4.1 Principal, Rate, Time

Simple Interest

In a simple interest environment, you calculate interest solely on the amount of money at the beginning of the transaction (amount borrowed or lent).

Assume $1,000 is placed into an account with 12% simple interest for a period of 12 months. For the entire term of this transaction, the amount of money in the account always equals $1,000. During this period, interest accrues at a rate of 12%, but the interest is never placed into the account. When the transaction ends after 12 months, the $120 (12% of $1,000) of interest and the initial $1,000 are then combined to total $1,120.

A loan or investment always involves two parties—one giving and one receiving. No matter which party you are in the transaction, the amount of interest remains unchanged. The only difference lies in whether you are earning or paying the interest.

The Formula

Formula 4.1 Simple Interest: [latex]I=Prt[/latex] where,

I is Interest Amount. The interest amount is the dollar amount of interest that is paid or received.

P is Present Value or Principal. The present value is the amount borrowed or invested at the beginning of a period.

r is Simple Interest Rate. The interest rate is the rate of interest that is charged or earned during a specified time period. It is expressed as a percent.

t is Time Period. The time period or term is the length of the financial transaction for which interest is charged or earned.

Important Notes

Recall that algebraic equations require all terms to be expressed with a common unit. This principle remains true for Formula 4.1, particularly with regard to the interest rate and the time period. For example, if you have a 3% annual interest rate for nine months, then either

- The time needs to be expressed annually as [latex]\frac{9}{12}[/latex] of a year to match the yearly interest rate, or

- The interest rate needs to be expressed monthly as [latex]\frac{3\%}{12}=0.25\%[/latex] per month to match the number of months.

It does not matter which you do so long as you express both interest rate and time in the same unit. If one of these two variables is your algebraic unknown, the unit of the known variable determines the unit of the unknown variable. For example, assume that you are solving Formula 4.1 for the time period. If the interest rate used in the formula is annual, then the time period is expressed in number of years.

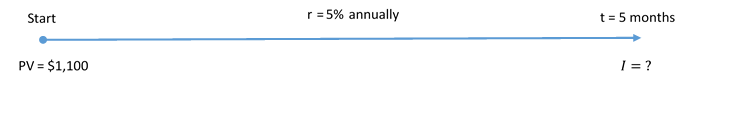

Example 4.1.1: How Much Interest is Owed?

Julio borrowed $1,100 from Maria five months ago. When he first borrowed the money, they agreed that he would pay Maria 5% simple interest. If Julio pays her back today, how much interest does he owe her?

Solution

Step 1: Given information:

P = $1,100; r = 5%; per year; t = 5 months

Step 2: The rate is annual, and the time is in months. Convert the time period from months to years; [latex]t=\frac{5}{12}[/latex]

Step 3: Solve for the amount of interest, I.

[latex]\begin{align} I&=Prt\\ &=\$1,\!100 \times 5\% \times \frac{5}{12}\\ &=\$1,\!100 \times 0.05 \times 0.41\overline{6}\\ &=\$22.92 \end{align}[/latex]

For Julio to pay back Maria, he must reimburse her for the $1,100 principal borrowed plus an additional $22.92 of simple interest as per their agreement.

Solving for P, r or t

Four variables are involved in the simple interest formula, which means that any three can be known, requiring you to solve for the fourth missing variable. To reduce formula clutter, the triangle technique illustrated in the video below will help you remember how to rearrange the simple interest formula as needed.

Concept Check

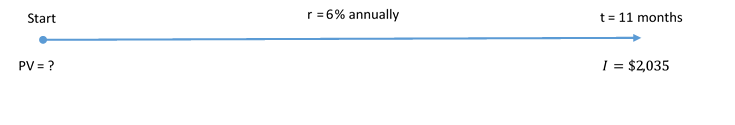

Example 4.1.2: What did You Start With?

What amount of money invested at 6% annual simple interest for 11 months earns $2,035 of interest?

Solution

Step 1: Given information:

r = 6%; t = 11 months; I = $2,035

Step 2: Convert the time from months to an annual basis to match the interest rate; [latex]t=\frac{11}{12}[/latex]

Step 3: Solve for the present value, P.

[latex]\begin{align} P&=\frac{I}{rt}\\ &=\frac{\$2,\!035}{6\% \times \frac{11}{12}}\\ &=\frac{\$2,\!035}{0.06 \times 0.91\overline{6}}\\ &=\$37,\!000 \end{align}[/latex]

To generate $2,035 of simple interest at 6% over a time frame of 11 months, $37,000 must be invested.

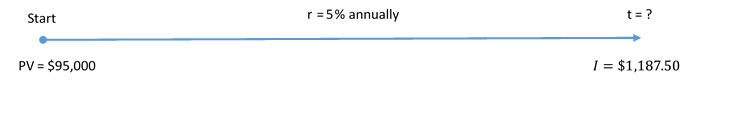

Example 4.1.3: How long?

For how many months must $95,000 be invested to earn $1,187.50 of simple interest at an interest rate of 5%?

Solution

Step 1: Given information:

P = $95,000; I = $1,187.50; r = 5%; per year

Step 2: Convert the interest rate to a “per month” format; [latex]r=\frac{0.05}{12}[/latex]

Step 3: Solve for the time period, t.

[latex]\begin{align} t&=\frac{I}{Pr}\\ &=\frac{\$1,\!187.50}{\$95,\!000 \times \frac{0.05}{12}}\\ &=\frac{\$1,\!187.50}{\$95,\!000 \times 0.0041\overline{6}}\\ &=3 \; \text {months} \end{align}[/latex]

For $95,000 to earn $1,187.50 at 5% simple interest, it must be invested for a three-month period.

Exercises

In each of the exercises that follow, try them on your own. Full solutions are available should you get stuck.

- If you want to earn $1,000 of simple interest at a rate of 7% in a span of five months, how much money must you invest?

- If you placed $2,000 into an investment account earning 3% simple interest, how many months does it take for you to have $2,025 in your account?

- A $3,500 investment earned $70 of interest over the course of six months. What annual rate of simple interest did the investment earn?

Time and Dates

In the examples of simple interest so far, the time period was given in months. While this is convenient in many situations, financial institutions and organizations calculate interest based on the exact number of days in the transaction, which changes the interest amount.

To illustrate this, assume you had money saved for the entire months of July and August, where [latex]t = \frac{2}{12}[/latex] or [latex]t = 0.16666...=0.1\overline{6}[/latex] of a year. However, if you use the exact number of days, the 31 days in July and 31 days in August total 62 days. In a 365-day year that is [latex]t =\frac{62}{365}[/latex] or t = 0.169863 of a year. Notice a difference of 0.003196 (0.169863 – 0.16) occurs. Therefore, to be precise in performing simple interest calculations, you must calculate the exact number of days involved in the transaction.

Important Notes

When solving for t, decimals may appear in your solution. For example, if calculating t in days, the answer may show up as 45.9978 or 46.0023 days; however, interest is calculated only on complete days. This occurs because the interest amount (I) used in the calculation has been rounded off to two decimals. Since the interest amount is imprecise, the calculation of t is imprecise. When this occurs, round t off to the nearest integer.

Example 4.1.4: Time Using Dates

On September 13, 2011, Aladdin decided to pay back the Genie on his loan of $15,000 at 9% simple interest. If he paid the Genie the principal plus $1,283.42 of interest, on what day did he borrow the money from the Genie?

Solution

Step 1: Given variables:

P = $15,000; I = $1,283.42; r = 9% per year; End Date = September 13, 2011

Step 2: The time is in days, but the rate is annual. Convert the rate to a daily rate; [latex]r=\frac{9\%}{365}[/latex]

Step 3: Solve for the time, t

[latex]\begin{align} t&=\frac{I}{Pr}\\ &=\frac{\$1,\!283.42}{\$15,\!000 \times \frac{0.09}{365}}\\ &= 346.998741=347\; \text{days} \end{align}[/latex]

Step 4: Use the DATE function to calculate the start date (DT1). Use the time in days.

If Aladdin owed the Genie $1,283.42 of simple interest at 9% on a principal of $15,000, he must have borrowed the money 347 days earlier, which is October 1, 2010.

Exercises

In each of the exercises that follow, try them on your own. Full solutions are available should you get stuck.

- Brynn borrowed $25,000 at 1% per month from a family friend to start her entrepreneurial venture on December 2, 2011. If she paid back the loan on June 16, 2012, how much simple interest did she pay?

- If $6,000 principal plus $132.90 of simple interest was withdrawn on August 14, 2011, from an investment earning 5.5% interest, on what day was the money invested?

Chapter Attribution

8.1 in Business Math: A Step-by-Step Handbook by J. Olivier published by Libretexts shared under CC BY-NC-SA license.