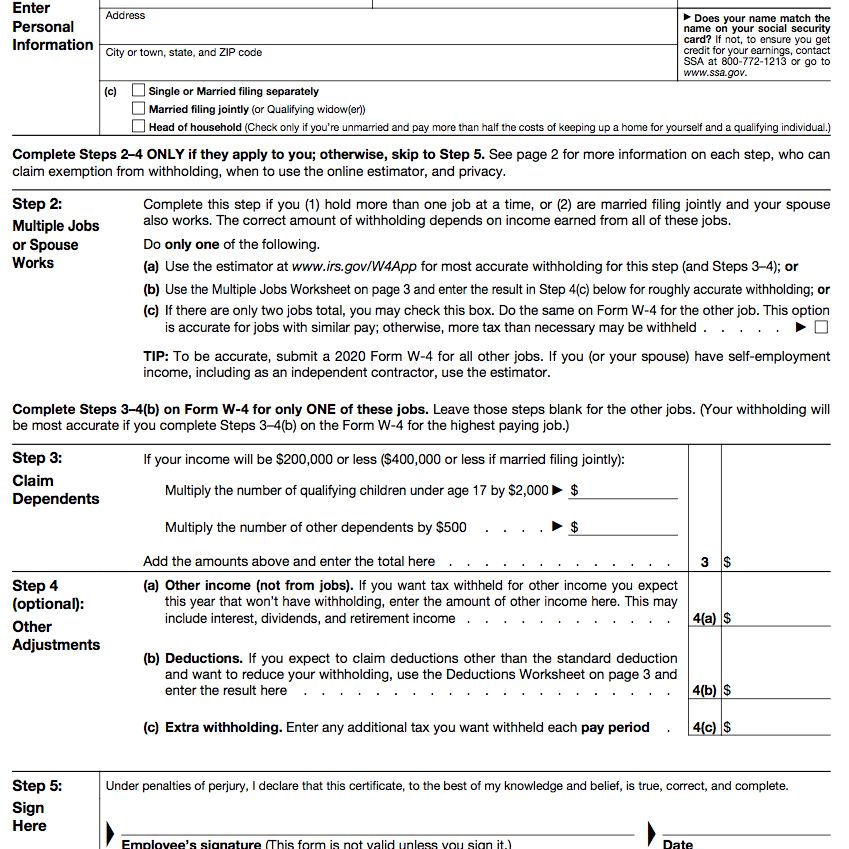

4.3 Income Tax Forms

W4[1]

The Form W-4 is used by employers to determine the amount of tax withholding to deduct from employees’ wages. The form is not mailed to the IRS but retained by the employer. Tax withholdings depend on employee’s personal situation and ideally should be equal to the annual tax due on the Form 1040. When filling out a Form W-4 an employee calculates the number of Form W-4 allowances to claim based on his or her expected tax filing situation for the year. The amount of money withheld as federal income tax is reduced for each Form W-4 allowance taken. No interest is paid on over-withholding, but penalties might be imposed for under-withholding. Alternatively, or in addition, the employee can send quarterly estimated tax payments directly to the IRS (Form 1040-ES). Quarterly estimates may be required if the employee has additional income (e.g. investments or self-employment income) not subject to withholding or insufficiently withheld. There are specialized versions of this form for other types of payment (W-4P for pensions as an example).

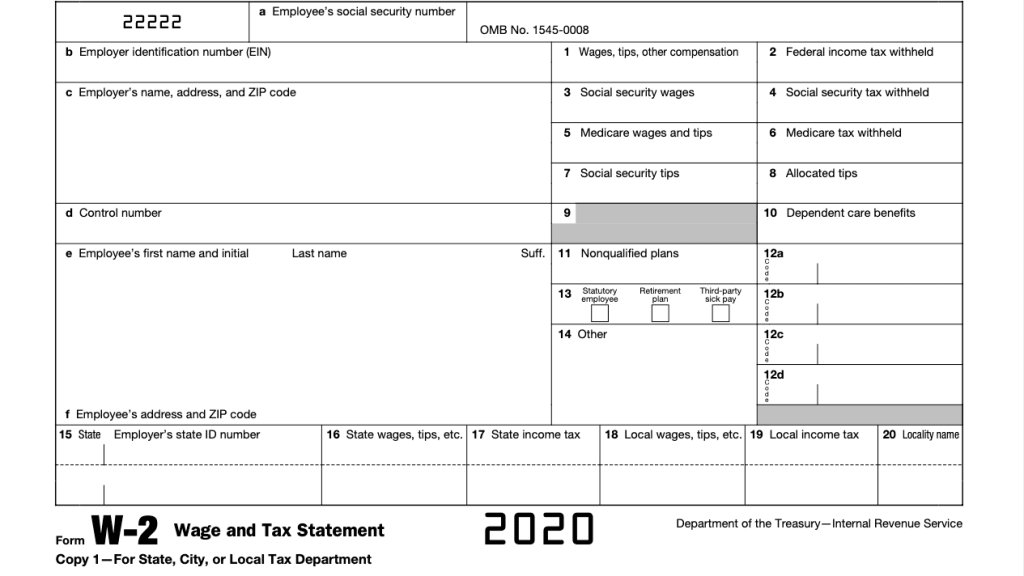

W2

The Form W-2, Wage and Tax Statement, is used to report wages paid to employees and the taxes withheld from them.[43] Employers must complete a Form W-2 for each employee to whom they pay a salary, wage, or other compensation as part of the employment relationship. An employer must mail out the Form W-2 to employees on or before January 31. This deadline gives these taxpayers about 3 months to prepare their returns before the April 15 income tax due date. The form is also used to report FICA taxes to the Social Security Administration. The Form W-2, along with Form W-3, generally must be filed by the employer with the Social Security Administration by the end of February. Relevant amounts on Form W-2 are reported by the Social Security Administration to the Internal Revenue Service. In territories, the W-2 is issued with a two letter code indicating which territory, such as W-2GU for Guam. If corrections are made, it can be done on a W-2c. The British-Irish equivalent form to a W-2 is a P60.

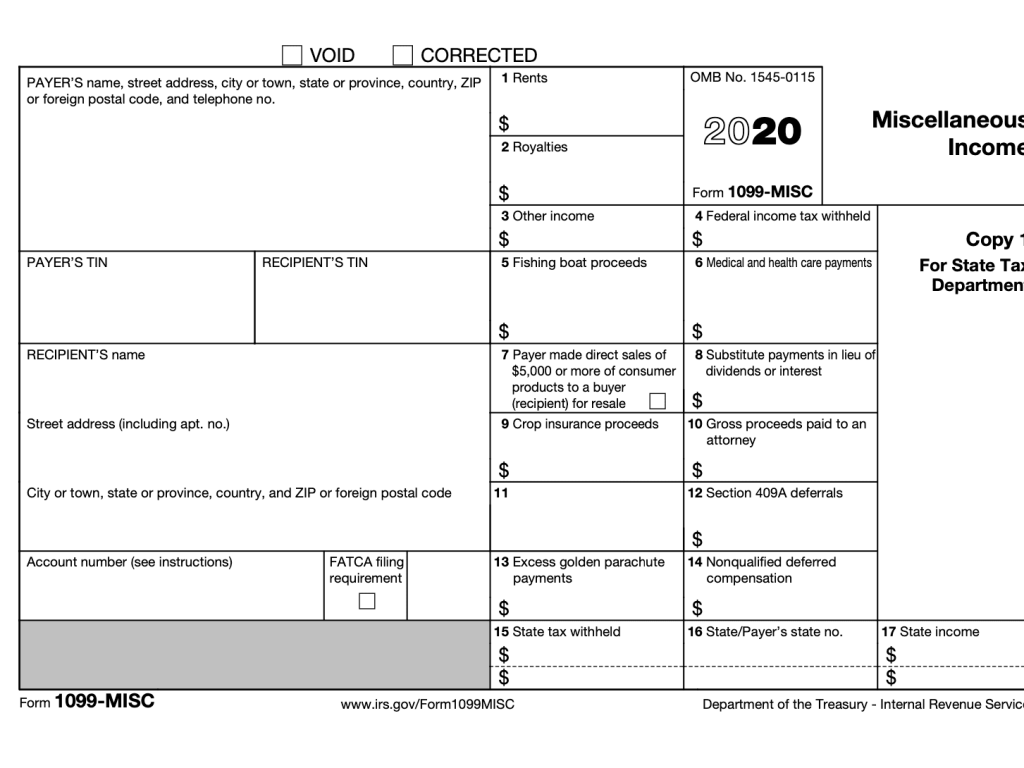

1099Misc

In the United States, Form 1099-MISC is a variant of Form 1099 used to report miscellaneous income. One notable use of Form 1099-MISC was to report amounts paid by a business (including nonprofits[1]:1) to a non-corporate US resident independent contractor for services (in IRS terminology, such payments are nonemployee compensation), but starting tax year 2020, this use was moved to the separate Form 1099-NEC. The ubiquity of the form has also led to use of the phrase “1099 workers” or “the 1099 economy” to refer to the independent contractors themselves.[2] Other uses of Form 1099-MISC include rental income, royalties, and Native American gaming profits.[3]

The form is issued by the payer (e.g. business) and is due to the recipient (e.g. contractor) by January 31 and to the IRS by the last day of February[4]:6 each year for work done during the previous tax year.[3][5] If the payer is registered to file electronically with the IRS the deadline for filing with the IRS is March 31.[6] In accordance with the recently passed PATH Act, these deadlines will be changing so the mailing and transmittal are both January 31 moving forward starting with Tax Year 2016.[7]

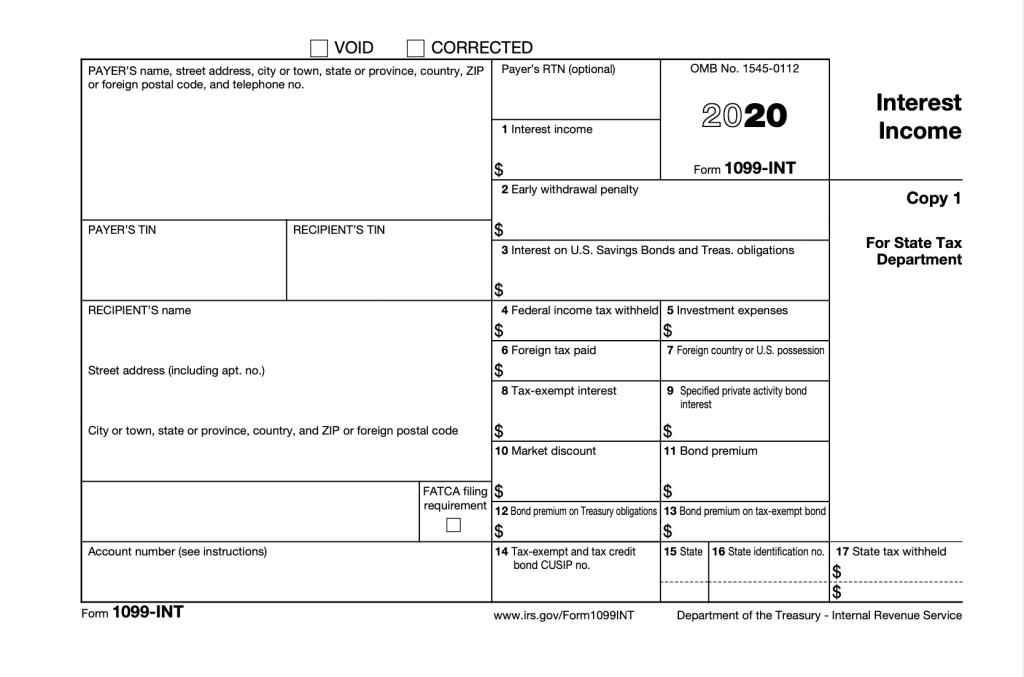

1099INT

This form shows the amount of interest paid in accounts such as savings accounts.

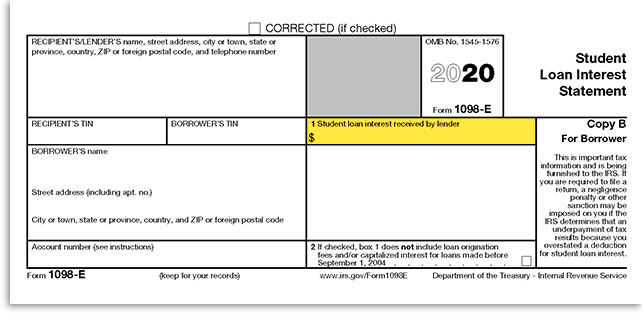

1098e

The Form 1098-E, Student Loan Interest Statement, reports interests the taxpayer paid on student loans that might qualify as an adjustment to income.

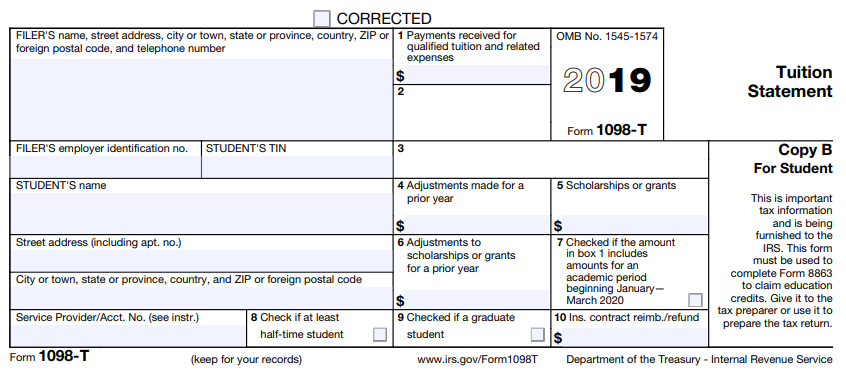

1098t

Form 1098-T, Tuition Statement, is an American IRS tax form filed by eligible education institutions (or those filing on the institution’s behalf) to report payments received and payments due from the paying student. The institution has to report a form for every student that is currently enrolled and paying qualifying tuition and related expenses.[1]

Form 1098-T consists of one page, with a red copy to be filed with the IRS, and a black copy to be kept for records or to be sent to the student. There are ten lines that require the institution’s tax information as well as the student’s, tuition payments received and billed, as well as the scholarships granted to the student. There are lines for adjustments to a prior year’s 1098-T, and a checkbox for whether the student is part-time or a graduate student.

- From: https://en.wikipedia.org/wiki/Form_W-4 ↵