7.5 Number of Annuity Payments

How long do you require to fulfill the goal of your annuity? It all depends on your annuity payment, interest rate, and the amount of money involved.

You must calculate the number of annuity payments in a variety of scenarios:

- Savings planning

- Debt extinguishment

- Sustaining withdrawals from an investment

The Formula

Recall that the number of annuity payments (n) is one of the variables in Formula 7.2A, Formula 7.2B, Formula 7.3A, and Formula 7.3B. Calculating this amount then requires you to substitute the known variables and rearrange the formula to solve for n. Since n is located in the exponent, the rearrangement and isolation demands the usage of natural logarithms. The most difficult part is figuring out which formula you need to use. Choose the formula using the same decision criteria explained in Section 7.4.

How It Works

Follow these steps, to solve for the number of annuity payments or the annuity term:

Step 1: Identify the annuity type. Draw a timeline to visualize the question.

Step 2: Identify the variables that always appear, including PMT, I/Y, C/Y, and P/Y. You must also identify one of the known values of PVORD, PVDUE, FVORD, or FVDUE.

Step 3: Calculate the periodic interest rate (i) using the formula

[latex]i=\frac{I/Y}{C/Y}[/latex]

Step 4: Substitute into the correct annuity payment formula that matches your annuity type and known present or future value. Select from Formula 7.2A, Formula 7.2B, Formula 7.3A, or Formula 7.3B. Rearrange and solve for n.

Step 5: To convert n back to a more commonly expressed format, such as years and months, take Formula 7.1 and rearrange it for Years. If Years is a decimal number, recall the steps required for converting in .. unit not used.

Dealing with decimals in n

At the end of step 4, the calculated value of n may have decimals. Apply the rounding rules as described below.

If the three decimals are zeroes, then the decimals are most likely a result of a rounded FV, PV, or PMT, so treat the n like an integer (ignoring the decimals).

If the three decimals are not all zeroes, then n must always be rounded up to the next integer regardless of the decimal value. You must never round it down, because the calculated value of n represents the minimum payments required.

Interpreting n

Since n represents the number of annuity payments, to assign its meaning you need to look at the P/Y value. For example, if n = 8 and P/Y = 4 then n represents 8 quarterly payments which means the term is two years (8/4=2).

The Term and the Lat Payment on Annuities Due

One of the characteristics of an annuity due is that the last payment occurs one payment interval before the end of the term of the annuity. When you calculate n, you have calculated the term of the annuity. The last payment occurs n – 1 intervals from the start of the annuity. For example, assume payments are monthly and you calculate n = 12 months. This means the term of the annuity is 12 months. The last payment on the annuity due is 12 – 1 = 11 months from the start. Be sure to recognize whether you are looking for the end of the term or when the last payment is made. This problem does not occur for ordinary annuities since the last payment and the end of the term are on the same date.

Concept Check

Example 7.5.1: How Long Until Retirement Savings are Depleted?

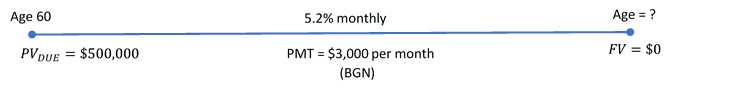

Samia has $500,000 accumulated in her retirement savings when she decides to retire at age 60. If she wants to receive beginning-of-month payments of $3,000 and her retirement annuity can earn 5.2% compounded monthly, how old is Samia when the fund is depleted?

Solution

Step 1: The payments are at the beginning of the payment intervals, and the compounding period and payment intervals are the same. Therefore, this is a simple annuity due. In looking for how old Samia will be when the fund is depleted, calculate the number of annuity payments, or [latex]n[/latex], that her retirement annuity can sustain.

The timeline for the retirement annuity appears below.

Step 2: Given information:

PVDUE = $500,000; I/Y = 5.2%; C/Y = 12; PMT = $3,000; P/Y = 12; FV = $0

Step 3: Calculate the periodic interest rate, i.

[latex]i=\frac{I/Y}{C/Y}=\frac{5.2\%}{12}=0.4\overline{3} \%[/latex]

Step 4: Substitute into Formula 7.3B, rearranging for n.

[latex]\begin{align} PV_{DUE}&=PMT \left[\frac{1-(1+i)^{-n}}{i}\right] \times(1+i)\\ \$500,\!000&=\$3,\!000 \left[\frac{1-(1+0.004\overline{3})^{-n}}{0.004\overline{3}}\right]\times(1+0.004\overline{3})\\ 165.947560&=\frac{1-0.995685^n}{0.0043}\\ 0.995685^n&=0.280893\\ n\times \ln(0.995685)&=\ln(0.280893)\\ n&=\frac{-1.2697323}{-0.004323}\\ n&=293.660180 \end{align}[/latex]

Rounding up to 294 monthly payments consisting of 293 regular payments plus one additional smaller payment.

Step 5: Convert n to years and months.

[latex]\begin{align} \text{Years}&=\frac{n}{P/Y}\\ &=\frac{294}{12}\\ &=24.5\;\text{years or}\; 24\;\text{years and}\;0.5\times 12 = 6\;\text{months} \end{align}[/latex]

24 years, 6 months

Calculator Instructions:

| Mode | N | I/Y | PV | PMT | FV | P/Y | C/Y |

|---|---|---|---|---|---|---|---|

| BGN | Answer: 293.660180 | 5.2 | -500,000 | 300 | 0 | 12 | 12 |

The figure shows how much principal and interest make up the payments. If Samia is currently 60 years old and the annuity endures for 24 years and six months, then she will be 84.5 years old when the annuity is depleted. Note that Samia will receive 293 payments of $3,000 along with a smaller final payment that is approximated by taking 66.018% × $3,000 = $1,980.54

Example: 7.5.2: How Long to Pay Off Your Car?

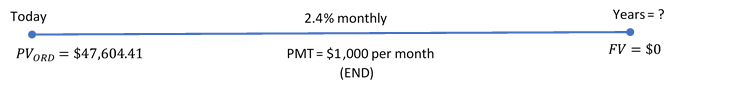

Brendan is purchasing a brand new Mazda MX-5 GT. Including all options, accessories, and fees, the total amount he needs to finance is $47,604.41 at the dealer’s special interest financing of 2.4% compounded monthly. If he makes payments of $1,000 at the end of every month, how long will it take to pay off his car loan?

Solution

Step 1: The payments are at the end of the payment intervals with a monthly compounding period and monthly payment intervals. Therefore, this is an ordinary simple annuity. Calculate the number of monthly payments, or [latex]n[/latex], to figure out the length of time required to pay off the loan.

The timeline for the car payments appears below.

Step 2: Given information:

PVORD = $47,604.41; I/Y = 2.4%; C/Y = 4; PMT = $1,000; P/Y = 12; FV = $0

Step 3: Calculate the periodic interest rate, i.

[latex]i=\frac{I/Y}{C/Y}=\frac{2.4\%}{12}=0.2 \%[/latex]

Step 4: Substitute into Formula 7.3A, rearranging for n.

[latex]\begin{align} PV_{ORD}&=PMT \left[\frac{1-(1+i)^{-n}}{i}\right]\\ \$47,\!604.41&=\$1,\!000 \left[\frac{1-(1+0.002)^{-n}}{0.002}\right]\\ 0.095208&=1-0.998003^n\\ 0.998003^n&=0.904791\\ n \times \ln(0.998003)&=\ln(0.904791)\\ n&=\frac{-0.100051}{-0.001998}\\ &=50.075560 \end{align}[/latex]

Rounded up to 51 monthly payments.

Step 5: Convert n to years and months.

[latex]\begin{align} \text{Years}&=\frac{n}{P/Y}\\ &=\frac{51}{12}\\ &=4.25\;\text{years or}\; 4\;\text{years and}\;0.25\times 12 = 3\;\text{months} \end{align}[/latex]

4 years, 3 months

Calculator Instructions

| N | I/Y | PV | PMT | FV | P/Y | C/Y |

|---|---|---|---|---|---|---|

| Answer: 50.075560 | 2.4 | 47,604.41 | -1,000 | 0 | 12 | 12 |

The figure shows how much principal and interest make up the payments. To own his vehicle, Brendan will make payments for four-and-a-quarter years. This consists of 50 payments of $1,000 and a smaller final payment that is approximated by taking 7.556% × $1,000 = $75.56.

Example 7.5.3: The Importance of the Annuity Type

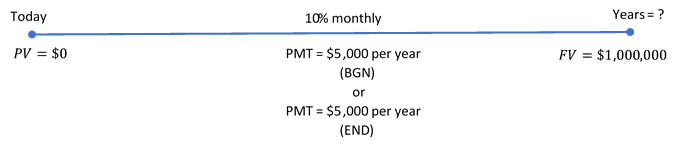

Trevor wants to save up $1,000,000. He will contribute $5,000 annually to an investment earning 10% compounded monthly. What is the time difference between his last payments (not the end of the annuities) if he makes his contributions at the end of the year instead of at the beginning of the year?

Solution

Step 1: In this question you are being asked to compare two annuities that differ in their payment intervals and their compounding periods. One annuity makes contributions at the beginning of the interval, while the other makes contributions at the end. Therefore, you must contrast one general annuity due with one ordinary general annuity. To determine the time difference, calculate n for each annuity and compare when the last payment is made.

A combined timeline for the two annuities appears below.

Step 2: Given information:

Ordinary general annuity: FVORD = $1,000,000; I/Y = 10%; C/Y = 12; PMT = $5,000; P/Y = 1

General annuity due: FVDUE = $1,000,000; I/Y = 10%; C/Y = 12; PMT = $5,000; P/Y = 1

Step 3: Calculate the periodic interest rate, i.

[latex]i=\frac{I/Y}{C/Y}=\frac{10\%}{12}=0.8\overline{3} \%[/latex]

Step 4: Apply Formula 7.2A and Formula 7.2B, rearranging for n.

Ordinary general annuity:

[latex]\begin{align} FV_{ORD}&=PMT \left[\frac{(1+i)^n-1}{i}\right]\\ \$1,\!000,\!000&=\$5,\!000 \left[\frac{(1+0.008\overline{3})^n-1}{0.0088\overline{3}}\right]\\ 20.942613&=1.104713^n-1\\ 21.942613&=1.104713^n\\ \ln(21.942613)&=n \times\ln(1.104713)\\ n&=\frac{21.942613}{1.104713}\\ &=31.012812\; \text{or}\; 32\; \text{years} \end{align}[/latex]

General annuity due:

[latex]\begin{align} FV_{DUE}&=PMT \left[\frac{(1+i)^n-1}{i}\right]\times(1+i)\\ \$1,\!000,\!000&=\$5,\!000 \left[\frac{(1+0.0088\overline{3})^n-1}{0.0088\overline{3}}\right]\times(1+0.0088\overline{3})\\ 18.957514&=1.104713^n-1\\ 19.957514&=1.104713^n\\ \ln(19.957514)&=n\times\ln(1.104713)\\ n&=\frac{19.957514}{1.104713}\\ &=30.060618\; \text{or}\; 31\; \text{years} \end{align}[/latex]

Step 5: The ordinary general annuity last payment is 32 years from today. The general annuity due has a term of 31 years, but the last payment is 31 − 1 = 30 years from today. The difference between the last payments is 32 − 30 = 2 years sooner.

Calculator instructions:

| Type | Mode | N | I/Y | PV | PMT | FV | P/Y | C/Y |

|---|---|---|---|---|---|---|---|---|

| Ordinary | Answer: 30.060618 | 10 | 0 | -5,000 | 1,000,000 | 1 | 12 | |

| Due | BGN | Answer: 31.012812 | 10 | 0 | -5,000 | 1,000,000 | 1 | 12 |

In order for Trevor to reach his goal, if he were to make his $5,000 contributions at the beginning of the year (that is, under the annuity due) instead of the end of the year (under the ordinary annuity), his last payment would be two years sooner. Do not confuse this with the terms of the two annuities, which end only one year apart (31 years from now and 32 years from now).

Exercises

In each of the exercises that follow, try them on your own. Full solutions are available should you get stuck.

- Amarjit wants to save up for a down payment on his first home. A typical starter home in his area sells for $250,000 and the bank requires a 10% down payment. If he starts making $300 month-end contributions to an investment earning 4.75% compounded monthly, how long will it take for Amarjit to have the necessary down payment?

- Hi-Tec Electronics is selling a 52″ LG HDTV during a special “no sales tax” event for $1,995 with end of month payments of $100 including interest at 15% compounded semi-annually. How long will it take a consumer to pay off her new television?

- Most financial institutions tout the benefits of “topping up” your mortgage payments—that is, increasing from the required amount to any higher amount. Assume a 25-year mortgage for $200,000 at a fixed rate of 5% compounded semi-annually.

a) How many fewer payments does it take to pay off your mortgage if you increased your monthly payments by 10%?

b) How much money is saved by “topping up” the payments? Assume that all payments are equal amounts in your calculations.

Note: Solution to exercises are demonstrated using the calculator only.