3 Human Resources and Economic Applications

Chapter 3 Topics

3.1 Gross Earnings

3.2 Personal Income Tax

3.3 Indexes

Has your employer paid you all that you have earned? While this problem is difficult to track, the Canadian Payroll Association estimates the frequency of payroll errors to be 5.7%.[1] Studies in the United States have found that 33% of employers have made some form of payroll mistake, whether in the calculation of pay or in deductions.[2] This means that you must always check your paycheque to ensure that you receive the correct amount of pay. If you are overpaid, you are not entitled to keep the overage and must reimburse your employer. If you are underpaid, your employer owes you money.

We all work to earn enough income to cover our expenses, such as mortgages, car payments, and recreational activities. There are many ways to earn that income, ranging from straight salaries and hourly wages to commission rates and piecework wages. The amount of money you generate by working is called your gross earnings. If you are an employee, this amount is then subject to automatic deductions, including federal taxes, provincial taxes, employment insurance, Canada Pension Plan, along with any other deductions required by your employer. All of these government deductions are submitted to the government on your behalf. What is left over after all of these deductions is your net pay, which is your take-home amount.

Payroll forms one of the largest and most contentious expenses in most organizations. It is critical to get it right. Workers often go on strike if they believe their take-home pay is unfair. And payroll errors are costly and time consuming to fix, aside from their impact on employee satisfaction.

Payroll decisions are affected by inflation. Ask your parents how much things cost when they were young. In the 1950s, my parents attended movie theatres for 25¢ admission. A chocolate bar was 5¢. Today, attending a first-run movie costs $8.99 or more, and chocolate bars are typically around one dollar. To keep up with these rising prices, incomes have constantly increased. In 1959, family income was approximately $4,500 compared to the 2009 median family income of $68,410.[3] Can you still afford the same things that people could afford back then? Business indexes are regularly used to understand the change over time in various quantities or how a quantity at one time point compares to the corresponding value at a certain reference time point.

For example, the next time you are offered a raise at work, an index can tell you whether you are truly receiving a raise or not! Assume that product prices have risen by 2% year-over-year. If you are offered a raise less than 2%, you have taken a wage cut and have less purchasing power than before. A raise of 2% allows you to at least break even, and anything above 2% increases your purchasing power.

Whether you are pursuing a career in human resources, economics, or some other field, the issues of gross earnings, income taxes, and indexes remain important both personally and professionally. This chapter examines some of the basic mathematical concepts involved in these calculations.

[1] Steven Van Alstine, Vice-President of Education, the Canadian Payroll Association.

[2] Mie-Yun Lee, “Outsource Your Payroll,” Entrepreneur. www.entrepreneur.com/humanresources/article47340.html (accessed November 29, 2009).

[3] Statistics Canada, “Median Total Income, by Family Type, by Province and Territory,” CANSIM table 111-0009, http://www40.statcan.ca/l01/cst01/famil108a-eng.htm (accessed October 19, 2010).

3.1 Gross Earnings

You work hard at your job, and you want to be compensated properly for all the hours you put in. Assume you work full time with an hourly rate of pay of $10. Last week you worked eight hours on Sunday and eight hours on Monday, which was a statutory holiday. Then you took Tuesday off, worked eight hours on each of Wednesday and Thursday, took Friday off, and worked 10 hours on Saturday. That’s a total of 42 hours of work for the week. What is your gross pay? Give or take a small amount depending on provincial employment standards, it should be about $570. But if you don’t understand how to calculate gross earnings, you could be underpaid without ever realizing it.

Here are some notes about the content in this chapter: About 10% of Canadian workers fall under federal employment standards, which are not discussed here. This textbook generalizes the most common provincial employment standards; however, to calculate your earnings accurately requires you to apply your own provincial employment standards legislation. Part-time employment laws are extremely complex, so this textbook assumes in all examples that the employee is full time.

This section addresses the calculation of gross earnings, which is the amount of money earned before any deductions from your paycheque. The four most common methods of employee remuneration include salaries, hourly wages, commissions, and piecework wages.

Salary and Hourly Wages

One ad in the employment classifieds indicates compensation of $1,270 biweekly, while a similar competing ad promotes wages of $1,400 semi-monthly. If both job ads are similar in every other way, which job has the higher annual gross earnings? To make this assessment, you must understand how salaries work. A salary is a fixed compensation paid to a person on a regular basis for services rendered. Most employers pay employees by salary in occupations where the employee’s work schedule generally remains constant.

In contrast, an hourly wage is a variable compensation based on the time an employee has worked. In contrast to a salary, this form of compensation generally appears in occupations where the number of hours is unpredictable or continually varies from period to period.

Employment Contract Characteristics[1]

Salaried and hourly full-time employees are similar with regard to their gross earnings. The major earnings issues in an employment contract involve regular earnings structure, overtime, and holidays.

[1] Special thanks to Steven Van Alstine (CPM, CAE), Vice-President of Education, the Canadian Payroll Association, for assistance in summarizing Canadian payroll legislation and jurisdictions.

Regular Earnings Structure

An agreement with your employer outlines the terms of your employment, including the time frame and frequency of pay.

- Time Frame. For salaried employees, the time frame that the salary covers must be clearly stated. For example, you could receive a salary of $2,000 monthly or $50,000 annually. Notice that each of these salaries is followed by the specific time frame for the compensation. For hourly employees, the time frame requires identification of the wage earned per hour.

- Frequency. How often the gross earnings are paid out to the employee must be defined.

a. Monthly: Earnings are paid once per month. By law, employees must receive compensation from their employer at least once per month, which equals 12 times per year.

b. Daily: Earnings are paid at the end of every day. This results in about 260 paydays per year (5 days per week multiplied by 52 weeks per year). In a leap year, there might be one additional payday.

c. Weekly: Earnings are paid once every week. This results in 52 paydays in any given year since there are 52 weeks per year.

d. Biweekly: Earnings are paid once every two weeks. This results in 26 paydays in any given year since there are 52 ÷ 2 = 26 biweekly periods per year.

e. Semi-monthly: Earnings are paid twice a month, usually every half month (meaning on the 15th and last day of the month). This results in 24 paydays per year.

Thus, the earnings structure specifies both the time frame and the frequency of earnings. For a salaried employee, this may appear as “$2,000 monthly paid semi-monthly” or “$50,000 annually paid biweekly.” For an hourly employee, this may appear as “$10 per hour paid weekly.” No matter whether you are salaried or hourly, earnings determined by your regular rate of pay are called your regular earnings.

Overtime

Overtime is work time in excess of your regular workday, regular workweek, or both. In most jurisdictions it is paid at 1.5 times your regular hourly rate (called time-and-a-half), though your company may voluntarily pay more or a union may have negotiated a more favourable rate such as two times your regular hourly rate (called double time). A contract with an employer will specify your regular workday and workweek, and some occupations are exempt from overtime. Due to the diversity of occupations, there is no set rule on what constitutes a regular workday or workweek. In most jurisdictions, a regular workweek is eight hours per day and 40 hours per week. Once you exceed these regular hours, you are eligible to receive overtime or premium earnings, which are based on your overtime rate of pay.

Holidays

A statutory holiday is a legislated day of rest with pay. Five statutory holidays are recognized throughout Canada, namely, New Year’s Day, Good Friday (or Easter Monday in Quebec), Canada Day, Labour Day, and Christmas Day. Each province or territory has an additional four to six public holidays (or general holidays), which may include Family Day (known as Louis Riel Day in Manitoba and Islander Day in PEI) in February, Victoria Day in May, the Civic Holiday in August, Thanksgiving Day in October, Remembrance Day in November, and Boxing Day in December. These public holidays may or may not be treated the same as statutory holidays, depending on provincial laws.

Statutory and public holidays generally require employees to receive the day off with pay. If the holiday falls on a nonworking day, it is usually the next working day that is given off instead. For example, if Christmas Day falls on a Saturday, typically the following Monday is given off with pay. Here’s how holidays generally work (though you should always consult legislation for your specific jurisdiction):

- You should be given the day off with pay, called holiday earnings. The holiday earnings are in the amount of a regular day’s earnings, and the hours involved count toward your weekly hourly totals for overtime purposes (preventing employers from shifting your work schedule that week).

- If you are required to work, the employer must offer another day off in lieu with pay. Your work on the statutory holiday is then paid at regular earnings and the hours involved contribute toward your weekly hourly totals for overtime purposes. You are paid holiday earnings on your future day off.

- If you are required to work and no day or rest is offered in lieu, this poses the most complex situation. Under these conditions:

- You are entitled to the holiday earnings you normally would have received for the day off. The hours that make up your holiday earnings contribute toward your weekly hourly totals for overtime purposes (again, consult your local jurisdiction).

In addition, for the hours you worked on the statutory holiday you are entitled to overtime earnings known as statutory holiday worked earnings. These hours do not contribute toward your weekly hourly totals for overtime purposes since you are already compensated at a premium rate of pay. For example, assume you work eight hours on Labour Day, your normal day is eight hours, and you won’t get another day off in lieu. Your employer owes you the eight hours of holiday earnings you should have received for getting the day off plus the eight hours of statutory holiday worked earnings for working on Labour Day.

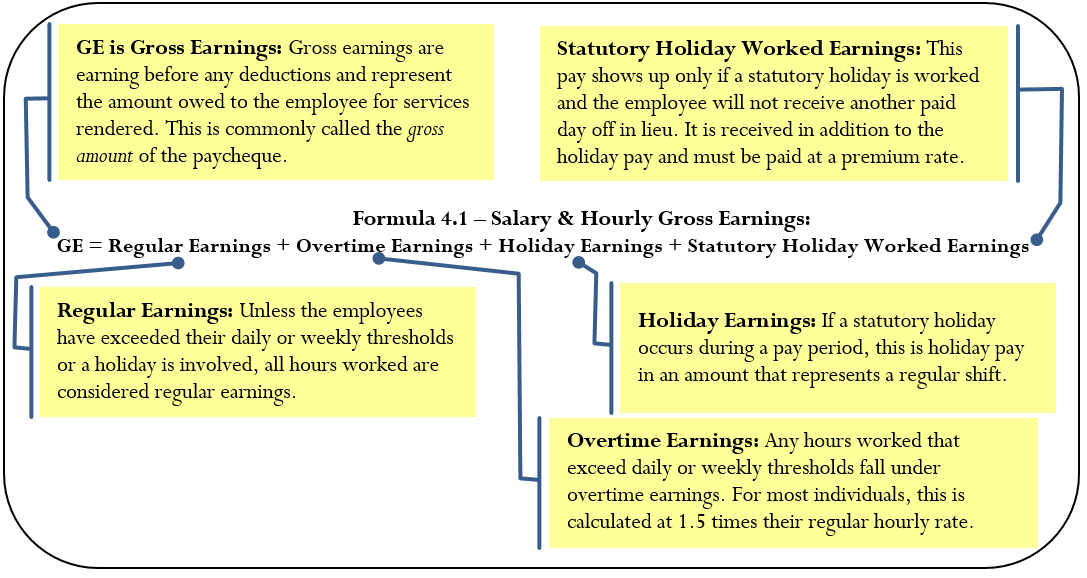

The Formula

The four forms of compensation consist of regular earnings, overtime earnings, holiday earnings, and statutory holiday worked earnings. Add these four elements together to determine total gross earnings. Formula 4.1 shows the relationship.

Gross Earnings

How It Works

Salaried Employees

To calculate the total gross earnings for a salaried employee, follow these steps:

Step 1: Analyze the employee’s work performed and assign hours as needed into each of the four categories of pay. If the employee has only regular hours of pay, skip to step 6.

Step 2: Calculate the employee’s equivalent hourly rate of pay. This means converting the salary into an equivalent hourly rate:

![]()

For example, use a $2,000 monthly salary requiring 40 hours of work per week. Express the salary annually by multiplying it by 12 months, yielding $24,000. Express the 40 hours per week annually by multiplying by 52 weeks per year, yielding 2,080 hours worked. The equivalent hourly rate is $24,000 ÷ 2,080 = $11.538461.

Step 3: Calculate any holiday earnings. Take the unrounded hourly rate and multiply it by the number of hours in a regular shift, or

Holiday Earnings = Unrounded Hourly Rate × Hours in a Regular Shift

A salaried employee earning $11.538461 per hour having a daily eight-hour shift receives $11.538461 × 8 = $92.31 in holiday earnings.

Step 4: Calculate any overtime earnings.

- Determine the overtime hourly rate of pay by multiplying the unrounded hourly rate by the minimum standard overtime factor of 1.5 (this could be higher if the company pays a better overtime rate than this):

Overtime Hourly Rate = Unrounded Hourly Rate × 1.5

- Round the final result to two decimals. For the salaried worker, $11.538461 × 1.5 = $17.31 per overtime hour.

- Multiply the overtime hourly rate by the overtime hours worked.

Step 5: Calculate any statutory holiday worked earnings which is similar to calculating overtime earnings:

Statutory Holiday Worked Earnings = Statutory Hourly Rate × Statutory Hours Worked

The statutory hourly rate is at minimum 1.5 times the unrounded hourly rate of pay. The salaried employee working eight hours on a statutory holiday receives $17.31 × 8 = $138.48.

Step 6: Calculate the gross earnings paid at the regular rate of pay. Take the amount of the salary and divide it by the number of pay periods involved, then subtract any holiday earnings:

![]()

You need to calculate the number of pay periods based on the regular earnings structure. For example, an annual $52,000 salary paid biweekly would have 26 pay periods annually. Therefore, a regular paycheque is $52,000 ÷ 26 = $2,000 per paycheque. As another example, a $2,000 monthly salary paid semi-monthly has two pay periods in a single month, resulting in regular earnings of $2,000 ÷ 2 = $1,000 per paycheque. If a holiday is involved in the pay period, you must deduct the holiday earnings from these amounts.

Step 7: Calculate the total gross earnings by applying Formula 4.1.

Hourly Employees

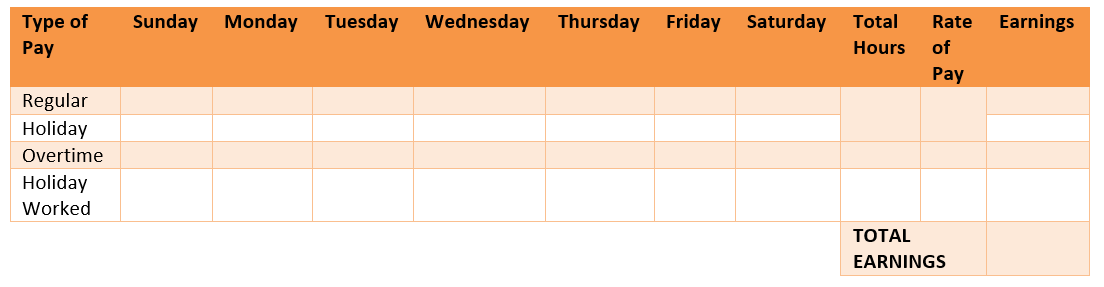

To calculate the total gross earnings for an hourly employee, follow steps similar to those for the salaried employee:

Step 1: Analyze the employee’s work performed and assign hours as needed into each of the four categories of pay. It is usually best to set up a table similar to the one below. This table allows you to visualize the employee’s week at a glance along with totals, enabling proper assessment of their hours worked.

This table separates the four types of earnings into different rows. Enter the information into the table about the employee’s workweek, placing it in the correct day and on the correct row. If any daily thresholds are exceeded, place the appropriate hours into the overtime row. Once you have completed this, total the regular hours and holiday hours for the week and check to see if they exceed any regular weekly threshold. If so, starting with the last workday of the week and working backwards, convert regular hours into overtime hours until you have reduced the regular hours to the regular weekly total.

Once you have completed the table, if the employee has only regular hours of pay, skip to step 5. Otherwise, proceed with the next step.

Step 2: Calculate any holiday earnings. Take the hourly rate and multiply it by the number of hours in a regular shift:

Holiday Earnings = Hourly Rate × Hours in a Regular Shift

Step 3: Calculate any overtime earnings.

- Determine the overtime hourly rate of pay rounded to two decimals by multiplying the hourly rate by the minimum standard overtime factor of 1.5 (or higher).

Overtime Hourly Rate = Hourly Rate × 1.5

- Multiply the overtime hourly rate by the overtime hours worked.

Step 4: Calculate any statutory holiday worked earnings. This is the same procedure as for a salaried employee.

Step 5: Calculate the gross earnings paid at the regular rate of pay. Take the number of hours worked and multiply it by the hourly rate of pay:

Regular Earnings = Hours Worked × Hourly Rate

For example, 20 hours worked at $10 per hour with no holiday earnings is 20 × $10 = $200.

Step 6: Calculate the total gross earnings by applying Formula 4.1.

Things To Watch Out For

Be careful about the language of the payment frequency. It is very common to confuse semi and bi, and sometimes businesses use the terms incorrectly. The term semi generally means half. Therefore, to be paid semi-monthly means to be paid every half month. The term bi means two. Therefore, to be paid biweekly means to be paid every two weeks. Some companies that pay semi-monthly mistakenly state that they pay bimonthly, which in fact would mean they paid every two months.

Paths To Success

In calculating the pay for a salaried employee, this textbook assumes for simplicity that a year has exactly 52 weeks. In reality, there are 52 weeks plus one day in any given year. In a leap year, there are 52 weeks plus two days. This extra day or two has no impact on semi-monthly or monthly pay, since there are always 24 semi-months and 12 months in every year. However, weekly and biweekly earners are impacted as follows:

- If employees are paid weekly, approximately once every six years there are 53 pay periods in a single year. This would “reduce” the employees’ weekly paycheque in that year. For example, assume they earn $52,000 per year paid weekly. Normally, they are paid $52,000 ÷ 52 = $1,000 per week. However, since there are 53 pay periods approximately every sixth year, this results in $52,000 ÷ 53 = $981.13 per week for that year.

- If employees are paid biweekly, approximately once every 12 years there are 27 pay periods in a single year. This has the same effect as the extra pay period above. For example, if they are paid $52,000 per year biweekly they normally receive $52,000 ÷ 26 = $2,000 per biweekly cheque. Approximately every twelfth year, they are paid $52,000 ÷ 27 = $1,925.93 per biweekly cheque for that year.

Many employers ignore these technical nuances in pay structure since the extra costs incurred to modify payroll combined with the effort required to calm down employees who don’t understand the smaller paycheque are not worth the savings in labour. Therefore, most employers treat every year as if it has 52 weeks (26 biweeks) regardless of the reality. In essence, employees receive a bonus paycheque approximately once every six or twelve years!

Give It Some Thought

A salaried employee whose normal workweek is 8 hours per day and 40 hours per week works 8 hours each day from Monday to Saturday inclusive, where Monday was a statutory holiday. Which of the following statements is correct (assuming she will not get another day off in lieu of the holiday)?

- The employee receives only her regular weekly earnings for 40 hours.

- The employee receives 32 hours of regular earnings, 8 hours of holiday earnings, 8 hours of overtime earnings, and 8 hours of statutory holiday worked earnings.

- The employee receives 40 hours of regular earnings, 8 hours of overtime earnings, and 8 hours of statutory holiday worked earnings.

- The employee receives 40 hours of regular earnings and 8 hours of overtime earnings.

Solutions:

The correct answer is b. When working on the statutory holiday and not getting another day off in lieu, the salaried employee is eligible for eight hours of holiday earnings plus eight hours of statutory holiday worked earnings. The holiday earnings count toward the weekly total, but not the statutory holiday worked earnings. Thus the employee from Tuesday to Friday inclusive worked an additional 32 regular hours, bringing her weekly total to 40 hours. The work on Saturday exceeds her 40 hour workweek, and therefore all eight hours are paid as overtime earnings.

Example 3.1 A: Salary with Overtime and a Holiday

|

Tristan is compensated with an annual salary of $65,000 paid biweekly. His regular workweek consists of four 10-hour days, and he is eligible for overtime at 1.5 times pay for any work in excess of his regular requirements. Tristan worked regular hours for the first two weeks. Over the next two weeks, Tristan worked his regular hours and became eligible for 11 hours of overtime. During these two weeks, he worked his regular shift on Good Friday but his employer has agreed to give him another day off with pay in the future. a. Determine Tristan’s gross earnings for the first two-week pay period. |

||||||||||||||||||||||

|

You have been asked to calculate Tristan’s gross earnings, or GE, for two consecutive pay periods. |

||||||||||||||||||||||

|

What You Already Know Step 1: You know Tristan’s compensation: Annual Salary = $65,000 You also know his work schedule: First Two Weeks = regular pay There is a holiday in the second two weeks, but he will receive another day off in lieu. |

How You Will Get There For each biweekly pay period, apply the following steps: Step 2: Calculate Tristan’s equivalent hourly rate of pay. Step 3: Calculate holiday earnings using the equivalent hourly rate. Step 4: Calculate overtime earnings by taking the overtime hourly pay rate multiplied by hours worked. Step 5: Calculate statutory holiday worked earnings at the premium rate of pay. Step 6: Calculate regular earnings: Step 7: Determine total gross earnings using Formula 4.1. |

|||||||||||||||||||||

|

||||||||||||||||||||||

|

For the first two-week pay period, Tristan worked only his regular hours and therefore is compensated $2,500 as per his salary. For the second two-week pay period, Tristan is eligible to receive his regular hours plus his overtime, but he receives no additional pay for the worked holiday since he will receive another day off in lieu. His total gross earnings are $3,015.68. |

||||||||||||||||||||||

Example 3.1 B: A Week in the Life of an Hourly Wage Earner

|

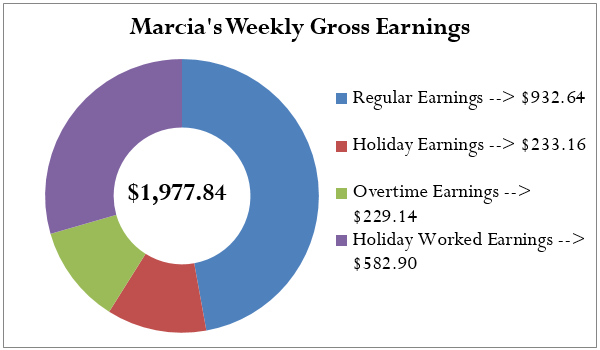

Marcia receives an hourly wage of $32.16 working on an automotive production line. Her union has negotiated a regular work day of 7.25 hours for five days totalling 36.25 hours for the week. Overtime is paid at 1.5 times her regular rate for any work that exceeds the daily or weekly limits. If work is required on a statutory holiday, her company does not give a day off in lieu and pays a premium rate of 2.5 times her regular rate. Last week, Marcia worked nine hours on Monday, her regular hours on Tuesday through Friday inclusive, and three hours on Saturday. Friday was a statutory holiday. Calculate Marcia’s gross earnings for the week. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

You need to calculate Marcia’s gross earnings, or GE, for the week. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

What You Already Know Step 1: You know Marcia’s pay structure and workweek: Regular Hourly Rate = $32.16 Overtime Hourly Pay = 1.5 times Statutory Holiday Worked Rate = 2.5 times Exceeding 7.25 hours daily or 36.25 hours weekly is overtime.

|

How You Will Get There Step 1 (continued): Take Marcia’s hours and place them into the table. Assess whether any daily or weekly totals are considered overtime and make any necessary adjustments. Step 2: Calculate holiday earnings using the hourly rate. Step 3: Calculate overtime earnings by determining the overtime hourly rate of pay multiplied by hours worked. Step 4: Calculate statutory holiday worked earnings at the premium rate of pay. Step 5: Calculate regular earnings. Step 6: Determine total gross earnings. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Step 1:

1 She worked nine hours. Therefore, the first 7.25 hours are regular pay and the last 1.75 are overtime pay. 2 Friday was a statutory holiday, and she will not receive another day off in lieu. She must receive statutory holiday worked pay in addition to her hours worked. 3 Note the weekly total of 36.25 has been exceeded by three hours. Move Saturday’s hours into overtime. The following table is the final layout of her workweek:

Steps 2-6: Explanations are noted in the table below.

1 Holiday Earnings = 2 Overtime Hourly Rate = 3 Statutory Holiday Worked Rate = 4 Regular Earnings = 5 GE = |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Marcia will receive total gross earnings of $1,977.84 for the week.

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Commission

Over the last two weeks you sold $50,000 worth of machinery as a sales representative for IKON Office Solutions Canada. IKON’s compensation plan involves a straight commission rate of 3.5%. What are your gross earnings? If you sold an additional $12,000 in machinery, how much more would you earn?

Particularly in the fields of marketing and customer service, many workers are paid on a commission basis. A commission is an amount or a fee paid to an employee for performing or completing some form of transaction. The commission typically takes the form of a percentage of the dollar amount of the transaction. Marketing and customer service industries use this form of compensation as an incentive to perform: If the representative doesn’t sell anything then the representative does not get paid. Issues to be discussed about commission include what constitutes regular earnings, how to handle holidays and overtime, and the three different types of commission structures.

- Regular Earnings. All commissions are considered to be regular earnings. To calculate the gross earnings for an employee, take the total amount of the transactions and multiply it by the commission rate:

Gross Earnings = Total Transaction Amount × Commission Rate

This is not a new formula. It is a specific application of Formula 2.2: Rate, Portion, Base. In this case, the Base is the total amount of the transactions, the Rate is the commission rate, and the Portion is the gross earnings for the employee.

- Holidays and Overtime. Commission earners are eligible to receive overtime earnings, holiday earnings, and statutory holiday worked earnings. However, the provincial standards on these matters vary widely and the mathematics involved do not necessarily follow any one procedure or calculation. As such, this textbook leaves these issues to be covered in a payroll administration course.

- Types of Commission. Commission earnings typically follow one of the following three structures:

- Straight Commission. If your entire earnings are based on your dollar transactions and calculated strictly as a percentage of the total, you are on straight commission. An application of Formula 2.2 (Rate, Portion, Base) calculates your gross earnings under this structure.

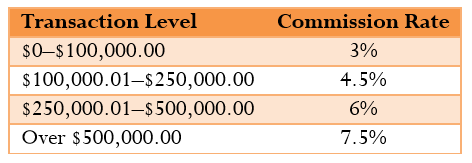

- Graduated Commission. Within a graduated commission structure, you are offered increasing rates of commission for higher levels of performance. The theory behind this method of compensation is that the higher rewards motivate employees to perform better. An example of a graduated commission scale is found in the table below.

Recognize that the commission rates are applied against the portion of the sales falling strictly into the particular category, not the entire balance. Thus, if the total sales equal $150,000, then the first $100,000 is paid at 3% while the next $50,000 is paid at 4.5%.

- Salary Plus Commission. If your earnings combine a basic salary together with commissions on your dollar transactions, you have a salary plus commission structure. No new mathematics are required for this commission type. You must combine salary calculations, discussed earlier in this section, with either a straight commission or graduated commission, as discussed above. Usually this form of compensation pays the lowest commission rate since a basic salary is already provided.

How It Works

Follow these steps to calculate commission earnings:

Step 1: Determine which commission structure is used to pay the employee. Identify information on commission rates, graduated scales, and any salary.

Step 2: Determine the dollar amounts that are eligible for any particular commission rate and calculate commissions.

Step 3: Sum all earnings from every eligible commission rate plus any salary.

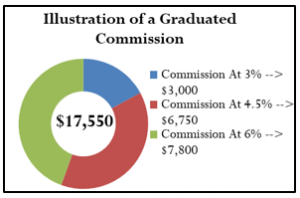

Let’s assume $380,000 of merchandise is sold. Using the previous table as our graduated commission scale, calculate commission earnings.

Step 1: Sales total $380,000 and all commission rates and scales are found in the table.

Step 2: The first $100,000 is compensated at 3%, equalling $3,000. The next $150,000 is compensated at 4.5%, equalling $6,750. The last $130,000 is compensated at 6%, equalling $7,800. There is no compensation at the 7.5% level since sales did not exceed $500,000.

Step 3: The total commission on sales of $380,000 is $3,000 + $6,750 + $7,800 = $17,550.

Example 3.1 C: Different Types of Commissions

|

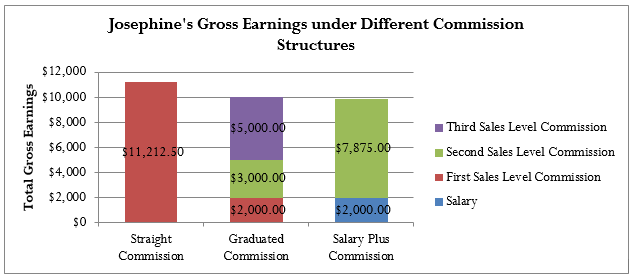

Josephine is a sales representative for Kraft Foods Canada. Over the past two weeks, she closed $325,000 in retail distribution contracts. Calculate the total gross earnings that Josephine earns if a. She is paid a straight commission of 3.45%. |

|||||||||||||||||||||||||||||

|

You need to calculate the gross earnings, or GE, for Josephine under various commission structures. |

|||||||||||||||||||||||||||||

|

What You Already Know Step 1: For all three option, total sales = $325,000 a. This is a straight commission where the commission rate = 3.45%.

c. This is a salary plus graduated commission, with salary = $2,000 and graduated commission structure as follows:

|

How You Will Get There Step 2: Determine the sales eligible for each commission and calculate total commissions. Note that all calculations are Step 3: Sum all commissions plus any salary to calculate total gross earnings. |

||||||||||||||||||||||||||||

|

Steps 2 & 3: a. b.

Total Gross Earnings = $2,000 + $3,000 + $5,000 = $10,000 c. Recall Base Salary = $2,000

Total Gross Earnings = $0 + $7,875 + $2,000 = $9,875 |

|||||||||||||||||||||||||||||

|

If Josephine is paid under straight commission, her total gross earnings will be $11,212.50. Under the graduated commission, she will receive $10,000 in total gross earnings. For the salary plus commission, she will receive $9,875 in total gross earnings.

|

|||||||||||||||||||||||||||||

Piecework

Have you ever heard the phrase “pay-for-performance”? Although this phrase has many interpretations in different industries, for some people this phrase means that they get paid based on the quantity of work that they do. For example, many workers in clothing manufacturing are paid a flat rate for each article of clothing they produce. As another example, employees in fruit orchards may get paid by the number of pieces of fruit that they harvest, or simply by the kilogram. As you can see, these workers are neither salaried nor paid hourly, nor are they on commission. They earn their paycheque for performing a specific task. Therefore, a piecework wage compensates such employees on a per-unit basis.

This section focuses on the regular earnings only for piecework wage earners. Similar to workers on commission, piecework earners are eligible to receive overtime earnings, holiday earnings, and statutory holiday worked earnings. However, the standards vary widely from province to province, and there is not necessarily any one formula to calculate these earnings. As with commissions, this textbook leaves those calculations for a payroll administration course.

The Formula

To calculate the regular gross earnings for a worker paid on a piecework wage, you require the piecework rate and how many units they are to be paid for:

Gross Earnings = Piecework Rate × Eligible Units

This is not a new formula but another application of Formula 2.2 (Rate, Portion, Base). The Piecework Rate is the Rate, the Eligible Units are the Base, and the Gross Earnings are the Portion.

How It Works

To calculate an employee’s gross earnings for piecework, follow these steps:

Step 1: Identify the piecework rate and the level of production or units.

Step 2: Perform any necessary modifications on the production or units to match how the piecework is paid.

Step 3: Calculate the commission gross earnings by multiplying the rate by the eligible units.

Assume that Juanita is a piecework earner at a blue jean manufacturer. She is paid daily and earns $1.25 for every pair of jeans that she sews. On a given day, Juanita sewed 93 pairs of jeans. Her gross earnings are calculated as follows:

Step 1: Her piecework rate = $1.25 per pair with production of 93 units.

Step 2: The rate and production are both expressed by the pair of jeans. No modification is necessary.

Step 3: Her gross piecework earnings are the product of the rate and units produced, or $1.25 × 93 = $116.25.

Things To Watch Out For

Pay careful attention to step 2 in the procedure. In some industries, the piecework rate and the units of production do not match. For example, a company could pay a piecework rate per kilogram, but a single unit may not represent a kilogram. This is typical in some canning industries, where workers are paid per kilogram for canning the products, but the cans may only be 200 grams in size. Therefore, if workers produce five cans, they are not paid for five units produced. Rather, they are paid for only one unit produced since five cans × 200 g = 1,000 g = 1 kg. Before calculating piecework earnings, ensure that both the piecework rate and the eligible units are in the same terms, whether it be metric tonnes, kilograms, or otherwise.

Example 3.1 D: A Telemarketer Earning Piecework Wages

|

In outbound telemarketing, some telemarketers are paid on the basis of “completed calls.” This is not commission since their pay is not based on actually selling anything. Rather, a completed call is defined as simply any phone call for which the agent speaks with the customer and a decision is reached, regardless of whether the decision was to accept, reject, or request further information. If a telemarketer produces five completed calls per hour and works 7½-hour shifts five times per week, what are the total gross earnings she can earn over a biweekly pay period if her piecework wage is $3.25 per completed call? |

|

|

We are looking for the total gross earnings, or GE, for the telemarketer over the biweekly pay period. |

|

|

What You Already Know Step 1: The frequency of the telemarketer’s pay, along with her hours of work, piecework wage, and unit of production are known: Piecework Rate = $3.25 per completed call Hourly Units Produced = 5 Hours of Work = 7½ hours per day, five days per week Frequency of Pay = biweekly |

How You Will Get There Step 2: You must determine the telemarketer’s production level. Calculate how many completed calls she achieves per biweekly pay period: Eligible Units = Units Produced per Hour × Hours per Day × Days per Week × Weeks Step 3: Apply Formula 2.2 (adapted for piecework wages) to get the portion owing. |

|

Step 2: Eligible Units = Step 3: GE = |

|

|

Over a biweekly period, the telemarketer completes 375 calls. At her piecework wage, this results in total gross earnings of $1,218.75. |

|

Exercises

Mechanics

- Laars earns an annual salary of $60,000. Determine his gross earnings per pay period under each of the following payment frequencies:

a. Monthly b. Semi-monthly c. Biweekly d. Weekly - A worker earning $13.66 per hour works 47 hours in the first week and 42 hours in the second week. What are his total biweekly earnings if his regular workweek is 40 hours and all overtime is paid at 1.5 times his regular hourly rate?

- Marley is an independent sales agent. He receives a straight commission of 15% on all sales from his suppliers. If Marley averages semi-monthly sales of $16,000, what are his total annual gross earnings?

- Sheila is a life insurance agent. Her company pays her based on the annual premiums of the customers that purchase life insurance policies. In the last month, Sheila’s new customers purchased policies worth $35,550 annually. If she receives 10% commission on the first $10,000 of premiums and 20% on the rest, what are her total gross earnings for the month?

- Tuan is a telemarketer who earns $9.00 per hour plus 3.25% on any sales above $1,000 in any given week. If Tuan works 35 regular hours and sells $5,715, what are his gross earnings for the week?

- Adolfo packs fruit in cans on a production line. He is paid a minimum wage of $9.10 per hour and earns $0.09 for every can packed. If Adolfo manages to average 160 cans per hour, what are his total gross earnings daily for an eight-hour shift?

Applications

- Charles earns an annual salary of $72,100 paid biweekly based on a regular workweek of 36.25 hours. His company generously pays all overtime at twice his regular wage. If Charles worked 85.5 hours over the course of two weeks, what are his gross earnings?

- Armin is the payroll administrator for his company. In looking over the payroll, he notices the following workweek (from Sunday to Saturday) for one of the company’s employees: 0, 6, 8, 10, 9, 8, and 9 hours, respectively. Monday was a statutory holiday, and with business booming the employee will not be given another day off in lieu. Company policy pays all overtime at time-and-a-half, and all hours worked on a statutory holiday are paid at twice the regular rate. A normal workweek consists of five, eight-hour days. If the employee receives $22.20 per hour, what are her total weekly gross earnings?

- In order to motivate a manufacturer’s agent to increase his sales, a manufacturer offers monthly commissions of 1.2% on the first $125,000, 1.6% on the next $150,000, 2.25% on the next $125,000, and 3.75% on anything above. If the agent managed to sell $732,000 in a single month, what commission is he owed?

- Humphrey and Charlotte are both sales representatives for a pharmaceutical company. In a single month, Humphrey received $5,545 in total gross earnings while Charlotte received $6,388 in total gross earnings. In sales dollars, how much more did Charlotte sell if they both received 5% straight commission on their sales?

- Mayabel is a cherry picker working in the Okanagan Valley. She can pick 17 kg of cherries every hour. The cherries are placed in pails that can hold 13.6 kg of cherries. If she works 40 hours in a single week, what are her total gross earnings if her piecework rate is $17.00 per pail?

- Miranda is considering three relatively equal job offers and wants to pick the one with the highest gross earnings. The first job is offering a base salary of $1,200 semi-monthly plus 2% commission on monthly sales. The second job offer consists of a 9.75% straight commission. Her final job offer consists of monthly salary of $1,620 plus 2.25% commission on her first $10,000 in monthly sales and 6% on any monthly sales above that amount. From industry publications, she knows that a typical worker can sell $35,000 per month. Which job offer should she choose, and how much better is it than the other job offers?

- A Canadian travel agent is paid a flat rate of $37.50 for every vacation booked through a certain airline. If the vacation is in North America, the agent also receives a commission of 2.45%. If the vacation is international, the commission is 4.68%. What are the total monthly gross earnings for the agent if she booked 29 North American vacations worth $53,125 and 17 international vacations worth $61,460?

- Vladimir’s employer has just been purchased by another organization. In the past, he has earned $17.90 per hour and had a normal workweek of 37.5 hours. However, his new company only pays its employees a salary semi-monthly. How much does Vladimir need to earn each paycheque to be in the same financial position?

Challenge, Critical Thinking, & Other Applications

- An employee on salary just received his biweekly paycheque in the amount of $1,832.05, which included pay for five hours of overtime at time-and-a-half. If a normal workweek is 40 hours, what is the employee’s annual salary?

- A graduated commission scale pays 1.5% on the first $50,000, 2.5% on the next $75,000, and 3.5% on anything above. What level of sales would it take for an employee to receive total gross earnings of $4,130?

- A sales organization pays a base commission on the first $75,000 in sales, base + 2% on the next $75,000 in sales, and base + 4% on anything above. What is the base commission if an employee received total gross earnings of $7,500 on $200,000 in sales?

- A typical sales agent for a company has annual sales of $4,560,000, equally spread throughout the year, and receives a straight commission of 2%. As the new human resource specialist, to improve employee morale you have been assigned the task of developing different pay options of equivalent value to offer to the employees. Your first option is to pay them a base salary of $2,000 per month plus commission. Your second option is to pay a base commission monthly on their first $100,000 in sales, and a base + 2.01% on anything over $200,000 per month. In order to equate all the plans, determine the required commission rates, rounded to two decimals in percent format, in both options.

- Shaquille earns an annual salary of $28,840.50 paid biweekly. His normal workweek is 36.25 hours and overtime is paid at twice the regular rate. In addition, he is paid a commission of 3% of sales on the first $25,000 and 4% on sales above that amount. What are his total gross earnings during a pay period if he worked 86 hours and had sales of $51,750?

- Mandy is paid $9.50 per hour and also receives a piecework wage of $0.30 per kilogram, or portion thereof. A regular workday is 7.5 hours and 37.5 hours per week. Overtime is paid at time-and-a-half, and any work on a statutory holiday is paid at twice the regular rate. There is no premium piecework wage. Mandy’s work record for a two-week period is listed below. Determine her total gross earnings.

| Week | Monday | Tuesday | Wednesday | Thursday | Friday | Saturday | |

| 1 | Hours worked | 7.5 | 7.5 | 9 | 8 | 7.5 | 3 |

| 250 g items produced | 1,100 | 1,075 | 1,225 | 1,150 | 1,025 | 450 | |

| 2 | Hours worked | 4

Statutory holiday, no day off in lieu |

7.5 | 10 | 7.5 | 8 | |

| 250 g items produced | 575 | 1,060 | 1,415 | 1,115 | 1,180 |

3.2 Personal Income Tax

You have just filled out your income tax return, where you see that your total payable for the year is more than $5,000. You are glad you do not have to pay this lump sum all at once! Instead, almost all of it has actually been paid already: Your employer has made regular deductions from each paycheque to cover your federal and provincial taxes.

In Canada, businesses are taxed differently than individuals and there are many nuances and complexities to address. For these reasons, this textbook does not cover business taxes, which require a course in corporate taxes.

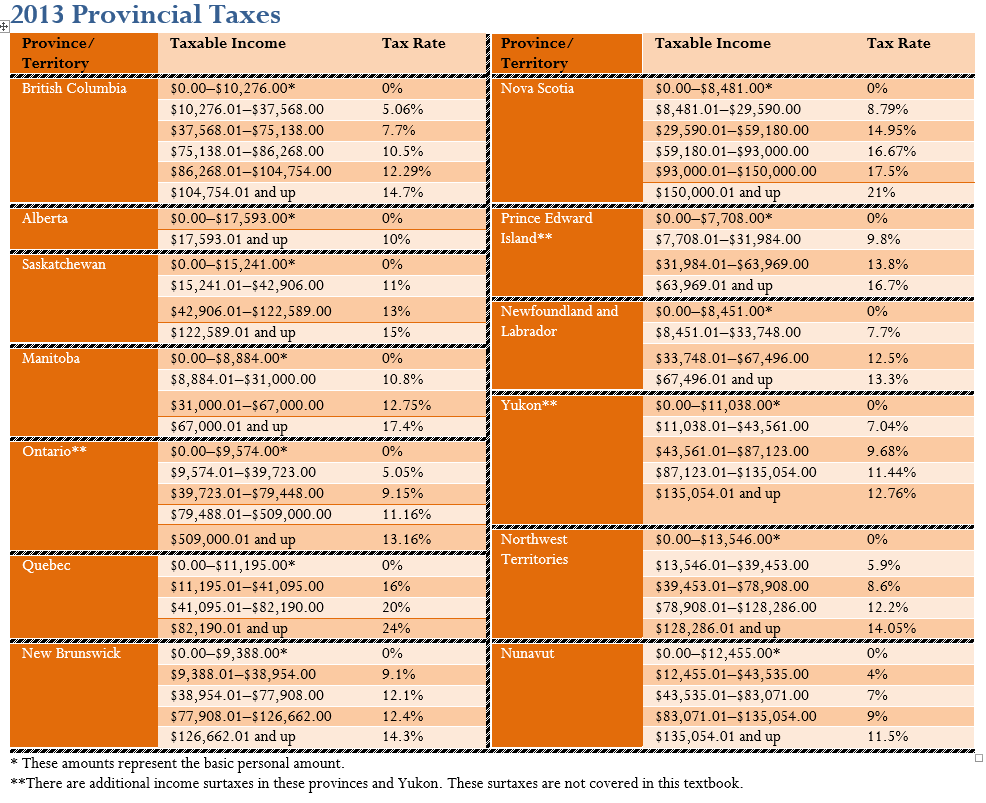

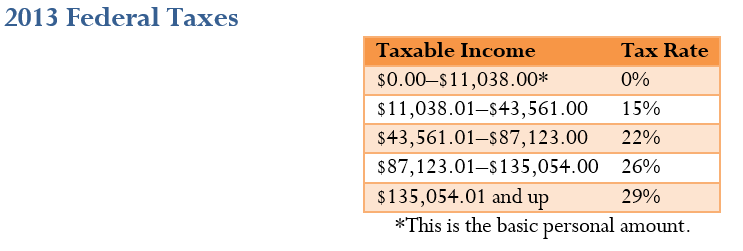

For individuals, taxes are relatively straightforward. This section of the book uses the 2013 tax year federal and provincial/territorial personal income tax brackets to calculate the amount of these taxes that are ultimately deducted from your gross earnings. You can find current-year tax brackets at www.taxtips.ca/marginaltaxrates.htm.

Federal and Provincial/Territorial Tax Brackets and Tax Rates

Personal income tax is a tax on gross earnings levied by both the federal and provincial/territorial governments. All of Canada uses a progressive tax system in which the tax rate increases as the amount of income increases; however, the increased tax rates apply only to income amounts above minimum thresholds. Thus, higher income earners pay higher marginal tax rates than lower income earners. The format is similar to a graduated commission structure.

The federal and provincial/territorial governments offer a basic personal amount, which is the amount of income for which the wage earner is granted a tax exemption. In other words, it is tax-free income. This is designed to help low-income earners in Canada. Tax brackets are adjusted annually federally and in most provinces and territories to reflect increases in the cost of living, as measured by the consumer price index (CPI).

The Formula

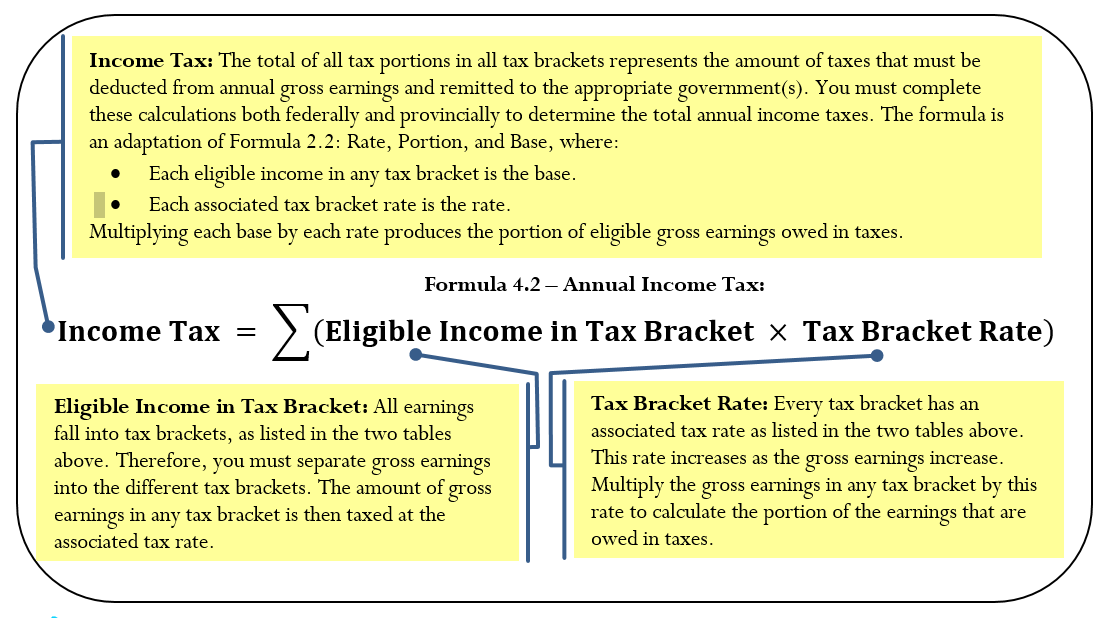

To calculate the income taxes for any individual, you must total all taxes from all eligible gross earnings in every tax bracket. Formula 4.2 shows the calculation.

Annual Income Taxes

How It Works

To calculate the total annual income tax owing in any tax year, follow these steps:

Step 1: Determine the total amount of gross earnings that are taxable for the individual.

Step 2: Calculate the federal income taxes owing. Using the federal tax table, split the gross earnings into each of the listed tax brackets, then calculate the taxes owing in each tax bracket by multiplying the income in the bracket and the tax rate. Round any tax amounts to two decimals.

Step 3: Calculate the provincial/territorial income taxes owing. Repeat the same process as in step 2, but use the appropriate tax brackets from the provincial tax table instead. Round any tax amounts to two decimals.

Step 4: Calculate the total annual income taxes owing by applying Formula 4.2. This means adding all calculated tax amounts from both steps 2 and 3 together.

Assume you live in British Columbia and your taxable gross income is $44,000. Here is how you would calculate your annual total federal and provincial taxes:

Step 1: The gross earnings are $44,000.

Step 2: Federally, your income falls into the first three brackets. Your first $11,038 is taxed at 0%; therefore, there are no income taxes on this amount. The next $32,523 (from $11,038.01 to $43,561.00) is taxed at 15%, thus $32,523 × 15% = $4,878.45. The last $439 (from $43,561.01 to $44,000.00) is taxed at 22%, thus $439 × 22% = $96.58.

Step 3: Provincially, your income falls into the first three brackets for British Columbia. Your first $10,276 is taxed at 0%; therefore, there are no income taxes on this amount. The next $27,292 (from $10,276.01 to $37,568.00) is taxed at 5.06%, thus $27,292 × 5.06% = $1,380.98. The last $6,432 (from $37,568.01 to $44,000) is taxed at 7.7%, thus $6,432 × 7.7% = $495.26.

Step 4: Your total federal income tax is $0.00 + $4,878.45 + $96.58 = $4,975.03. Your total provincial income tax is $0.00 + $1,380.98 + $495.26 = $1,876.24. Applying Formula 4.1, income tax = $4,975.03 + $1,876.24 = $6,851.27, which is the amount that will be deducted from total gross earnings.

Things To Watch Out For

Have you ever heard someone say, “I earn more income and moved to a higher tax bracket, so now I am earning less money and my paycheque is lower”? The progressive tax system used in Canada makes this statement untrue.

Remember that tax rates apply only to the portion of the gross earnings in the tax bracket and are not retroactive to lower levels of income. For example, if your taxable gross income increased from $80,000 to $88,000, your highest tax bracket is now 26% instead of 22%. However, your federal income tax is not calculated at 26% for your entire income. Rather, the first $11,038 is tax free, the next $32,523 is taxed at 15%, the next $43,562 is taxed at 22%, and the final $877 is taxed at 26%.

Paths To Success

It is sometimes beneficial to pre-calculate the total income taxes in any tax bracket under the assumption that the individual’s income comprises the entire tax bracket. This technique is particularly useful when repetitive calculations are required, such as determining the federal income taxes for each employee in an entire company. For example, the second federal tax bracket extends from $11,038.01 to $43,561, representing $32,523 of employee income. Since this bracket is taxed at 15%, someone who earns a higher income always owes the full amount of tax in this category, which is $32,523 × 15% = $4,878.45. The next tax bracket covers $43,561.01 to $87,123, representing $43,562 of income. Someone earning a higher income always owes the full amount of tax in this category, which is $43,562 × 22% = $9,583.64.

Assume taxable gross earnings of $88,000. With your pre-calculated income taxes in each bracket, you know the income taxes in the first three tax brackets are $0, $4,878.45, and $9,583.64, or $14,462.09 in total. You only need to calculate the tax on the portion of income in the final tax bracket of $877 × 26% = $228.02. The grand total is $14,462.09 + $228.02 = $14,690.11.

Example 3.2 A: Federal and Provincial Income Taxes

|

A Canadian wage earner has taxable gross income of $97,250. Calculate the federal and provincial annual income taxes individually and then sum the amounts to calculate the total annual income taxes if the wage earner lives in a. Ontario |

||||||||||

|

For each of the provinces, you need to calculate the individual’s total federal income tax and total provincial income tax. Then sum these amounts to arrive at the annual income tax. |

||||||||||

|

What You Already Know Step 1: The employee’s gross taxable earnings are $97,250. From the tax tables, you also know the federal and provincial income tax brackets and corresponding tax rates. |

How You Will Get There Step 2: Calculate the federal income tax. This amount is the same in all three provinces and needs to be calculated only once. Looking at the federal tax table, you see that this wage earner falls into the first four tax brackets, which requires the sum of the income tax calculations for each bracket. Step 3: Calculate the provincial income tax. Using the provincial tax table, the income spans all four of Ontario’s tax brackets. In New Brunswick, the individual falls into the first four tax brackets. In Alberta, the individual spans both of Alberta’s tax brackets. In all three provinces, the total provincial income is the sum of the income tax calculations for each bracket. Step 4: Calculate total annual income taxes using Formula 4.2. |

|||||||||

|

Step 2:

Total federal income tax = $0.00 + $4,878.45 + $9,583.64 + $2,633.02 = $17,095.11

Step 3:

Step 4: Total income tax if living in Ontario = $17,095.11 + $7,144.06 = $24,239.17 Total income tax if living in New Brunswick = $17,095.11 + $9,802.35 = $26,897.46 Total income tax if living in Alberta = $17,095.11 + $7,965.70 = $25,060.81 |

||||||||||

|

For an individual earning $97,250 in taxable gross income, the person will pay $24,239.17 in total income tax if living in Ontario, $26,897.46 total income tax if living in New Brunswick, and $25,060.81 if living in Alberta. |

||||||||||

Exercises

Use the provincial and federal tax tables introduced earlier in this chapter when you determine income taxes in these exercises.

Mechanics

For questions 1–3, determine only the federal income taxes on the following gross taxable incomes.

- $22,375

- $158,914

- $102,100

For questions 4–6, determine only the provincial income taxes on the following gross taxable incomes.

- $61,000 in Newfoundland and Labrador

- $83,345 in Saskatchewan

- $78,775 in British Columbia

For questions 7 and 8, determine the total federal and provincial/territorial taxes on the following gross taxable incomes.

- $48,910 in the Northwest Territories

- $65,525 in Prince Edward Island

Applications

- Nadia lives in Manitoba and has three part-time jobs. Her gross annual taxable income from each job was $5,300, $21,450, and $25,390. How much federal and provincial income tax does Nadia owe?

- If Delaney’s gross taxable income increases from $71,000 to $79,000, by what dollar amount will her after-tax pay change once federal and provincial income taxes are deducted in the province of Quebec?

- Helen just moved from Saskatchewan to her new job in Alberta at the same rate of pay of $51,225. By what dollar amount will her provincial income taxes change?

- Jane has received two job offers that she thinks are relatively equal. The only difference lies in the salary. The first job offer is for a position in Nova Scotia earning gross taxable income of $63,375. The second job offer is for a position in British Columbia earning gross taxable income of $61,990. If Jane will select the job that has the highest after-tax income, which one should she choose? How much better is this option in dollars?

- Suppose an employee earns $111,300 in gross taxable income. Calculate the federal and provincial income taxes that need to be deducted if he lives in either Saskatchewan, Ontario, or the Northwest Territories. In which province or territory will he earn the most income after income tax deductions? The least? What is the dollar amount difference among the three alternatives?

- After both federal and provincial income taxes are deducted, who would earn more money, an individual earning $85,000 in New Brunswick or an individual earning $79,000 in Nunavut?

Challenge, Critical Thinking, & Other Applications

- Rawatha is the human resources manager for her firm located in Yukon. The salespeople for her organization are paid an annual base salary of $30,000 plus 8% straight commission on their annual sales. If the average salesperson sells $210,000 annually, what is the total annual federal and provincial income tax owing on the salesperson’s gross taxable income?

- Esmerelda works on the production line and is paid a piecework rate of $2.25 per unit produced. She is capable of producing an average of five units per hour, and works eight hours every weekday. Assuming a 52-week year, what is the annual federal income tax and provincial income tax owing if she lives in Prince Edward Island?

- Mary Jane is paid biweekly at a rate of $34.68 per hour and works 36.25 hours every week. Assuming a 52-week year, what are the amounts of the federal income tax deduction and provincial income tax deduction that must be removed from each paycheque if Mary Jane lives in Manitoba? (Hint: income tax would be deducted equally across all paycheques for the year.)

- Felix was transferred from his head office in Ontario to Alberta. In accepting the transfer, his employer agreed to increase his salary of $88,000 by $7,000. What is the percent change in Felix’s after-tax income?

- If a wage earner paid $2,277.98 in total annual Ontario provincial income taxes, determine his annual gross taxable income.

- Perform a comparison across all territories and provinces of the income earned after both federal and provincial income taxes are deducted for a Canadian who earns $56,738 in gross taxable income. Which province or territory has the highest income after deductions? Which has the lowest? What is the percent difference between the two?

3.3 Indexes

You read in the Financial Post that the S&P/TSX Composite Index is up 12.74 points while the NASDAQ is down 45.98, and you wonder what this means for your investment portfolio. The consumer price index rose 3.1% since last year, and you wonder if the raise your employer offered you keeps pace. You need to understand indexes to make sense of these numbers.

What Is An Index?

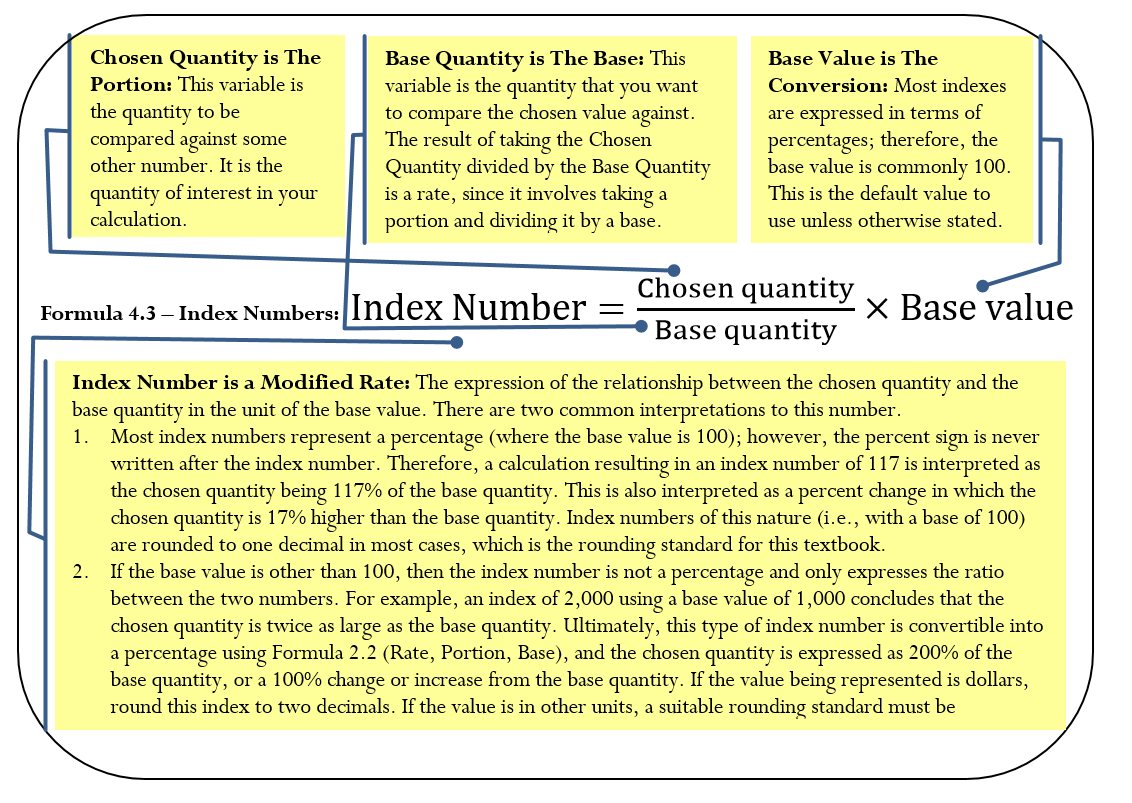

An index is a number used to compare two quantities sharing the same characteristic as measured under different circumstances. Usually, the comparison involves two different points of time. The two quantities are expressed as a rate of one another and are then converted to an index number using a base value (usually 100 or 1,000). The result is called an index number, which expresses the relationship between the two quantities.

The Formula

Index Numbers

How It Works

Follow these steps to calculate an index number:

Step 1: Identify the base and the base value for the index.

Step 2: Identify the value of the chosen quantity to be compared against the base value.

Step 3: Calculate the index number by applying Formula 4.3.

In the above steps, note that in the event that the index number is known and you are solving for a different unknown, identify the known variables in steps 1 and 2. Assume the price of tuition was $3,535.00 in 2009 and $3,978.67 in 2012. The goal is to express the 2012 tuition indexed against the 2009 tuition.

Step 1: The tuition in 2009 is the amount to be compared against; thus, Base Quantity = $3,535. No base value is specified; thus, use the default of Base Value = 100.

Step 2: The 2012 tuition is the quantity for which you wish to compute the index, resulting in Chosen Quantity = $3,978.67.

Step 3: The Index Number ![]() . You can conclude that tuition in 2012 is 112.6% higher than 2009, or that tuition has increased by 12.6% over the three years.

. You can conclude that tuition in 2012 is 112.6% higher than 2009, or that tuition has increased by 12.6% over the three years.

Example 3.3 A: Indexing the Price of Gold

|

In January 2000, the average price of gold per troy ounce was $284.32 (in US dollars). In May 2011, the average price of gold was $1,494.89. Express the gold price in 2011 indexed against the gold price in 2000. |

|

|

You need to calculate an index number that compares the 2011 gold price against the 2000 gold price. |

|

|

What You Already Know Step 1: Base Quantity = 2000 Step 2: Chosen Quantity = 2011 price = $1,494.89 |

How You Will Get There Step 3: Apply Formula 4.3. |

|

Step 3: Index Number = |

|

|

The May 2011 gold price has an index number of 525.8 when compared to the January 2000 price. This means that the price of gold has increased by 425.8% over the approximate 11-year period. |

|

Specialty Indexes

While indexes can be created for any comparison of two quantities, two specialized indexes are widely used across the business and financial sectors of Canada: the consumer price index and the S&P/TSX Composite Index.

Consumer Price Index

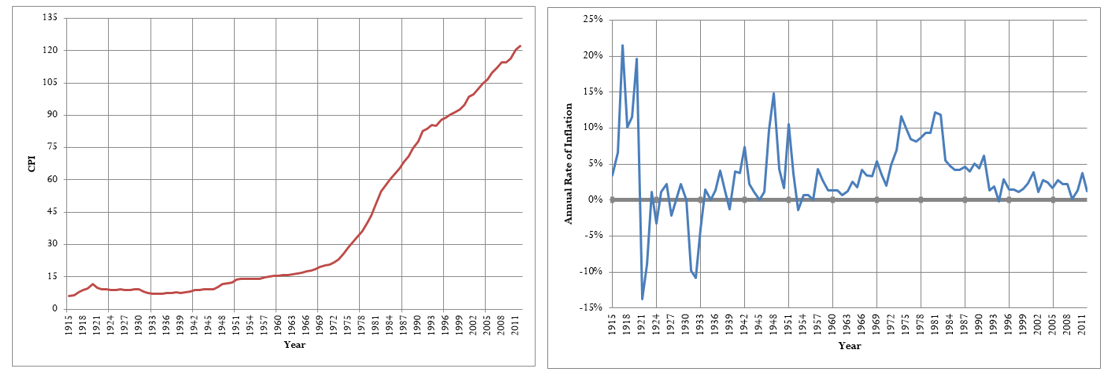

One of the most closely watched price indexes in Canada is the consumer price index, or CPI. Historical values for this index (base year = 2002) are illustrated the graph on the left while the historical rates of inflation (1915-2012) are depicted in the graph on the right.[1]

[1] Values determined from Bank of Canada “Inflation Calculator” (all index values measured in May of each year). www.bankofcanada.ca/rates/related/inflation-calculator/?page_moved=1 (accessed November 26, 2012).

The CPI, calculated by Statistics Canada on a monthly basis, is used as a measure for estimating the rate of inflation or the cost of living (notice the slope of the CPI line increases or decreases in accordance with the change in the rate of inflation). The CPI measures the average price of the goods and services that a typical Canadian household commonly purchases, which is called the market basket. This basket contains about 600 items in categories such as food, housing, transportation, furniture, recreation, and clothing. The CPI is used for many purposes, such as increases in wages, pensions, salaries, prices, the Canada Pension Plan (CPP), and Old Age Security (OAS).

In the section opener, you need to know the CPI in discussing your raise with your employer. Since the CPI reflects the changing cost of living, you must ensure that any raise your employer offers covers, at the barest minimum, the increased costs of living. For example, if the CPI increased from 114.3 to 116.5 over the year, reflecting a 1.78% rate of inflation, then your raise needs to be at least 1.78% to keep you in the same financial position as last year.

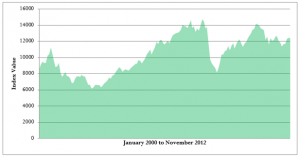

S&P/TSX Composite Index

Another index reported daily and nationally across Canada is the Standard & Poor’s/Toronto Stock Exchange Composite Index, or S&P/TSX Composite Index. This index captures the equity prices of approximately 200 of Canada’s largest companies on the Toronto Stock Exchange as measured by their market capitalization , representing approximately 70% of the Canadian market capitalization listed on the TSX. The historical values of the index are illustrated on the previous page. The exact number of companies in the index continually changes because of strict requirements on market capitalization, liquidity, and domicile that must be met. The index is a measure of the strength and direction of the economy of Canada. For example, during the 2008 subprime mortgage crisis in the United States, the index retreated from a value of 14,714 to just over 8,123 in a very short time frame (demonstrating the close interconnectedness of Canada’s economy with that of the United States). At this time, the Canadian economy entered its first recession in years.

, representing approximately 70% of the Canadian market capitalization listed on the TSX. The historical values of the index are illustrated on the previous page. The exact number of companies in the index continually changes because of strict requirements on market capitalization, liquidity, and domicile that must be met. The index is a measure of the strength and direction of the economy of Canada. For example, during the 2008 subprime mortgage crisis in the United States, the index retreated from a value of 14,714 to just over 8,123 in a very short time frame (demonstrating the close interconnectedness of Canada’s economy with that of the United States). At this time, the Canadian economy entered its first recession in years.

In the section opener, knowing the S&P/TSX Composite Index is invaluable for the meeting with your financial adviser to evaluate the health of your investment portfolio. For example, from May 2010 to May 2011 the index rose approximately 15.7%. If your investment portfolio rose by 9% over the same time frame (which on its own sounds impressive), you know from comparison to the index that your portfolio in fact had a subpar performance.

The Formula

The base year used in CPI calculations is mid-2002, and the base value is 100. The CPI is always rounded to one decimal. The base year used in S&P/TSX calculations is 1975, and the base value is 1,000. The S&P/TSX is always rounded to two decimals. Regardless of which index is being calculated, Formula 4.3 remains unchanged.

Often when you are working with these indexes, you want to compare how quantities have increased or decreased. This requires you to use Formula 3.1 (Percent Change) to calculate percent changes.

How It Works

No new steps or procedures are required when you work with the CPI or the S&P/TSX Composite Index. To calculate the value of an index, apply the index number steps. To calculate the percent change between two index values, apply the percent change steps.

For example, in July 2005 the CPI was 107.1. In March 2011 the CPI was 119.4. How much did the cost of living rise from July 2005 to March 2011? To solve this problem, apply the percent change steps:

Step 1: New = 119.4 and Old = 107.1. You are looking for the Δ%.

Step 2: Substituting into Formula 3.1: Δ% = ![]() You can conclude that the cost of living has risen by 11.4846% over the approximate six-year time frame.

You can conclude that the cost of living has risen by 11.4846% over the approximate six-year time frame.

Important Notes

From time to time, Statistics Canada updates the base period for the CPI and adjusts all CPI numbers accordingly. Previously, the base period was 1992 before being adjusted to 2002. Another update to the base period can probably be expected soon; however, this occurs retroactively since it takes time to recalculate all indexes and gather all of the latest data.

Example 3.3 B: How Much Money Do You Have?

|

If you had invested $15,000 into an S&P/TSX portfolio in 1975, how much money would you have in 2011 when the S&P/TSX Composite Index indicated a value of 13,607.25? |

|

|

You need to determine the amount of money in the portfolio at the current time period of 2011. This amount represents the Chosen Quantity. |

|

|

What You Already Know Step 1: Since the money was invested in the base year (1975), the amount of the investment is the base quantity. Step 2: In this case, seek the Chosen Quantity with a known |

How You Will Get There Step 3: Apply Formula 4.3 and rearrange for Chosen Quantity.

|

|

Step 3:

|

|

|

If you had invested $15,000 in the S&P/TSX Composite Index back in 1975, your investment portfolio is now valued at $204,108.75, representing an increase of 1,260.725%. |

|

Purchasing Power

The consumer price index is applied in determining the purchasing power of a dollar, which is the amount of goods and services that can be exchanged for a dollar. The result of the calculation is a percentage showing how much more or less product is received in return for every dollar spent. For example, recall that my parents could attend a movie for 25¢ in the 1950s. If my parents had lost that quarter under their mattress and found it today, the quarter no longer can purchase admission to the movie (nor much else!). Therefore, the purchasing power of that quarter has drastically declined.

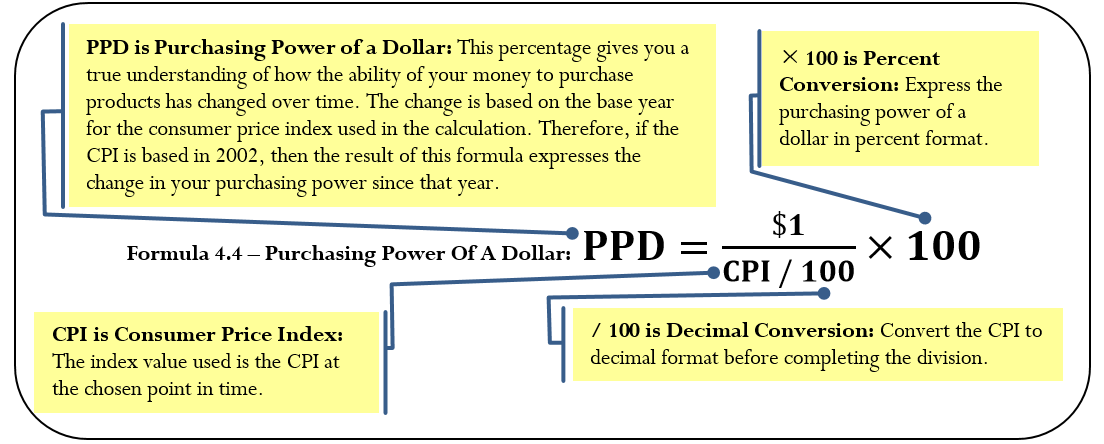

The Formula

Purchasing Power

How It Works

Follow these steps to calculate the purchasing power of a dollar:

Step 1: Choose the point in time to perform the calculation. Identify the value of the CPI at that point in time as well as noting the base year upon which the CPI is determined (so you can properly interpret the calculated amount). Note that in the event that the purchasing power is known and you are solving for a different unknown, you must identify the known variables in this step.

Step 2: Calculate the purchasing power of a dollar by applying Formula 4.4.

Assume the CPI is 111.1 today. How has your purchasing power changed since 2002 (the base year for the CPI)?

Step 1: The CPI = 111.1 and the base year is 2002.

Step 2: Substitute into the formula: PPD = ![]() . Therefore, your purchasing power is 90.009% what it was in 2002. In 2002, if you could buy 10 loaves of bread with your dollar, today you could buy approximately nine loaves of bread with the same amount of money. In other words, your dollar purchases about 10% less product with the same amount of money.

. Therefore, your purchasing power is 90.009% what it was in 2002. In 2002, if you could buy 10 loaves of bread with your dollar, today you could buy approximately nine loaves of bread with the same amount of money. In other words, your dollar purchases about 10% less product with the same amount of money.

Example 3.3 C: How Has Your Purchasing Power Changed?

|

In March 2006, the CPI was 108.6. By March 2011 it had risen to 119.4. As a percent change, how did your purchasing power change over that time frame? |

|||||||||

|

You need to calculate the percent change, or Δ%, between the purchasing power of a dollar (PPD) in 2006 and 2011. |

|||||||||

|

What You Already Know Step 1: 2006 represents your purchasing power of a dollar in the past, and 2011 represents the present.

The current CPI is based in 2002. |

How You Will Get There Step 2: Apply Formula 4.4 to calculate the PPD for both 2006 and 2011. Step 3: Apply Formula 3.1 to calculate the percent change.’ |

||||||||

|

Step 2:

Step 3:

|

Calculator Instructions

|

||||||||

|

From March 2006 to March 2011, your purchasing power declined by 9.0452%. This means that if in March 2006 you were able to buy approximately 92 items with a certain sum of money, in March 2011 you were only able to buy about 83 items with the same amount of money. |

|||||||||

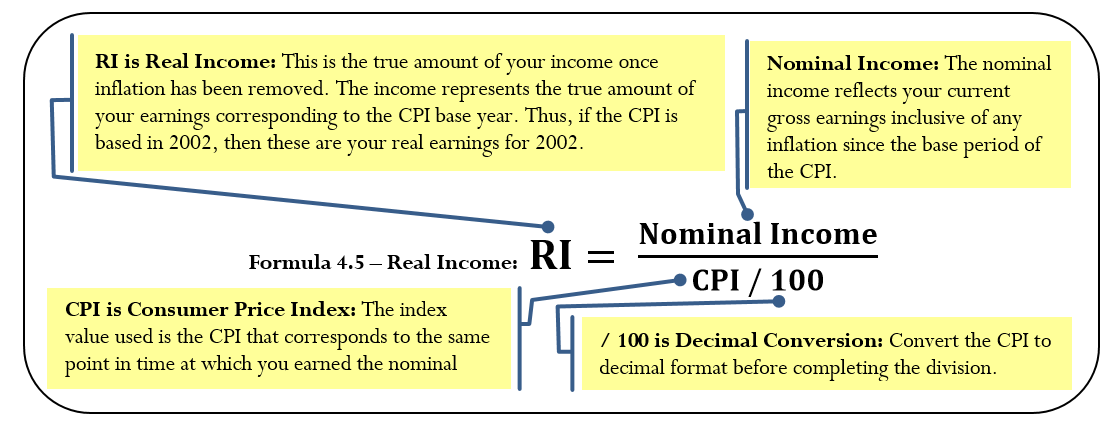

Real Income

Another application of the consumer price index allows you to assess your real earnings. With the cost of living (inflation) always changing, it is difficult to assess how much more or less money you are truly making. Real income allows you to remove the effects of inflation from your income, allowing for a fair comparison of earnings at different points in time. For example, if your gross earnings last year were $50,000 and you received a $1,500 raise this year, how much more are you truly earning if the CPI changed from 114.6 to 116.6 over the same time frame?

The Formula

Real Income

How It Works

Follow these steps to calculate your real income:

Step 1: Identify the nominal income. Determine the CPI value that corresponds to the same time frame as the nominal income and note the base year for interpretation purposes. In the event that the real income is known and you are solving for a different unknown, you must identify the known variables in this step.

Step 2: Calculate the real income by applying Formula 4.5.

Assume your gross earnings were $40,000 when the CPI was 111.7. Currently your income is $42,000 and the CPI is 113.3. Calculate your real income to assess how your income has changed.

Step 1: In this case, you have two nominal incomes to convert for comparison purposes. In the past, nominal income = $40,000 and CPI = 111.7. Currently, nominal income = $42,000 and CPI = 113.3.

Step 2: In the past, RI = ![]() . Currently, RI =

. Currently, RI = ![]() . Comparing the amounts, you see that your real income expressedin 2002 dollars has risen by $37,069.73 − $35,810.21 = $1,259.52. Notice that your nominal income rose by $2,000. This means that of your $2,000 increase in income, you really are only making $1,259.82 more. The other $740.18 represents your increased cost of living.

. Comparing the amounts, you see that your real income expressedin 2002 dollars has risen by $37,069.73 − $35,810.21 = $1,259.52. Notice that your nominal income rose by $2,000. This means that of your $2,000 increase in income, you really are only making $1,259.82 more. The other $740.18 represents your increased cost of living.

Example 3.3 D: Did You Get a Raise?

|

Now that your boss has conducted your performance review, the time has come to discuss your raise. Currently, you earn $81,250 annually. Your boss has offered you a new salary of $83,000 annually. You know last year that the CPI was 104.1 and this year it sits at 106.6. Assess the salary offer. |

|||||

|

To assess the offer, remove inflation from your nominal incomes, allowing for a fair comparison between the two salary amounts. Calculate the real income (RI) for each salary. |

|||||

|

What You Already Know Step 1: You know the following information about your old and new salaries:

Both CPI amounts are based on the year 2002. |

How You Will Get There Step 2: Apply Formula 4.5 to each salary. |

||||

|

Step 2:

|

|||||

|

Although it appears as if you are receiving a $1,750 wage increase, when you factor in the increased cost of living you are actually earning $188.79 less than you did last year. Perhaps you should discuss this matter further with your boss. Since the CPI had a percent change of 2.4015%, your income must rise to at least $83,201.25 for you to break even. |

|||||

Exercises

Mechanics

For questions 1–4, solve for the unknown variables (identified with a ?) based on the information provided. Round index numbers to one decimal and base values to the nearest integer.

| Chosen Quantity ($) | Base Quantity ($) | Base Value | Index Number | |

| 1. | $559.99 | $539.99 | 100 | ? |

| 2. | $315,000.00 | ? | 1,000 | 12,415.9 |

| 3. | $114.30 | $112.50 | ? | 101.6 |

| 4. | ? | $248.75 | 1,000 | 1,548.9 |

For questions 5–9, solve for the unknown variables (identified with a ?) based on the information provided.

| Consumer Price Index (CPI) | Purchasing Power of a Dollar (PPD) | |

| 5. | 107.9 | ? |

| 6. | ? | 80% |

| Nominal Income ($) | Consumer Price Index (CPI) | Real Income (RI) | |

| 7. | $45,000.00 | 120.0 | ? |

| 8. | ? | 105.0 | $29,523.81 |

| 9. | $86,000.00 | ? | $80,298.71 |

Applications

- In Regina, a 4 L bag of 2% milk has an average price of $3.71. Prices in Toronto and Montreal are $4.55 and $5.40, respectively. Calculate an index of these prices using Regina as the base.

- If Sabrina is currently earning $53,000 and the CPI changes from 105.9 to 107.6, how much money does she need to earn next year just to keep up with inflation?

- If the CPI rises from 103.4 to 108.8, how much money at the start is required to have the same purchasing power as $100 at the end?

- George currently earns $28,000 per year. As per his union salary grid, next year he will earn $32,500 per year. If the CPI increases from 104.0 to 106.1 over the same time frame, how much of his raise is real income?

- Last year the purchasing power of a dollar was 84.3%. This year the purchasing power of a dollar is 81.4%. What is the percent change in the CPI between the two years?

Challenge, Critical Thinking, & Other Applications

- An investor had $200,000 invested in an S&P/TSX Composite Index portfolio in 2009. By 2011, the index rose to 14,136.50. If the index in 2009 was 8,694.90, how much money would the investor have in her portfolio in 2011, if she was able to match the market performance?

- Over the years, Hannah’s income has changed from $36,000 to $40,000 to $45,000. If the CPI changed from 102.9 to 105.1 to 108.6 over the same time period, determine Hannah’s percent change in real income from year to year.

- The CPI rose from 102.6 in 2003 to 116.5 in 2010. The S&P/TSX Composite Index rose from 6,569.49 to 11,294.42 over the same time period. If an investor had $125,000 invested in 2003, how much of the growth (in dollars) for the portfolio over the seven years represents real growth?

- An enterprise has 136 employees earning an average income of $42,250 per year. If the CPI rises from 103.7 to 107.2, by what amount do total wages rise if all employee wages are adjusted to match the CPI?

- Using January 2003 as your base year with a base value = 100, compute a series of indexes for the S&P/TSX Composite Index from select years in 2003 to 2011. Interpret your results.

| Year | 2003 | 2005 | 2007 | 2009 | 2011 |

| January index | 6,569.49 | 9,204.05 | 13,034.12 | 8,694.90 | 13,551.91 |

- Below is select information on the CPI from 2004 to 2010:

| Year | 2004 | 2006 | 2008 | 2010 |

| July CPI | 105.0 | 109.6 | 115.8 | 116.8 |

-

- The purchasing power of a dollar for each year. Interpret your results.

- If you were earning $34,500 in 2002, calculate the nominal income required each year to keep up with the changes in the CPI.

The Language of Business Mathematics

basic personal amount The amount of income for which the wage earner is granted a tax exemption.

commission An amount or a fee paid to an employee for performing or completing some form of transaction.

consumer price index A measure of the average price of a typical Canadian market basket, which is used to estimate inflation in Canada.

graduated commission A form of compensation where an employee is offered increasing rates of commission for higher levels of performance.

gross earnings The amount of money earned before any deductions are removed from a paycheque.

holiday earnings Earnings paid to an employee on a statutory holiday for which no work is performed.

hourly wage A variable compensation based on the time an employee has worked.

index A number used to compare two quantities sharing the same characteristic as measured under different circumstances.

index number The expression of a relationship between two quantities; it is a result of an index calculation.

market basket The average price of the goods and services that a typical Canadian household commonly purchases; used in calculating the consumer price index.

overtime Work time in excess of an employee’s regular workday or regular workweek.

overtime or premium earnings Earnings determined by an employee’s overtime rate of pay and that occur when regular hours are exceeded.

personal income tax A tax on earned income that is levied by both the federal and provincial/territorial governments.

piecework A form of compensation where an employee is paid on a per-unit basis.

progressive tax system A personal income tax system where the tax rate increases as the amount of income increases; however, the increased tax rates apply only to income amounts above a minimum threshold.

public holiday A provincially recognized day for which employees may or may not get a day of rest and may or may not receive pay depending on provincial employment standards.

purchasing power of a dollar The amount of goods and services that can be purchased with a dollar.

real income Income that has the effects of inflation removed from its amount.

regular earnings Earnings determined by an employee’s regular rate of pay.