3 Finding, Evaluating and Selecting Suppliers

Note. From geralt, n.d. Licensed for reuse under the Pixabay license.

Learning Objectives

- Discuss the various sources of market intelligence.

- Recognize the use of market intelligence in identifying potential suppliers.

- Understand key supplier evaluation practices.

- Explain the need for identifying and evaluating global suppliers.

- Understand the key aspects of procurement contract execution.

- Implement the various forms of procurement enablers.

- Analyze the key forms of documentation used in procurement.

- Evaluate key aspects of managing the procurement process and managing the internal processes involved in procuring goods and services.

What do you know about the finding, evaluating, and selecting suppliers?

Flip the cards and match the description to its corresponding image.

Supplier Identification and Evaluation

Supplier identification and evaluation is the process of searching for potential suppliers who will be able to deliver products, materials, or services required by companies. The outcome of this process is to compile a list of potential suppliers. Procurement then takes the lead to evaluate each prospective supplier against specific criteria like cost, quality, consistency, and other performance metrics.

Inclusion and Exclusion for Suppliers

Approved suppliers for a product or service may already exist, which could be the case for repetitive purchases. For items that do not currently have approved suppliers or situations in which organizations want to re-evaluate the existing supply base, evaluations involve identifying possible new suppliers that might be able to satisfy the user requirements.

It is important at this stage to include, where appropriate, possible suppliers that have not previously been used. Identifying possible suppliers, especially in the global business and supply environment, can be a challenge and often requires extensive research.

Importance of the Supplier Identification and Evaluation Process

Among the most important responsibilities of the procurement function are supplier identification, evaluation, and eventual selection. Having fewer suppliers with long-term contracts exposes the form to the risks and costs of making incorrect decisions that can have long-lasting consequences. As suppliers often command a significant proportion of firms’ total spending, the logic behind creating a world-class identification and evaluation process becomes increasingly important. Suppliers also can impact a broad range of end-customer requirements in terms of quality, reliability, and availability of products.

Not all supplier identification and selection decisions warrant the comparable effort. This means the amount of time and effort involved in searching for and evaluating suppliers that provide generic, low-cost items such as motor oil or bandages would be different from the time and effort involved in searching for and evaluating suppliers that provide high-cost, specially engineered items like motor car engines or surgical equipment.

Market Intelligence for Identifying Suppliers

A major request made of supply management tends to be where to find suitable suppliers. The issue of obtaining credible market intelligence confronts supply managers in their efforts to find, qualify, and approve appropriate sources of supply. However, the answer to this seemingly simple request for information (RFI) has many aspects.

The Process of Obtaining Supply Market Intelligence

First, supply departments must identify which potential suppliers exist for a particular commodity and where they are located. Next, they must determine which suppliers are capable of providing the required goods and at what total cost. Organizations must then narrow the supplier pool through a structured evaluation process to arrive at a smaller set of supplier candidates. Lastly, a rigorous evaluation must occur to evaluate suppliers’ past performance and capabilities.

These factors, however, become more challenging when suppliers are located in distant areas. Gathering supply market intelligence (SMI) requires supply managers to obtain and analyze the available intelligence, which is generally more complex and more difficult when suppliers are located in distant areas requiring extensive, and often costly, travel. According to Trent and Roberts (2009), supply market intelligence exists in many forms and places, so no single source of this intelligence is available.

Elements of Supply Market Intelligence

Supply market intelligence is the result of obtaining and analyzing information relevant to companies’ current and potential supply markets with the objective of supporting effective decision-making. According to Dominick (2008), supply market intelligence includes six important elements:

- Commodity profile information: This information identifies the type and nature of products or services, manufacturing or service delivery processes, and quality requirements or standards.

- Cost structure: This element consists of the costs associated with capital investment, raw materials, manufacturing, quality, storage, transportation, duties, export control, inventory carrying, taxes, insurance, port of entry, supplier development, energy, overhead, and profit.

- Supply base information: This portion includes current and potential suppliers, supplier characteristics, and country location.

- Market information: This information identifies supply and demand price drivers, capacity utilization, and other factors that determine price and availability for the commodities in question, along with the market size and predicted growth rate.

- Competitive analysis information: This analysis is for buyers’ and suppliers’ relative size and buying power, substitute products and services (i.e., products and services that can be readily substituted for those currently sourced and are comparable at lower prices), other customers using the same sources of supply, and other factors influence buying leverage.

- Quality: Evaluation of suppliers’ past performance regarding product failure rates and overall quality leading to customer satisfaction. Further evaluation would reveal the extent of quality programs to prevent defects (such as Total Quality Management or lean) and how defects are corrected.

Uses, Categories, and Levels of Market Intelligence

Supply managers obtain and use intelligence to identify suppliers who can provide the necessary products and services that will enable the procuring company to enhance its competitive standing. The intelligence gathered under these categories allows supply managers to make informed decisions about the various supply issues. When collected on a regular basis, this information also allows supply managers to keep abreast of developments, such as shifts and changes in demand and supply markets, the introduction of new products and technologies, the entrance of new competitors, and changes to manufacturing processes. Insights gained from this intelligence help supply departments adjust their sourcing strategies in a timely manner. Market intelligence can be gathered at the following levels:

- Macro environmental level: Information from this level includes market dynamics, world trade, demographics, political climate, economics, environment, and technology.

- Country level: This information is often a subset of the macro-environmental level, with additional topics that include cultural issues, levels of crime, logistics infrastructure including the natural geography and size of the country, the safety of intellectual property (IP), political climate and stability, national holidays, working hours, and time zone differences.

- Industry and commodity level: Industry and commodity market intelligence related to the types, sizes, and relative strengths of industries that exist and the worldwide users and suppliers of commodities.

- Supplier level: Supplier information comprises the next level of supplier market intelligence and relates to the number of potential suppliers that exist, the products and services they provide, their locations, relative sizes, and capabilities.

Supplier Evaluation

After potential suppliers have been identified, it is necessary to evaluate suppliers. An important step is to pre-screen possible sources of supply to identify the suppliers who meet a minimum set of criteria. Pre-screening reduces the number of potential suppliers to those who can satisfy users’ demands. In some instances, and for some goods or services, pre-screening can be a relatively simple task. In other instances that involve complex items (e.g., jet engines and medical testing equipment), more time and effort are required.

With the potential pool of suppliers reduced to those who can meet users’ requirements, the next step is to determine which suppliers can best meet those requirements. This could be accomplished through competitive bidding if the procurement items are fairly simple or standard (e.g., stationery items, such as pens and paper or consumable maintenance items, such as grease, nuts, and bolts) and if there is a sufficient number of potential vendors. If these conditions do not exist, a more elaborate evaluation, such as engineering tests, may be necessary, and a site visit to the supplier’s facility could be warranted.

Supplier Evaluation Objectives

A key objective in the supplier evaluation process is to identify the suppliers who can become a source of competitive advantage for the procuring company. Another objective should be to reduce risk and maximize value. Risk includes the potential risk of a supplier failure, such as the risk of suppliers not being able to deliver products or services at a consistent level of quality, quantity, and cost over time. With regard to maximizing value, the evaluation process should be able to determine suppliers that are willing to, and capable of, working with the buying company to co-design engineered items, collaborate to reduce total costs, and work together on ongoing quality improvement projects.

The time involved in evaluating suppliers should be related to the importance of items purchased. For example, the effort involved in evaluating suppliers should be different for jet engines than it is for commercial stationery. For the most important goods and services with high engineering complexity or significant cost, organizations should employ cross-functional teams to evaluate suppliers’ financial conditions, capacities, global capabilities, logistical networks, cost structures, supply management practices, process capabilities, technology innovations, quality, and design and engineering capabilities. The time and cost of making supplier visits can be high, but the cost of making a poor selection decision can be devastating.

Supplier Evaluation Criteria

According to Monczka et al. (2005), the following broad criteria are examples of what supply managers should consider during the evaluation process. This list is not exhaustive, but does include some of the more common criteria used in organizations:

- Location: This criterion lists where suppliers are located in relation to the purchasing firm and the relative advantages and disadvantages of the location, including distance, supply chain infrastructure, and geographic stability.

- Employee capabilities: This criterion provides a commitment to quality and continuous improvement, the overall skills and abilities of the workforce, turnover, history of strikes and labour disputes, and general morale.

- Cultural and language differences: This consists of the type of culture in place and any challenges to communicating clearly among parties due to language differences.

- Cost structure: This includes suppliers’ total costs, including production costs, administrative costs, material costs, supply chain costs, and marketing costs.

- Infrastructure and assets: This criterion is the age and quality of buildings and equipment and the support infrastructure for maintaining buildings and equipment.

- Citations and awards: This encompasses reviewing the citations and awards a supplier has received from other customers and local, state, and federal agencies.

- Working conditions: This is the amount of attention paid to general working conditions, health and safety practices, first aid capabilities, and the use of child labour.

- Process and technological capability: This includes current and future capabilities in design, methods, equipment, processes, and investments in research and development.

- Management capability: This broad category includes management qualifications and experience, long-range planning practices, commitment to quality management, customer focus, the history of labour-management relations, investment to sustain growth, employee training and development programs, and strategic sourcing programs.

- Environmental regulation compliance: This criterion includes demonstrated commitment to the protection of the environment and the level and severity of infractions that have occurred, as well as companies’ capabilities in, and history of, toxic waste management, use of environmentally friendly materials, and use of returnable and recyclable packaging and shipping containers.

- Financial stability: This entails the financial history of companies, the levels of capital available for investment in companies, credit history, level of debt, and current stability.

- IT capability: This consists of the types of IT in place, the ability to link and communicate electronically with the technology used at buying organizations or other supply chain partners, and a demonstrated willingness to invest in new technologies.

- Suppliers’ own supplier network: This includes the nature and extent of the network and the potential risk exposure to target suppliers from their own multilevel supplier networks.

- Employee turnover: This includes assessing the stability of the workforce by evaluating the tenure of employees and new hires versus terminations and identifying critical skills like welding.

- Quality capabilities: This consists of the quality assurance systems and procedures in place, workers’ involvement in quality assurance, quality records, and the ability to sustain quality consistency for current demand and anticipated increases in demand.

- Evaluation of customer base: This entails assessing the degree to which the supplier is dependent on other customers for business; being dependent on only one customer may not enable a supplier to focus on new requirements.

Each of these criteria should also include a set of detailed questions designed to evaluate suppliers’ capabilities with a predetermined scale such as a weighted scorecard shown below, which is then used to rate suppliers’ capabilities against each of the previously explained criteria. A summary supplier evaluation matrix or scorecard is a weighted scoring framework that may be used to compare the merits of different potential suppliers. Specific criteria are listed and weighted according to their perceived relative merits. Companies are then evaluated on each of the criteria, and weighted scores are tallied across all criteria to determine the best potential supplier.

Current Supplier Evaluation

Sometimes, companies evaluate their current suppliers when they need to source products or services, especially new products or services. These companies will typically identify which of their current suppliers may be capable of providing these products or services and look for other potential suppliers where necessary. Investigating new suppliers can provide a basis of comparison for costs, quality, delivery capabilities, and other supply essentials. Current suppliers’ capabilities will then be evaluated against prospective suppliers’ capabilities to determine how well they fit with particular companies’ needs. For existing suppliers, sourcing professionals have a wealth of information about historical performance that can be used in the evaluation process. This information is helpful, but good performances on contracts in the past do not guarantee good performances on future contracts and different products or services.

Global Supply Management

The search for new sources of competitive advantage is a relentless challenge that organizations face, and it is crucial that supply groups showcase annual progress. Organizations must show constant improvements, particularly cost reductions, which result in a search for low-cost sources of supply that have become a central part of most supply strategies. This has resulted in procurement groups in many companies seeking overseas sources of supply to achieve lower costs.

Sourcing Globally

Most companies are under constant pressure to contain and reduce their costs, which largely explains the motivation behind global sourcing; the primary reason that companies source from around the world is to obtain lower prices. For example, as a cost-cutting measure, Dell moved its European manufacturing plant from Ireland to Poland (Fottrell & Scheck, 2009). This was no small undertaking and affected almost 2,000 employees; however, the move was part of a $3 billion company-wide cost reduction initiative. Other reasons that companies use global suppliers include gaining access to new sources of technology, obtaining a higher quality, or introducing competitive organizations to the domestic supply base.

Global purchasing can result in cost savings, but the global supply process also requires supply managers to address a wider range of issues of cost, time, and complexity. At least a quarter of the unit cost savings from global purchasing disappears, on average, when estimating the total cost of purchase ownership. This is due to hidden costs associated with lengthened supply chains, including increased lead times, increased inventory and increased risks.

Finding Global Suppliers and Supply Classification

Many supply managers use a classification scheme to segment suppliers by their geographic capabilities. This designation helps when searching databases for potential suppliers. In fact, internal supply groups can benefit from this classification in their examination of potential suppliers, whether they are involved with global supply management or not. This approach helps strategy development teams understand the location of suppliers and supplier capabilities more accurately. The classification scheme is as follows:

- Local supplier: A local supplier serves only a limited number of sites or buying locations (often only one) within a country. The database should include information about the country and the sites within that country that the supplier is capable of serving.

- Domestic supplier: A domestic supplier can serve any location within a country. The database must note the country or countries that the supplier can competitively serve.

- Regional supplier: A regional supplier competitively serves many countries within a single region. Examples of regions include North America, Latin America, Asia-Pacific, and Europe. A few suppliers may also serve only a portion of a region.

- Multi-regional supplier: A multi-regional supplier can competitively serve two or more regions.

- Global supplier: A global supplier can competitively serve most, if not all, countries around the world.

Purchasing Approval

After suppliers have been selected, evaluated, and approved, procurement departments may choose to utilize those suppliers to provide products and services. This can occur in several ways, depending on the system in place in procurement: awarding a specific purchase order (PO) or a blanket PO, material purchase release, or contract. Developing and awarding POs is an important step because almost all POs include standard legal conditions to which the orders are subject, including the following:

- PO number

- Item description

- Material specifications, including any references to SOWs and engineering drawings

- Quantity requirements

- Quality requirements

- Price

- Delivery due date and method of shipment

- Ship-to address

- Order due date

- Name and address of purchasing firm

- Payment terms

Purchasing will typically issue a PO for each required item. Depending on the nature of the item and the relative price of the item, negotiations may or may not be required before awarding the PO.

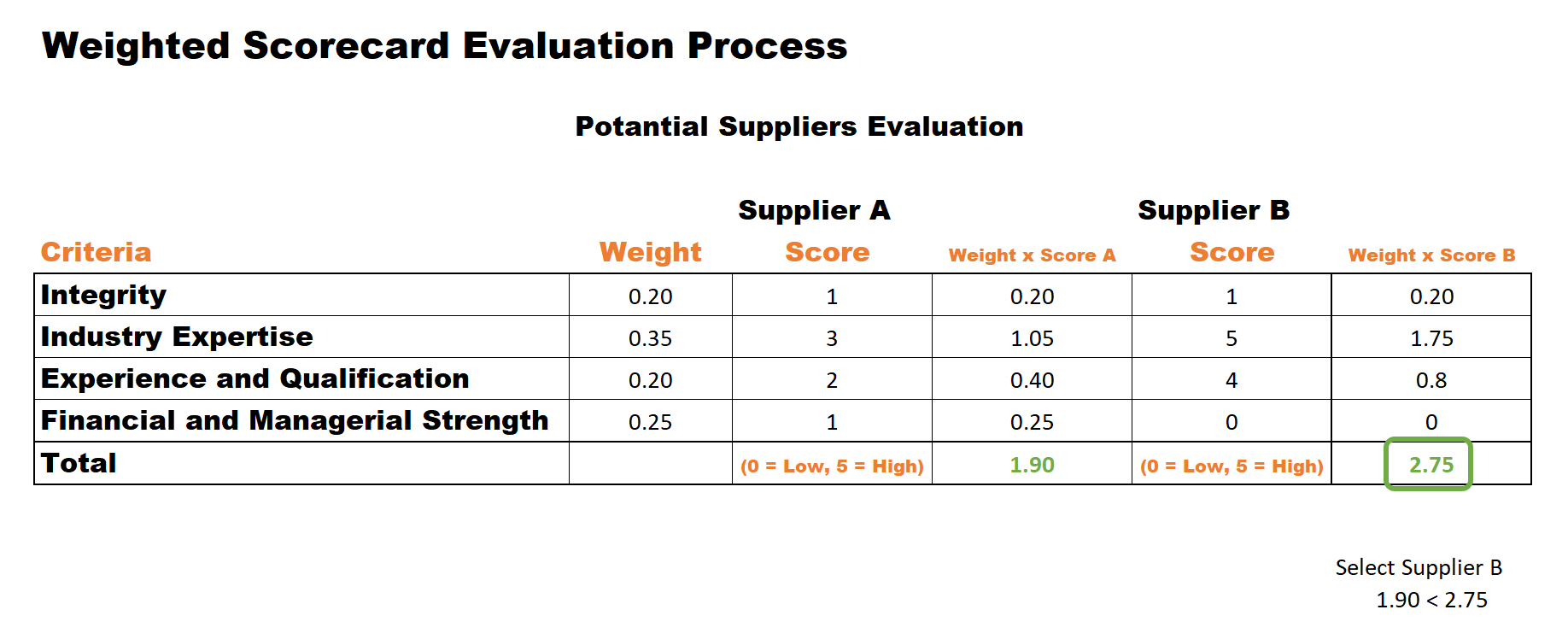

Weighted Scorecard

A weighted scorecard is a tool often used by procurement to perform an objective evaluation of multiple supplier responses for the same item. It also serves as a permanent record to justify a contractual commitment in the form of a purchase order to the highest scoring supplier. Procurement routinely uses a weighted scorecard process to document key criteria, such as industry experience or financial strength for an item to be purchased and assigns a proportionate value for each criterion.

For example, a company wants to procure an item that will be used in its manufacturing process to assemble an end product. The criteria that are important for this item might be price, delivery, and quality. Percentage values are then assigned for each of the three criteria and several supplier responses are evaluated and compared by populating the weighted scorecard, which defines the comparative value of the criteria.

In developing the weighted scorecard for this example, the criteria (what is important to the company) are defined and listed in the far left column, followed by the weight for each of the criteria. As suppliers’ responses are received, they are scored by entering data into the appropriate columns. These scores are then mathematically calculated into points for each supplier; the points are totaled to determine the award. Supplier B scored the higher value compared to supplier A. The purchase order would be awarded to supplier B.

Figure 3.1

Weighted Scorecard Comparing Supplier A vs B

Note. From Snage. [Image Description]

Blanket Purchase Orders (BPOs)

Blanket purchase orders (BPOs) are typically used when the same materials or services are ordered on a regular basis, whether on a consistent, periodic schedule like cleaning services or on an as-needed basis when quantities fall below desired levels, such as when materials for a manufacturing process run low. When using this type of purchasing arrangement, buyers and suppliers work together to evaluate the anticipated demand for specific items required for a defined period of time and agree on the terms of the agreement. Buyers also reserve the right to cancel BPOs in the case of poor supplier performance or changes in demand.

The BPO is established as a master agreement; buyers subsequently use material release documents at periodic intervals, as necessary and based on usage, to order items covered by the BPO. This material release typically specifies the required part number, quantity required, unit and quantity price, required receipt date, ship-to address, and method of shipment.

Award Purchase Orders

In this step, POs are awarded and released to the supplier, and deliveries are subsequently received by the ordering organization. Many organizations transmit orders electronically through electronic data interchange (EDI); orders can also be transmitted over the Internet. After the award, procurement is also responsible for monitoring the status of open POs, expediting orders, and providing ongoing administration for other tasks.

Goods Receipt

The goods receiving process involves several processes and documents, including a material packing slip, bill of lading, and discrepancy report, each of which is explained further below.

- Material Packing Slip: This includes weights, dimensions and the quantity of units used in the transportation. The goods receiving process involves several processes and documents, including a material packing slip, bill of lading, and discrepancy report, each of which is explained further.

- Bill of Lading: Transportation carriers issue a bill of lading, which records the number of goods delivered to a location on a specific date. The bill of lading details the number of boxes or containers delivered; other details about the shipment appear on packing slips and are the suppliers’ responsibility for recording on this slip. The bill of lading also ensures that carriers are protected against wrongful allegations that they have damaged, lost, or otherwise tampered with the goods they have delivered.

- Discrepancy Report: Receiving discrepancy reports are used to record any differences between goods received and goods ordered; discrepancies are recorded by the receiving clerk during the receiving process. Procurement groups use the discrepancy report to follow up and resolve any issues with suppliers.

Evaluate Supplier Post-Purchase Performance

When products and services have been delivered, supplier performance must be evaluated to determine if they have actually met the requirements of the procuring organization. Firms should determine whether suppliers have performed according to requirements by using a system for measuring performance. When supplier performance does not satisfy the requirements of the procuring organization, the discrepancies must be identified and recorded, and corrective actions must be undertaken by working with the supplier. The precise nature of feedback to suppliers varies among companies, but feedback must occur at a prescribed frequency. This enables procuring organizations to work with suppliers to identify defect trends, implement corrective actions to fix those defects and take preventive actions to eliminate recurrences. Some examples of feedback are:

- Weekly performance metric reports

- Quarterly, mid-level review meetings for supply chain managers between buyers and suppliers

- Annual, executive-level meetings about SCM between buyers and suppliers

Procurement Enablers

A variety of tools and techniques are available to procurement professionals; they can be used to enable and support the sourcing process. This section outlines these tools and techniques, and provides examples of best practices, including the following:

- E-procurement and electronic purchasing

- Procurement cards

- Long-term purchasing agreements

- EDI

- Electronic catalogues

E-Procurement and Electronic Purchasing

E-procurement is an Internet process used to make the procurement of goods and services easier, faster, and less expensive for businesses. The overall goal is to streamline the purchasing process so that businesses can focus more management time on earning revenue and serving customers. According to EPIQ (2014), e-procurement does not work for all items purchased by firms. For instance, items of strategic importance to firms, such as custom-designed engines for a package transportation vehicle, are typically not purchased using e-procurement. However, many noncritical items like stationery are well-suited to be purchased using these types of systems.

Procurement Cards

Procurement cards are essentially credit cards provided for internal users to purchase low-cost items without having to go through procurement’s administrative process. Procurement cards work well for low-cost items that are required on an as-needed basis; they are especially helpful when approved suppliers for low-cost items do not exist and where suppliers are not approved by other purchasing systems.

Authorized procurement cardholders make the buying decisions, up to the value allowed on the procurement card and within the prescribed budget of the department that is making the purchase. The monetary value of items purchased and covered by procurement cards is typically low and might consist of brochures for a trade show or conference. In these cases, the cost of involving procurement groups in a supplier search, evaluation, and approval process would typically outweigh the cost of items purchased (Monczka et al., 2005).

Long-Term Purchasing Agreements

Firms enter into long-term agreements with suppliers they plan to work with over an extended period of time. Long-term agreements involve base contracts that are generally in place for a year or more. These types of agreements are similar to a BPO process but are established to cover the purchase of higher-value items over a long period of time, such as special packaging supplies, machine maintenance parts, and high-value raw materials. Long-term purchase agreements can reduce transaction costs by eliminating the need for time-consuming renewals of purchases.

In addition, when buyers and suppliers agree on contract terms, material-releasing responsibility can shift to users in many cases. This means that end-users arrange directly with suppliers for products required to be delivered without involving procurement at all. Ideally, material releasing is accomplished electronically instead of manually, which saves time and money (Monczka et al., 2005).

Electronic Data Interchange (EDI)

EDI involves a computer-to-computer exchange of information. It can be used to support transactions between buyers and sellers, allowing for greater efficiencies and streamlined communication. This, in turn, can lead to less time and money dedicated to the procurement process.

Electronic Catalogs

Electronic catalogues provide a user-friendly way of accessing information about a supplier’s products and services. The chief benefit of using electronic catalogues is their low-cost search capability; if users order directly from these catalogues, cycle times and ordering costs can also be reduced. Pricing is often included as part of the catalogue and is referred to as a published price list. Procuring organizations with higher buying volumes may be offered a percentage discount on the rates from the published price list.

Automation of Bidding

At many firms, entire bid processes have been automated. Bid packages and specifications are made available online from which bidders submit their bids and proposals, and the bid openings and awards are communicated electronically. Cycle-time reductions and other cost savings can be significant if the automated process is efficient.

In online auction situations, potential sources are also prequalified and invited to take part in the online bidding. The auction, or event, is set for a specific date and time period, much like the deadline and bid opening deadlines of offline processes. An auction’s success depends, in large part, on the quality of bid specifications and the ability of procurement professionals and processes to prequalify suppliers. In an online environment, bidders can see the actual bid amounts but not who is involved in the bidding.

Procurement Documents

Procurement departments utilize and maintain certain documents for purchases. The types of documentation kept will depend on the organizational requirements and will differ for each organization. A number of procurement documents are used to obtain information and proposals from prospective suppliers. These include the following:

- Request for Information (RFI): An RFI is a document that companies send to potential suppliers requesting key information, including products or services provided, length of time in business, and markets served.

- Request for Proposal (RFP): A request for Proposal (RFP) is a document that companies send to approved suppliers requesting them to submit a proposal that outlines how they would complete the scope of work along with pricing, quality, and delivery data.

- Request for Quote (RFQ): An RFQ is a document that companies send to approved suppliers requesting price quotations for products or services.

The terminology may vary among industries, and in some organizations, the preparation and use of the previously mentioned documents is a specialized field assigned to certain individuals. Procurement groups typically use standard documents to obtain the necessary information from prospective suppliers.

Commonly Used Procurement Documents

According to Muckstadt, Murray, Rappold, and Collins (2003), a number of documents are commonly used in procurement. These include the following:

- Requisition: A requisition is a request outlining requirements for products or services that normally takes the form of a hard-copy or electronic document created by the demand planning organization; after approval, it is forwarded to the specific procurement organization.

- Sourcing information/justification: These are documents that are used to record the reasons for the procurement method and the types of suppliers used; for example, if the purchase is made from a sole-source supplier, the document explains why no other sources are available.

- Statement of Work (SOW): An SOW is a formal document that details the work activities and tasks suppliers must carry out, the products or services to be delivered, and a planned timeline for completion. The SOW normally includes highly detailed requirements, prices, terms, and conditions.

- Contract: An agreement between two or more parties with the terms and conditions of the work to be carried out, the products or services to be provided, timing, fees, and deliverables. Contracts can be verbal or written but are usually written documents that involve an offer and the acceptance of an offer.

- Requirement definitions: Requirement definitions are formal, clear definitions of the products or services required and include product specifications, performance requirements, quality specifications, and SOWs.

- Bill of materials (BOM): A BOM is a document that accompanies engineering drawings, in which parts, materials, labour, etc., are listed. A BOM itemizes what is required to manufacture an item; it enables suppliers to price accurately the work on which they are bidding.

- Shortlist: A shortlist is a list of candidates, normally potential suppliers, who have been selected for further review or for final consideration before actually approving a supplier and awarding a contract.

- Progress reports: These are accounts of the advances made in fulfilling the contract or proofs of delivery of goods and services at required times, in required quantities, and at acceptable levels of quality.

- Correspondence with a contractor: This comprises all interactions about the work to be carried out or the work being carried out along with the products and services being provided.

- Proof of payment: The proof of payment indicates that payments have been made to suppliers by buyers’ accounts payable departments.

- Offers received (technical and financial): The offers received (technical and financial) document comprise the various offers received from potential suppliers to a request for tender—a formal, structured invitation to suppliers to bid on supplying products or services—and contain the necessary information about suppliers’ technical and financial capabilities and other strengths relevant to the work required by buyers.

- Evaluation report: The evaluation report is developed based on a review of the information provided by suppliers in response to RFIs, RFQs, or RFPs; it comprises an assessment of potential suppliers’ capabilities about the work required or products and services to be provided. This report is also referred to as a weighted scorecard.

- Proof of receipt of goods: The proof of receipt of goods document is signed by buyers to indicate that they have received the required goods. One copy of this document is normally kept by buyers, while another copy is returned to suppliers.

- Receipt and inspection reports: The receipt and inspection reports are about inspections carried out on goods delivered to buyers and about the quality of the goods received; they detail any issues about quality, quantity, and inconsistency.

- Supplier evaluation reports: These reports are normally developed on a scheduled basis; they indicate how well suppliers are performing in their contractual, and other, obligations.

- Amendments to solicitation documents: Amendments to solicitation documents list any changes, deletions, or additions to the RFI, RFQ, or RFP, and any other clarifications and correspondence with suppliers.

- Amendments to contracts: The amendments to the contracts document includes any agreed modification to contracts.

Key Takeaways

Discovering potential suppliers is the process of searching for suppliers who will be able to deliver the products, materials, or services required by a company. The outcome of this process is the list of potential suppliers, after which procurement evaluates each prospective supplier against specific criteria like cost, quality, consistency, and other performance metrics. Obtaining suitable market intelligence is an issue that confronts procurement managers daily in their efforts to find, qualify, and use appropriate sources of supply. Additionally, supply departments must identify which potential suppliers exist for a particular commodity and where they are located.

Supply market intelligence is the outcome of the process of obtaining and analyzing information relevant to a company’s current and potential supply markets with the objective of supporting effective decision-making. Supply market intelligence includes five elements: commodity profile information, cost structure, supply base information, market information, and competitive analysis. Supply market intelligence also has varied uses. Supply managers obtain and use intelligence to identify suppliers that can provide the necessary products and services at consistent levels of cost, quality, and quantity. The evaluation of potential suppliers attempts to answer two main questions: Is this supplier capable of supplying the purchaser’s requirements satisfactorily over both the short and long terms? Is this supplier motivated to supply these requirements in the way that the purchaser expects over the short and long terms?

The main objective of the evaluation process is to reduce purchase risk and maximize overall value, and the time that goes into evaluating suppliers should be a function of the importance of items purchased. Suppliers are generally rated across multiple categories using weighting evaluation criteria, according to the relative importance of each criterion. Most firms engage in global sourcing at some level, and the primary reason to source on a worldwide basis is to obtain lower prices. Many firms source globally and have realized savings as a result. Supply managers from leading companies have developed a classification scheme to segment suppliers by their geographic capabilities.

Tactical aspects of the procurement process to enable the placement and approval of POs with suppliers, the information needed for a comprehensive purchase requirement, the necessary forms and documents, and the necessary elements in the post-award process that must be managed. Additionally, alternate forms of procurement were reviewed, including procurement cards for non-procurement personnel, electronic catalogues for requisitions, and EDI and bidding automation, both of which used to streamline procurement processes.

Review Questions

References

Dominick, C. (2008). Buyers ask: What is market intelligence? Next Level Purchasing Association. http://www.nextlevelpurchasing.com/articles/what-is-marketintelligence.html

EPIQ. (2014). Electronic procurement. https://www.epiqtech.com/E-Procurement-Systems.htm

Fottrell, Q., & Scheck, J. (2009, January 8). Dell moving Irish operations to Poland. The Wall Street Journal.

http://www.wsj.com/articles/SB123141025524864021

geralt. (n.d.). Business establishing a business [Computer graphic]. Pixabay. https://pixabay.com/illustrations/business-establishing-a-business-3639463/

Monczka, D., Trent, R., & Handfield, R. (2005). Purchasing and supply chain management (3rd ed.). New York, NY: McGraw-Hill.

Muckstadt, J. A., Murray, D. H., Rappold, J. A., & Collins, D. E. (2003). The five principles of supply chain management: An innovative approach to managing uncertainty. https://www.semanticscholar.org/paper/The-Five-Principles-of-Supply-Chain-Management-An-Muckstadt-Murray/c407061b21531ff22515a14cd52b65e232b3b33b.

Trent, R. J., & Roberts, L. R. (2009). Managing global supply and risk: Best practices, concepts, and strategies. Plantation, FL: J. Ross.

Creative Commons Attribution

This chapter contains material adapted from Supply Management and Procurement Certification Track. LINCS in Supply Chain Management Consortium. March 2017. Version: v2.26. www.LINCSeducation.org.

Image Descriptions:

Figure 3.1: This figure is a weighted scorecard, and it is a tool often used by procurement to perform an objective evaluation of multiple supplier responses for the same item. It also serves as a permanent record to justify a contractual commitment in the form of a purchase order to the highest scoring supplier. On the right side of this figure, there are four criteria that each supplier gets weighted for integrity, industry expertise, experience and qualification and financial and managerial strength. Supplier A scored a total of 1.90 and Supplier B scored a total of 2.75. Supplier A scored a higher weight than Supplier B in financial and managerial strength whereas Supplier B scored a higher weight than Supplier A in both industry expertise and experience and qualification leading Supplier B to be chosen. [Back to Image]