7.6 Annuity Interest Rate

You must calculate the interest rate on an annuity in a variety of situations:

- To determine the interest rate being charged on any debt

- To determine the interest rate that an investment is earning

- To calculate the required interest rate for savings to reach a goal within a certain time period

- To calculate the required interest rate needed for a series of payments to be sustained over a certain time period

The Formula

A most interesting circumstance arises when you attempt to solve any of the future value or present value annuity formula for the periodic interest rate (i). The periodic interest rate (i) appears in the formulas twice and there is no algebraic way to isolate the periodic interest rate.

So how do you solve for the periodic interest rate (i)?

We will use technology (BAII+ Calculator). All problems in this section, therefore, assume you have access to technology, so no algebraic solutions appear in the formula calculations.

How It Works

Follow these steps to solve for any nominal interest rate, I/Y:

Step 1: Identify the annuity type. Draw a timeline to visualize the question.

Step 2: Identify the variables that you know, including C/Y, PMT, P/Y, and Years. You must also identify a value for one of PVORD, PVDUE, FVORD, or FVDUE. You may or may not have a value for FV or PV.

Step 3: Use Formula 11.1 to calculate the number of payments (n). Input all six of the known variables into your calculator and solve for the nominal interest rate, I/Y, which is compounded according to the value you entered into the C/Y variable.

Note: If you want to solve for the effective interest rate in any situation, you can change the C/Y to a value of one (C/Y = 1) and recalculate the I/Y.

Concept Check

Example: 7.6.1: Rent to Own

Smartchoice, a rent-to-own store, offers a Dell 10″ Mini Inspiron Netbook for a cash n’ carry price of $399. Alternatively, under its rent-to-own plan you could make $59.88 monthly payments in advance and own the laptop after one year. What interest rate is effectively being charged on the rent-to-own plan?

Solution

Step 1: The payments are made at the beginning of the payment intervals, and the compounding period and payment intervals are different. Therefore, this is a general annuity due. Solve for the effective interest rate, which is the nominal interest rate, I/Y, that has a compounding frequency of one.

The timeline for the retirement annuity appears below.

Step 2: Given information:

PVDUE = $399; FV = $0; C/Y = 1; PMT = $59.88; P/Y = 12; Years = 1

Step 3: Enter the information into the calculator and solve for I/Y.

Calculator instructions:

| Mode | N | I/Y | PV | PMT | FV | P/Y | C/Y |

|---|---|---|---|---|---|---|---|

| BGN | 12 | Answer: 337.975924 | 399 | -59.88 | 0 | 12 | 1 |

The figure shows the effective interest and the laptop’s value that make up the payments. The effective interest rate being charged under the rent-to-own payment plan is 337.9759%.

Example: 7.6.2: Interest Rate Required to Allow for Capital Project Savings

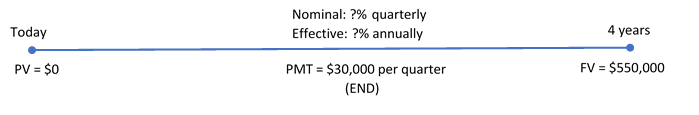

Cubonic Industries deposits $30,000 at the end of every quarter to save up $550,000 for a capital project in four years. To achieve its goal, what nominal interest rate compounded quarterly does Cubonic Industries require on its investment? What is the effective rate?

Solution

Step 1: There are two questions here. The first question about the nominal interest rate involves an ordinary simple annuity. Solve this for I/Y when C/Y = 4. The second question about the effective rate involves an ordinary general annuity. Solve this for I/Y when C/Y = 1.

The timeline for both questions appears below.

Step 2: Given information:

Ordinary simple annuity: FVORD = $550,000; PV = $0; C/Y = 4; PMT = $30,000; P/Y = 4; Years = 4

Ordinary general annuity: All the same except C/Y = 1

Step 3: Enter the information into the calculator and solve for I/Y.

Ordinary simple annuity: Enter the information into the calculator and solve for I/Y.

Ordinary general annuity: Change the C/Y to 1 (for the effective rate) and recalculate I/Y.

Calculator instructions:

| Type | N | I/Y | PV | PMT | FV | P/Y | C/Y |

|---|---|---|---|---|---|---|---|

| Simple | 16 | Answer: 7.145908 | 0 | -30,000 | 550,000 | 4 | 4 |

| General | 16 | Answer: 7.339689 | 0 | -30,000 | 550,000 | 4 | 1 |

The figure shows how much principal and interest make up the final balance. For Cubonic Industries to achieve its savings goal, the savings annuity must earn 7.1459% compounded quarterly, or 7.3397% effectively.

Example 7.6.3: Interest Rate Required to Achieve RRSP Goal

Amadeus has already saved $5,000 in his RRSP today. Suppose he continues to make $250 contributions at the beginning of each month for the next 14 years. For him to achieve his goal of having $100,000, what monthly nominal rate of return must his investment earn?

Solution

Step 1: The payments are made at the beginning of the payment intervals, and the compounding period and payment intervals are the same. Therefore, this is a simple annuity due. Solve for the monthly nominal interest rate, I/Y.

The timeline for RRSP contributions appears below.

Step 2: Given information:

FVDUE = $100,000; PV = $5,000; C/Y = 12; PMT = $250; P/Y = 12; Years = 14

Step 3: Enter the information into the calculator and solve for I/Y.

Calculator instructions:

| Mode | N | I/Y | PV | PMT | FV | P/Y | C/Y |

|---|---|---|---|---|---|---|---|

| BGN | 168 | Answer: 8.808808 | -5,000 | -250 | 100,000 | 12 | 12 |

The figure shows how much principal and interest make up the final balance. The nominal rate of interest that Amadeus must earn on his investment is 8.8088% compounded monthly.

Example 7.6.4: Ordinary General Annuity with Present Value and a Balance Owing in Future

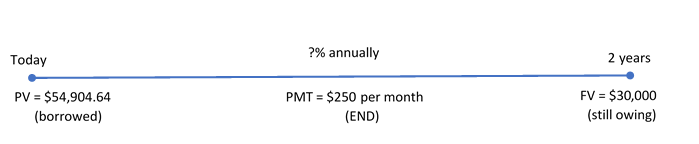

Gemma is looking to purchase a new Nissan Pathfinder for $54,904.64 including all fees and sales taxes. She can afford to pay no more than $1,500 at the end of every month, and she wants to have the balance owing reduced to $30,000 after two years, when she can pay off the vehicle with her trust fund. What is the maximum effective rate of interest she could be charged on the car loan to meet her goals?

Solution

Step 1: The payments are made at the end of the payment intervals, and the compounding period and payment intervals are different. Therefore, this is an ordinary general annuity. Solve for the effective interest rate, I/Y.

The timeline for the car loan appears below.

Step 2: Given information:

PVORD = $54,904.64; FV = $30,000; C/Y = 1; PMT = $1,500; P/Y = 12; Years = 12

Step 3: Enter the information into the calculator and solve for I/Y.

Calculator instructions:

| N | I/Y | PV | PMT | FV | P/Y | C/Y |

|---|---|---|---|---|---|---|

| 24 | Answer: 13.527019 | 54,904.64 | -1,500 | -30,000 | 12 | 1 |

The figure shows how much principal and interest make up the payments. Gemma will be able to purchase the car if she can obtain a car loan that has an effective interest rate lower than 13.527%.

Exercises

In each of the exercises that follow, try them on your own. Full solutions are available should you get stuck.

- Francisco just changed occupations. Unfortunately, he is not able to transfer his company pension with him to his new company. The administrators of the pension plan offer him the choice of a lump-sum payout of $103,075 today or beginning-of-month payments of $535 for the next 25 years. What semi-annually compounded rate of return are the pension administrators using in their calculations?

- An investment today requires $1,125.51 to purchase. In return, the investment pays out $30 after every six months for the next 20 years, along with an additional final lump-sum payout of $1,000. What semi-annually compounded interest rate is being earned on the investment?

- When you buy a car, a cash rebate is usually available if you finance the vehicle through your bank instead of the dealership; if you finance the vehicle through the dealership, you are not eligible for the cash rebate. Assume you can purchase a vehicle for $24,960 and finance it for four years with month-end payments at 0% through the dealership. Alternatively, you could get a loan from a bank and pay cash for your vehicle, which would entitle you to receive a $3,500 cash rebate. What monthly compounded interest rate would the bank have to charge to arrive at the same monthly payment as the dealership alternative? What decision rule can you create from this calculation?

Timeline for exercise 2 is included in Solutions to Exercises.