22 Operating Budgets and Income Statements

An operating budget is management’s plan for generating revenue and incurring expenses over the time of the budget. Operating budgets are usually in effect for a fiscal year, but they are subject to alterations if anticipated revenues or costs change markedly from what was projected.

In the following section, it is assumed that there are records from previous years that can be used to create an operating budget. When a business first starts up, the operating budget is based upon a careful analysis of the market and the expertise senior management brings with them to the new enterprise from other jobs in the food service industry. Creating a first budget is beyond the intent of this book.

A budget is developed by calculating projected sales, determining required profit levels and fixed expenses, and calculating food costs.

Example 43: Sales/Cost/Profit Equation

Profit can only occur when sales exceed the break-even point. That is,

profit = sales − costs

= sales − (labour + food costs + overhead)

or sales = labour + food costs + overhead + profit

Overhead is a fixed cost. Your rent payment usually is the same regardless of the level of your sales. Labour costs are semi-variable costs. As was explained earlier, some labour costs are constant and must be paid even if sales do not meet expectations while other labour costs are the result of increases in sales.

Since labour costs are not truly fixed, the variable part of the cost of labour can be manipulated in times of poor sales by cutting back on paid hours, introducing shift changes, and even laying off personnel. Personnel working in the food industry often learn how flexible their hours can become in times of poor sales!

Hoped-for profit can be treated as a fixed cost. Often, profit is considered to be that which is left over after all costs have been paid. However, more and more businesses try to treat profit as an expense that should be met.

With the exception of some labour costs, only the cost of food is truly a variable cost in the cost/profit equation because the amount of food purchased is directly influenced by the amount of food sold by the establishment.

By determining overhead, labour, and profit costs, you can calculate optimum food costs by subtracting all the other costs from projected total sales. This relationship can be seen by manipulating the sales equation presented above (sales = labour + food costs + overhead + profit) into food costs = sales – (labour + overhead + profit).

Planning for a Profit

The first step in planning for a profit is to determine how much return the investor or company needs. The restaurant business is considered a risky investment. Some people make a lot of money; more people go broke. If people can earn 10% by investing their money in safer investments, investors will expect to earn more than this as they have a chance of losing all their money.

Example 44

A restaurant owner has put up $100 000. The owner wishes to have a profit of 15%. The cost to the restaurant for the use of this money is:

cost (profit) = principle × interest rate

= $100 000 × 15%

= $100 000 × 0.15

= $15 000

Calculating Other Costs

Remember, fixed costs include rent, heat, light, and other overhead costs. For this discussion, assume the restaurant has been in business for a number of years and last year the overhead costs amounted to $55 000. These costs have been increasing at about 5% per year.

Example 45: Projected Food Cost

The projected fixed cost for next year will be:

new overhead cost = old overhead cost + increase in overhead cost

= $55 000 + (5% of old cost)

= $55 000 + (0.05 × $55 000)

= $55 000 + ($2750)

= $57 750

The semi-variable cost of labour can be treated in much the same manner. Assume that last year labour costs were $75 000 which was an increase of 5% over the previous year. Other indicators suggest that labour costs will increase about the same for the coming year.

Example 46: Projected labour cost

The projected labour cost for next year will be:

new labour cost = old labour cost + increase in labour cost

= $75 000 + (5% of old cost)

= $75 000 + (0.05 × $75 000)

= $75 000 + ($3750)

= $78 750

Calculating Projected Sales Levels

To forecast sales it helps to have a past record on which to base projections. Assume such records are available and the last year sales were at $225 000. It is thought sales can be increased by 10% this year.

Example 47: Projected sales

new sales level = old sales level + increase in sales level

= $225 000 + (0.10 × $225 000)

= $225 000 + $22 500

= $247 500

Calculating Food Costs

To calculate food costs, use the equation derived previously.

Example 48: Food costs

food costs = sales − (labour + overhead + profit)

In the example being developed, food costs are:

food costs = sales − (labour + overhead + profit)

= $247 500 − $78 750 − $57 750 − $15 000

= $96 000

If all the expenses are to be met, the restaurant should not spend more than $96 000 in food costs. From this amount, the restaurant must generate $247 500 in sales.

Cost Percentages

Once all the costs have been determined (predicted), it is fairly easy to determine cost percentages. In the example under discussion, the cost percentage can be determined using the basic cost percentage equation below.

Example 49

cost % = cost ÷ sales

labour cost % = labour cost ÷ sales

= $78 750 ÷ $247 500

= 0.318

= 31.8%

overhead cost % = overhead cost ÷ sales

= $57 750 ÷ $247 500

= 0.233

= 23.3%

profit % = profit ÷ sales

= $15 000 ÷ $247 500

= 0.0606

= 6.1%

food cost % = food cost ÷ sales

= $96 000 ÷ $247 500

= 0.3878

= 38.8%

The information gathered above can be used to generate a projected budget.

Calculating Projected Sales

Past sales figures are collected from monthly up-to-date income statements and from the audited budget of the previous year. The past sales should be carefully analyzed to see if any trends are emerging. For example, if sales have been falling in the last quarter, you want to ask why, as the drop in revenue may be a sign of continuing trouble in the new fiscal year.

The assumption is usually made that growth in the past year will mean growth into the new year. This is probably true but only if the conditions of the new year are thought to be nearly the same as the past year. If a new restaurant is going in across the street, if the local mill is going to lay off 150 workers, if previously untaxed food is going to be subjected to a sales tax, or if the minimum wage is going to be increased and you depend on help paid at or near that level, past growth records may mean very little. Equally important are positive changes in the community. For example, an excellent review from a restaurant critic can have a huge impact on business that was not counted in your projections.

If possible, compare the monthly food sales of last year with its corresponding sales for the previous year. Again, this is only possible if the restaurant has been in business a few years. Such a comparison is shown in Figure 31.

Figure 31: Sales comparison year over year

| Month | Sales This Year | Sales Last Year | Difference | Percentage Change |

|---|---|---|---|---|

| January | $20 925 | $19 020 | $1 905 | 10% |

| February | $21 390 | $19 810 | $1 580 | 8% |

| March | $22 090 | $19 725 | $2 365 | 12% |

| April | $23 020 | $21 320 | $1 700 | 8% |

| May | $23 030 | $21 730 | $1 300 | 6% |

| June | $23 950 | $21 780 | $2 170 | 10% |

| July | $23 715 | $21 365 | $2 350 | 11% |

| August | $23 720 | $21 200 | $2 520 | 12% |

| September | $23 320 | $20 710 | $1 610 | 8% |

| October | $25 110 | $22 900 | $2 210 | 10% |

| November | $24 830 | $22 200 | $2 630 | 12% |

| December | $24 900 | $21 240 | $3 660 | 17% |

| Totals | $279 000 | $253 000 | $26 000 | 10% |

The sales picture looks bright in Figure 31. Management could probably safely assume that next year the growth will continue. They would then draw up an estimated monthly sales chart.

The monthly projections can be used in the next fiscal year to track sales in relation to the projection. For example, if sales in January are significantly less than the projection, is it time to worry, or can the loss be picked up next month? That is the type of question management has to be constantly asking.

A monthly projection is shown in Figure 32. Last year’s sales are increased by 10%, which is the total percentage change in sales as reflected in Figure 31. Less conservative managers might be tempted to project a greater percentage increase based on the steady growth since June. However, it is usually best to err on the side of caution as it tends to be easier to handle excess income than it is to handle income shortfalls. But, if sales do increase dramatically, management should be prepared to redraw the budget.

Figure 32: Sales projections based on previous year’s growth

| Month | Sales This Year | Increase by 10% | Projected Sales |

|---|---|---|---|

| January | $20 925 | $2 090 | $23 015 |

| February | $21 390 | $2 140 | $23 530 |

| March | $22 090 | $2 210 | $24 300 |

| April | $23 020 | $2 300 | $25 320 |

| May | $23 030 | $2 300 | $25 350 |

| June | $23 950 | $2 400 | $26 350 |

| July | $23 715 | $2 370 | $26 085 |

| August | $23 720 | $2 370 | $26 090 |

| September | $22 320 | $2 230 | $24 550 |

| October | $25 110 | $2 510 | $27 620 |

| November | $24 830 | $2 490 | $27 320 |

| December | $24 900 | $2 500 | $27 400 |

| Totals | $279 000 | $27 910 | $306 910 |

Determining Profit Levels and Costs

Again, the best plan is to analyze past costs and see if they can be lowered and to determine if the profit level must be adjusted. Costs tend to go up, but fixed costs may stay at the same level as in the previous year while some controllable costs might actually decline after careful analysis.

Costs include the following:

- Food costs, sometimes called product costs

- Controllable expenses, such as labour, advertising, janitorial service, promotion, utilities, maintenance

- Uncontrollable costs, such as rent or lease payments, licence fees and property taxes, sometimes referred to as occupancy costs

- Depreciation, which is uncontrollable but not an occupancy cost

If the figures are available, monthly costs of the current and last operating years can be used. However, it is quite acceptable to use the annual current cost and prorate across every month by using cost percentage figures on the projected sales for each month.

To find annual cost figures, monthly reports can be used and summarized on a single form (Figure 33). Alternatively, the previous year’s income statement can be used.

Figure 33: Annual cost figures

| Food cost | $110 000 |

| Payrolls costs | $75 000 |

| Other controllable costs | $35 000 |

| Occupancy costs | $25 000 |

| Depreciation | $12 000 |

| Profit (before taxes) | $22 000 |

| Total | $279 000 |

To convert the figures into cost percentages, the individual costs are divided by the total sales (Figure 34). The percentages have been rounded off to the nearest percent.

Figure 34: Annual cost percentages

| Item | Cost | Cost Percentage |

|---|---|---|

| Food cost | $110 000 | 39% |

| Payroll costs | $75 000 | 27% |

| Other controllable costs | $35 000 | 13% |

| Occupancy costs | $25 000 | 9% |

| Depreciation | $12 000 | 4% |

| Profit (before taxes) | $22 000 | 8% |

| Total | $279 000 | 100% |

If management feels that before-tax profits have to be increased by more than the amount that will be generated by multiplying the present profit percentage by the projected sales, decisions will have to be made regarding increasing sales or reducing costs.

Creating the Projection Budget

For simplicity, costs have not been broken down into the subcategories as they would appear on an actual budget statement. However, the example shown in Figure 35 provides a general idea of what a monthly budget looks like.

Figure 35: January sample budget

| A | B | C | D | E | F | G | H |

| Item | Budget % | Month (Budget) | Year (Actual) | Month (Actual) | Year | Variance | Actual % |

|---|---|---|---|---|---|---|---|

| Food sales | $23,015.00 | $306,910.00 | $23,100.00 | $23,100.00 | $85.00 | ||

| Food cost | 39.0% | $8,976.00 | $119,695.00 | $9,110.00 | $9,110.00 | $(134.00) | 39.4% |

| Payroll costs | 27% | $6,214.00 | $82,866.00 | $6,205.00 | $6,205.00 | $9.00 | 26.9% |

| Other controllable costs | 13.05 | $2,992.00 | $39,898.00 | $3,110.00 | $3,110.00 | $(118.00) | 13.5% |

| Occupancy costs | 9.0% | $2,071.00 | $27,622.00 | $1,955.00 | $1,955.00 | $116.00 | 8.5% |

| Depreciation | 4.0% | $921.00 | $12,276.00 | $921.00 | $921.00 | – | 4.0% |

| Profits | 8.0% | $1,841.00 | $24,553.00 | $1,799.00 | $1,799.00 | $(42.00) | 7.8% |

| Total expenses | $23,015.00 | $306,910.00 |

Notice the food sales projection amounts (Columns C and D) are from Figure 32 and the cost percentages (Column B) are from Figure 34. The actual amounts (Column E and F) would be computed from the monthly sales report.

The monthly budget form should be completed soon after all expenses are known. Most business will have accounting software that will track the costs and actual sales against the budgets.

Interpreting a Budget

The simplest way to examine a budget is to go through it in point form line by line. The following refers to Figure 35.

- Food sales are $85 greater than expected. The actual month figure in Column E would be from the monthly sales receipts. Since this budget form is for January, the yearly figures in Column F are the same as the figures in Column E. Next month, however, the figures in Column F would be determined by adding the figures for this month and the actual figures from the February sales receipts.

- Food costs are higher than projected and are even greater than the increase in food sales. Since sales are higher than projected, food costs should also be higher but the figure suggests that food costs should be watched carefully for the next few months to see if increases in wholesale prices are more than what has been budgeted for.

- Payroll costs are slightly lower than projected. The difference is very slight (as they are in all categories), so no staffing decisions can be made based on this first month’s report.

- Other controllable costs are a bit higher but insignificant. If an actual budget was being used, these costs would be broken down into several categories and the area causing the increase would be pinpointed.

- Occupancy costs are slightly lower than projected. This could mean that property taxes or a licence fee need not be paid until later in the year.

- Depreciation costs cover the expense of having to replace equipment that has worn out through age, wear, or deterioration. There are strict taxation rules for determining depreciation. In this example, depreciation remains constant during all the budget months.

- Profits are down from the projection because, in the example, profits have been determined as the difference between expenses and sales and so fluctuations and changes in sales and costs will be reflected in the profits for the month.

- The total expenses are the same as the projected and actual food sales for the month.

- The actual figures and the projected figures for the month are very close. This would suggest that, at least for this month, the budget process has been accurate. However, managers should look very closely at the areas where actual costs have exceeded estimates and pay particular attention to food costs.

Income Statement

An income statement is an official financial document that presents the actual income and expenses of a business for a declared period of time—often the end of each month and at the end of the fiscal year.

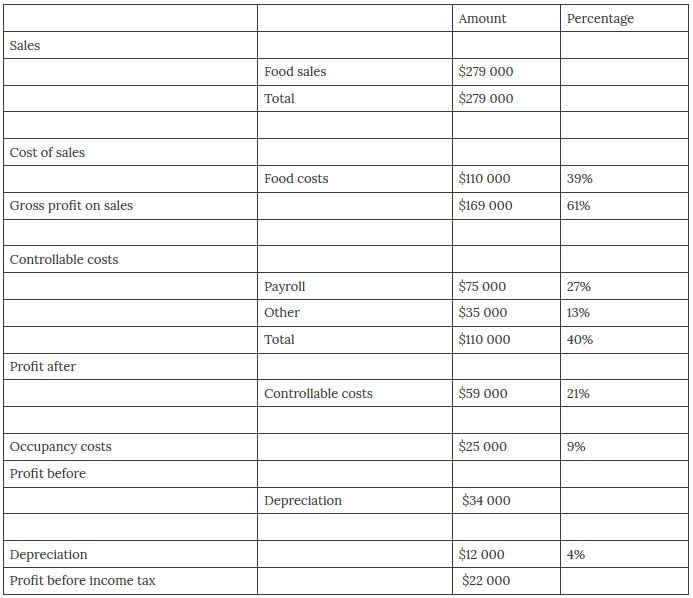

The income statement is essentially the monthly budget with actual cost and income figures inserted. For example, the income statement from the example above (Figure 35) could be laid out as shown in Figure 36.

Income statements are also known as profit and loss statements. An example of a detailed profit and loss statement is shown in Figure 37.

Figure 37: Detailed profit and loss statement

| End of December, 20—

Sales Customers $ 258 310 (92.6%) Staff meals $ 12 500 (4.5%) Returns and promotions $ 8190 (2.9%) Total sales $ 279 000

Cost of sales Beginning inventory $ 16 500 Purchases $ 105 900 Ending inventory $ 12 400 Cost of food sold $ 110 000 (39.4%)

Gross profit $ 169 000 (60.6%)

Expenses Payroll Salaries and wages $ 63 750 (22.8%) E. I. and WorkSafe $ 6000 (2.2%) Casual labour $ 5250 (1.9%)

Other controllable costs Advertising $ 9 800 (3.5 %) Laundry and linen $ 7700 (2.8% ) Cleaning and paper supplies $ 10 500 (3.8%) Freight and cartage $ 5250 (1.9%) Office supplies $ 1750 (0.6%)

Occupancy costs Insurance $ 3000 (1.1%) Utilities and fuel $ 2750 (1.0%) Repairs and maintenance $ 500 (0.2%) Lease $ 18 750 (6.7%)

Depreciation $ 12 000 (4.3%) Total operating expenses $ 147 000 (52.7%)

Total net profit $ 22 000 (7.9%)

Note: The figures in brackets are cost percentage. |

As you can see, there is a great deal of financial information that goes into the operation of a restaurant. Learning to understand and interpret the information is a skill that you will need to develop in order to manage a kitchen successfully.

Image Descriptions

Income statement for year ending December 31st.

Sales

- Food sales = $279,00

- Total = $279,000

Cost of sales

- Foot costs = $110,000, 39%

Gross profit on sales = $169,000, 61%

Controllable costs

- Payroll = $75,000, 27%

- Other = $35,000, 13%

- Total = 110,000, 40%

Profit after controllable costs = $59,000, 21%

Occupancy costs = $25,000, 9%

Profit before depreciation = $34,000

Depretiation = $12,000, 4%

Profit before income tax = $22,000

The ongoing expenses required to operate a business that are not direct costs of producing goods or services.