprising-facts-about-customer-loyalty-marketing-infographic#ixzz2wj6EeIlJ

Young & Rubicam. (n.d.). Brand asset valuator. http://ruby.fgcu.edu/courses/tdugas/ids3332/acrobat/bav.pdf

9.4 Brand Positioning and Alignment

Reading: Brand Positioning and Alignment

Alexas_Fotos. (2015, December 12). Gummi bears [Photograph]. CCO Pixabay. https://pixabay.com/en/giant-rubber-bear-gummib%C3%A4r-1089618/

Coca-Cola. (n.d.). Workplace culture. Retrieved March 1, 2019, from http://www.coca-colacompany.com/our-company/diversity/workplace-culture/

Don the Upnorth Memories Guy. (2010, October 26). Lone Texas cowboy [Photograph]. CC BY-NC-ND 2.0 Flickr. https://www.flickr.com/photos/upnorthmemories/5147038060/

EquiBrand Consulting. (n.d.). Positioning templates. http://equibrandconsulting.com/templates/positioning-templates

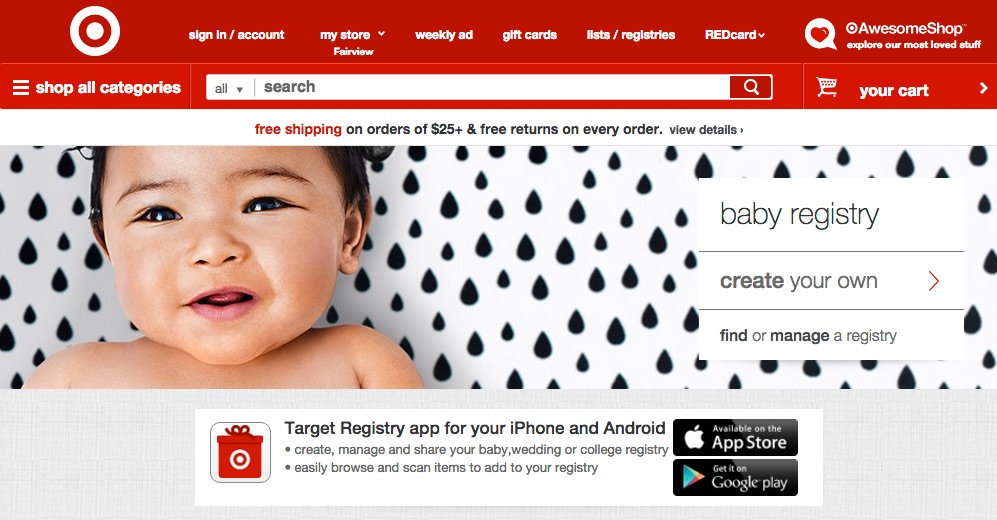

Target. (n.d.). A bullseye view: Behind the scenes at Target. Retrieved March 1, 2019, from https://corporate.target.com/about/purpose-values

Toms. (n.d.). Improving lives. Retrieved March 1, 2019, from https://www.toms.com/improving-lives

Zappos Insights. (n.d.). Zappos 10 core values. Retrieved March 1, 2019, from https://www.zapposinsights.com/about/core-values

Video: Red Bull’s Extreme Brand Alignment

Red Bull. Provided by: BBC. Located at: https://youtu.be/p-_ilG3pZ7Y. License: CC BY-NC-ND: Attribution-NonCommercial-NoDerivatives

9.5 Name Selection

Reading: Name Selection

Buick LaCrosse. (n.d.). In Wikipedia. https://en.wikipedia.org/wiki/Buick_LaCrosse

Krüg, K. (2006, February 17). RCMP in formal dress [Photograph]. CC BY-SA 2.0 Flickr. https://www.flickr.com/photos/kk/100453947/

Kyro. (2009, March 18). The iPod line [Photograph]. CC BY 3.0 Wikimedia. https://commons.wikimedia.org/wiki/File:IPod_line_as_of_2014.png

One Way Stock. (2013, January 13). Hello my name Is opportunity [Photograph] CC BY-ND 2.0 Flickr. https://www.flickr.com/photos/paulbrigham/8423157044/

OpenIcons. (2013, April 1). Registered trademark symbol [Image]. CCO Pixabay. https://pixabay.com/en/registered-trademark-brand-sign-98574/

9.6 Packaging

Moré, M. E. (2010, December 14). The importance of product design and packaging in branding. More Than Branding. http://morethanbranding.com/2010/12/14/product-design-and-packaging/

Reading: Packaging

Beardon, W.O. & Etzel, M.G. (1982). Reference group influence on product and brand choice. Journal of Consumer Research 9 (2), 183-194. https://doi.org/10.1086/208911

Burnett, J. (2011). Introducing and managing the product. Introducing marketing (pp.159-167). CC BY 3.0 http://solr.bccampus.ca:8001/bcc/file/ddbe3343-9796-4801-a0cb- 7af7b02e3191/1/Core%20Concepts%20of%20Marketing.pdf

DS Smith. (2014, June 30). Royal Fruitmasters holland box [Photograph]. http://www.dssmith.com/packaging/about/media/news-press- releases/2014/6/communicating-quality-through-packaging/

Gap. (n.d.). Gap [Logos]. San Francisco, CA: Gap.

Michel, C. (2005, March 12). Little pringle [Photograph]. CC BY 2.0 Flickr. https://www.flickr.com/photos/cmichel67/39944369/

Sibley, A. (2012, July 17). 8 of the biggest marketing faux pas of all time. HubSpot. https://blog.hubspot.com/blog/tabid/6307/bid/33396/8-of-the-biggest-marketing-faux-pas-of-all-time.aspx

Thau, B. (2012, May 22). Behind the spritz: What really goes into a bottle of $100 perfume. AOL. https://www.aol.com/2012/05/22/celebrity-perfume-cost-breakdown/

Versace. (n.d.).Versace bright crystal perfume [Photograph]. TripleClicks. https://www.tripleclicks.com/detail.php?item=404322

9.7 Brand Development Strategies

Reading: Brand Development Strategies

Campbell Soup. (n.d.). Campbell’s Star wars soup [Photograph]. Camden, NJ: Campbell Soup.

Georgia Sierra Club. (2015, December 18). Outings Sierra Club GA [Photograph]. CC BY-NC 2.0 Flickr. https://www.flickr.com/photos/gasierraclub/23718280462/

Intel. (n.d.). Intel Inside [Logo]. Wikimedia. https://upload.wikimedia.org/wikipedia/commons/thumb/4/44/Intel_Inside_Logo.svg/1000px- Intel_Inside_Logo.svg.png

Jurvetson, S. (2007, December 19). Steve Jobs with red shawl [Photograph]. CC BY 2.0 Wikipedia. https://commons.wikimedia.org/wiki/File:Steve_Jobs_with_red_shawl_edit.jpg

Kraft Foods. (n.d.). Kool-Aid man [Cartoon]. Wikipedia. https://en.wikipedia.org/wiki/File:Kool_Aid_Man.jpeg

Timbers Army. (2010, May 19). Timbers Army crest [Logo]. Wikipedia. https://en.wikipedia.org/wiki/File:Timbers_Army_crest.png.

Xavigivax. (2009, May 16). Fiat 500 Barbie [Photograph]. CC BY-SA 3.0 Flickr. https://es.wikipedia.org/wiki/Fiat_500_Barbie#/media/File:Fiat_Barbie_500.jpg

Zippo Manufacturing. (n.d.). Zippo perfume [Screenshot]. Bradford, PA: Zippo Manufacturing.

What Happens Here, Stays Here – Sketchbook Commercial. Authored by: Visit Las Vegas. Located at: https://youtu.be/HsCJCsDd2IY.

9.8 Putting It Together: Branding

Chenel, T. (2018, October 9). The are the 17 most powerful brands in the world. Business Insider. https://www.businessinsider.com/these-are-the-17-most-powerful-brands-in-the-world-2018-10

Curry, C. (2016, January 13). The Chinese artist Ai Weiwei has convinced Lego to change its policy on political projects. Vice News. https://www.vice.com/en/article/vb8z8y/the-chinese-artist-ai-weiwei-has-convinced-lego-to-change-its-policy-on-political-projects

Forbes. (n.d.). The world’s most valuable brands. Retrieved September 23, 2019, from https://www.forbes.com/powerful-brands/list/

Interbrand. (n.d.). Best brands. Retrieved September 23, 2019, from https://www.interbrand.com/best-brands/best-global-brands/2018/ranking/

Lego. (2014). Lego brand identity & experience. Hot Bricks. https://www.hothbricks.com/pdf/6123880.pdf

Lego. (n.d.) Lego brand framework [Screenshot]. https://www.lego.com/en-us/aboutus/lego-group/the- lego-brand/

Lisa-skorpion. (2015, July 29). Legoland [Photograph]. CC BY-ND 2.0 Flickr. https://www.flickr.com/photos/muszka/19991616450/

Ryan, F. (2015, October 25). Ai Weiwei swamped by Lego donation offers after ban on use for ‘political’ artwork. The Guardian. https://www.theguardian.com/artanddesign/2015/oct/25/ai-weiwei-swamped-by-lego-donation-offers-after-ban-on-use-for-political-artwork

Trangbaek, R. R. (2015, December 31). Adjusted guidelines for bulk sales. https://www.lego.com/en-si/aboutus/news/2019/november/adjusted-guidelines-for-bulk-sales/

MODULE 10: PRODUCT MARKETING

10.1 Why It Matters: Product Marketing

Dillet, R. (2013, April 29). Benchmark’s Bill Gurley: “Uber is growing faster than eBay did”. Tech Crunch. https://techcrunch.com/

Growth Hackers. (n.d.). Uber – what’s fueling Uber’s growth engine? https://growthhackers.com/growth-studies/uber

Sandeepnewstyle. (n.d.). Uber on a phone [Photograph]. CC BY-SA 4.0 Wikimedia. https://commons.wikimedia.org

Zaveri, P. & Bosa, D. (2019, February 15). Uber’s growth slowed dramatically in 2018. CNBC. https://www.cnbc.com/2019/02/15/uber-2018-financial-results.html

10.2 Products and Marketing Mix

Reading: Defining Product

American Marketing Association. (n.d.). What is marketing? https://www.ama.org/the-definition-of-marketing-what-is-marketing/

Burnett, J. (2011). Introducing and managing the product. Introducing marketing (pp.159-167). CC BY 3.0 http://solr.bccampus.ca:8001/bcc/file/ddbe3343-9796-4801-a0cb- 7af7b02e3191/1/Core%20Concepts%20of%20Marketing.pdf

Business Dictionary. (n.d.). Industrial goods. http://www.businessdictionary.com/definition/industrial-goods.html

Miller, G. (2011, September 1). New kicks [Photograph]. CC BY-NC-ND 2.0 Flickr. https://www.flickr.com/photos/gracemillerphotography/6101851438/

Reading: Consumer Product Categories

Burnett, J. (2011). Introducing and managing the product. Introducing marketing (pp.159-167). CC BY 3.0 http://solr.bccampus.ca:8001/bcc/file/ddbe3343-9796-4801-a0cb- 7af7b02e3191/1/Core%20Concepts%20of%20Marketing.pdf

V Threepio. (2014, November 8). Blizzcon 2014 [Photograph]. CC BY-NC-ND 2.0 Flickr. https://www.flickr.com/photos/warriorpoet/15592693770/

Walmart. (2011, April 11). Walmart’s action alley [Photograph]. CC BY 2.0 Flickr. https://www.flickr.com/photos/walmartcorporate/5684811762/

Reading: Products and Services

Berry, L.L. (1980). Services marketing is different. Business 30 (May/June), 24-29.

Burnett, J. (2011). Introducing and managing the product. Introducing marketing (pp.159-167). CC BY 3.0 http://solr.bccampus.ca:8001/bcc/file/ddbe3343-9796-4801-a0cb- 7af7b02e3191/1/Core%20Concepts%20of%20Marketing.pdf

Dougoblue. (2011, February 7). allStarGame_1971 [Photograph]. CC BY-NC-ND 2.0 Flickr. https://www.flickr.com/photos/27703647@N04/5442111811/

Jagendorf, B. (2006, December 30). Cruise ship deck [Photograph]. CC BY-NC 2.0 Flickr. https://www.flickr.com/photos/bobjagendorf/465126372/

Target, E. (Ed.). (2019, June 28). SaaS spending to hit $100B this year: Still just 20% of enterprise software market. CBR. https://www.cbronline.com/news/saas-market

Trading Economics. (n.d.). Canada GDP from services. https://tradingeconomics.com/canada/gdp-from-services

Reading: Augmenting Products with Services

Burnett, J. (2011). Introducing and managing the product. Introducing marketing (pp.159-167). CC BY 3.0 http://solr.bccampus.ca:8001/bcc/file/ddbe3343-9796-4801-a0cb- 7af7b02e3191/1/Core%20Concepts%20of%20Marketing.pdf

Cerriteño, A. (2009, August 23). Zappos concept [Illustration]. CC BY-NC-ND 2.0 Flickr. https://www.flickr.com/photos/acerriteno/3850366833/

Fox, L. (2018, November 28). Global airline ancillary revenue will close in on $100B in 2018. Phocus Wire. https://www.phocuswire.com/cartrawler-ideaworkscompany-2018-ancillary-revenue

99 Firms. (n.d.). LinkedIn statistics. https://99firms.com/blog/linkedin-statistics/#gref

Ransley, I. (2014, March 28). Planes-2 [Illustration]. CC BY 2.0 Flickr. https://www.flickr.com/photos/design-dog/13475654373/

Reading: Product Marketing in the Marketing Mix

Pragmatic Marketing. (n.d.). Pragmatic marketing framework. https://www.pragmaticinstitute.com/framework/

10.3 Product Life Cycle

Reading: Stages of the Product Life Cycle

Burnett, J. (2011). Introducing and managing the product. Introducing marketing (pp.159-167). CC BY 3.0 http://solr.bccampus.ca:8001/bcc/file/ddbe3343-9796-4801-a0cb- 7af7b02e3191/1/Core%20Concepts%20of%20Marketing.pdf

Mullor-Sebastian, A. (1983). The product life cycle theory: Empirical evidence. Journal of International Business Studies 14 (3), 95-105.

Product life-cycle management (marketing). (n.d.). In Wikipedia. CC BY-SA 3.0 https://en.wikipedia.org/wiki/Product_life-cycle_management_(marketing)

Reading: Challenges in the Product Life Cycle

Hawk, T. (2013, October 13). Ok glass, find spaceship [Photograph]. CC BY-NC 2.0 Flickr. https://www.flickr.com/photos/thomashawk/22467231948/`

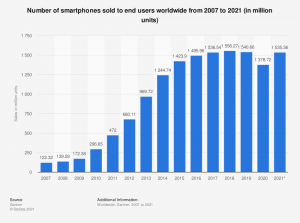

O’Dea, S. (2020, February 28). Global smartphone sales to end users 2007-2020. Statista. https://www.statista.com/statistics/263437/global-smartphone-sales-to-end-users-since-2007/

Richter, F. (2019, May 29). The slow goodbye of Apple’s former cash cow. Statista. https://www.statista.com/chart/10469/apple-ipod-sales/

Statista. (2014, October 7). Apple: iPod sales worldwide 2006-2014. https://www.statista.com/statistics/276307/global-apple-ipod-sales-since-fiscal-year-2006/

Statista. (2020, February 19). CIPA companies: Shipments of digital cameras 1999-2018. https://www.statista.com/statistics/263437/global-smartphone-sales-to-end-users-since-2007/

10.4 Product Portfolio Management

Reading: The Product Portfolio

American Marketing Association. (n.d.). Definitions of marketing. https://www.ama.org/the-definition-of-marketing-what-is-marketing/

Johnson & Johnson. (2015, January 20). Johnson & Johnson reports 2014 fourth quarter and full-year results. https://www.jnj.com/media-center/press-releases/johnson-johnson-reports-2014-fourth-quarter-and-full-year-results

Sundari C. (2015, November 27). Best face wash for oily skin – Neutrogena oil-free acne face wash [Photograph]. CC BY-NC 2.0 Flickr. https://www.flickr.com/photos/99248777@N04/23313151006/

Reading: Achieving Portfolio Objectives

Alvarez, D. (2012, September 24). Gandini juggling [Photograph]. CC BY-NC-ND 2.0 Flickr. https://www.flickr.com/photos/danialvarezfotos/8056057415/

Burnett, J. (2011). Introducing and managing the product. Introducing marketing (pp.159-167). CC BY 3.0 http://solr.bccampus.ca:8001/bcc/file/ddbe3343-9796-4801-a0cb- 7af7b02e3191/1/Core%20Concepts%20of%20Marketing.pdf

Business Dictionary. (n.d.). Line extension. http://www.businessdictionary.com/definition/line-extension.html#ixzz3wK7lJ700

Business Dictionary. (n.d.). Line filling. http://www.businessdictionary.com/definition/line-filling.html#ixzz3wK9onLtn

Doritos. (n.d.). Doritos product [Screenshot]. http://www.businessdictionary.com/definition/line-extension.html#ixzz3wK7lJ700

Faultless Starch/Bon Ami. (2009). Current Bon Ami products on the market [Photograph]. Wikipedia. https://en.wikipedia.org/wiki/File:Photo_of_Bon_Ami_Products.jpg#/media/File:Photo_of_Bon _Ami_Products.jpg.

Reading: New Products in the Portfolio

Johnson & Johnson. (2015, January 20). Johnson & Johnson reports 2014 fourth quarter and full-year results. https://www.jnj.com/media-center/press-releases/johnson-johnson-reports-2014-fourth-quarter-and-full-year-results

10.5 New Product Development Process

Market Watch. (2015, April 11). 12 worst American product flops. https://www.marketwatch.com/story/12-worst-american-product-flops-2015-04-10

Reading: Overview of the New-Product Development Process

Burnett, J. (2011). Introducing and managing the product. Introducing marketing (pp.159-167). CC BY 3.0 http://solr.bccampus.ca:8001/bcc/file/ddbe3343-9796-4801-a0cb- 7af7b02e3191/1/Core%20Concepts%20of%20Marketing.pdf

Dombrowski, Q. (2012, September 30). Science! [Photograph]. CC BY-SA 2.0 Flickr. https://www.flickr.com/photos/quinnanya/8042323280/

Jordanhill School D&T Dept. (2008, May 28). Design sketching [Drawing]. CC BY 2.0 Flickr. https://www.flickr.com/photos/designandtechnologydepartment/3968172841/

Post-it-note. (n.d.). In Wikipedia. https://en.wikipedia.org/wiki/Post-it_Note

Opensource.com. (2012, July 3). Open ideas [Illustration]. CC BY-SA 2.0 Flickr. https://www.flickr.com/photos/opensourceway/7496802920/

Qi, J. (2013, June 6). Circuit sticker prototypes [Photograph].CC BY 2.0 Flickr. https://www.flickr.com/photos/jieq/9002249677/

Reading: Generating and Screening Ideas

Fettinger, C. (2012, February 7). Solar powered [Image]. CC BY 2.0 Flickr. https://www.flickr.com/photos/charlesfettinger/6839804523/

Koen, P.A., Ajamian, G., Boyce, S.D., Clamen, A. Fisher, E.S., Fountoulakis, S.G., Johnson, A., Puri., P.S., & Seibert, R. (2002). 1 fuzzy front end: Effective methods, tools, and techniques. Semantic Scholar. https://www.semanticscholar.org/paper/1-Fuzzy-Front-End-%3A-Effective-Methods-%2C-Tools-%2C-and-Koen-Ajamian/e6b921c6125984aede5285e23f23b03efa95b967

Mikey. (2008, September 16). Big ideas need big spaces [Photograph]. CC BY 2.0 Flickr. https://www.flickr.com/photos/raver_mikey/2916351853/

7 Shocking 3D Printed Things. Authored by: Freeze HD. Located at: https://youtu.be/xVU4FLrsPXs?t=1s.

Reading: Developing New Products

Abhi. (2008, May 8). Yes and no [Photograph]. CC BY 2.0 Flickr. https://www.flickr.com/photos/abhi_ryan/2476059942/

Business Model Alchemist. (2010, April 25). Business model canvas [Poster]. CC BY-SA 1.0 Wikipedia. https://en.wikipedia.org/wiki/Business_Model_Canvas#/media/File:Business_Model_Canvas.pn g

Video: Target Product Design

Target Product Design. Provided by: BBC. Located at: https://youtu.be/3MqEp1ePfbo. License: CC BY-NC-ND: Attribution-NonCommercial-NoDerivatives

10.6 Challenges for New Product

Reading: Diffusion of Innovation

Dombrowski, Q. (2009, August 9). Early adopter [Photograph]. CC BY-SA 2.0 Flickr. https://www.flickr.com/photos/quinnanya/3813741958/

Reading: Improved Success in Product Development

Andreesen, M. (2007, June 25). Product/market fit. Stanford University. http://web.stanford.edu/class/ee204/ProductMarketFit.html

Brown, P., & Brown, H. (2008, May 17). Fits Like a glove [Photograph]. CC BY-NC 2.0 Flickr. https://www.flickr.com/photos/p-r-b/2501319678/

Ries, E. (n.d.). The lean startup methodology. http://theleanstartup.com/principles

10.7 Putting It Together: Product Marketing

Griswold, A. (2014, September 11). How Uber and Lyft stack up in the United States. Slate. https://slate.com/business/2014/09/uber-vs-lyft-futureadvisor-study-compares-revenue-users-growth-at-the-companies.html

Zaveri, P. & Bosa, D. (2019, February 15). Uber’s growth slowed dramatically in 2018. CNBC. https://www.cnbc.com/2019/02/15/uber-2018-financial-results.html

MODULE 11: PRICING STRATEGIES

11.1 Why It Matters: Pricing Strategies

Amazon Prime. Provided by: BBC. Located at: https://youtu.be/bh5nT_dqN4Q. License: CC BY-NC-ND: Attribution-NonCommercial-NoDerivatives

Burnett, J. (2011). Pricing the Product. Introducing marketing (pp.237-257). CC BY 3.0 http://solr.bccampus.ca:8001/bcc/file/ddbe3343-9796-4801-a0cb- 7af7b02e3191/1/Core%20Concepts%20of%20Marketing.pdf

J-No. (2011, September 13). Bibhu Mohapatra: NY fashion week [Photograph]. CC BY-NC-ND 2.0 Flickr. https://www.flickr.com/photos/j-no/6167576401/

Mangalindan, J.P. (2015, February 3). Inside Amazon Prime. Fortune Magazine. https://fortune.com/2015/02/03/inside-amazon-prime/

Tsukayama, H. (2015, February 3). What Amazon’s learned from a decade of Prime. The Washington Post. https://www.washingtonpost.com/news/the-switch/wp/2015/02/03/what-amazons-learned-from-a-decade-of-prime

11.2 Pricing Impact on Value of Products or Services

Reading: The Psychology of Pricing

Anderson, E.T. & Simester, D.I. (2003). Effects of $9 price endings on retail sales: Evidence from field experiments. Quantitative Marketing and Economics, 1 (1), 93-110.

Chase-Sheerman, T. (2012, October 29). “Volunteer duty” psychological testing [Photograph]. CC BY 2.0 Flickr. https://www.flickr.com/photos/tim_uk/8135755109/

LaPlante, A. (2005, July 1). Asking consumers to compare may have unintended results. Insights by Standford Business. https://www.gsb.stanford.edu/insights/asking-consumers-compare-may-have-unintended-results

Malia. (2009, September 10). Niner – 9/9/09 [Image]. CC BY-NC-ND 2.0 Flickr. https://www.flickr.com/photos/malia111/3905163055/

Science Daily. (n.d.). Anchoring bias in decision-making. https://www.sciencedaily.com/terms/anchoring.htm#:~:text=During%20normal%20decision%20making%2C%20individuals,a%20bias%20toward%20that%20value.

Video: Value in Branded Eyewear

Expensive Glasses. Provided by: BBC. Located at: https://youtu.be/XvDCqn7MrvM. License: CC BY-NC-ND: Attribution-NonCommercial-NoDerivatives

11.3 Pricing Considerations

Reading: Pricing Objectives

Geralt. (2012, December 31). Best price [Graphic]. CCO Pixabay. https://pixabay.com/en/award-price- tag-note-board-offer-73084/

Jordan. (2014, July 14). Nike price hikes drive U.S. sneaker growth. Footwear News. https://footwearnews.com/2014/business/news/nike-price-hikes-drive-u-s-sneaker-growth-144128/

Levasha. (2015, December 8). Van Westendorp price sensitivity meter [Table]. CC BY-SA 4.0 Wikipedia. https://en.wikipedia.org/wiki/Van_Westendorp%27s_Price_Sensitivity_Meter

Trefis Team. (2015, June 11). Airlines’ stocks drop as fear of price war clouds the industry. Forbes. https://www.forbes.com/sites/greatspeculations/2015/06/11/airlines-stocks-drop-as-fear-of-price-war-clouds-the-industry/#af62ae318121

Reading: Break-Even Pricing

Jasline. (2015, September 4). Bake [Photograph]. CC BY-NC-ND 2.0 Flickr. https://www.flickr.com/photos/foodiebaker/20515342453/

Splinter, H. (2013, May 18). Have a cookie [Photograph]. CC BY-ND 2.0 Flickr. https://www.flickr.com/photos/archeon/8817752554/

Reading: Competitor Impact on Pricing

Burnett, J. (2011). Pricing the Product. Introducing marketing (pp.237-257). CC BY 3.0 http://solr.bccampus.ca:8001/bcc/file/ddbe3343-9796-4801-a0cb- 7af7b02e3191/1/Core%20Concepts%20of%20Marketing.pdf

Ellison, B. (2012, May 8). Shoe store in Trinidad [Photograph]. CC BY 2.0 Flickr. https://www.flickr.com/photos/budellison/15920712043/

Reading: Benefits of Value-Based Pricing

Bell, D. (2009, March 8). Choices [Photograph]. CC BY-NC 2.0 Flickr. https://www.flickr.com/photos/darwinbell/3340033037/

Partridge, J. (n.d.). Hot soup charitable elephants [Photograph]. CC BY-SA 2.0 Flickr. https://www.flickr.com/photos/julianpartridge/11512394244/

11.4 Common Pricing Strategies

Reading: Skim Pricing

Burnett, J. (2011). Pricing the Product. Introducing marketing (pp.237-257). CC BY 3.0 http://solr.bccampus.ca:8001/bcc/file/ddbe3343-9796-4801-a0cb- 7af7b02e3191/1/Core%20Concepts%20of%20Marketing.pdf

Morffew, A. (2015, April 26). Skimmer skimming! [Photograph]. CC BY 2.0 Flickr. https://www.flickr.com/photos/andymorffew/16660136473/

Price Skimming. (n.d.) In Wikipedia. CC BY-SA 3.0 https://en.wikipedia.org/wiki/Price_skimming

Reading: Penetration Pricing

Dean, J. (1976). Pricing policies for new products. Harvard Business Review 54 (6), 141-153.

Penetration pricing. (n.d.). In Wikipedia. CC BY-SA 3.0 https://en.wikipedia.org/wiki/Penetration_pricing#cite_note-4

Gary, Y. (2012, March 8). Mallards feeding [Photograph]. CC BY-ND 2.0 Flickr. https://www.flickr.com/photos/49663413@N08/6965646827/

Reading: Cost-Oriented Pricing

Burnett, J. (2011). Pricing the Product. Introducing marketing (pp.237-257). CC BY 3.0 http://solr.bccampus.ca:8001/bcc/file/ddbe3343-9796-4801-a0cb- 7af7b02e3191/1/Core%20Concepts%20of%20Marketing.pdf

Dombrowski, Q. (2008, September 24). Mango [Photograph]. CC BY-SA 2.0 Flickr. https://www.flickr.com/photos/quinnanya/2886818380/

Reading: Discounting Strategies

Burnett, J. (2011). Pricing the Product. Introducing marketing (pp.237-257). CC BY 3.0 http://solr.bccampus.ca:8001/bcc/file/ddbe3343-9796-4801-a0cb- 7af7b02e3191/1/Core%20Concepts%20of%20Marketing.pdf

Home Depot. (n.d.). Pro Xtra. https://www.homedepot.com/c/Pro_Xtra

Laura. (n.d.). Fabric bolts [Photograph]. CC BY 2.0 Flickr. https://www.flickr.com/photos/luckylaura/2749694639/

11.5 Price Elasticity

What Is Economics?. Authored by: Plain Prep. Located at: https://youtu.be/nWPrMmv1Tis?t=1s.

Video: Elasticity of Demand

Elasticity of Demand. Authored by: mjmfoodie. Located at: https://youtu.be/4oj_lnj6pXA?t=1s.

Reading: Elasticity and Price Changes

Conniiely. (2009, November 23). Cookies [Photograph]. CC BY-NC-ND 2.0 Flickr. https://www.flickr.com/photos/connielyphotography/5254405013/

Ofravim. (2006, December 26). Parking lot [Photograph]. CCO Pixabay. https://pixabay.com/en/rent-a- car-automobiles-parking-lot-664986/

Reading: Products with Elastic and Inelastic Demand

Daynes, M. (2015, September 18). Coffee beans [Photograph]. CCO Unsplash. https://unsplash.com/photos/QKylkd3HS6o

11.6 Competitive Bidding

Reading: Competitive Bidding

Zeldman, J. (2014, November 17). Attendees at an event apart San Francisco 2014 [Photograph]. CC BY- NC-ND 2.0 Flickr. https://www.flickr.com/photos/zeldman/15629794278/

Reading: Price in the Competitive Bid

Parks, D. (2014, July 26). Competitive kiting [Photograph]. CC BY-NC 2.0 Flickr. https://www.flickr.com/photos/parksdh/14830636071/

11.7 Putting It Together: Pricing Strategies

Tsukayama, H. (2015, February 3). What Amazon’s learned from a decade of Prime. Washington Post. https://www.washingtonpost.com/news/the-switch/wp/2015/02/03/what-amazons-learned-from-a-decade-of-prime/

MODULE 12: PLACE: DISTRIBUTION CHANNELS

12.1 Why It Matters: Place: Distribution Channels

Lewis, L. (2005). The trader Joe’s adventure: Turning a unique approach to business to a retail and cultural phenomenon. Kaplan Publishing.

MIT Sloan School. (n.d.) Trader Joe’s vs. whole foods market: a comparison of operational management. CC BY-NC-SA 4.0 http://ocw.mit.edu/courses/sloan-school-of-management/15- 768-management-of-services-concepts-design-and-delivery-fall- 2010/projects/MIT15_768F10_paper05.pdf.

Trader Joe’s. (n.d.). Our story. https://www.traderjoes.com/our-story/timeline

Forager, Elly Truesell, Whole Foods Market. Provided by: WholeFoodsMarket. Located at: https://youtu.be/vgpugYqyKBM.

12.2 Using Channels of Distribution

Coca-Cola. (2014, August 14). The Coca-Cola Company and Monster Beverage Corporation enter into long-term strategic partnership. https://www.coca-colacompany.com/press-releases/coca-cola-and-monster-enter-into-long-term-partnership

Mitchell, D. (2015, May 11). These are the top 5 energy drinks. Time. https://time.com/3854658/these-are-the-top-5-energy-drinks/

Reading: Define Channels of Distribution

Burnett, J. (2011). Chanel concepts: Distributing the product. Introducing marketing (pp.262-284). CC BY 3.0 http://solr.bccampus.ca:8001/bcc/file/ddbe3343-9796-4801-a0cb- 7af7b02e3191/1/Core%20Concepts%20of%20Marketing.pdf

Coca-Cola. (2020). The Coca-Cola system. https://www.coca-colacompany.com/company/coca-cola-system

Moloney, L. (2010, November 22). Channels of grace [Photograph]. CC BY-SA 2.0 Flickr. https://www.flickr.com/photos/tir_na_nog/5244765107/

Mozart, M. (2014, February 17). Monster Energy [Photograph]. CC BY 2.0 Flickr. https://www.flickr.com/photos/jeepersmedia/13100200773/

Reading: Distribution Objectives

Burnett, J. (2011). Chanel concepts: Distributing the product. Introducing marketing (pp.262-284). CC BY 3.0 http://solr.bccampus.ca:8001/bcc/file/ddbe3343-9796-4801-a0cb- 7af7b02e3191/1/Core%20Concepts%20of%20Marketing.pdf

Uacescomm. (2015, September 11). Shopping cart [Image]. CCO Flickr. https://www.flickr.com/photos/uacescomm/21133249788/

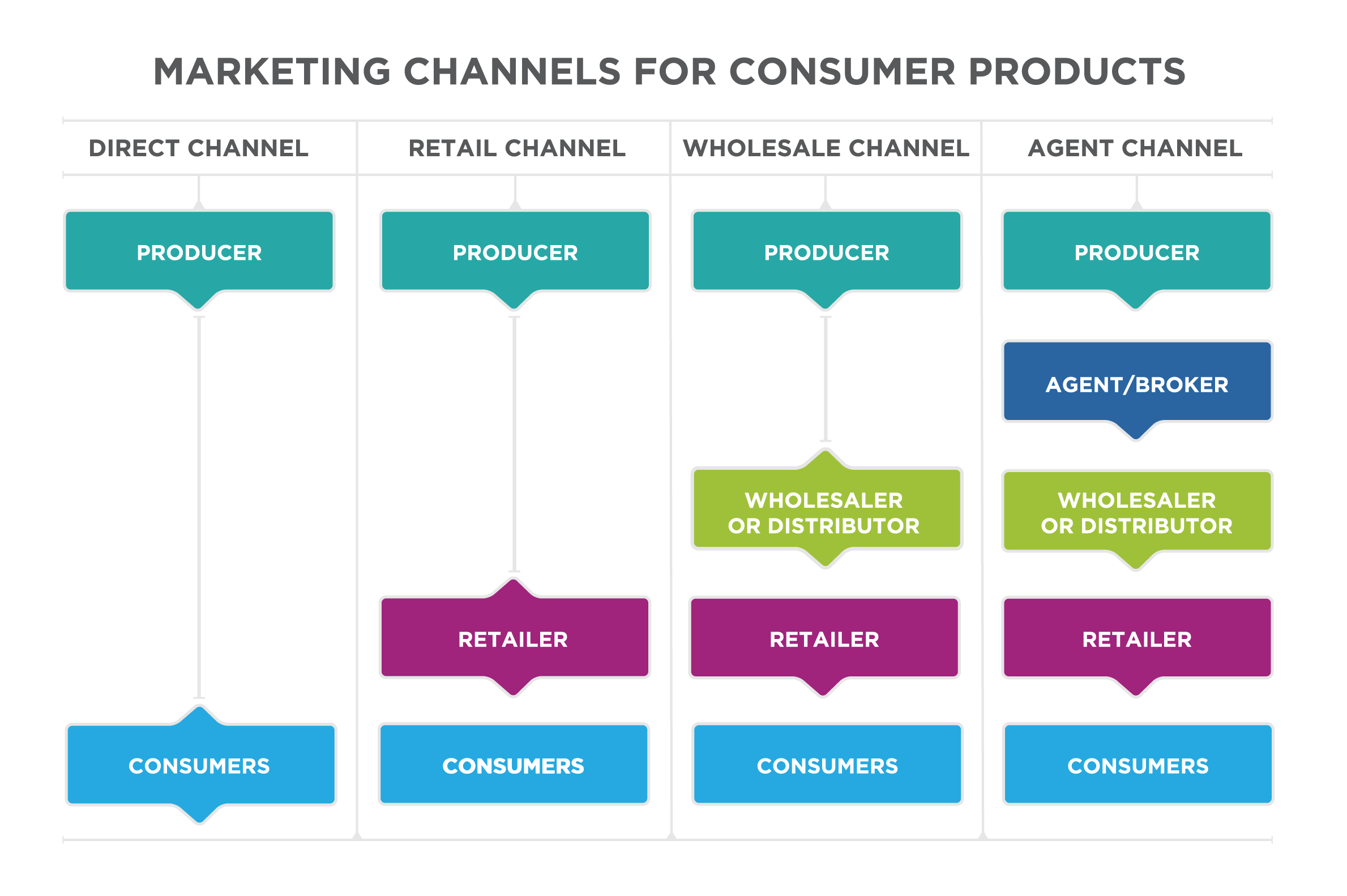

Reading: Channel Structures

Burnett, J. (2011). Chanel concepts: Distributing the product. Introducing marketing (pp.262-284). CC BY 3.0 http://solr.bccampus.ca:8001/bcc/file/ddbe3343-9796-4801-a0cb- 7af7b02e3191/1/Core%20Concepts%20of%20Marketing.pdf

Oregon Department of Agriculture. (2010, June 26). Portland farmer’s market [Photograph]. CC BY-NC- ND 2.0 Flickr. https://www.flickr.com/photos/oragriculture/8080735396/

Reading: The Role of Intermediaries

Bacquet, O. (2013, October 20). Potatoes [Photograph]. CC BY 2.0 Flickr. https://www.flickr.com/photos/olibac/10508674534/

Durtschi, S. (2016, February 15). Why McLane is 2016’s general merchandise category captain. Convenience Store News. https://csnews.com/why-mclane-2016s-general-merchandise-category-captain?nopaging=1

McLane. (n.d.). About us. https://www.mclaneco.com/content/mclaneco/en/about.html

McLane. (n.d.). Grocery supply chains solutions. https://www.mclaneco.com/content/mclane/en/solutions/grocery-supply-chain-solutions/locations/mclane-minnesota.html

Unstats. (2015). Central Product Classification (CPC). Department of Economic and Social Affairs. https://unstats.un.org/unsd/classifications/unsdclassifications/cpcv21.pdf

Reading: Marketing Channels vs. Supply Chains

Council of Supply Chain Management Professionals. (n.d.). Definitions of supply chain management. https://cscmp.org/CSCMP/Educate/SCM_Definitions_and_Glossary_of_Terms.aspx

Nagurney, A. (2006). Supply chain network economics: Dynamics of prices, flows, and profits. Edward Elgar.

Staveren, E.V. (2013, September 23). Supply chain of peanut butter [Illustration]. CC BY-SA 2.0 Flickr. https://flic.kr/p/gcQi8S

Supply chain. (n.d.). In Wikipedia. CC BY-SA 3.0 https://en.wikipedia.org/wiki/Supply_chain

12.3 Managing Distribution Channels

Daniels, S. (2014, March 3). Geico overtakes all state as no.2 auto insurer: State farm remains category leader by far. AdAge. https://adage.com/article/cmo-strategy/geico-overtakes-allstate-2-auto-insurer/291947

Reading: Optimizing Channels

Burnett, J. (2011). Chanel concepts: Distributing the product. Introducing marketing (pp.262-284). CC BY 3.0 http://solr.bccampus.ca:8001/bcc/file/ddbe3343-9796-4801-a0cb- 7af7b02e3191/1/Core%20Concepts%20of%20Marketing.pdf

Grienauer, N. (2012, July 8). Public relations Camp Vienna [Photograph]. CC BY 2.0 Flickr. https://www.flickr.com/photos/nico_g/7542560062/

kuhnmi. (2014, July 19). Madagascar day gecko [Photograph]. CC BY 2.0 Flickr. https://www.flickr.com/photos/31176607@N05/16537089484/

Reading: Third-Party Sales

Karnes, A. (2008, September 12). Nanette Lepore [Photograph]. CC BY-NC-ND 2.0 Flickr. https

Reading: Service Outputs

Neil, K. (2018, February 13). Snowy River Farm eggs [Photograph]. CCO Unsplash. https://unsplash.com/photos/omEpnvmwWz0

12.4 Retailers as Channels of Distribution

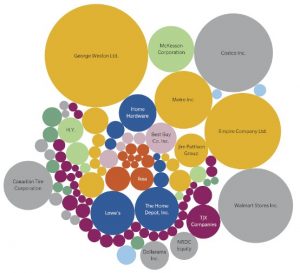

Retail Council of Canada. (2020, March 4). Canada’s top 100 retailers. https://www.retailcouncil.org/community/store-operations/canadas-top-100-retailers/

Statista. (n.d.). Monthly gross domestic product for the retail trade industry in Canada from 2015-2020 (in billion Canadian dollars). https://www.statista.com/statistics/858030/gdp-for-retail-trade-in-canada/

Statistics Canada. (n.d.). Business dynamic measures, by industry, per province or territory. https://www150.statcan.gc.ca/t1/tbl1/en/tv.action?pid=3310008701

Statistics Canada. (2013). Portrait of the Canadian labour force: National household survey, 2011. https://www12.statcan.gc.ca/nhs-enm/2011/as-sa/99-012-x/99-012-x2011002-eng.pdf

Reading: Define Retailing

Burnett, J. (2011). Chanel concepts: Distributing the product. Introducing marketing (pp.262-284). CC BY 3.0 http://solr.bccampus.ca:8001/bcc/file/ddbe3343-9796-4801-a0cb- 7af7b02e3191/1/Core%20Concepts%20of%20Marketing.pdf

Hawk, T. (2008, March 1). Powell’s Books [Photograph]. CC BY-NC 2.0 Flickr. https://www.flickr.com/photos/thomashawk/2987249389/

Retail Council of Canada. (2020, March 4). Canada’s top 100 retailers. https://www.retailcouncil.org/community/store-operations/canadas-top-100-retailers/

Reading: Types of Retailers

Acroterion. (2016, October 6). Piggly Wiggly VA [Photograph]. CC BY-SA 4.0 Wikimedia. https://commons.wikimedia.org/wiki/File:Piggly_Wiggly_VA1.jpg

Bedford, E. (2020, February 14). Number of grocery stores in Canada as of December 19, by employment size. Statista. https://www.statista.com/statistics/459536/number-of-grocery-stores-by-employment-size-canada/

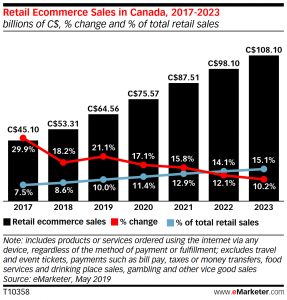

Briggs, P. (2019, June 27). Canada e-commerce 2019. One in 10 retail dollars now transact digitally. eMarketer. https://www.emarketer.com/content/canada-ecommerce-2019

Burnett, J. (2011). Chanel concepts: Distributing the product. Introducing marketing (pp.262-284). CC BY 3.0 http://solr.bccampus.ca:8001/bcc/file/ddbe3343-9796-4801-a0cb- 7af7b02e3191/1/Core%20Concepts%20of%20Marketing.pdf

Franganillo, J. (2013, January 19). Ankara: Panora shopping mall [Photograph]. CC BY 2.0 Flickr. https://flic.kr/p/eDYfQW

Franks, K. (2011, December 27). Bike & skate [Photograph]. CC BY-NC-ND 2.0 Flickr. https://www.flickr.com/photos/karolfranks/6586652573/

Hewgill, G. (2009, March 14). iPod vending machine [Photograph]. CC BY 2.0 Flickr. https://flic.kr/p/68Mbr5

Gellar, L. (2012, October 16). Why are printed catalogs still around? Forbes. https://www.forbes.com/sites/loisgeller/2012/10/16/why-are-printed-catalogs-still-around/#4a4f2dd779c6

Ruiz, R.R. (2015, January 25). Catalogs, after years of decline, are revamped for changing times. The New York Times. https://www.nytimes.com/2015/01/26/business/media/catalogs-after-years-of-decline-are-revamped-for-changing-times.html

Reading: Retail Strategy

Fastily. (2017, April 23). Anthropologie store [Photograph]. CC BY-SA 4.0 Wikimedia. https://commons.wikimedia.org/wiki/File:Anthropologie_Walnut_Creek_2_2017-04-29.jpg

Success for Costco. Provided by: BBC. Located at: https://youtu.be/P57mHjQzeKg. License: CC BY-NC-ND: Attribution-NonCommercial-NoDerivatives

Webb, D. (2018, April 28). Grocery store [Photograph]. CCO Pexels. https://www.pexels.com/photo/grocery-store-piggly-wiggly-produce-small-town-1055443/

12.5 Integrated Supply Chain Management and the Distribution Strategy

Nagurney, A. (2006). Supply chain network economics: Dynamics of prices, flows, and profits. Edward Elgar.

Reading: Components of a Supply Chain

A Day in an Amazon Warehouse. Authored by: Bloomberg Business. Located at: https://youtu.be/8-DgmfMa5Zk.

Accounting Tools. (2018, August 26). Inventory. https://www.accountingtools.com/articles/2017/5/13/inventory

Best Manufacturing Practices Center of Excellence. (n.d.) Best practices. http://www.bmpcoe.org/bestpractices/pdf/hp.pdf

Distribution center. (n.d.). In Wikipedia. CC BY-SA 3.0 https://en.wikipedia.org/wiki/Distribution_center

Maschinenjunge. (2008, March 11). RFID chip [Photograph]. CC BY-SA 3.0 Flickr. https://commons.wikimedia.org/wiki/File:RFID_Chip_004.JPG

National Science Foundation. (n.d.). Manufacturing the form of things unknown (p.55). https://www.nsf.gov/about/history/nsf0050/pdf/manufacturing.pdf

PublicDomainPictures. (2013, July 19). Dominoes [Graphic]. CCO Pixabay. https://pixabay.com/en/domino-circuit-element-concept-163522/

Radio-frequency identification. (n.d.). In Wikipedia. CC BY-SA 3.0 https://en.wikipedia.org/wiki/Radio- frequency_identification

Saltmarsh, N. (2004, April 30). Food for the supermarkets [Photograph]. CC BY 2.0 Flickr. https://en.wikipedia.org/wiki/Radio-frequency_identification

Soanes, C. & Hawker, S. (2005). Outsourcing. In Oxford English dictionary (3rd ed.). Oxford University Press.

Trebilcock, B. (2014, July 8). 2014 top 20 global supply chain management software suppliers. Supply Chain 247. http://www.supplychain247.com/article/2014_top_20_global_supply_chain_management_software_suppliers

Reading: Integrated Supply Chain Management

Geralt. (2014, September 12). Network [Graphic]. CCO Pixabay. https://pixabay.com/en/network-ball- about-structure-441686/

12.6 Putting It Together: Place: Distribution Channels

Brat, Ilan. (2016, February 14). Whole Foods works to reduce costs and boost clout with suppliers. The Wall Street Journal. https://www.wsj.com/articles/whole-foods-works-to-reduce-costs-and-boost-clout-with-suppliers-1455445803

Kowitt, B. (2010, August 23). Inside the secret world of Trader Joe’s. Fortune. https://archive.fortune.com/2010/08/20/news/companies/inside_trader_joes_full_version.fortune/index.htm

Lutz, A. (2014, October 7). How Trader Joe’s sells twice as much as Whole Foods. Business Insider. https://www.businessinsider.com/trader-joes-sales-strategy-2014-10

Whole Foods Market. (n.d.). Standards that aren’t standard anywhere else. Retrieved, March 4, 2019, from https://www.wholefoodsmarket.com/quality-standards

Whole Foods Market. (2010). 2009 annual report (p.4). https://www.annualreports.com/HostedData/AnnualReportArchive/w/NASDAQ_WFM_2009.pdf

MODULE 13: PROMOTION: INTEGRATED MARKETING COMMUNICATION (IMC)

13.1 Why It Matters: Promotion: Integrated Marketing Communication (IMC)

AMERICAN EXPRESS OPEN: Small Business Gets An Official Day. Authored by: CannesPredictions. Located at: https://youtu.be/NgmLC6jbxfg?list=PLGhn_uYiaIc8injQ6hgMPXHwmXc3l66Hx.

Ariel Fashion Shoot case study. Authored by: Janis Polis. Located at: https://youtu.be/gOOLyUfO1Ag?list=PLGhn_uYiaIc8injQ6hgMPXHwmXc3l66Hx.

13.2 Integrated Marketing Communication (IMC) Defined

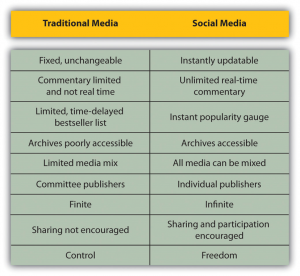

Reading: Integrated Marketing Communication (IMC) Definition

Boundless. (n.d.). Shifting from fragmented to integrated communications. Boundless marketing. [Course]. CC BY-SA 4.0 Lumenlearning. https://courses.lumenlearning.com/boundless- marketing/

Burnett, J. (2011). Communicating to mass markets. Introducing marketing (pp.195-214). CC BY 3.0 http://solr.bccampus.ca:8001/bcc/file/ddbe3343-9796-4801-a0cb- 7af7b02e3191/1/Core%20Concepts%20of%20Marketing.pdf

Studio tdes. (2015, March 8). People On internet argue about dress colour [Cartoon]. CC BY 2.0 Flickr. https://www.flickr.com/photos/thedailyenglishshow/16725299326/

Reading: Marketing Campaigns and IMC

Burnett, J. (2011). Communicating to mass markets. Introducing marketing (pp.195-214). CC BY 3.0 http://solr.bccampus.ca:8001/bcc/file/ddbe3343-9796-4801-a0cb- 7af7b02e3191/1/Core%20Concepts%20of%20Marketing.pdf

Clear Channel: Where brands meet people. Authored by: Charis Tsevis. Located at: https://youtu.be/u1b5EtGqUOI.

Denker, P. (2011, April 26). Important message [Photograph]. CC BY 2.0 Flickr. https://www.flickr.com/photos/pdenker/6001236724/

ITU Pictures. (n.d.). 1984-01 [Image]. CC BY 2.0 Flickr. https://www.flickr.com/photos/itupictures/16474896040/

Tsevis, C. (n.d.). Clear Channel: Where brands meet people. Behance. https://www.behance.net/gallery/29879405/Clear-Channel-Where-brands-meet-people

13.3 Defining the Message

Reading: Defining the Message

Hannington, J. & Garrett, C. (2020, April 15). How to create brand messaging that really resonates. Salesforce Pardot. https://www.pardot.com/blog/how-to-create-brand-messaging-that-resonates/

13.4 Determining IMC Objectives and Approach

Reading: Determining IMC Objectives and Approach

Boundless. (n.d.). AIDA model. Boundless marketing [Course]. CC BY-SA 4.0 Lumenlearning. https://courses.lumenlearning.com/boundless- marketing/

Boundless. (n.d.). Push and pull strategies. Boundless marketing [Course]. CC BY-SA 4.0 Lumenlearning. https://courses.lumenlearning.com/boundless- marketing/

Cooper, P. (2018, November 13). 41 Facebook stats that matter to marketers in 2019. VII Digital. https://www.viidigital.com/41-facebook-stats-that-matter-to-marketers-in-2019/

Mini. (n.d.). Mini [Advertisement]. https://www.miniusa.com/

SMART criteria. (n.d.). In Wikipedia. https://en.wikipedia.org/wiki/SMART_criteria

Video: Prioritizing Marketing Communications

A Guide for Prioritizing Marketing Communications: Nick Scarpino at TEDxUofIChicago. Provided by: TEDx. Located at: https://youtu.be/UhQ2T5V2SQE?list=PLzGAKV7EcDXvAMT-rhjYDfBOTmd_2dSiQ.

13.5 Marketing Communication Methods

Reading: Advertising

Behavioral Targeting. Provided by: BBC. Located at: https://youtu.be/HtOkaAMOmAc. License: CC BY-NC-ND: Attribution-NonCommercial-NoDerivatives

Black + Decker 20v Max*- Lithium Drill/Driver with AutoSense Technology. Provided by: Lowe’s Canada. Located at: https://youtu.be/w6tqDoJQokM.

Burnett, J. (2011). Communicating to mass markets. Introducing marketing (pp.195-214). CC BY 3.0 http://solr.bccampus.ca:8001/bcc/file/ddbe3343-9796-4801-a0cb- 7af7b02e3191/1/Core%20Concepts%20of%20Marketing.pdf

California Milk Processor Board. (2013, June 22). Got milk? [Advertisement]. Wikimedia. https://commons.wikimedia.org/wiki/File:Gotmilk.png

Heinz Ketchup Wiener Stampede. Provided by: Heinz. Located at: https://youtu.be/LOlfhBT8i9I

Hoover. (n.d.). Hoover [Advertisement]. https://www.hoover.com/

Naked Juice. (n.d.). Naked Juice [Advertisement]. https://www.nakedjuice.com/

Puma. (n.d.). Puma [Advertisement]. https://us.puma.com/en/us/home

Revision and adaptation of advertising. (n.d.). In Wikipedia. CC BY-SA 3.0 https://en.wikipedia.org/wiki/Advertising

Rogue Ales and Spirits. (n.d.). Rogue Voodoo Porter [Advertisement]. https://www.rogue.com/

VAwebteam. (2008, January 5). Pears soap [Advertisement]. Wikimedia. https://commons.wikimedia.org/wiki/File:Pears_Soap_1900.jpg

Weissman, J. (2014, April 28). The decline of newspapers hits a stunning milestone. Slate. https://slate.com/business/2014/04/decline-of-newspapers-hits-a-milestone-print-revenue-is-lowest-since-1950.html

Reading: Public Relations

Edward Lowe Foundation. (n.d.). How to establish a promotional mix. https://edwardlowe.org/how-to-establish-a-promotional-mix/

ICT Authority. (2014, April 16). Innovation awards [Photograph]. CC BY 2.0 Flickr. https://www.flickr.com/photos/kenyaictboard/14140767473/

Rawpixel. (n.d.). Announcement [Photograph]. CCO Pixabay. https://pixabay.com/photos/announcement-announcing-audio-3976318/

Tyson Foods Meals That Matter. Provided by: Tyson Foods. Located at: https://youtu.be/awsB5_H2PlI.

Reading: Sales Promotions

Boundless. (n.d.). Sales promotion. Boundless marketing [Course]. CC BY-SA 4.0 Lumenlearning. https://courses.lumenlearning.com/boundless-marketing/

Burnett, J. (2011). Communicating to mass markets. Introducing marketing (pp.195-214). CC BY 3.0 http://solr.bccampus.ca:8001/bcc/file/ddbe3343-9796-4801-a0cb- 7af7b02e3191/1/Core%20Concepts%20of%20Marketing.pdf

Carter, B. (2017, November 15). Coupon statistics: The ultimate collection. Access Development. https://blog.accessdevelopment.com/ultimate-collection-coupon-statistics

Edward Lowe Foundation. (n.d.). How to establish a promotional mix. https://edwardlowe.org/how-to-establish-a-promotional-mix/

Gamification. Provided by: BBC. Located at: https://youtu.be/1nikw1v5Zjo. License: CC BY-NC-ND: Attribution-NonCommercial-NoDerivatives

Gitman, L.J., McDaniel, C., Shah, A., Reece, M., Koffel, L., Talsma, B., Hyatt, J.C. (2018). Sales promotion. Introduction to business [Course]. CC BY 4.0 OpenStax http://cnx.org/contents/4e09771f- a8aa-40ce-9063-aa58cc24e77f@8.6.

Hendricks, D. (2015, May 13). 5 ways to enhance your SEO campaign with online coupons. Forbes. https://www.forbes.com/sites/drewhendricks/2015/05/13/5-ways-to-enhance-your-seo-campaign-with-online-coupons/#29c061f162aa

Muzellec, L. (2016, June 23). James Bond, Dunder Mifflin, and the future of product placement. Harvard Business Review. https://hbr.org/2016/06/james-bond-dunder-mifflin-and-the-future-of-product-placement

Steinberg, D. (2017, September 25). Science affliction: Are companies cursed by cameos in Blade Runner? The Wall Street Journal. https://www.wsj.com/articles/science-affliction-are-companies-cursed-by-cameos-in-blade-runner-1506356096

Terry, J. (2017, July 31). Unfunny Emoji movie is a sad echo of 2015’s “Inside Out”. Deseret News. https://www.deseret.com/2017/7/31/20616700/unfunny-emoji-movie-is-a-sad-echo-of-2015-s-inside-out#gene-t-j-miller-and-hi-5-james-corden-in-the-emoji-movie

Tincher, J. (2016, August 30). Your moment of truth. Customer Think. https://customerthink.com/your-moment-of-truth/

Urban Bohemian. (2010, September 1). Sampler tray of Starbucks new mocha toffee latte [Photograph]. CC BY-NC-ND 2.0 Flickr. https://www.flickr.com/photos/urbanbohemian/4948232118/

Reading: Personal Selling

Boundless. (n.d.). Personal selling In Boundless marketing [Course]. CC BY-SA 4.0 Lumenlearning. https://courses.lumenlearning.com/boundless-marketing/

Burnett, J. (2011). Communicating to mass markets. Introducing marketing (pp.195-214). CC BY 3.0 http://solr.bccampus.ca:8001/bcc/file/ddbe3343-9796-4801-a0cb- 7af7b02e3191/1/Core%20Concepts%20of%20Marketing.pdf

CWCS Managed Hosting. (2012, November 1). Phone call [Photograph]. CC BY 2.0 Flickr. https://www.flickr.com/photos/122969584@N07/13780153345/

Cytonn Photography. (2018, March 23). Handshake [Photograph]. CCO Unsplash. https://unsplash.com/photos/n95VMLxqM2I

Kakati, W. (2010, September 2). Personal selling – when and how? SME Times. http://www.smetimes.in/smetimes/in-depth/2010/Sep/02/personal-selling-when-and-how500001.html

Merchant, P. (n.d.). Strategic selling techniques. Hearst. https://smallbusiness.chron.com/strategic-selling-techniques-15747.html

Zabanga Marketing. (2019, April 26). How companies integrate personal selling into the IMC program. https://www.zabanga.us/marketing-communications/how-companies-integrate-personal-selling-into-the-imc-program.html

Reading: Direct Marketing

Duhbigg, C. (2012, February 16). How companies learn your secrets. The New York Times. https://www.nytimes.com/2012/02/19/magazine/shopping-habits.html

Rodriguez, R. (2012, October 5). Email marketing [Photograph]. CC BY-SA 2.0 Flickr. https://www.flickr.com/photos/rahulrodriguez/9162677329/

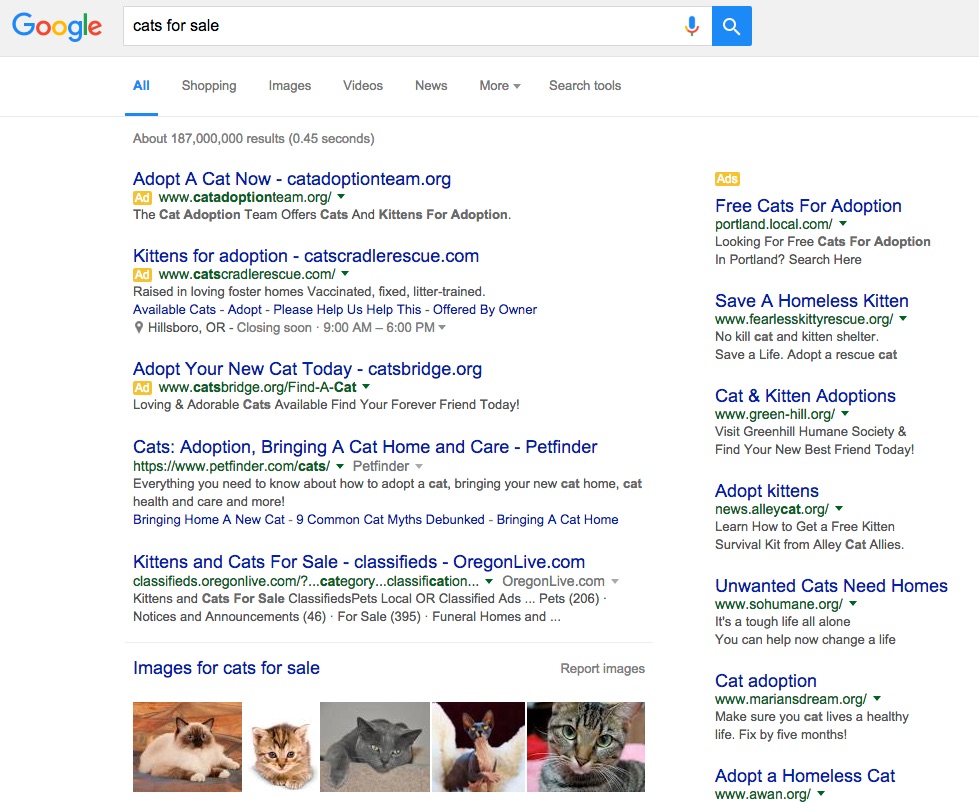

Reading: Digital Marketing

Always #LikeAGirl. Provided by: Always. Located at: https://youtu.be/XjJQBjWYDTs.

Barker, M., Barker, D. I., Bormann, N., Neher, K. (2012). Social media marketing: A strategic approach. Boston, MA: Cengage Learning.

Farmers Insurance. (n.d.) Farmers Insurance web site [Screenshot]. https://www.farmers.com/

Google. (n.d.). Cats for sale search [Screenshot]. https://www.google.com/

Google AdWords. Provided by: BBC. Located at: https://youtu.be/NIL2POjhvI8. License: CC BY-NC-ND: Attribution-NonCommercial-NoDerivatives

Social Fresh interview with Morgan Johnston of jetBlue. Provided by: Social Fresh. Located at: https://youtu.be/mzsN3oEV1YE.

Reading: Guerrilla Marketing

Business Insider. (2010, April 19). How to pull off a Guerrilla marketing campaign. Entrepreneur. https://www.entrepreneur.com/article/206202

Marrs, M. (2020, July 1). 20+ jaw-dropping guerrilla marketing examples. WordStream. https://www.wordstream.com/blog/ws/2014/09/22/guerrilla-marketing-examples

O’Neil, D.X. (2007, June 6). Downtown guerilla marketing [Photograph]. CC BY 2.0 Flickr. https://flic.kr/p/PSjaN

Nike Livestrong – ChalkBot – Web Film. Located at: https://youtu.be/iCLdyKHxBnQ?list=PLGhn_uYiaIc8injQ6hgMPXHwmXc3l66Hx.

Speed up your life – Take the slide!. Provided by: Volkswagen. Located at: https://youtu.be/W4o0ZVeixYU.

13.6 Using IMC in the Sales Process

Reading: Using IMC in the Sales Process

How Zombies Helped Deliver the Right Message to the Right Audience at the Right Time. Authored by: MarketingSherpa. Located at: https://youtu.be/kmMU6gGa5ZE.

Kirkpatrick, D. (2013, November 20). Case study: Multichannel marketing: IT company’s zombie-themed campaign increases CTO 3% at president, owner level. MarketingSherpa. https://www.marketingsherpa.com/article/case-study/zombie-themed-campaign-sungard

Patch, C. (2005, October 18). Handshake [Photograph]. CC BY-NC 2.0 Flickr. https://www.flickr.com/photos/chuckp/252924532/

13.7 Customer Relationship Management (CRM) System

Reading: Customer Relationship Management (CRM) Systems and IMC

Boundless. (n.d.). CRM and personal selling. Boundless marketing [Course]. CC BY-SA 4.0 Lumenlearning. https://courses.lumenlearning.com/boundless-marketing/

Pardot Customer Story: Precor. Provided by: Pardot. Located at: https://youtu.be/GVH4THFmjrU?list=PLNmYf_HyHDDo5uLP-Fowrm5LIKNM8zj0d.

Personalized Recommendations Online. Provided by: BBC. Located at: https://youtu.be/I952kdcpE3Y. License: CC BY-NC-ND: Attribution-NonCommercial-NoDerivatives

13.8 Measuring Marketing Communication Effectiveness

Reading: Measuring Marketing Communication Effectiveness

Barker, M., Barker, D. I., Bormann, N., Neher, K. (2012). Examples of key performance indicators. Social media marketing: A strategic approach. Boston, MA: Cengage Learning.

Kansai Explorer. (2010, March 7). Citizen watch [Photograph]. CC BY-SA 3.0 Wikimedia. https://commons.wikimedia.org/wiki/File:Citizen_Attesa_Eco-Drive_ATV53-3023_02.JPG

Klim, A. (n.d.). Compass [Illustration]. CC BY 2.0 Flickr. https://www.flickr.com/photos/igraph/8231264538/

SnapApp. (2014). Case study: Citizen watch drives social engagement with interactive content. http://cdn.snapapp.com/site/images/resources/SnapApp-CaseStudy-CitizenWatch.pdf

What Are Key Performance Indicators (KPIs)?. Authored by: Bernard Marr. Located at: https://youtu.be/9Co8slUvYj0.

13.9 Developing a Marketing Campaign and Budget

Reading: Developing a Marketing Campaign and Budget

American Express Open Small Business Gets An Official Day. Authored by: CannesPredictions. Located at: https://youtu.be/NgmLC6jbxfg?list=PLGhn_uYiaIc8injQ6hgMPXHwmXc3l66Hx.

Amnesty: Wake up, humans!. Authored by: sonicecreative. Located at: https://youtu.be/WdklF22ciok?list=PLGhn_uYiaIc8injQ6hgMPXHwmXc3l66Hx

Blackwell, D. (2014, February 13). Raining cats and dogs [Image]. CC BY-ND 2.0 Flickr. https://www.flickr.com/photos/mobilestreetlife/12505752913/

Min, H. (n.d.). Innovation – 3 [Photograph]. CC BY-NC-ND 2.0 Flickr. https://www.flickr.com/photos/nyoin/2751494190/

WorldIslandInfo.com. (2006, December 9). Planning session [Photograph]. CC BY 2.0 Flickr. https://www.flickr.com/photos/76074333@N00/317952268/

13.10 Putting It Together: Promotion: Integrated Marketing Communication (IMC)

Neisser, D. (2012, November 20). Myth busting with small business Saturday. Marketing Daily. https://www.mediapost.com/publications/article/187192/myth-busting-with-small-business-saturday.html

13.12 Focus on Social Media Marketing

QuickBooks Canada Team. (2019). 5 Canadian companies that excel at social media marketing. Intuit. https://quickbooks.intuit.com/ca/resources/marketing/canadian-companies-excel-social-media-marketing/

StatCounter. (n.d.). Social media stats Canada May 2018 – May 2019. https://gs.statcounter.com/social-media-stats/all/canada/#monthly-201805-201905-bar

MODULE 14: MARKETING GLOBALLY

14.1 Why It Matters: Marketing Globally

Chinese Flavors for American Snacks. Provided by: BBC. Located at: https://youtu.be/BA8bCNiKZsg. License: CC BY-NC-ND: Attribution-NonCommercial-NoDerivatives

14.2 Globalization Benefits and Challenges

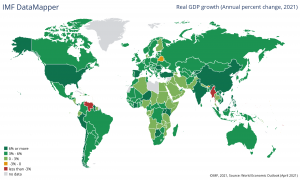

Reading: Globalization Benefits and Challenges

Globalization Easily Explained. Authored by: Explainity. Located at: https://youtu.be/JJ0nFD19eT8

JackintheBox. (2018, April 10). Real GDP growth rate in 2017 [Map]. CC BY-SA 4.0 Wikimedia. https://commons.wikimedia.org/wiki/File:Real_GDP_growth_rate_(%25)_in_2017.png

Piotrus. (2008, May 1). Poland potholes [Photograph]. CC BY-SA 3.0 Wikimedia. https://commons.wikimedia.org/wiki/File:Poland_-_potholes_(Malopolska)_01a.JPG

14.3 Approaches to Global Competition

Reading: Entry Strategies in Global Markets

Koutoulas, N. (2012, July 4). Acceleration! [Photograph]. CC BY 2.0 Flickr. https://www.flickr.com/photos/33284937@N04/7507679046/

Monblat, T. (2015, March 4). Sutton, Surrey, Greater London – Holiday Inn clock [Photograph]. CC BY-SA 2.0 Flickr. https://www.flickr.com/photos/128484499@N06/16160166243/

Siekierska, A. (2018, June 6). Air Canada and Air China sign long-awaited joint venture deal. Financial Post. https://financialpost.com/transportation/airlines/air-canada-air-china-sign-joint-venture-deal-in-state-airlines-first-deal-with-north-american-carrier

Reading: Approaches to Global Competition

Muraguchi, S. (2007, August 24). IMG_3639.JPG [Photograph]. CC BY-NC-ND 2.0 Flickr. https://www.flickr.com/photos/shok/1794713372/

Tsang, B. (2009, January 26). How did these hipsters get here? [Photograph]. CC BY-NC-ND 2.0 Flickr. https://www.flickr.com/photos/bettytsang/3231176585/

Video: McDonald’s “Glocalization”

McDonald’s. Provided by: BBC. Located at: https://youtu.be/4hQwdIVyi2s. License: CC BY-NC-ND: Attribution-NonCommercial-NoDerivatives

Reading: Applying Marketing Principles in the Global Environment

Case, D. (2013, August 6). Chopstick shelves [Photograph]. CC BY-SA 3.0 Wikimedia. https://commons.wikimedia.org/wiki/File:Chopstick_shelves_at_Wal- Mart_store_in_Shenzhen,_China.jpg

Lay’s. (n.d.). Lay’s: Hot chili squid flavor [Image]. https://www.lays.com

Wiriya, D. (2017, December 8). Globe map [Photograph]. CCO Unsplash. https://unsplash.com/photos/KiMpFTtuuAk

14.4 Factors Shaping the Global Marketing Environment

Reading: Demographic Factors Shaping the Global Marketing Environment

Kransky. (2008, January 2). COB data Sweden [Map]. CC BY-SA 3.0 Wikimedia. https://commons.wikimedia.org/wiki/File:COB_data_Sweden.PNG

Reading: Cultural Factors Shaping the Global Marketing Environment

Matthew G. (2014, April 19). B&W shades [Photograph]. CC BY 2.0 Flickr. https://www.flickr.com/photos/streetmatt/13926933406/

Ossama, R. (2007, November 27). Fixing my hijab [Photograph]. CC BY-SA 2.0 Flickr. https://www.flickr.com/photos/ranoush/2113881040/

Waddington, R. (2013, November 4). Too cool, Surmi Tribe [Photograph]. CC BY-SA 2.0 Flickr. https://www.flickr.com/photos/rod_waddington/10659035426/

The White House President Barak Obama. (2015). President Obama offers namaste greeting in India [Photograph]. https://obamawhitehouse.archives.gov/photos-and- video/photo/2015/01/president-obama-offers-namaste-greeting-india

Reading: Institutional Factors Shaping the Global Marketing Environment

Happenstance. (2014, June 26). Map of World Trade Organization members and observers [Map]. Wikimedia. https://commons.wikimedia.org/wiki/File:WTO_members_and_observers.svg

International Fair Trade certification mark [Logo] (n.d.). In Wikipedia. https://en.wikipedia.org/wiki/File:Fairtrade.png

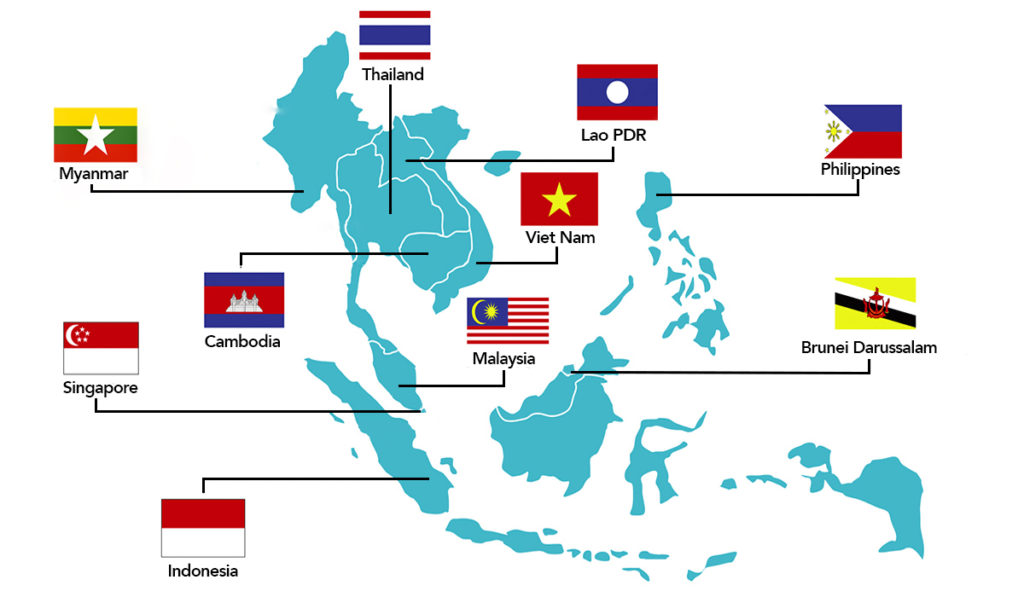

Sidney KH. (n.d.). Modification of ASEAN countries [Photograph]. CC BY-SA 4.0 Wikimedia. https://commons.wikimedia.org/wiki/File:Khmerall.jpg

United Nations Development Programme. (2010, January 13). Haitian national palace earthquake [Photograph]. CC BY 2.0 Wikimedia. https://commons.wikimedia.org/wiki/File:Haitian_national_palace_earthquake.jpg

World Trade Organization. (2015). International trade statistics 2015. https://www.wto.org/english/res_e/statis_e/its2015_e/its2015_e.pdf

14.5 Putting It Together: Marketing Globally

Braizaz, M. (2014). L’Oréal a success story in international marketing to women. Womenology. http://www.womenology.com/sectors/beauty-toiletries/loreal-a-success-story-in-international-marketing-to-women/

Interview with Lubomira Rochet, Chief Digital Officer, L’Oru00e9al. Provided by: L’Oréal. Located at: https://www.youtube.com/watch?v=8ch08b2-OCE.

Tech giant Google may return to China. Provided by: CCTV News. Located at: https://youtu.be/dQNdxlssOXI.

Waddell, K. (2016, January 19). Why Google quit China – and why it’s heading back. The Atlantic. https://www.theatlantic.com/technology/archive/2016/01/why-google-quit-china-and-why-its-heading-back/424482/

MODULE 15: MARKETING PLAN

15.3 Presenting the Marketing Plan

Reading: Presenting the Marketing Plan

Bitey Mad Lady. (2015, March 24). Sneaky Beb [Photograph]. CC BY-NC-ND 2.0 Flickr. https://www.flickr.com/photos/froggenstein/16911480062/

Life After Death by PowerPoint 2012 by Don McMillan. Authored by: Don McMillan. Located at: https://www.youtube.com/watch?v=MjcO2ExtHso.

Reading: Business Presentations

ImagineCup. (2012, July 9). Imagine Cup 2012 – Day 4 finalist presentations [Photograph]. CC BY 2.0 Flickr. https://www.flickr.com/photos/imaginecup/7534287902/

15.5 Putting It Together: Marketing Plan

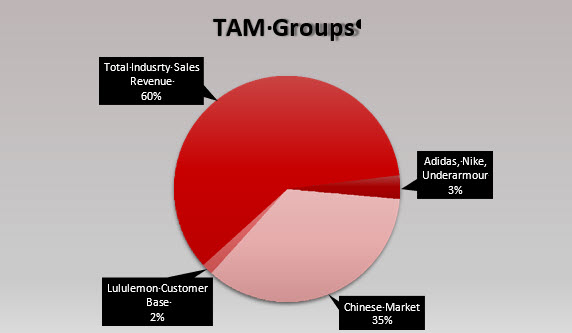

Allison. (2020, March 12). Nike in China: Embracing digital transformation. Daxue Consulting. https://daxueconsulting.com/nike-in-china/

Amazon. (n.d.). Lululemon dupes. https://www.amazon.ca/s?k=lululemon+dupes&ref=nb_sb_noss_2

Boyd, D. (2020, January 3). Writing a marketing plan – writing the product or service analysis [Course]. LinkedIn Learning. https://www.linkedin.com/learning/writing-a-marketing-plan-2

Business Strategy Hub. (2019). Lululemon: Vision / mission / values / strategy (2019) – here is everything you need to know! https://bstrategyhub.com/lululemon-vision-mission-values-strategy-here-is-everything-you-need-to-know/

CPG, FMCG & Retail. (2019, April 1). 61% of Chinese consumers choose premium products because of superior quality. Nielson. https://www.nielsen.com/cn/en/insights/article/2019/61-percent-of-chinese-consumers-choose-premium-products-because-of-superior-quality/

Digital Crew Insights and Analysis. (2019). Buying cycle of a Chinese consumer: What you need to know. https://www.digitalcrew.com.au/blogs-and-insights/buying-cycle-of-a-chinese-customer-what-you-need-to-know/

Digital Marketing to China. (2019, January 18). Digital marketing in China 2019: Some figures about what digital will be this year. Marketing To China. https://www.marketingtochina.com/digital-marketing-in-china-2019-some-figures-about-what-digital-will-be-this-year/

Dun & Bradstreet. (2019). Hoover report: Lululemon Athletica Canada profile. https://www.dnb.com/business-directory/company-profiles.lululemon_athletica_canada_inc.c5bbdb80eaff4370a208afaddbe0787b.html

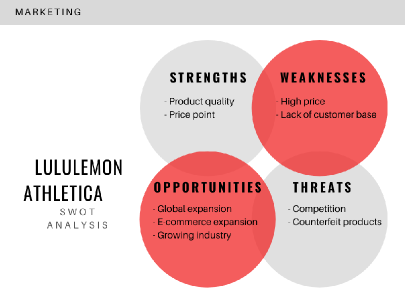

Farooq, U. (2018, April 22). SWOT analysis of Lululemon Athletica Inc. Marketing Tutor. https://www.marketingtutor.net/lululemon-swot-analysis/

Gentlemen in China. (2017, November 21). The world’s most important e-commerce day is in China. Marketing to China. https://www.marketingtochina.com/worlds-important-e-commerce-day-china/

Gentlemen in China. (2018, June 28). How to connect with 85,000 Chinese distributors. Marketing to China. https://www.marketingtochina.com/connect-85-000-chinese-distributors/

Ghani, A. (2015, August 9). Lululemon strategy report. Slideshare. https://www.slideshare.net/azizghani0/lululemon-strategy-report-51426773

Kalpazanova, I. (2016, June 9). The life cycle analysis of Lululemon “wunder-under” leggings. Prezi. https://prezi.com/bi0fn44ptpny/the-life-cycle-analysis-of-lululemon-wunder-under-leggings/

Lee, J. (2017, May 23). 3 successful marketing strategies to win over the new Chinese consumer. Jing Daily. https://jingdaily.com/marketing-strategies-new-chinese-consumer/

Lululemon Athletica. (n.d.). Financial information. https://investor.lululemon.com/financial-information

Lululemon Athletica. (n.d.). Lululemon website. https://shop.lululemon.com/?CID=Google_All_PPC%2BBrand_CA&gclid=CjwKCAjwvtX0BRAFEiw AGWJyZBUnHxotBcF1Z9wVJHIcyLFr- u8hFj4WGX6g1dZ1oeFPxqEPU151SxoCPa0QAvD_BwE&gclsrc=aw.ds

Lululemon Athletica. (n.d.). The wunder under collection. https://shop.lululemon.com/story/womens-wunder-under-pants

Lutz, A. (2015, February 2). Lululemon calls its ideal customers ‘Ocean’ and ‘Duke’ – here’s everything we know about them. Business Insider. https://www.businessinsider.com/lululemon-idea-customers-ocean-and-duke-2015-2

Mission Statement Academy. (2019, November 20). Lululemon mission and vision statements analysis. https://mission-statement.com/lululemon/

Nike. (n.d.). Nike one. https://www.nike.com/ca/t/one-mid-rise-leggings-LS2tbp/AJ8827-639

Pan, Y. (2018, February 15). In China, flashy logos are making a comeback as a status symbol. Quartz Media. https://qz.com/1198053/in-china-flashy-logos-are-making-a-comeback-as-a-status-symbol/

Policella, G. (2019, November 14). How Lululemon uses lifestyle marketing to create a strong brand community. Smile. https://blog.smile.io/how-lululemon-uses-lifestyle-marketing-to-create-a-strong-brand-community/

Quiroz, M.A. (2018, January 8). A growth strategy for Lululemon 2018. Medium. https://medium.com/@michaelangelo_q/a-growth-strategy-for-lululemon-68819680e511

Rapp, J. (2017, June 19). Lululemon taps China’s digital natives craving experiential luxury. Jing Daily. https://jingdaily.com/china-lululemon-yoga-wellness/

Rapp, J. (2018, April 23). Athleisure wears sales in China grow, but as fashion trend it is still in its infancy. South China Morning Post. https://www.scmp.com/lifestyle/fashion-beauty/article/2142894/athleisure-wear-sales-china-grow-fashion-trend-it-still-its

Swartz, D. (2020, March 29). Covid-19 poses a big challenge, but Lululemon has the brand strength and finances to overcome it. Morningstar. https://analysisreport.morningstar.com/stock/research/c- report?&t=XNAS:LULU®ion=usa&culture=en- US&productcode=QS&ops=clear&cur=&urlCookie=eyJhbGciOiJSU0EtT0FFUCIsImVuYyI6IkExMjh HQ00ifQ.P1SL79EEH3Im3qRNRNGBvV8pKUIiIGu30aAqy8zwh3mipafX8hUQ8UP1yGjRi2KZyfd

Thangavelu, P. (2018, December 6). Understanding Lululemon’s business model (LULU). Investopedia. https://www.investopedia.com/articles/investing/052715/understanding-lululemons-business-model.asp

Tmall. (n.d.). Tmall website. https://www.tmall.com/

Verot, O. (2017, May 5). 2017: 80% of Chinese perform professional tasks on Wechat. Marketing to China. https://www.marketingtochina.com/2017-80-chinese-perform-professional-tasks-wechat/

Who Knows China. (2020). An opportunity or a challenge: Lululemon in China. https://whoknowschina.com/case-study/lululemon-entering-chinese-market/

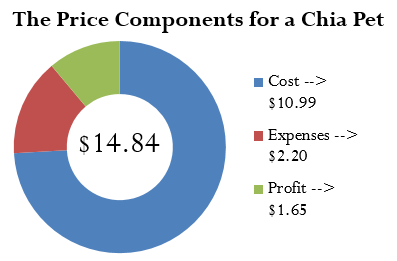

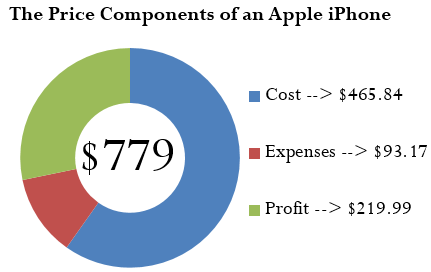

Example: Perfume manufacturers devote extensive time and attention to making beautiful, distinctive designs for perfume bottles and packaging. One estimate suggests that for each $100 bottle of perfume, the manufacturer’s expense for the bottle and packaging is $10. Meanwhile, their expense for the bottle’s contents is only about $2.

Example: Perfume manufacturers devote extensive time and attention to making beautiful, distinctive designs for perfume bottles and packaging. One estimate suggests that for each $100 bottle of perfume, the manufacturer’s expense for the bottle and packaging is $10. Meanwhile, their expense for the bottle’s contents is only about $2.

Let’s look at an example of viral marketing and a successful new product that has changed transportation in cities around the world. How did the individuals who created the product at the beginning of its life cycle develop a winning product concept and take it to market?

Let’s look at an example of viral marketing and a successful new product that has changed transportation in cities around the world. How did the individuals who created the product at the beginning of its life cycle develop a winning product concept and take it to market?

Johnson & Johnson has hundreds of products. They sell baby shampoo to new parents and knee systems to surgeons who perform knee replacement surgeries. Imagine trying to understand all of the different products and their target buyers. It would be impossible to span all of those products well. At the same time, what if your organization owns a single product—say, Johnson & Johnson’s Neutrogena face wash? A different organization owns Johnson & Johnson’s Aveeno face wash. It would be easy to optimize for a single product, rather than trying to achieve company objectives across all the products.

Johnson & Johnson has hundreds of products. They sell baby shampoo to new parents and knee systems to surgeons who perform knee replacement surgeries. Imagine trying to understand all of the different products and their target buyers. It would be impossible to span all of those products well. At the same time, what if your organization owns a single product—say, Johnson & Johnson’s Neutrogena face wash? A different organization owns Johnson & Johnson’s Aveeno face wash. It would be easy to optimize for a single product, rather than trying to achieve company objectives across all the products.

Have you ever found a product that seems like it was made for you? You don’t need to read the instructions. You don’t have to learn how to use it. It seems natural to conform to your preferences and needs. The creation of such products is the goal of user-centered design.

Have you ever found a product that seems like it was made for you? You don’t need to read the instructions. You don’t have to learn how to use it. It seems natural to conform to your preferences and needs. The creation of such products is the goal of user-centered design.

![A circle diagram illustrating price components for a fridge. The circle represents the regular selling price ($2,666.67.) The blue portion of the circle represents cost ($1,200.00). The red portion of the circle represents expenses [0.3($2,666.67) = $800.00.] The green portion of the circle represents profit [0.25($2,666.67) = $666.67]](https://ecampusontario.pressbooks.pub/app/uploads/sites/862/2020/08/4.2c-fridge-price.png)

![A circle diagram illustrating price components of an MP3 player. The circle represents the regular selling price ($39.99.) The blue portion of the circle represents cost ($26.15.) The red portion of the circle represents expenses [0.3($26.15) = $7.84.] The green portion of the circle represents profit [0.13($39.99) = $6.00.]](https://ecampusontario.pressbooks.pub/app/uploads/sites/862/2020/08/4.2d-mp3-player.png)

Beyond the distinctions in the products they provide, there are structural differences among retailers that influence their strategies and results. One of the reasons the retail industry is so large and powerful is its diversity. For example, stores vary in size, in the kinds of services that are provided, in the assortment of merchandise they carry, and in their ownership and management structures.

Beyond the distinctions in the products they provide, there are structural differences among retailers that influence their strategies and results. One of the reasons the retail industry is so large and powerful is its diversity. For example, stores vary in size, in the kinds of services that are provided, in the assortment of merchandise they carry, and in their ownership and management structures.

Malls and shopping centers are successful because they provide customers with a wide assortment of products across many stores. If you want to buy a suit or a dress, a mall provides many alternatives in one location. Malls are larger centers that typically have one or more department stores as major tenants. Strip malls are a common string of stores along major traffic routes, while isolated locations are freestanding sites not necessarily in heavy traffic areas. Stores in isolated locations must use promotion or some other aspect of their marketing mix to attract shoppers.

Malls and shopping centers are successful because they provide customers with a wide assortment of products across many stores. If you want to buy a suit or a dress, a mall provides many alternatives in one location. Malls are larger centers that typically have one or more department stores as major tenants. Strip malls are a common string of stores along major traffic routes, while isolated locations are freestanding sites not necessarily in heavy traffic areas. Stores in isolated locations must use promotion or some other aspect of their marketing mix to attract shoppers.

In managing the supply chain, many businesses prefer to use a just-in-time (JIT) inventory management approach. This means that the company will keep very little inventory on hand at each step in the supply chain. Let’s revisit a real example to see why this might be a good idea.

In managing the supply chain, many businesses prefer to use a just-in-time (JIT) inventory management approach. This means that the company will keep very little inventory on hand at each step in the supply chain. Let’s revisit a real example to see why this might be a good idea.

Public relations (PR) is the process of maintaining a favorable image and building beneficial relationships between an organization and the public communities, groups, and people it serves. Unlike advertising, which tries to create favorable impressions through paid messages, public relations does not pay for attention and publicity. Instead, PR strives to earn a favorable image by drawing attention to newsworthy and attention-worthy activities of the organization and its customers. For this reason, PR is often referred to as “free advertising.”

Public relations (PR) is the process of maintaining a favorable image and building beneficial relationships between an organization and the public communities, groups, and people it serves. Unlike advertising, which tries to create favorable impressions through paid messages, public relations does not pay for attention and publicity. Instead, PR strives to earn a favorable image by drawing attention to newsworthy and attention-worthy activities of the organization and its customers. For this reason, PR is often referred to as “free advertising.”

Personal selling uses in-person interaction to sell products and services. This type of communication is carried out by sales representatives, who are the personal connection between a buyer and a company or a company’s products or services. Salespeople not only inform potential customers about a company’s product or services, they also use their power of persuasion and remind customers of product characteristics, service agreements, prices, deals, and much more. In addition to enhancing customer relationships, this type of marketing communications tool can be a powerful source of customer feedback, as well. Later we’ll cover marketing alignment with the sales process in greater detail. This section focuses on personal selling as one possible tool in the promotional mix.

Personal selling uses in-person interaction to sell products and services. This type of communication is carried out by sales representatives, who are the personal connection between a buyer and a company or a company’s products or services. Salespeople not only inform potential customers about a company’s product or services, they also use their power of persuasion and remind customers of product characteristics, service agreements, prices, deals, and much more. In addition to enhancing customer relationships, this type of marketing communications tool can be a powerful source of customer feedback, as well. Later we’ll cover marketing alignment with the sales process in greater detail. This section focuses on personal selling as one possible tool in the promotional mix. The most significant strength of personal selling is its flexibility. Salespeople can tailor their presentations to fit the needs, motives, and behaviour of individual customers. A salesperson can gauge the customer’s reaction to a sales approach and immediately adjust the message to facilitate better understanding.

The most significant strength of personal selling is its flexibility. Salespeople can tailor their presentations to fit the needs, motives, and behaviour of individual customers. A salesperson can gauge the customer’s reaction to a sales approach and immediately adjust the message to facilitate better understanding.

Guerrilla marketing campaigns can be very diverse in their approach and tactics. So what do they have in common? Guerrilla marketing often has the following characteristics:

Guerrilla marketing campaigns can be very diverse in their approach and tactics. So what do they have in common? Guerrilla marketing often has the following characteristics:

Why is this helpful? For a sale to occur, the buyer needs to move through the decision-making process successfully. To help the buyer do that, the seller needs to provide information and assistance along the way. For some products and services, such as those that employ personal selling, the seller’s role is very hands-on. For other product and services, particularly ones in low-involvement decisions, the seller’s role may be fairly hands-off. In either case, though, it’s helpful for marketers to understand the sales process that happens alongside the consumer decision-making process.

Why is this helpful? For a sale to occur, the buyer needs to move through the decision-making process successfully. To help the buyer do that, the seller needs to provide information and assistance along the way. For some products and services, such as those that employ personal selling, the seller’s role is very hands-on. For other product and services, particularly ones in low-involvement decisions, the seller’s role may be fairly hands-off. In either case, though, it’s helpful for marketers to understand the sales process that happens alongside the consumer decision-making process.

As you can appreciate at this point—especially after learning about all the available IMC methods and tools—IMC is complicated and often elaborate. Even simple marketing plans require multiple steps to execute effectively. For this reason, marketers routinely create campaign plans (also called IMC plans), which carefully list each step required to complete an IMC project. These “action plans” fit into a broader marketing plan and are used to document the actual steps that need to happen, when, and who is responsible for them.

As you can appreciate at this point—especially after learning about all the available IMC methods and tools—IMC is complicated and often elaborate. Even simple marketing plans require multiple steps to execute effectively. For this reason, marketers routinely create campaign plans (also called IMC plans), which carefully list each step required to complete an IMC project. These “action plans” fit into a broader marketing plan and are used to document the actual steps that need to happen, when, and who is responsible for them. Effective marketing campaign plans require several elements that, together, paint a complete picture of what the marketing team will execute with their IMC tools. These include the following:

Effective marketing campaign plans require several elements that, together, paint a complete picture of what the marketing team will execute with their IMC tools. These include the following: once a campaign is defined and the action plan is in place. It’s helpful to identify any noteworthy risks or dependencies that might put your campaign in jeopardy. For example, if the campaign relies on one person to make everything happen and that person gets sick or decides to take a new job, then that’s a risk that managers should know about. Below are a few more:

once a campaign is defined and the action plan is in place. It’s helpful to identify any noteworthy risks or dependencies that might put your campaign in jeopardy. For example, if the campaign relies on one person to make everything happen and that person gets sick or decides to take a new job, then that’s a risk that managers should know about. Below are a few more:

The same marketing principles that lead to marketing success in domestic marketing can also apply to global marketing. With the rapidly growing force of globalization, the distinction between marketing within an organization’s home country and marketing within external markets is disappearing very quickly. With this in mind, organizations are modifying their marketing strategies to meet the challenges of the global marketplace while trying to sustain their competitiveness within home markets. These changes have also prompted brands to customize their global marketing mix for different markets, based on local languages, needs, wants, and values.

The same marketing principles that lead to marketing success in domestic marketing can also apply to global marketing. With the rapidly growing force of globalization, the distinction between marketing within an organization’s home country and marketing within external markets is disappearing very quickly. With this in mind, organizations are modifying their marketing strategies to meet the challenges of the global marketplace while trying to sustain their competitiveness within home markets. These changes have also prompted brands to customize their global marketing mix for different markets, based on local languages, needs, wants, and values.

Culture refers to the influence of religious, family, educational, and social systems on people, how they live their lives, and the choices they make. Marketing always exists in an environment shaped by culture. Organizations that intend to market products in different countries must be sensitive to the cultural factors at work in their target markets. Even cultural differences between different countries–or between different regions in the same country–seem small, marketers who ignore them risk failure in implementing their programs.