6

Learning Objectives

By the end of the chapter, you should be able to:

- Identify the questions to ask in choosing the appropriate form of ownership for a business.

- Describe the sole proprietorship and partnership forms of organization, and specify the advantages and disadvantages.

- Identify the different types of partnerships, and explain the importance of a partnership agreement.

- Explain how corporations are formed and how they operate.

- Discuss the advantages and disadvantages of the corporate form of ownership.

- Examine special types of business ownership, including limited liability companies, cooperatives, and not-for-profit corporations.

- Define mergers and acquisitions, and explain why companies are motivated to merge or acquire other companies.

Show What You Know

The Ice Cream Men

Who would have thought it? Two ex-hippies with strong interests in social activism would end up starting one of the best-known ice cream companies in the country—Ben & Jerry’s. Perhaps it was meant to be. Ben Cohen (the “Ben” of Ben & Jerry’s) always had a fascination with ice cream. As a child, he made his own mixtures by smashing his favorite cookies and candies into his ice cream.

But it wasn’t until his senior year in high school that he became an official “ice cream man,” happily driving his truck through neighborhoods filled with kids eager to buy his ice cream pops. After high school, Ben tried college but it wasn’t for him. He attended Colgate University for a year and a half before he dropped out to return to his real love: being an ice cream man. He tried college again—this time at Skidmore, where he studied pottery and jewelry making—but, in spite of his selection of courses, still didn’t like it.

In the meantime, Jerry Greenfield (the “Jerry” of Ben & Jerry’s) was following a similar path. He majored in pre-med at Oberlin College in the hopes of one day becoming a doctor. But he had to give up on this goal when he was not accepted into medical school. On a positive note, though, his college education steered him into a more lucrative field: the world of ice cream making. He got his first peek at the ice cream industry when he worked as a scooper in the student cafeteria at Oberlin. So, fourteen years after they first met on the junior high school track team, Ben and Jerry reunited and decided to go into ice cream making big time. They moved to Burlington, Vermont—a college town in need of an ice cream parlor—and completed a $5 correspondence course from Penn State on making ice cream. After getting an A in the course—not surprising, given that the tests were open book—they took the plunge: with their life savings of $8,000 and $4,000 of borrowed funds they set up an ice cream shop in a made-over gas station on a busy street corner in Burlington.[1] The next big decision was which form of business ownership was best for them. This chapter introduces you to their options.

The Canadian Landscape

Innovation, Science and Economic Development Canada (ISED) defines a business based upon the number of paid employees. For this reason, self-employed and “indeterminate” businesses are generally not included in the present publication as they do not have paid employees.

Accordingly, this publication defines an SME (small-to-medium enterprise) as a business establishment with 1–499 paid employees, more specifically:

- A small business has 1 to 99 paid employees.

- A medium-sized business has 100 to 499 paid employees.

- A large business has 500 or more paid employees.

ISED also categorizes businesses with 1-4 employees as micro-enterprises.

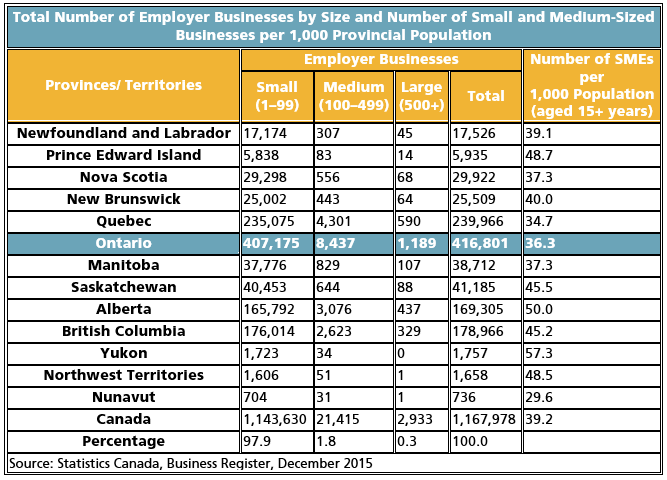

“As of December 2015, there were 1.17 million employer businesses in Canada, as shown in Table 1.1-1. Of these, 1.14 million (97.9 percent) businesses were small businesses, 21,415 (1.8 percent) were medium-sized businesses and 2,933 (0.3 percent) were large enterprises.” (Industry Canada)

Factors to Consider

If you’re starting a new business, you have to decide which legal form of ownership is best for you and your business. Do you want to own the business yourself and operate as a sole proprietorship? Or, do you want to share ownership, operating as a partnership or a corporation? Before we discuss the pros and cons of these three types of ownership, let’s address some of the questions that you’d probably ask yourself in choosing the appropriate legal form for your business.

- In setting up your business, do you want to minimize the costs of getting started? Do you hope to avoid complex government regulations and reporting requirements?

- How much control would you like? How much responsibility for running the business are you willing to share? What about sharing the profits?

- Do you want to avoid special taxes?

- Do you have all the skills needed to run the business?

- Are you likely to get along with your co-owners over an extended period of time?

- Is it important to you that the business survive you?

- What are your financing needs and how do you plan to finance your company?

- How much personal exposure to liability are you willing to accept? Do you feel uneasy about accepting personal liability for the actions of fellow owners?

No single form of ownership will give you everything you desire. You’ll have to make some trade-offs. Because each option has both advantages and disadvantages, your job is to decide which one offers the features that are most important to you. In the following sections we’ll compare three ownership options (sole proprietorship, partnership, corporation) on these eight dimensions.

Sole Proprietorship and Its Advantages

In a sole proprietorship, you make all important decisions and are generally responsible for all day-to-day activities. In exchange for assuming all this responsibility, you get all the income earned by the business. Profits earned are taxed as personal income, so you don’t have to pay any special federal and provincial income taxes.

Disadvantages of Sole Proprietorships

For many people, however, the sole proprietorship is not suitable. The flip side of enjoying complete control is having to supply all the different talents that may be necessary to make the business a success. And when you’re gone, the business dissolves. You also have to rely on your own resources for financing: in effect, you are the business and any money borrowed by the business is loaned to you personally. Even more important, the sole proprietor bears unlimited liability for any losses incurred by the business. The principle of unlimited personal liability means that if the business incurs a debt or suffers a catastrophe (say, getting sued for causing an injury to someone), the owner is personally liable. As a sole proprietor, you put your personal assets (your bank account, your car, maybe even your home) at risk for the sake of your business. You can lessen your risk with insurance, yet your liability exposure can still be substantial. Given that Ben and Jerry decided to start their ice cream business together (and therefore the business was not owned by only one person), they could not set their company up as a sole proprietorship.

Partnership

A partnership (or general partnership) is a business owned jointly by two or more people. About 10 percent of U.S. businesses are partnerships[2] and though the vast majority are small, some are quite large. For example, the big four public accounting firms, Deloitte, PwC, Ernst & Young, and KPMG, are partnerships. Setting up a partnership is more complex than setting up a sole proprietorship, but it’s still relatively easy and inexpensive. The cost varies according to size and complexity. It’s possible to form a simple partnership without the help of a lawyer or an accountant, though it’s usually a good idea to get professional advice.

Professionals can help you identify and resolve issues that may later create disputes among partners.

Provincial and federal governments also support small businesses and offer free resources as well as opportunities for funding. Canada Business Network (@canadabusiness #SMEPME) is a collaborative arrangement among federal departments and agencies, provincial and territorial governments and not-for-profit entities.

It offers webinars and other learning events across the country. For example, Ontario’s Small Business Access, offers workshops, a help line, funding, and provides up-to-date information on legal requirements.

The Partnership Agreement

The impact of disputes can be lessened if the partners have executed a well-planned partnership agreement that specifies everyone’s rights and responsibilities. The agreement might provide such details as the following:

- Amount of cash and other contributions to be made by each partner

- Division of partnership income (or loss)

- Partner responsibilities—who does what

- Conditions under which a partner can sell an interest in the company

- Conditions for dissolving the partnership

- Conditions for settling disputes

Unlimited Liability and the Partnership

A major problem with partnerships, as with sole proprietorships, is unlimited liability: in this case, each partner is personally liable not only for his or her own actions but also for the actions of all the partners. If your partner in an architectural firm makes a mistake that causes a structure to collapse, the loss your business incurs impacts you just as much as it would him or her. And here’s the really bad news: if the business doesn’t have the cash or other assets to cover losses, you can be personally sued for the amount owed. In other words, the party who suffered a loss because of the error can sue you for your personal assets. Many people are understandably reluctant to enter into partnerships because of unlimited liability. Certain forms of businesses allow owners to limit their liability. These include limited partnerships and corporations.

Limited Partnerships

The law permits business owners to form a limited partnership which has two types of partners: a single general partner who runs the business and is responsible for its liabilities, and any number of limited partners who have limited involvement in the business and whose losses are limited to the amount of their investment.

Advantages and Disadvantages of Partnerships

The partnership has several advantages over the sole proprietorship. First, it brings together a diverse group of talented individuals who share responsibility for running the business. Second, it makes financing easier: the business can draw on the financial resources of a number of individuals. The partners not only contribute funds to the business but can also use personal resources to secure bank loans. Finally, continuity needn’t be an issue because partners can agree legally to allow the partnership to survive if one or more partners die.

Still, there are some negatives. First, as discussed earlier, partners are subject to unlimited liability. Second, being a partner means that you have to share decision making, and many people aren’t comfortable with that situation. Not surprisingly, partners often have differences of opinion on how to run a business, and disagreements can escalate to the point of jeopardizing the continuance of the business. Third, in addition to sharing ideas, partners also share profits. This arrangement can work as long as all partners feel that they’re being rewarded according to their efforts and accomplishments, but that isn’t always the case. While the partnership form of ownership is viewed negatively by some, it was particularly appealing to Ben Cohen and Jerry Greenfield. Starting their ice cream business as a partnership was inexpensive and let them combine their limited financial resources and use their diverse skills and talents. As friends they trusted each other and welcomed shared decision making and profit sharing. They were also not reluctant to be held personally liable for each other’s actions.

Corporation

A corporation (sometimes called a regular or C-corporation) differs from a sole proprietorship and a partnership because it’s a legal entity that is entirely separate from the parties who own it. It can enter into binding contracts, buy and sell property, sue and be sued, be held responsible for its actions, and be taxed. Once businesses reach any substantial size, it is advantageous to organize as a corporation so that its owners can limit their liability. Corporations, then, tend to be far larger, on average, than businesses using other forms of ownership. Most large well-known businesses are corporations, but so are many of the smaller firms with which likely you do business.

Ownership and Stock

Corporations are owned by shareholders who invest money in the business by buying shares of stock. The portion of the corporation they own depends on the percentage of stock they hold. For example, if a corporation has issued 100 shares of stock, and you own 30 shares, you own 30 percent of the company. The shareholders elect a board of directors, a group of people (primarily from outside the corporation) who are legally responsible for governing the corporation. The board oversees the major policies and decisions made by the corporation, sets goals and holds management accountable for achieving them, and hires and evaluates the top executive, generally called the CEO (chief executive officer). The board also approves the distribution of income to shareholders in the form of cash payments called dividends.

Benefits of Incorporation

The corporate form of organization offers several advantages, including limited liability for shareholders, greater access to financial resources, specialized management, and continuity.

Limited Liability

The most important benefit of incorporation is the limited liability to which shareholders are exposed: they are not responsible for the obligations of the corporation, and they can lose no more than the amount that they have personally invested in the company. Limited liability would have been a big plus for the unfortunate individual whose business partner burned down their dry cleaning establishment. Had they been incorporated, the corporation would have been liable for the debts incurred by the fire. If the corporation didn’t have enough money to pay the debt, the individual shareholders would not have been obligated to pay anything. They would have lost all the money that they’d invested in the business, but no more.

Financial Resources

Incorporation also makes it possible for businesses to raise funds by selling stock. This is a big advantage as a company grows and needs more funds to operate and compete. Depending on its size and financial strength, the corporation also has an advantage over other forms of business in getting bank loans. An established corporation can borrow its own funds, but when a small business needs a loan, the bank usually requires that it be guaranteed by its owners.

Specialized Management

Because of their size and ability to pay high sales commissions and benefits, corporations are generally able to attract more skilled and talented employees than are proprietorships and partnerships.

Continuity and Transferability

Another advantage of incorporation is continuity. Because the corporation has a legal life separate from the lives of its owners, it can (at least in theory) exist forever.

Transferring ownership of a corporation is easy: shareholders simply sell their stock to others. Some founders, however, want to restrict the transferability of their stock and so choose to operate as a privately-held corporation. The stock in these corporations is held by only a few individuals, who are not allowed to sell it to the general public.

Companies with no such restrictions on stock sales are called public corporations; stock is available for sale to the general public.

Drawbacks to Incorporation

Like sole proprietorships and partnerships, corporations have both positive and negative aspects. In sole proprietorships and partnerships, for instance, the individuals who own and manage a business are the same people. Corporate managers, however, don’t necessarily own stock, and shareholders don’t necessarily work for the company. This situation can be troublesome if the goals of the two groups differ significantly.

Managers, for example, are often more interested in career advancement than the overall profitability of the company. Stockholders might care more about profits without regard for the well-being of employees. This situation is known as the agency problem, a conflict of interest inherent in a relationship in which one party is supposed to act in the best interest of the other. It is often quite difficult to prevent self-interest from entering into these situations.

Another drawback to incorporation—one that often discourages small businesses from incorporating—is the fact that corporations are more costly to set up. When you combine filing and licensing fees with accounting and attorney fees, incorporating a business could set you back by $1,000 to $6,000 or more depending on the size and scope of your business.[3] Additionally, corporations are subject to levels of regulation and governmental oversight that can place a burden on small businesses. Finally, corporations are subject to what’s generally called “double taxation.” Corporations are taxed by the federal and provincial governments on their earnings. When these earnings are distributed as dividends, the shareholders pay taxes on these dividends. Corporate profits are thus taxed twice—the corporation pays the taxes the first time and the shareholders pay the taxes the second time.

The Canadian Comparison

“Incorporation: Tax savings, but more paperwork”, a 2017 article in The Globe and Mail, puts incorporation in to the Canadian perspective:

In Ontario, an incorporated business pays a tax rate of 15 per cent on the first $500,000 of income each year, thanks to the small business tax deduction, and 26.5 per cent for anything beyond that. Rates vary by province. A lower tax rate is one of the key advantages to incorporating a business. However, accountants make the distinction that the taxes aren’t being saved, but instead deferred. That’s because, when the money is taken out of the corporation for personal use, through salary or dividends, the individual winds up paying approximately the same tax rate as if they were a sole proprietor. It’s known as the “theory of integration” in the Canadian tax system.

Most accountants recommend business owners incorporate if they can afford to leave money in the company longer-term with the goal of watching the value of the assets grow.

Another tax advantage comes when it’s time to sell the business. The shares of most Canadian private corporations are eligible for a lifetime capital-gains exemption. In 2016, that exemption amounts to the first $824,176 of capital gains from personal income tax, per shareholder. If the business were a sole proprietorship, any gain from the sale of a private corporation would be taxed.

Another advantage to incorporating is the opportunity to use income splitting among family members. If one spouse makes more money, you can income-split. Over all, both spouses will be in a lower income-tax bracket.

Another advantage of incorporation, beyond taxes, is the ability to shift liability to the corporation and away from the individual. Incorporating can also add credibility; some larger companies require contractors to be incorporated before they can be hired.

The disadvantages to incorporation are increased paperwork and administration. That includes the one-time cost to set up the corporation, including accounting and legal fees, which can run to more than $1,000. Owners also have to file two tax returns, a personal one and a more complicated one for the business.

Five years after starting their ice cream business, Ben Cohen and Jerry Greenfield evaluated the pros and cons of the corporate form of ownership, and the “pros” won. The primary motivator was the need to raise funds to build a $2 million manufacturing facility. Not only did Ben and Jerry decide to switch from a partnership to a corporation, but they also decided to sell shares of stock to the public (and thus become a public corporation). Their sale of stock to the public was a bit unusual: Ben and Jerry wanted the community to own the company, so instead of offering the stock to anyone interested in buying a share, they offered stock to residents of Vermont only. Ben believed that “business has a responsibility to give back to the community from which it draws its support”.[4] He wanted the company to be owned by those who lined up in the gas station to buy cones. The stock was so popular that one in every hundred Vermont families bought stock in the company.[5] Eventually, as the company continued to expand, the stock was sold on a national level.

Other Types of Business Ownership

In addition to the three commonly adopted forms of business organization—sole proprietorship, partnership, and regular corporations—some business owners select other forms of organization to meet their particular needs. We’ll look at several of these options:

- Limited liability companies

- Cooperatives

- Not-for-profit corporations

Limited Liability Companies

How would you like a legal form of organization that provides the attractive features of the three common forms of organization (corporation, sole proprietorship and partnership) and avoids the unattractive features of these three organization forms? The limited liability company (LLC) accomplishes exactly that. This form provides business owners with limited liability (a key advantage of corporations) and no “double taxation” (a key advantage of sole proprietorships and partnerships). Let’s look at the LLC in more detail.

In 1977, Wyoming became the first state to allow businesses to operate as limited liability companies. Twenty years later, in 1997, Hawaii became the last state to give its approval to the new organization form. Since then, the limited liability company has increased in popularity. Its rapid growth was fueled in part by changes in state statutes that permit a limited liability company to have just one member. The trend to LLCs can be witnessed by reading company names on the side of trucks or on storefronts in your city. It is common to see names such as Jim Evans Tree Care, LLC, and For-Cats-Only Veterinary Clinic, LLC. But LLCs are not limited to small businesses. Companies such as Crayola, Domino’s Pizza, Ritz-Carlton Hotel Company, and iSold It (which helps people sell their unwanted belongings on eBay) are operating under the limited liability form of organization. In a limited liability company, owners (called members rather than shareholders) are not personally liable for debts of the company, and its earnings are taxed only once, at the personal level (thereby eliminating double taxation).

We have touted the benefits of limited liability protection for an LLC. We now need to point out some circumstances under which an LLC member (or a shareholder in a corporation) might be held personally liable for the debts of his or her company. A business owner can be held personally liable if he or she:

- Personally guarantees a business debt or bank loan which the company fails to pay.

- Fails to pay employment taxes to the government.

- Engages in fraudulent or illegal behavior that harms the company or someone else.

- Does not treat the company as a separate legal entity, for example, uses company assets for personal uses.

Cooperatives

A cooperative (also known as a co-op) is a business owned and controlled by those who use its services. Individuals and firms who belong to the cooperative join together to market products, purchase supplies, and provide services for its members. If run correctly, cooperatives increase profits for its producer-members and lower costs for its consumer-members. Cooperatives are fairly common in the agricultural community. For example, some 750 cranberry and grapefruit member growers market their cranberry sauce, fruit juices, and dried cranberries through the Ocean Spray Cooperative.[6] More than three hundred thousand farmers obtain products they need for production—feed, seed, fertilizer, farm supplies, fuel—through the Southern States Cooperative.[7] Co-ops also exist outside agriculture. For example, MEC (Mountain Equipment Co-op), which sells quality outdoor gear, has more than 5 million members across the country, who have each paid $5 for their lifetime memberships.The company shares its financial success with its members and also gives back 1% of its sales to maintain participation in the outdoors.

Not-for-Profit Corporations

A not-for-profit corporation (sometimes called a nonprofit) is an organization formed to serve some public purpose rather than for financial gain. As long as the organization’s activity is for charitable, religious, educational, scientific, or literary purposes, it can be exempt from paying income taxes. Additionally, individuals and other organizations that contribute to the not-for-profit corporation can take a tax deduction for those contributions. The types of groups that normally apply for nonprofit status vary widely and include churches, synagogues, mosques, and other places of worship; museums; universities; and conservation groups.

Since Statistics Canada ended its deep collection of nonprofit statistics in 2008, the most recent data available is:

- 170,000 charitable and non profit organizations in Canada

- 85,000 of these are registered charities (recognized by the Canada Revenue Agency).

- The charitable and nonprofit sector contributes an average of 8.1% of total Canadian GDP, more than the retail trade industry and close to the value of the mining, oil and gas extraction industry

- Two million Canadians are employed in the charitable and nonprofit sector

- Over 13 million people volunteer for charities and nonprofits

Do you think these numbers have increased or decreased over the last decade? Why?

Mergers and Acquisitions

Track how quickly you can match some of the more recent, larger mergers or major corporations.

Track how quickly you can match some of the more recent, larger mergers or major corporations.

If you do not see the embedded match game, access it: https://quizlet.com/274512349/match.

The headline read, “Wanted: More than 2,000 in Google hiring spree”.[8] The largest Web search engine in the world was disclosing its plans to grow internally and increase its workforce by more than 2,000 people, with half of the hires coming from the United States and the other half coming from other countries. The added employees will help the company expand into new markets and battle for global talent in the competitive Internet information providers industry. When properly executed, internal growth benefits the firm.

An alternative approach to growth is to merge with or acquire another company. The rationale behind growth through merger or acquisition is that 1 + 1 = 3: the combined company is more valuable than the sum of the two separate companies. This rationale is attractive to companies facing competitive pressures. To grab a bigger share of the market and improve profitability, companies will want to become more cost efficient by combining with other companies.

Though they are often used as if they’re synonymous, the terms merger and acquisition mean slightly different things. A merger occurs when two companies combine to form a new company. An acquisition is the purchase of one company by another.

The Canadian Landscape

In June 2013, Shoppers Drug Mart, Canada’s biggest pharmacy chain merged with Loblaw, Canada’s largest grocery retailer, in a 12.4 billion dollar deal. Rather than cutting into each other’s market share, the deal allows the two companies to play on each other’s strengths. Shoppers has about $1 billion in food sales annually, versus Loblaw’s $30 billion. But Loblaw’s share of the pharmacy market is only five per cent, so adding Shoppers health products and services to Loblaw grocery stores allows the food retailer to expand its services in what it sees as a growing sector: health, wellness and nutrition. (www.cbc.ca). Contrast this merger with an acquisition in that same year. Sobey’s acquired 200 Safeway stores in Western Canada under a 5.8 billion dollar deal. According to news reports, along with 213 Safeway grocery stores — more than 60 percent of which are in Calgary, Vancouver, Edmonton and Winnipeg — Sobeys will also acquire:

- 199 in-store pharmacies;

- 62 gas stations;

- 10 liquor stores;

- 4 primary distribution centres and a related wholesale business; and

- 12 manufacturing facilities.

Sobeys will also get $1.8 billion worth of real estate in the deal.

Another example of an acquisition is the purchase of Reebok by Adidas for $3.8 billion.[9] The deal was expected to give Adidas a stronger presence in North America and help the company compete with rival Nike. Once this acquisition was completed, Reebok as a company ceased to exist, though Adidas still sells shoes under the Reebok brand.

Motives Behind Mergers and Acquisitions

Companies are motivated to merge or acquire other companies for a number of reasons, including the following.

Gain Complementary Products

- Shoppers Drug Mart began to sell President’s Choice products in its merger with Loblaw.

- Loblaw is able to add Shoppers health care products to its shelves.

- Sobey’s gains Safeway’s gas stations and liquors stores in its acquisition.

Attain New Markets or Distribution Channels

- Sobey’s acquired access to 12 manufacturing facilities, 4 distribution centres, and a related wholesale business.

- Loblaw increases access to urban centres where Shoppers are already located, bringing a wider variety of products to customers in densely populated areas.

Realize Synergies

- Integration of the companies’ loyalty programs will provide the two with a vast knowledge base of consumers’ buying habits and provide economies of scale — which, the companies estimate, will translate into savings of about $300 million annually.

- Loblaw’s share of the pharmacy market is only five per cent so adding Shoppers health products and services to its grocery stores will allow the food retailer to expand its services in what it sees as a growing sector: health, wellness and nutrition.

The Less-Friendly Option

Hostile Takeovers: Ben and Jerry’s

What happens, though, if one company wants to acquire another company, but that company doesn’t want to be acquired? The outcome could be a hostile takeover—an act of assuming control that’s resisted by the targeted company’s management and its board of directors. Ben Cohen and Jerry Greenfield, the Ice Cream Men from above, found themselves in one of these situations: Unilever—a very large Dutch/British company that owns three ice cream brands—wanted to buy Ben & Jerry’s, against the founders’ wishes. Most of the Ben & Jerry’s stockholders sided with Unilever. They had little confidence in the ability of Ben Cohen and Jerry Greenfield to continue managing the company and were frustrated with the firm’s social-mission focus. The stockholders liked Unilever’s offer to buy their Ben & Jerry’s stock at almost twice its current market price and wanted to take their profits. In the end, Unilever won; Ben & Jerry’s was acquired by Unilever in a hostile takeover.[10] Despite fears that the company’s social mission would end, it didn’t happen. Though neither Ben Cohen nor Jerry Greenfield are involved in the current management of the company, they have returned to their social activism roots and are heavily involved in numerous social initiatives sponsored by the company.

Solidifying the Vocabulary

Use this quick activity to ensure you understand the vocabulary related to mergers and acquisitions.

Key Takeaways

Important terms and concepts

- A sole proprietorship is a business owned by only one person.

- Advantages include: complete control for the owner, easy and inexpensive to form, and owner gets to keep all of the profits.

- Disadvantages include: unlimited liability for the owner, complete responsibility for talent and financing, and business dissolves if the owner dies.

- A general partnership is a business owned jointly by two or more people.

- Advantages include: more resources and talents come with an increase in partners, and the business can continue even after the death of a partner.

- Disadvantages include: partnership disputes, unlimited liability, and shared profits.

- A limited partnership has a single general partner who runs the business and is responsible for its liabilities, plus any number of limited partners who have limited involvement in the business and whose losses are limited to the amount of their investment.

- A corporation is a legal entity that’s separate from the parties who own it, the shareholders who invest by buying shares of stock. Corporations are governed by a Board of Directors, elected by the shareholders.

- Advantages include: limited liability, easier access to financing, and unlimited life for the corporation.

- Disadvantages include: the agency problem, double taxation, and incorporation expenses and regulations.

- A limited liability company (LLC) is similar to an C-corporation, but it has fewer rules and restrictions than an C-corporation. For example, an LLC can have any number of members.

- A cooperative is a business owned and controlled by those who use its services. Individuals and firms who belong to the cooperative join together to market products, purchase supplies, and provide services for its members.

- A not-for-profit corporation is an organization formed to serve some public purpose rather than for financial gain. It enjoys favorable tax treatment.

- A merger occurs when two companies combine to form a new company.

- An acquisition is the purchase of one company by another with no new company being formed. A hostile takeover occurs when a company is purchased even though the company’s management and Board of Directors do not want to be acquired.