5 Accounting Applications

Chapter 5 Topics

5.1 Sales Taxes

5.2 Property Taxes

5.3 Exchange Rates and Currency Exchange

The price tag on the product is not necessarily what you pay for it. In 1789, Benjamin Franklin might have said it best when he wrote, “In this world nothing can be said to be certain, except death and taxes.”[1] Almost everything is taxed, whether a physical good, a service, or even property.

For instance, while shopping on eBay, you find a product listed in an eBay store located in your home province. Another product you need is listed by a seller in the United States. You need both products and the prices including shipping costs are reasonable, so for each you click the “Buy It Now” option. The Canadian invoice lists the product’s pre-tax price along with two more lines indicating GST and PST amounts, all totalled at the bottom. The US invoice lists the price of the item in US currency. When paying this seller, PayPal converts the price from US currency to Canadian currency using an exchange rate that does not quite match the rate you have seen published in the newspaper, and you wonder why. If you go with this US seller, you know that the Canada Border Services Agency (customs) will charge for GST.

This scenario highlights three of this chapter’s key topics: taxes, currency exchange, and invoicing.

- If there is one thing you encounter in all aspects of your life, it is sales tax, which provides revenue to governments in Canada and abroad. In addition, anyone involved in the ownership of real estate must deal with property taxes. Corporate offices, production facilities, and warehouses sit on business-owned real estate, which is charged property taxes. Residential homeowners pay annual taxes to their municipalities. Even if you just rent property like an apartment, the apartment building owner is charged property taxes, which are passed on to tenants within the rental charges.

- Canadian businesses and consumers operate in a global economy in which they commonly complete international transactions. Any payment will incorporate an exchange rate ensuring that the amount paid in Canadian currency is equivalent to the amount charged in the foreign currency.

- Many transactions are completed through an invoicing procedure. Along with a list of the items purchased and their respective prices, invoices show terms of payment, consequences of failing to make the payment, and additional charges such as taxes and shipping.

There is no avoiding sales taxes, property taxes, currency exchange, and invoicing. As a consumer, you generally need to pay these costs. As a business, you not only pay these costs but you need to charge your customers appropriately and collect taxes on behalf of the government. This chapter explores the mathematics behind these concepts.

5.1 Sales Taxes

On your recent cross-Canada road trip, you purchased from many different Tim Hortons’ stores. At each store, your products retailed for $6.99. When you review your credit card receipts after returning home from your trip, you notice that you paid different totals everywhere. In Alberta, they only added GST and your combo cost $5.34. In British Columbia, they added both PST and GST, resulting in total cost of $7.83. In Ontario, they added something called HST, resulting in a total cost of $7.90. You find it interesting that the same combo came to different totals as you travelled across Canada.

Three Sales Taxes

A sales tax is a percent fee levied by a government on the supply of products. In Canada, there are three types of sales taxes: the goods and services tax (GST), provincial sales tax (PST), and the harmonized sales tax (HST). In this section you will learn the characteristics of each of these taxes and then the mathematics for calculating any sales tax.

Goods & Services Tax (GST)

The goods and services tax, better known as GST, is a national federal tax of 5% that applies to the purchase of most goods and services in Canada. Every province and territory has GST. The consumer ultimately bears the burden of this sales tax.

Businesses must collect GST on most of their sales and pay GST on most purchases in the daily course of operations. However, when remitting these taxes, businesses claim a credit with the federal government to recover the GST they paid on eligible purchases. The net result is that businesses do not pay the GST on these eligible purchases. While this may outrage some people, the logic is simple. If a business pays the GST, it becomes a cost of the business, which is then passed on to consumers as it is incorporated into retail prices. When the consumer purchases the product, the consumer would be charged the GST again! In essence, a consumer would be double-taxed on all purchases if businesses paid the GST.

Some goods and services are exempt from GST. While there are many complexities and nuances to the exemptions, generally items that are deemed necessities (such as basic groceries), essential services (such as health, legal aid, and childcare), and charitable activities are nontaxable. You can find a complete listing of exemptions on the Canada Revenue Agency website at www.cra.gc.ca.

Provincial Sales Tax (PST)

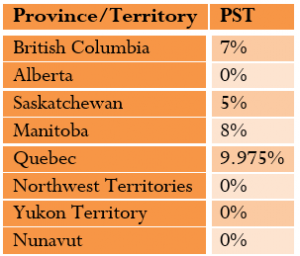

Provincial sales taxes, or PST, are provincially administered sales taxes that are determined by each individual provincial or territorial government in Canada. The table here lists the current PST rates in Canada.

Similar to GST, PST applies to the purchase of most goods and services in the province, and consumers bear the burden. For the same reasons as with GST, businesses typically pay the PST on purchases for non-resale items (such as equipment and machinery) and do not pay the PST on resale items. Businesses are responsible for collecting PST on sales and remitting the tax to the provincial government. Individual provincial websites list the items and services that are exempt from PST.

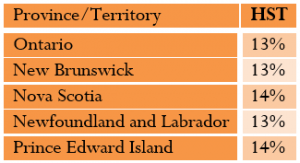

Harmonized Sales Tax (HST)

The harmonized sales tax, or HST, is a combination of GST and PST into a single number. Since most goods and services are subjected to both taxes anyway, HST offers a simpler method of collecting and remitting the sales tax—a business has to collect and remit only one tax instead of two. Because there are pros and cons to HST, not all provinces use this method of collection, as summarized in the table below.

Pros

· Items that are previously PST payable to a business are now refunded, lowering input costs and lowering consumer prices

· Results in overall lower corporate taxes paid

· Increases the competitiveness of businesses and results in job creation

· Businesses only remit one tax and not two, resulting in financial and auditing savings

Cons

· Many items such as utilities, services, and children’s clothing that are ineligible for PST become taxed at the full HST rate

· Consumer cost of living increases

· Tax-exempt items see prices rise because HST is being applied to services and goods such as transportation and gasoline

The Formula

With respect to sales taxes, you usually calculate two things:

- The dollar amount of the sales tax.

- The price of a product including the sales tax.

Calculating the Sales Tax Amount

A sales tax is a percent rate calculated on the base selling price of the product. Therefore, if you are interested solely in the amount of the sales tax (the portion owing), apply Formula 2.2 on Rate, Portion, Base: ![]()

becomes ![]()

Rearranging this formula to solve for the tax amount gives the following:

Tax Amount = Tax Rate × Price before Taxes (which is the same as Portion = Rate × Base)

This is not a new formula. It applies the existing formula from Chapter 2.

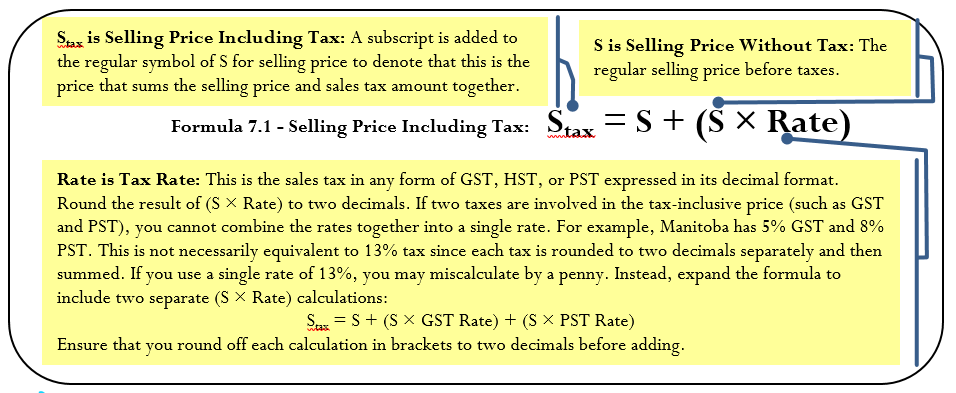

Calculating a Price Including Tax

When calculating a selling price including the tax, you take the regular selling price and increase it by the sales tax percentage. This is a percent change calculation using Formula 3.1 from Chapter 3:

The Old price is the price before taxes, the percent change is the sales tax percentage, and you need to calculate the New price including the tax. Rearranging the formula for New, you have which you factor and rewrite as or this is a widespread application of the percent change formula. Since it can be tedious to keep rearranging Formula 3.1, Formula 5.1 expresses this relationship.

Selling Price Including Tax

Key Takeaways

Stax is Selling Price Including Tax: A subscript is added to the regular symbol S for Selling Price to denote that this is the price that sums the selling price and sales tax amount together.

S is Selling Price Without Tax: The regular selling price before taxes.

Rate is Tax Rate: This is the sales tax in any form of GST, HST, or PST expressed in its decimal format.

Round the result of (S x Rate) to two decimals. If two taxes are involved in the tax-inclusive price (such as

GST and PST), you cannot combine the rates together into a single rate. For example, Manitoba has 5% GST

and 8% PST. This is not necessarily equivalent to 13% tax since each tax is rounded to two decimals separately

and then summed. If you use a single rate of 13%, you may miscalculate by a penny. Instead, expand the

formula to include two sepaate (S x Rate) calculations:

Stax = S (S x GST Rate) (S x PST Rate)

How It Works

Follow these steps to perform calculations involving sales taxes:

Step 1: Identify the pricing information. In particular, pay careful attention to distinguish whether the price is before taxes (S) or inclusive of taxes (Stax). Also identify all applicable sales taxes, including GST, PST, and HST.

Step 2: Apply Formula 5.1 to solve for the unknown variable.

Step 3: If you need to find sales tax amounts, apply Formula 2.2 and rearrange for portion. Ensure that for the base you use the price before taxes.

Assume a $549.99 product is sold in British Columbia. Calculate the amount of the sales taxes and the price including the sales taxes.

Step 1: The price before taxes is S = $549.99. In British Columbia, GST is 5% and PST is 7% (from the PST Table).

Step 2: To calculate the price including the sales taxes, apply Formula 5.1:

Stax = $549.99 ($549.99 × 5%) ($549.99 × 7%) = $615.99

Step 3: Applying the rearranged Formula 2.2 for the GST, you calculate:

GST Tax Amount = 5% × $549.99 = $27.50

Applying the same formula for the PST, you calculate:

PST Tax Amount = 7% × $549.99 =$38.50.

(Note: You may notice that you could just pull these amounts from the interim calculations in step 2). Therefore, on a $549.99 item in British Columbia, $27.50 in GST and $38.50 in PST are owing, resulting in a price including sales taxes of $615.99.

Important Notes

To calculate a price including a single sales tax rate, use the percent change function (∆%) on the calculator. You can review the full instructions for this function at the end of Chapter 3. When using this function, OLD is the price before taxes, NEW is the price after taxes, and %CH is the single tax rate in its percentage format. You do not use the #PD variable, which therefore defaults to 1. Note that if more than one tax rate applies on the same base, you cannot use this calculator function because of the possibility of a rounding error, as explained above.

Paths To Success

You will often need to manipulate Formula 5.1. Most of the time, prices are advertised without taxes and you need to calculate the price including the taxes. However, sometimes prices are advertised including the taxes and you must calculate the original price of the product before taxes. When only one tax is involved, this poses no problem, but when two taxes are involved (GST and PST), combine the taxes into a single amount before you solve for S.

Give It Some Thought

On any given product selling for the same price, put the following provinces in order from highest price to lowest price including taxes (GST and PST, or HST): Alberta, Saskatchewan, British Columbia, Ontario, Prince Edward Island.

Solutions:

PEI (14% HST), Ontario (13% HST), British Columbia (5% GST 7% PST), Saskatchewan (5% GST 5% PST), Alberta (5% GST, no PST)

Example 5.1 A: Calculating Sales Taxes Across Canada

Example 5.1 B: Calculating Taxes on a Tax-Inclusive Price

[table id=26 /]

The GST/HST Remittance

When a business collects sales taxes, it is a go-between in the transaction. These sales tax monies do not belong to the business. On a regular basis, the business must forward this money to the government. This payment is known as a tax remittance.

The Formula

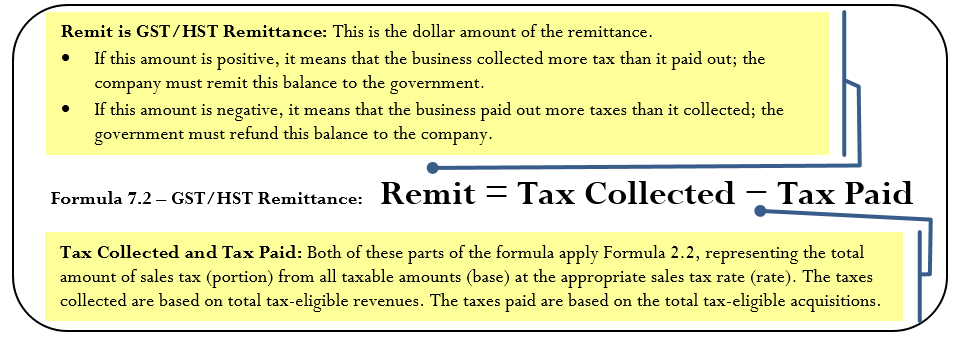

Generally speaking, a business does not pay sales taxes. As a result, the government permits a business to take all eligible sales taxes that it paid through its acquisitions and net them against all sales taxes collected from sales. The end result is that the business is reimbursed for any eligible out-of-pocket sales tax that it paid. Formula 5.2 expresses this relationship.

GST/HST Remittance

Tax Collected and Tax Paid: Both of these parts of the formula apply Formula 2.2, representing the total amount of sales tax (portion) from all taxable amounts (base) at the appropriate sales tax rate (rate). The taxes collected are based on total tax-eligible revenues. The taxes paid are based on the total tax-eligible acquisitions

How It Works

Follow these steps to complete a GST/HST remittance:

Step 1: Identify the total amounts of tax-eligible revenues and acquisitions upon which the sales tax is collected or paid, respectively. Identify the applicable sales tax rate of the GST or HST.

Step 2: Calculate the total taxes collected by applying Formula 2.2, where the sales tax is the rate and the total revenue is the base. Solve for portion.

Step 3: Calculate the total taxes paid by applying Formula 2.2, where the sales tax is the rate and the total acquisitions are the base. Solve for portion.

Step 4: Apply Formula 5.2 to calculate the tax remittance.

Assume a business has paid GST on purchases of $153,000. It has also collected GST on sales of $358,440. Calculate the GST remittance.

Step 1: Identifying the variables, you have:

Total Revenue =$358,440

Total Acquisitions = $153,000 GST Tax Rate = 5%

Step 2: Calculate taxes collected by applying Formula 2.2, where:

GST collected = 5% × $358,440 = $17,922.

Step 3: Calculate taxes paid by applying Formula 2.2, where:

GST paid = 5% × $153,000 = $7,650.

Step 4: To calculate the remittance, apply Formula 5.2 and calculate Remit = $17,922 − $7,650 = $10,272. The business should remit a cheque for $10,272 to the government.

Paths To Success

A shortcut can help you calculate the GST/HST Remittance using Formula 5.2. If you do not need to know the actual amounts of the tax paid and collected, you can net GST/HST–eligible revenues minus acquisitions and multiply the difference by the tax rate:

Remit = (Revenues − Acquisitions) × Rate

In the example above, Remit = ($358,440 – $153,000) x 5% = $10,272. If this calculation produces a negative number, then the business receives a refund instead of making a remittance.

Example 5.1 C: Calculating GST/HST Remittance

Exercises

Mechanics

You are purchasing a new BlackBerry at the MSRP of $649.99. Calculate the price including taxes in the following provinces or territories:

- Northwest Territories

- New Brunswick

- Nova Scotia

- British Columbia

The Brick is advertising a new Serta mattress nationally for a price of $899.99 including taxes. What is the price before taxes and the sales tax amounts in each of the following provinces?

- Ontario

- Saskatchewan

- Audiophonic Electronics is calculating its HST remittance in Prince Edward Island. For each of the following months, calculate the HST remittance or refund on these HST-eligible amounts.

|

Month |

Purchases |

Sales |

|

January |

$48,693 |

$94,288 |

|

February |

$71,997 |

$53,639 |

8. Airwaves Mobility is calculating its GST remittance in Alberta. For each of the following quarters, calculate the GST remittance or refund on these GST-eligible amounts.

|

Quarter |

Purchases |

Sales |

|

Winter |

$123,698 |

$267,122 |

|

Spring |

$179,410 |

$158,905 |

|

Summer |

$216,045 |

$412,111 |

|

Fall |

$198,836 |

$175,003 |

Applications

- Elena lives in Nova Scotia and has relatives in Alberta, Saskatchewan, and Quebec. She gets together with them often. She wants to purchase a new aerobic trainer and would like to pay the lowest price. If a family member buys the item, Elena can pick it up at one of their regular family gatherings. The price of the trainer for each province is listed below:

|

Province |

Regular |

|

Nova |

$1,229.50 |

|

Alberta |

$1,329.95 |

|

Saskatchewan |

$1,274.25 |

|

Quebec |

$1,219.75 |

a. Where should Elena have the aerobic trainer purchased and how much would she pay?

b. How much money would she save from her most expensive option?

10. Mary Lou just purchased a new digital camera in Nunavut for $556.49 including taxes. What was the price of the camera before taxes? What amount of sales tax is paid?

11. Marley is at Peoples Jewellers in New Brunswick wanting to purchase an engagement ring for his girlfriend. The price of the ring is $2,699.95. If the credit limit on his credit card is $3,000, will he be able to purchase the ring on his credit card? If not, what is the minimum amount of cash that he must put down to use his credit card?

12. In the IKEA store in Vancouver, British Columbia, you are considering the purchase of a set of kitchen cabinets priced at $3,997.59. Calculate the amount of GST and PST you must pay for the cabinets, along with the total price including taxes.

13. A company in Saskatchewan recorded the following GST-eligible purchases and sales throughout the year. Determine the GST remittance or refund per quarter.

|

Quarter |

Purchases |

Sales |

|

1st |

$2,164,700 |

$2,522,000 |

|

2nd |

$1,571,300 |

$2,278,700 |

|

3rd |

$1,816,100 |

$1,654,000 |

|

4th |

$2,395,900 |

$1,911,700 |

14. A manufacturer in Nova Scotia recorded the following HST-eligible purchases and sales in its first three months of its fiscal year. Determine the HST remittance or refund per month.

|

Month |

Purchases |

Sales |

|

March |

$20,209 |

$26,550 |

|

April |

$28,861 |

$20,480 |

|

May |

$22,649 |

$42,340 |

Challenge, Critical Thinking, & Other Applications

- If the selling price of an item is 6% higher in Yukon than in Ontario, will the price including taxes be higher in Yukon or Ontario? What percentage more?

- Colin just travelled across the country on a road trip. He bought some skis in Alberta for $879.95 plus tax, a boombox in British Columbia for $145.58 including taxes, a Niagara Falls souvenir in Ontario for $99.97 plus tax, and some maple syrup in Quebec for $45.14 including tax. Overall, how much GST, PST, and HST did Colin pay on his trip?

- Cisco Enterprises in Ontario purchased the following in a single month:

- 16,000 units of network routers at $79.25 each, priced at $97.97 each

- 12,000 units of wireless LAN adapters at $129.95 each, priced at $189.55 each

- 13,500 units of computer boards at $229.15 each, priced at $369.50 each.

Assuming that all units purchased are sold during the same month and that all purchases and sales are taxable, calculate the tax remittance or refund for the month.

- In Quebec, the PST used to be calculated on the price including GST. When the PST was calculated in this manner, what PST rate did Quebec set to arrive at the same price including taxes?

- For each of the following situations, compute the selling price of the product before taxes in the other province/territory that would result in the same selling price including taxes as the item listed.

|

|

Price |

Sold |

Find |

|

a. |

$363.75 |

British |

Prince |

|

b. |

$1,795.00 |

Alberta |

Manitoba |

|

c. |

$19,995.95 |

Saskatchewan |

Ontario |

|

d. |

$4,819.35 |

New |

Quebec |

20. A company made the following taxable transactions in a single month. Compute the GST remittance on its operations assuming all sales and purchases are eligible for GST.

|

Transaction |

Unit |

Quantity |

|

Purchase |

$168.70 |

5,430 |

|

Sale |

$130.00 |

4,000 |

|

Sale |

$148.39 |

3,600 |

|

Purchase |

$93.47 |

2,950 |

|

Purchase |

$24.23 |

3,325 |

|

Purchase |

$121.20 |

2,770 |

|

Sale |

$188.88 |

6,250 |

5.2 Property Taxes

As you drive through your neighbourhood, you pass a city crew repairing the potholes in the road. Hearing sirens, you check your rear-view mirror and pull to the side of the road as a police car and fire engine race by, heading toward some emergency. Pulling back out, you drive slowly through a public school zone, where you smile as you watch children playing on the gigantic play structure. A city worker mows the lawn.

Where does the municipality get the money to pay for all you have seen? No one owns the roads, schools are free, fire crews and police do not charge for their services, play structures have no admission, and parks are open to everyone. These are just some examples of what your municipality does with the money it raises through property taxes.

Property Taxation

Property taxes are annual taxes paid by real estate owners to local levying authorities to pay for services such as roads, water, sewers, public schools, policing, fire departments, and other community services. Every individual and every business pays property taxes. Even if you don’t own property, you pay property taxes that are included in your rental and leasing rates from your landlord.

Property taxes are imposed on real estate owners by their municipal government along with any other bodies authorized to levy taxes. For example, in Manitoba each divisional school board is authorized to levy property taxes within its local school division boundaries.

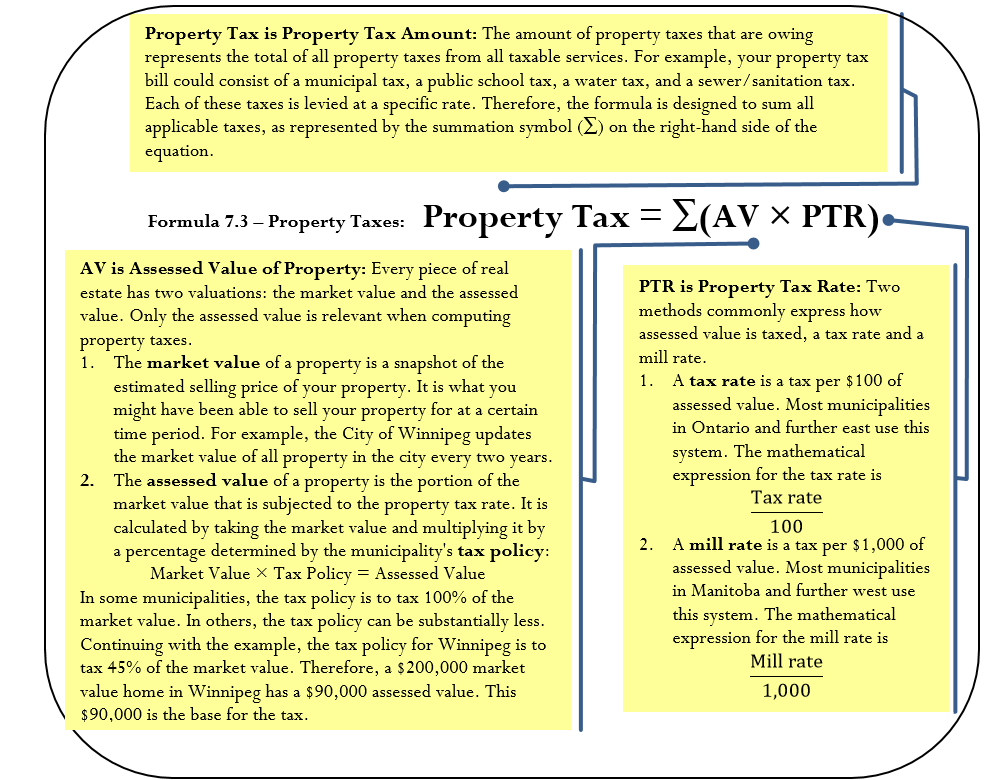

The Formula

Since property taxes are administered at the municipal level and every municipality has different financial needs, there are a variety of ways to calculate a total property tax bill. Formula 5.3 (on next page) is designed to be flexible to meet the varying needs of municipal tax calculations throughout Canada.

How It Works

Follow these steps when working with calculations involving property taxes:

Step 1: Identify all known variables. This includes the market value, tax policy, assessed value, all property tax rates, and the total property taxes.

Step 2: If you know the assessed value, skip this step. Otherwise, calculate the assessed value of the property by multiplying the market value and the tax policy.

Step 3: Calculate either the tax amount for each property tax levy or the grand total of all property taxes by applying Formula 5.3.

Continuing with the Winnipeg example in which a home has a market value of $200,000, the tax policy of Winnipeg is to tax 45% of the market value. A Winnipegger receives a property tax levy from both the City of Winnipeg itself and the local school board. The mill rates are set at 14.6 and 16.724, respectively. Calculate the total property tax bill.

Step 1: The known variables are market value = $200,000, tax policy = 45%, City of Winnipeg mill rate = 14.6, and school board mill rate = 16.724.

Step 2: Calculate the assessed value by taking the market value of $200,000 and multiplying by the tax policy of 45%, or Assessed Value =$200,000 × 45% = $90,000.

Step 3: To calculate each property tax, apply Formula 5.3. The City of Winnipeg Property Tax = $90,000 × 14.6 ÷ 1,000 =$1,314. The school board Property Tax = $90,000 × 16.724 ÷ 1,000 = $1,505.16. Add these separate taxes together to arrive at Total Property Tax = $1,314 $1,505.16 = $2,819.16.

Property Tax

Important Notes

Mill rates are commonly expressed with four decimals and tax rates are expressed with six decimals. Although some municipalities use other standards, this text uses these common formats in its rounding rules. In addition, each property tax levied against the property owner is a separate tax. Therefore, you must round each property tax to two decimals before summing the grand total property tax.

Things To Watch Out For

The most common mistake is to use the wrong denominator in the tax calculation. Ensure that you read the question accurately, noting which term it uses, tax rate or mill rate. If neither appears, remember that Ontario eastward uses tax rates and Manitoba westward uses mill rates.

A second common mistake is to add multiple property tax rates together when the assessed value remains constant across all taxable elements. For example, if the assessed value of $250,000 is used for two tax rates of 2.168975 and 1.015566, you may be tempted to sum the rates, which would yield a rate of 3.184541. This does not always work and may produce a small error (a penny or two) since each tax is itemized on a tax bill. You must round each individual tax to two decimals before summing to the total property tax.

Example 5.2A Calculating Property Taxes

Paths To Success

The collective property taxes paid by all of the property owners form either all or part of the operating budget for the municipality. Thus, if a municipality consisted of 1,000 real estate owners each paying $2,000 in property tax, the municipality’s operating income from property taxes is $2,000 × 1,000 = $2,000,000. If the municipality needs a larger budget from property owners, either the assessed values, the mill/tax rate, or some combination of the two needs to increase.

Example 5.2B Setting a New Mill Rate

Exercises

Mechanics

For questions 1–4, solve for the unknown variables (identified with a ?) based on the information provided.

|

|

Market |

Tax |

Assessed |

Rate |

Type |

Property |

|

1. |

$320,000 |

55% |

? |

26.8145 |

Mill |

? |

|

2. |

? |

85% |

$136,000 |

1.984561 |

Tax |

? |

|

3. |

$500,000 |

? |

? |

9.1652 |

Mill |

$3,666.08 |

|

4. |

? |

50% |

$650,000 |

? |

Tax |

$4,392.91 |

Applications

- A house with an assessed value of $375,000 is subject to a tax rate of 1.397645. What is the property tax?

- If a commercial railway property has a property tax bill of $166,950 and the mill rate is 18.5500, what is the assessed value of the property?

- A house in Calgary has a market value of $450,000. The tax policy is 100%. The property is subject to a 2.6402 mill rate from the City of Calgary and a 2.3599 mill rate from the province of Alberta. What are the total property taxes?

- A residential property in Regina has a market value of $210,000. The Saskatchewan tax policy is 70%. The property is subject to three mill rates: 13.4420 in municipal taxes, 1.4967 in library taxes, and 10.0800 in school taxes. What amount of tax is collected for each, and what are the total property taxes?

- A municipality needs to increase its operating budget. Currently, the assessed value of all properties in its municipality total $1.3555 billion and the tax rate is set at 0.976513. If the municipality needs an additional $1.8 million next year, what tax rate should it set assuming the assessed values remain constant?

- A municipality set its new mill rate to 10.2967, which increased its total operating budget by $10 million on a constant assessed value of $7.67 billion. What was last year’s mill rate?

Challenge, Critical Thinking, & Other Applications

- A school board is determining the mill rate to set for next year. The assessed property values for next year total $5.782035 billion, representing an increase of 5% over the current year. If the school board needs an additional $5.4 million in funding next year, by what amount should it change its current year mill rate of 11.9985?

- In the current year, the market value of properties totals $6.896 billion. The current tax policy is 85% and the current mill rate is 15.6712. If the municipality requires an additional $2 million in its operating budget next year, market values increase by 4%, and the tax policy changes to 90%, what mill rate should it set for next year?

- A $600,000 market value property is assessed with a tax policy of 75% and subject to two mill rates. If the total property taxes are $6,766.67 and the second mill rate is half of the first tax rate, calculate each mill rate.

- Two properties in different provinces pay the same property taxes of $2,840. One province uses a mill rate of 24.6119 with a 60% tax policy, while the other province uses a tax rate of 1.977442 with an 80% tax policy. Compute the market values for each of these properties.

- A water utility funded through property taxes requires $900 million annually to operate. It has forecasted increases in its operating costs of 7% and 3.5% over the next two years. Currently, properties in its area have a market value of $234.85 billion, with projected annual increases of 3% and 5% over the next two years. The provincial government has tabled a bill that might change the tax policy from 70% to 75% effective next year, but it is unclear if the bill will pass at this point. For planning purposes, the utility wants to forecast its new mill rates for the next two years under either tax policy. Perform the necessary calculations for the utility.

5.3 Exchange Rates and Currency Exchange

You have set aside $6,000 in Canadian funds toward hostel costs during a long backpacking trip through the United States, Mexico, and Europe. After searching on the Internet, you decide to use Hotwire.com to reserve your hostel rooms. The website quotes you the following amounts for each country: 1,980 US dollars, 21,675 Mexican pesos, and 1,400 euros. Have you allocated enough money to cover these costs?

Whether you are a consumer backpacking around the world on distant vacations, investing in international securities, or shopping online at global Internet sites, you must pay for your purchases in local currencies out of your Canadian currency accounts. Businesses are no different as they export and import products to and from other countries. With outsourcing on the rise, it is also common for business services such as call centres and advertising agencies to be located abroad along with manufacturing facilities. Large-scale companies may have operations in several countries throughout the world.

All of these transactions and operations require the conversion of Canadian currency to a foreign currency or vice versa. This section shows you the basics of currency conversion rates and then explores finer details such as charges for currency conversion and what happens when one currency gets stronger or weaker relative to another.

Exchange Rates

An exchange rate between two currencies is defined as the number of units of a foreign currency that are bought with one unit of the domestic currency, or vice versa. Since two currencies are involved in every transaction, two published exchange rates are available. Let’s use Canada and the United States to illustrate this concept.

- The first exchange rate indicates what one dollar of Canada’s currency becomes in US currency.

- The second exchange rate indicates what one dollar of US currency becomes in Canadian currency.

These two exchange rates allow Canadians to determine how many US dollars their money can buy and vice versa. These currency rates have an inverse relationship to one another: if 1 Canadian dollar equals 0.80 US dollars, then 1 US dollar equals = 1.25 Canadian dollars.

Most Canadian daily and business newspapers publish exchange rates in their financial sections. Although exchange rates are published in a variety of ways, a currency cross-rate table, like the table below, is most common. Note that exchange rates fluctuate all of the time as currencies are actively traded in exchange markets. Therefore, any published table needs to indicate the date and time at which the rates were determined. Also note that the cells where the same currency appears show no published rate as you never need to convert from Canadian dollars to Canadian dollars!

| Per C$ |

Per US$ |

Per € |

Per ¥ |

Per MXN$ |

Per AU$ |

|

| Canadian Dollar (C$) |

—— |

0.9787 |

1.4012 |

0.0122 |

0.0823 |

1.0360 |

| US Dollar (US$) |

1.0218 |

—— |

1.4317 |

0.0125 |

0.0841 |

1.0585 |

| Euro (€) |

0.7137 |

0.6985 |

—— |

0.0087 |

0.0588 |

0.7394 |

| Japanese Yen (¥) |

82.0233 |

80.2765 |

114.9287 |

—— |

6.7540 |

84.9747 |

| Mexican Peso (MXN$) |

12.1445 |

11.8859 |

17.0165 |

0.1481 |

—— |

12.5814 |

| Australian Dollar (AU$) |

0.9652 |

0.9447 |

1.3525 |

0.0118 |

0.0795 |

—— |

In the table, all exchange rates have been rounded to four decimals. In true exchange markets, most exchange rates are expressed in 10 decimals or more such that currency exchanges in larger denominations are precisely performed. For the purposes of this textbook, we will use a four decimal standard to simplify the calculations while still illustrating the principles of currency exchange.

Technically, only half of the table is needed, since one side of the diagonal line is nothing more than the inverse of the other. For example, the euro is 0.7137 per C$ on the bottom of the diagonal. The inverse, or ![]() = 1.4011 per €, is what is listed on top of the diagonal (the difference of 0.0001 is due to rounding to four decimals).

= 1.4011 per €, is what is listed on top of the diagonal (the difference of 0.0001 is due to rounding to four decimals).

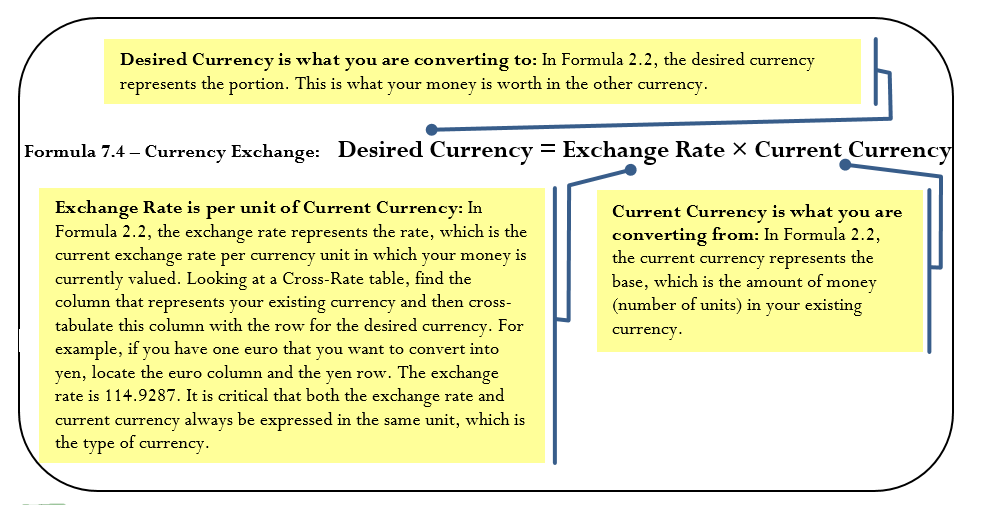

The Formula

Currency Exchange

Currencies, exchange rates, and currency cross-tables all raise issues regarding decimals and financial fees.

- Decimals in Currencies. Not all currencies in the world have decimals. Here in North America, MXN$, US$, and C$ have two decimals. Mexicans call those decimals centavos while Canadians and Americans call them cents. Australia and the European countries using the euro also have cents. However, the Japanese yen does not have any decimals in its currency. If you are unsure about the usage of decimals, perform a quick Internet search to clarify the issue.

- Financial Fees. Technically, the rates in a cross-rate table are known as mid-rates. A mid-rate is an exchange rate that does not involve or provide for any charges for currency conversion. When you convert currencies, you need to involve a financial organization, which will charge for its services.

- Sell Rates. When you go to a bank and convert your domestic money to a foreign currency, the bank charges you a sell rate, which is the rate at which a foreign currency is sold. When you exchange your money, think of this much like a purchase at a store—the bank’s product is the foreign currency and the price it charges is marked up to its selling price. The sell rate is always higher than the mid-rate in terms of C$ per unit of foreign currency and thus is always lower than the mid-rate in terms of foreign currency per unit of C$. For example, the exchange rate of C$ per US$ is 0.9787 (you always look up the “per currency” column that you are purchasing). This means it will cost you C$0.9787 to purchase US$1.00. The bank, though, will sell you this money for a sell rate that is higher, say $0.9987. This means it will cost you an extra C$0.02 per US$ to exchange the money. That $0.02 difference is the fee from the bank for its services, and it is how the bank makes a profit on the transaction.

- Buy Rates. When you go to a bank and convert your foreign currency back into your domestic money, the bank charges you a buy rate, which is the rate at which a foreign currency is purchased. The buy rate is always lower than the mid-rate in terms of C$ per unit of foreign currency and thus is always higher than the mid-rate in terms of foreign currency per unit of C$. Using the same example as above, if you want to take your US$1.00 to the bank and convert it back to Canadian funds, the bank charges you a buy rate that is lower, say $0.9587. In other words, you receive C$0.02 less per US$. Again, the $0.02 difference is the bank’s fee for making the currency exchange on your behalf.

How It Works

Follow these steps when performing a currency exchange:

Step 1: Identify all known variables. Specifically, identify the currency associated with any amounts. You also require the mid-rate. If buy rates and sell rates are involved, identify how these rates are calculated.

Step 2: If there are no buy or sell rates, skip this step. If buy and sell rates are involved, calculate these rates in the manner specified by the financial institution.

Step 3: Apply Formula 7.4 using the appropriate mid-rate, buy rate, or sell rate to convert currencies.

This section opened with your backpacking vacation to the United States, Mexico, and Europe, for which you were quoted prices of US$1,980, MXN$21,675, and €1,400 for hostels. Assume all purchases are made with your credit card and that your credit card company charges 2.5% on all currency exchanges. Can your C$6,000 budget cover these costs?

Step 1: There are three currency amounts: US$1,980, MXN$21,675, and €1,400. Using the cross-rate table, the Canadian exchange mid-rate per unit of each of these currencies is 0.9787 US$, 0.0823 MXN$, and 1.4012 €.

Step 2: Calculate the buy rates (since you are converting foreign currency into domestic currency) for each currency:

US$ = 0.9787(1.025) =1.0032

MXN$ = 0.0823(1.025) = 0.0844

€ = 1.4012(1.025) = 1.4362

Step 3: Apply Formula 7.4 to each of these currencies:

US$: Desired Currency = US$1,980 × 1.0032 = C$1,986.34.

MXN$: Desired Currency = MXN$21,675 × 0.0844 = C$1,829.37.

€: Desired Currency = €1,400 × 1.4362 = C$2,010.68.

Putting the three amounts together, your total hostel bill is:

$1,986.34 $1,829.37 $2,010.68 = $5,826.39

Because this is under budget by $173.61, all is well with your vacation plans.

Things To Watch Out For

When working with currency exchange, probably the trickiest element is that you have to choose one of two inverse exchange rates depending on which way the money conversion is taking place. In any currency situation, it is important that you take the time to understand the basis on which the currency rate is being expressed. Typically, exchange rates are expressed on a per-unit basis in the country’s domestic currency. For example, Canadians express the US dollar exchange rate on a per C$ basis. From the cross-rate table, that exchange rate is 1.0218. In contrast, Americans express the Canadian dollar exchange rate on a per US$ basis, or 0.9787.

Paths To Success

Let the buyer beware when it comes to international transactions. If you have ever purchased and returned an item to an international seller, you may have noticed that you did not receive all of your money back. For most consumers, international purchases are made via credit cards. What most consumers do not know is that the credit card companies do in fact use buy and sell rates that typically charge 2.5% of the exchange rate when both buying and selling.

For example, if you purchase a US$2,000 item at the rates listed in the cross-rate table, your credit card is charged $2,000 × 0.9787(1.025) = $2,006.40. If you return an item you do not want, your credit card is refunded $2,000 × 0.9787(0.975) = $1,908.40. In other words, you are out $2,006.40 − $1,908.40 = $98! This amount represents your credit card company’s charge for the currency conversion—a whopping 4.9% of your purchase price!

Give It Some Thought

In each of the following situations and using the cross-rate table, determine on a strictly numerical basis whether you would have more or fewer units of the target currency than of the original currency. You want to convert:

- C$ into US$

- AU$ into MXN$

- MXN$ into ¥

- C$ into €

Solutions:

- More, since C$1 becomes US$1.0218

- More, since AU$1 becomes MXN$12.5814

- More, since MXN$1 becomes ¥6.7540

- Less, since C$1 becomes €0.7137

Solutions:

- US dollars 2. Increase 3. Mexican pesos 4. Decrease

Example 5.3 A: Straight Currency Conversion

Example 5.3 B: Calculating Profit Using Buy and Sell Rates

Currency Appreciation and Depreciation

An analyst on Global News is discussing how the Canadian dollar has strengthened against the US dollar. Your first reaction is that a strong Canadian dollar ought to be good thing, so hearing that this change might hurt Canada’s exports, you wonder how that could be.

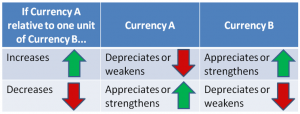

Currencies are actively traded in the international marketplace, which means that exchange rates are changing all the time. As such, exchange rates rise and decline. A currency appreciates (or strengthens) relative to another currency when it is able to purchase more of that other currency than it could previously. A currency depreciates (or weakens) relative to another currency when it is able to purchase less of that other currency than it could previously. Take a look at two examples illustrating these concepts:

- EXAMPLE 1: If C$1 buys US$1.02 and the exchange rate rises to US$1.03, then your C$1 purchases an additional penny of the US dollars. Therefore, the Canadian currency appreciates, or strengthens, relative to the US dollar.

- EXAMPLE 2: Similarly, if the exchange rate drops to US$1.01, then your C$1 purchases one less penny of the US dollars. Therefore, the Canadian currency depreciates, or weakens, relative to the US dollar.

These concepts are particularly important to international business and global economies. Generally speaking, when a currency appreciates it has a positive effect on imports from the other country because it costs less money than it used to for domestic companies to purchase the same amount of products from the other country. However, the currency appreciation tends to also have a negative effect on exports to other countries because it costs the foreign companies more money to purchase the same amount of products from the domestic companies.

Important Notes

It is critical to observe that if currency A appreciates relative to currency B, then the opposite is true for currency B relative to currency A (currency B depreciates relative to currency A). The figure to the right illustrates this concept. Recalling Example 1 above, the Canadian currency appreciated, so the US currency depreciated. In Example 2, the Canadian currency depreciated, so the US currency appreciated.

How It Works

When you work with currency appreciation or depreciation, you still use the same basic steps as before. The additional skill you require in the first step is to adjust an exchange rate appropriately based on how it has appreciated or depreciated.

Things To Watch Out For

It is very easy to confuse the two relative currencies, their values, and the concepts of appreciation and depreciation. For example, if the exchange rate increases between currency A relative to a unit of currency B, which exchange rate appreciated? If currency A has increased per unit of currency B, then it takes more money of currency A to buy one unit of currency B. As a result, currency B appreciates because a single unit of currency B can now buy more of currency A. For example, if the exchange rate is US$1.0218 relative to C$1 and it increases to US$1.0318 relative to C$1, then the Canadian dollar purchases one penny more. The figure helps you understand the relationships involved and provides a visual reminder of which direction everything is moving.

Give It Some Thought

- If the exchange rate in terms of US dollars per unit of euros increases, which currency weakened?

- If the Australian dollar weakens against the Canadian dollar, did the exchange rate increase or decrease in terms of Australian dollars per unit of Canadian dollars?

- If the exchange rate in terms of yen per unit of the Mexican pesos decreases, which currency weakened?

- If the British pound (£) appreciates against the US dollar, did the exchange rate increase or decrease in terms of pounds per unit of US dollars?

Example 5.3 C: Effect of Currency Appreciation

Exercises

For questions 1–6, use the mid-rates in the cross-rate table below to convert the current currency to the desired currency.

| Per C$ |

Per US$ |

Per € |

Per ¥ |

Per MXN$ |

Per AU$ |

|

| Canadian Dollar (C$) |

—— |

0.9787 |

1.4012 |

0.0122 |

0.0823 |

1.0360 |

| US Dollar (US$) |

1.0218 |

—— |

1.4317 |

0.0125 |

0.0841 |

1.0585 |

| Euro (€) |

0.7137 |

0.6985 |

—— |

0.0087 |

0.0588 |

0.7394 |

| Japanese Yen (¥) |

82.0233 |

80.2765 |

114.9287 |

—— |

6.7540 |

84.9747 |

| Mexican Peso (MXN$) |

12.1445 |

11.8859 |

17.0165 |

0.1481 |

—— |

12.5814 |

| Australian Dollar (AU$) |

0.9652 |

0.9447 |

1.3525 |

0.0118 |

0.0795 |

—— |

Mechanics

|

|

Current |

Desired |

|

1. |

C$68,000 |

US$ |

|

2. |

¥15,000,000 |

€ |

|

3. |

AU$3,000 |

MXN$ |

|

4. |

US$180,000 |

AU$ |

|

5. |

€230,500 |

C$ |

|

6. |

MXN$1,300,000 |

¥ |

Applications

- If the exchange rate is ¥95.3422 per C$, what is the exchange rate for C$ per ¥?

- Procter & Gamble just received payment for a large export of Tide in the amount of 275,000 Denmark kroner (DKK). If the exchange mid-rate is C$0.1992 per DKK, and the bank charges 3% on its buy rates, how many Canadian dollars will Procter & Gamble receive?

- The exchange rate per US$ is C$0.9863. If the Canadian dollar depreciates by $0.0421 per US$, how many more or less US$ is C$12,500 able to purchase?

- Jack is heading home to visit his family in Great Britain and decided to stop at the airport kiosk to convert his money. He needs to convert C$5,000 to British pounds (£). The exchange mid-rate per C$ is £0.5841. The kiosk charges a commission of 4.5% on the conversion, plus a flat fee of £5.00.

- How many pounds will Jack have?

- What is the percentage cost of his transaction?

- Yarianni is heading on a vacation. She converts her C$4,000 into Chinese yuan renminbi (CNY) at a sell rate of CNY6.3802 per C$. While in China, she spends CNY14,000 of her money. At the airport, she converts her remaining money into Indian rupees (INR) at a sell rate of INR6.7803 per CNY. In India, she spends INR50,000. When she returns home, she converts her INR back to C$ at a buy rate of C$0.0231 per INR. How many Canadian dollars did she return with? Note that all currencies involved have two decimals.

- Elena is an international investor. Four years ago she purchased 2,700 shares of a US firm at a price of US$23.11 per share when the exchange rate was US$0.7536 per C$. Today, she sold those shares at a price of US$19.87 per share when the exchange rate was US$1.0063 per C$. In Canadian dollars, determine how much money Elena earned or lost on her investment.

- International Traders regularly imports products from Hong Kong. If the exchange rate of C$ per Hong Kong dollar (HKD) is 0.1378 and the Canadian dollar appreciates by HKD0.0128, by what amount would the cost of a HKD1,000,000 purchase increase or decrease in Canadian dollars for International Traders?

- Brian needs to purchase some Brazilian reals (BRL). He takes C$7,500 to the bank and leaves the bank with BRL12,753.20. If the exchange mid-rate per C$ is 1.7621, determine the sell rate commission percentage (rounded to two decimals) charged by the bank.

Challenge, Critical Thinking, & Other Applications

- Fernando could purchase a 55″ Samsung HDTV in Winnipeg, Manitoba, for $2,999.99 plus taxes. Alternatively, he could head across the border on Black Friday and shop in Grand Forks, North Dakota, where the same product is selling for US$2,499.99 (plus 5% state sales tax and 1.75% local sales tax) at Best Buy. He estimates he would incur $65 in gasoline and vehicle wear and tear, $130 in accommodations, and $25 in food (all money in US$). He would make all purchases on his credit card, which uses the mid-rate plus 2.5%. When returning across the border, he would have to pay in Canadian dollars the 5% GST on the Canadian value of the HDTV not including taxes. Once home, he can then have the North Dakota government refund all taxes paid on the HDTV through their Canadian sales tax rebate program. For all currency exchanges, assume a mid-rate of US$0.9222 per C$. Which alternative is Fernando’s better choice and by how much?

- The current mid-rate is C$1.5832 per €. Scotiabank has a sell rate of C$1.6196 per € while an airport kiosk has a sell rate of C$1.6544 per € plus a service charge of C$4.75. You need to purchase €800.

- Calculate the fee percentages charged by each financial institution. Round your answers to one decimal.

- Rounded to two decimals, what percentage more than Scotiabank is the airport kiosk charging on your purchase?

- Henri and Fran have retired and are considering two options for a two-month vacation in Europe. Their local Lethbridge travel agent is offering them an all-inclusive package deal at C$7,975 per person. Alternatively, they can book their own flights for C$1,425 per person, stay in Britain at a small apartment averaging £65 per night for 30 days, and then in France for €70 average per night for 30 days. Estimated groceries cost a total of £250 in Britain and €400 in France. They will need to purchase a Eurail pass for €986 each while they are there. The exchange rates are €0.6808 per C$ and £0.5062 per C$. Which alternative is their cheapest option and by how much in Canadian dollars?

- A Canadian manufacturer imports three parts from different countries. It assembles the three parts into a finished item that is then exported to the United States. Every transaction always involves 25,000 units. Expenses average $6.25 per unit.

|

Component |

Price |

Exchange |

Exchange |

|

Part |

¥1,500 |

¥107.9420 |

¥108.9328 |

|

Part |

AU$14.38 |

AU$1.1319 |

AU$1.0928 |

|

Part |

€10.73 |

€0.6808 |

€0.6569 |

|

Finished |

US$59.45 |

US$1.0128 |

US$1.0243 |

19. In each of the following situations, convert the old amount to the new amount using the information provided.

|

|

Old Amount |

Old Exchange Rate per C$ |

Exchange Rate Change |

New Amount |

|

a. |

US$625.00 |

US$0.9255 |

C$ appreciated by US$0.0213 |

? US$ |

|

b. |

€16,232.00 |

€0.5839 |

C$ depreciated by €0.0388 |

? € |

|

c. |

¥156,500 |

¥93.4598 |

C$ depreciated by ¥6.2582 |

? ¥ |

|

d. |

MXN$136,000 |

MXN$13.5869 |

C$ appreciated by MXN$0.4444 |

? MXN$ |

20. Compare the following four situations and determine which one would result in the largest sum of money expressed in Canadian funds.

|

Situation |

Amount |

Exchange Rate per C$ |

|

a. |

65,204 Algerian dinars (DZD) |

DZD65.5321 |

|

b. |

1,807,852 Colombian pesos (COP) |

COP1,781.1354 |

|

c. |

3,692 Israeli new shekels (ILS) |

ILS3.7672 |

|

d. |

30,497 Thai baht (THB) |

THB30.4208 |

The Language of Business Mathematics

assessed value The portion of the market value of a property that is subject to municipal taxes.

buy rate The rate at which a foreign currency is bought; it will always be lower than the mid-rate in terms of money per unit of foreign currency.

cash discount A percentage of the balance owing on an invoice that can be deducted for payment received either in full or in part during the discount period.

credit period The number of interest-free days from the date of commencement before full payment of the invoice is required.

currency appreciation When one currency strengthens relative to another currency, resulting in an ability to purchase more of that other currency than it could previously.

currency depreciation When one currency weakens relative to another currency, resulting in an ability to purchase less of that other currency than it could previously.

date of commencement The first day from which the invoice terms extend forward in time and from which all due dates are established.

discount period The number of days from the date of commencement for which a cash discount is offered.

end-of-month invoice dating A term of payment where the date of commencement is the last day of the same month as indicated by the invoice date.

exchange rate The number of units of a foreign currency that are bought with one unit of the domestic currency, or vice versa.

GST The goods and services tax is a Canadian federal sales tax on most products purchased by businesses and consumers alike.

HST The harmonized sales tax is a tax that combines the GST and PST into a single tax.

market value A snapshot of the estimated selling price of a property at some specified point in time.

mid-rate An exchange rate that does not involve or provide for any charges for currency conversion.

mill rate A tax per $1,000 of assessed value to determine property taxes.

ordinary invoice dating A term of payment where the date of commencement is the same date as the invoice date.

property taxes Annual taxes paid by the owners of real estate to local levying authorities to pay for services such as roads, water, sewers, public schools, policing, fire departments, and other community services.

PST The provincial sales tax is a consumer sales tax administered by Canadian provinces and territories.

receipt-of-goods invoice dating A term of payment where the date of commencement is the day on which the customer physically receives the goods.

sales tax A percent fee levied by a government on the supply of products.

sell rate The rate at which a foreign currency is sold. It is always higher than the mid-rate in terms of money per unit of foreign currency.

tax policy A municipality-based percentage of the market value of a property that is used to convert the market value into an assessed value.

tax rate A tax per $100 of assessed value to determine property taxes.

tax remittance The fulfillment of a tax obligation.

The Formulas You Need to Know

Symbols Used

AV = assessed value of a property

Current Currency = currency you are converting from

Desired Currency = currency you are converting to

Exchange Rate = per-unit conversion rate for current currency

Property Tax = property tax amount

PTR = property tax rate, usually set on a per $100 (tax rate) or per $1,000 (mill rate) basis

Rate = sales tax

Remit = tax remittance

S = selling price

Stax = selling price including taxes

Tax Collected = total tax collected through sales

Tax Paid = total tax paid through purchases

Exercises

Mechanics

- Suppose you own property with a market value of $412,000 in a municipality that has a 60% tax policy. What are your total property taxes if the mill rate is set at 15.4367?

- Convert 140,000 Indian rupees (INR) to Belgian francs (BEF) if the exchange rate is BEF0.6590 per INR.

- Calculate the price including taxes for a product that has a regular selling price of $995.95 in: a) Ontario b) Alberta c) Saskatchewan d)Prince Edward Island

- An invoice for $15,000.00 dated February 16 of a leap year has terms of 3/15, 2/30. What payment in full is required if the payment is received on March 3?

- The exchange rate is US$0.9063 per Canadian dollar. If over the course of a year the Canadian dollar appreciates by $0.0644 per C$, how many more or less US dollars are purchased with C$1,750?

- A company recorded the following purchases and sales throughout the year. Assume all amounts are taxable.

|

Quarter |

Purchases |

Sales |

|

1st |

$2,138,450.25 |

$1,444,297.93 |

|

2nd |

$3,496,821.15 |

$4,989,201.01 |

|

3rd |

$1,265,733.49 |

$6,422,604.19 |

|

4th |

$2,725,706.28 |

$2,003,125.50 |

a) Calculate the GST remittance or refund per quarter.

b)Calculate the HST remittance or refund per quarter in Newfoundland and Labrador.

7) The assessed values in a municipality total $4.986 billion. If the city council needs an operating budget of $100 million, what mill rate should it set for its constituent property owners?

Applications

8. An invoice for $37,650 is dated June 24 with terms of 2/10, 1/30, ROG. Merchandise is received on June 29. If a payment of $20,000 is made on July 5 and another payment of $10,000 is made on July 26, what is the balance remaining on the invoice? Assume all payments are received on the dates indicated.

9. If the price including taxes for an item is $1,968.35 in Quebec, what is the dollar amount of each of the PST and GST on the item?

10. Obiwan is going on vacation to Slovakia and stops at a currency shop in his local airport. He needs to convert C$7,500 to the Slovakian koruna (SKK). The exchange mid-rate per C$ is 21.4624. The shop charges a commission of 6.5% on the conversion, plus a flat fee of C$15.75. How many koruna will Obiwan have?

11. A town in Saskatchewan has residential property values totalling $968 million in market value. The councillors have set the tax policy at 75% of market value. The following is a list of projected municipal expenditures in the coming year.

| Sewers & water |

$5,250,000 |

| Public education |

$13,500,000 |

| City services (fire, police, ambulance) |

$1,115,000 |

| Roads & maintenance |

$3,300,000 |

| Other |

$2,778,000 |

If the council expects to raise 85% of these expenditures from residential property taxes, what mill rate must it set?

- What amount must be remitted if invoices dated January 25 for $1,700, February 1 for $1,800, and February 15 for $900, all with terms of 3/25, n/50, EOM are paid with the same cheque on March 12? Assume it is a non–leap year.

- Many Canadians complain about the high cost of automobile gasoline. In the United States, regular grade gasoline costs approximately $3.652 per gallon (as of June 2011).

- What is the equivalent Canadian cost per liter (rounded to three decimals) if the exchange rate is US$1.0152 per C$? A US gallon is equivalent to 3.7854 litres.

- At the same time, Canadians were paying $1.239 per litre. What percentage more (rounded to two decimals in percent format) than Americans do Canadians pay?

- An invoice for $13,398.25 dated August 27 with terms of 5/10, 2/25, n/45 was partially paid on September 7. If the invoice balance was reduced to $2,598.25, what was the amount of the payment? Assume the payment was received on the date indicated.

Challenge, Critical Thinking, & Other Applications

- In Saint-Lazare, Quebec, the average market value of a residential home in 2010 rose to $308,000 from its previous 2009 value of $262,000. The residential property tax rate was lowered from 2009 to 2010 by 9.8918% to 0.583. In Saint-Lazare, the tax policy is to tax 100% of the market value. By what percentage did the residential property tax bill go up or down in 2010 for a Saint-Lazare residential homeowner?

- What percentage of a tax-inclusive price is each of the GST and PST in the following provinces?

- Quebec

- Manitoba

- It is well known that airport kiosks are much more expensive for currency exchange than visiting a bank. The current mid-rate is $2.4226 Brazilian reals (BRL) per euro. The Banco do Brasil has a sell rate of BRL$2.4710 per euro, while a kiosk at Salvador airport has a sell rate of BRL$2.5473 per euro plus a flat service charge of BRL$3.00. A traveller through the airport wants to convert BRL$2,000 to euros. Assuming the traveller has the time, would it be worth the BRL$15.00 return taxi ride to the nearest bank to convert the currency? How many euros more would the best option present?

- An invoice for $147,477.77 dated July 26 with terms of 5/15, 3½/25, 2/40, EOM was partially paid with two equal payments on August 10 and September 4, reducing the balance owing to $76,579.81. What amount was paid on each of the two dates? Assume the payment was received on the date indicated.

- An American tourist is travelling across Canada and makes the following purchases on her credit card (all purchases are fully taxable):

|

Total |

Province/Territory |

|

$319.95 |

British Columbia |

|

$114.75 |

Alberta |

|

$82.45 |

Northwest |

|

$183.85 |

Manitoba |

|

$59.49 |

Quebec |

|

$123.99 |

Prince Edward |

On the first purchase, the credit card company used an exchange rate of C$1.0412 per US$. Each subsequent purchase used an exchange rate that appreciated (for the US dollar) by 0.2% each time. What total amount in US dollars was charged to the traveller’s credit card?

- A Canadian manufacturer imports 2,000 units of product worth US$262.25 each from an American supplier. These imports are subject to GST on the equivalent Canadian value of the product. All of the product is then sold for C$419.50 each to another Canadian distributor. The sale is subject to GST. Assume an exchange rate of US$0.9345 per C$. If the company needs to submit a GST remittance on this transaction, what amount is remitted or refunded?

Chapter 5 Case Study Completing Summary Financial Reports

The Situation

An accountant at Lightning Wholesale needs to summarize the GST remittances, costs of goods sold, and sales for 2013 by quarter. The table below presents the purchases (in US$) that it made from its American supplier, average monthly supplier cash discounts, total monthly sales (in C$), and the average monthly exchange rate appreciation or depreciation.

The Data

|

Quarter |

Month |

2013 |

Average |

2013 |

C$ |

|

I |

January |

$2,021 |

2.00% |

$1,798 |

Start |

|

February |

$2,200 |

3.00% |

$2,407 |

1.00% |

|

|

March |

$2,531 |

2.50% |

$2,568 |

–0.50% |

|

|

II |

April |

$2,623 |

1.50% |

$2,985 |

0.35% |

|

May |

$2,676 |

1.00% |

$3,114 |

–1.50% |

|

|

June |

$2,805 |

2.00% |

$3,242 |

1.75% |

|

|

III |

July |

$3,309 |

2.25% |

$3,306 |

1.00% |

|

August |

$4,146 |

2.00% |

$3,852 |

0.50% |

|

|

September |

$6,196 |

3.00% |

$4,815 |

–1.40% |

|

|

IV |

October |

$10,981 |

3.00% |

$7,222 |

–0.30% |

|

November |

$8,332 |

3.25% |

$12,839 |

0.90% |

|

|

December |

$1,520 |

1.75% |

$9,630 |

–0.75% |

(all figures are in thousands of dollars)

Important Information

- The imported products require GST to be paid on the equivalent Canadian value of the imported goods before any discounts.

- All sales are subject to GST.

- Lightning Wholesale’s suppliers offer it various cash discounts, which the accounting department always takes advantage of. These discounts have not been deducted from the purchase amounts listed in the table.

Your Tasks

- Calculate the exchange rates for each month throughout the 2013 operating year. Round all exchange rates to four decimals before calculating the next exchange rate.

- Compute quarterly GST remittances.

- Convert monthly purchases into Canadian funds and determine the monthly GST paid to the CBSA (Canada Border Services Agency).

- Assess the monthly GST collected on all sales.

- Complete a quarterly GST remittance table summarizing GST paid, GST collected, and the net amount refunded or remitted in 2013.

- Create a quarterly cost of goods sold and revenue table.

- Apply the average monthly cash discount to the Canadian monthly purchases amounts. Round all answers to the nearest thousands of dollars.

- Create a quarterly table summarizing costs of goods sold and sales with yearly totals of each.

Chapter 5: Accounting Applications (answers to section exercises)

-

5.1 Sales Taxes

- Stax =$682.49

- Stax =$750.74

- Stax =$747.49

- Stax =$727.99

- S = $796.45; HST Tax Amount = $103.54

- S = $818.17; GST Tax Amount = $40.91; PST Tax Amount = $40.91

- January Remit $5,471.40; February Refund $2,202.96

- Winter Remit $7,171.20; Spring Refund $1,025.25; Summer Remit $9,803.30; Fall Refund $1,191.65

- a.Alberta is best = $1,396.45; b. Savings = $17.48

- S =$529.99; GST Tax Amount = $26.50

- Can’t purchase at Stax=$3,050.94; Down Payment = $45.08

- Stax=$4,477.30; GST Tax Amount = $199.88; PST Tax Amount = $279.83

- Q1 Remit $17,865; Q2 Remit $35,370; Q3 Refund $8,105; Q4 Refund $24,210

- March Remit $951.15; April Refund; $1,257.15; May Remit $2,953.65

- Higher in Ontario by 1.5274%

- Total PST = $13.02; Total GST = $52.46; Total HST = $13

- Remit $378,227.85

- PST Rate = 9.505%

- a. S = $352.72; b. S = $1,682.81; c. S = $19,465.09; d. S = $4,736.57

- Remit $31,331.89

-

5.2 Property Taxes

- AV = $176,000;

Property Tax = $4,719.35 - Market Value = 247,272.73; Property Tax = $2,699.00

- Assessed Value = $400,000; Tax Policy = 80%

- Market Value = $1,300,000; Tax Rate = 0.675832

- Property Tax = $5,241.17

- AV = $9,000,000

- Property Tax = $2,250.05

- Municipal Property Tax = $1,975.97; Library Property Tax = $220.01; School Property Tax = $1,481.76; Total Property Tax = $3,677.74

- Tax Rate = 1.109305

- Mill Rate = 8.9929

- Increase the mill rate by 0.3626

- Mill Rate = 14.5412

- 10.0247 and 5.0124

- $192,318.89 and $179,524.86

- Mill Rates Under 70% Policy: 5.6872 then 5.6060; Mill Rates Under 75% Policy: 5.3081 then 5.2322

-

5.3 Exchange Rates and Currency Exchange

- 69,482.40 US$

- 130,500€

- 37,744.20 AU$

- 170,046 AU$

- 322,976.60 C$

- 8,780,200 ¥

- 0.0103 ¥ per C$

- 53,130 C$

- Purchase $518.75 less than before

- a. 2,784 £; b. 4.6739%

- 649.44 C$

- Elena lost $29,489.81 on her investment

- The products cost $12,800 C$ less than before

- 3.5%.

- Buy in the U.S. to save $196.60

- a.Scotiabank’s sell rate fee is 2.3%; The kiosk’s sell rate fee is 4.5%; b. The airport kiosk charges 2.52% more than Scotiabank

- Booking it themselves saves $1,824.98

- Currency fluctuations have decreased profits by $38,432.12

- a. 639.38 US$; b. €15,153.19; c. ¥166,983; d. 140,447.70 MXN$

- Columbia Pesos = $1,084.71 C$

- Benjamin Franklin. Letter to Jean-Baptiste Leroy dated November 13, 1789. ↵