Chapter 3: Evaluating the External Environment

Evaluating the Industry

Learning Objectives

The Purpose of Five Forces Analysis

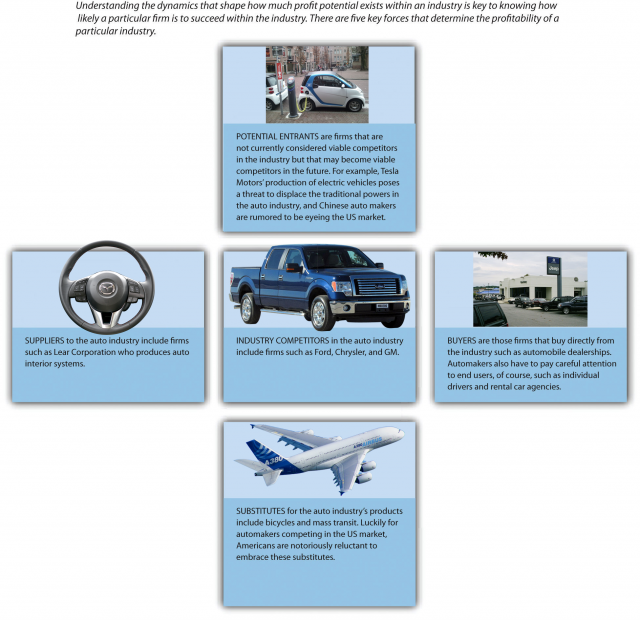

Visit the executive suite of any company and the chances are very high that the chief executive officer and the vice presidents are relying on five forces analysis to understand their industry. Introduced more than thirty years ago by Professor Michael Porter of the Harvard Business School, five forces analysis has long been and remains perhaps the most popular analytical tool in the business world (Figure 3.13 “Industry Analysis”).

The purpose of five forces analysis is to identify how much profit potential exists in an industry. To do so, five forces analysis considers the interactions among the competitors in an industry, potential new entrants to the industry, substitutes for the industry’s offerings, suppliers to the industry, and the industry’s buyers (Porter, 1979). If none of these five forces works to undermine profits in the industry, then the profit potential is very strong. If all the forces work to undermine profits, then the profit potential is very weak. Most industries lie somewhere in between these extremes. This could involve, for example, all five forces providing firms with modest help or two forces encouraging profits while the other three undermine profits. Once executives determine how much profit potential exists in an industry, they can then decide what strategic moves to make to be successful. If the situation looks bleak, for example, one possible move is to exit the industry.

The Rivalry among Competitors in an Industry

The competitors in an industry are firms that produce similar products or services. Competitors use a variety of moves such as advertising, new offerings, and price cuts to try to outmaneuver one another to retain existing buyers and to attract new ones. Because competitors seek to serve the same general set of buyers, rivalry can become intense (Figure 3.15 “Rivalry”). Subway faces fierce competition within the restaurant business, for example. This is illustrated by a quote from the man who built McDonald’s into a worldwide icon. Former CEO Ray Kroc allegedly once claimed that “if any of my competitors were drowning, I’d stick a hose in their mouth.” While this sentiment was (hopefully) just a figure of speech, the announcement in March 2011 that Subway had surpassed McDonald’s in terms of numbers of stores might have increased McDonald’s hostility toward its rival.

Figure 3.15 Rivalry

High levels of rivalry tend to reduce the profit potential of an industry. A number of characteristics that affect the intensity of the rivalry among competitors are described below.

Rivalry among existing competitors tends to be high to the extent that…

- Competitors are numerous or are roughly equal in size and power. As such, no one firm rules the industry, and cutthroat moves are likely as firms jockey for position.

- The growth rate of the industry is slow. A shortage of new customers leads firms to steal each other’s customers.

- Competitors are not differentiated from each other. This forces firms to compete based on price rather than based on the uniqueness of their offerings.

- Fixed costs in the industry are high. These costs must be covered, even if it means slashing prices in order to do so.

- Exit barriers are high. Firms must stay and fight rather than leaving the industry gracefully.

- Excess capacity exists in the industry. When too much of a product is available, firms must work hard to earn sales.

- Capacity must be expanded in large increments to be efficient. The high costs of adding these increments needs to be covered.

- The product is perishable. Firms need to sell their wares before they spoil and become worthless.

Understanding the intensity of rivalry among an industry’s competitors is important because the degree of intensity helps shape the industry’s profit potential. Of particular concern is whether firms in an industry compete based on price. When competition is bitter and cutthroat, the prices competitors charge—and their profit margins—tend to go down. If, on the other hand, competitors avoid bitter rivalry, then price wars can be avoided and profit potential increases.

Every industry is unique to some degree, but there are some general characteristics that help to predict the likelihood that fierce rivalry will erupt. Rivalry tends to be fierce, for example, to the extent that the growth rate of demand for the industry’s offerings is low (because a lack of new customers forces firms to compete more for existing customers), fixed costs in the industry are high (because firms will fight to have enough customers to cover these costs), competitors are not differentiated from one another (because this forces firms to compete based on price rather than based on the uniqueness of their offerings), and exit barriers in the industry are high (because firms do not have the option of leaving the industry gracefully). Exit barriers can include emotional barriers, such as the bad publicity associated with massive layoffs, or more objective reasons to stay in an industry, such as a desire to recoup considerable costs that might have been previously spent to enter and compete.

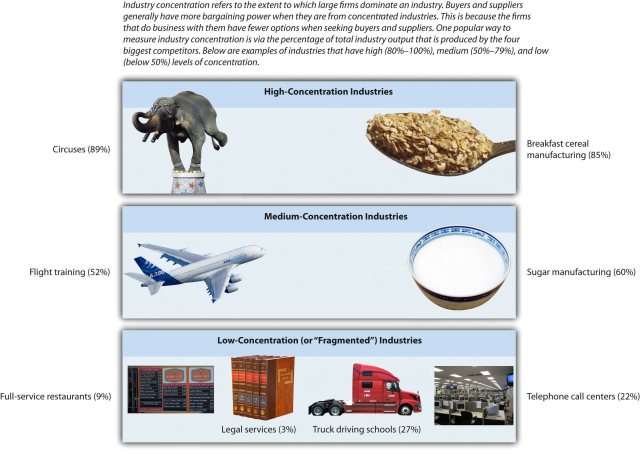

Industry concentration is an important aspect of competition in many industries. Industry concentration is the extent to which a small number of firms dominate an industry (Figure 3.16: “Industry Concentration”). Among circuses, for example, the four largest companies collectively own 89 percent of the market. Meanwhile, these companies tend to keep their competition rather polite. Their advertising does not lampoon one another, and they do not put on shows in the same city at the same time. This does not guarantee that the circus industry will be profitable; there are four other forces to consider as well as the quality of each firm’s strategy. But low levels of rivalry certainly help build the profit potential of the industry.

In contrast, the restaurant industry is fragmented, meaning that the largest rivals control just a small fraction of the business and a large number of firms are important participants. Rivalry in fragmented industries tends to become bitter and fierce. Quiznos, a chain of sub shops that is roughly 15 percent the size of Subway, has aimed some of its advertising campaigns directly at Subway, including one depicting a fictional sub shop called “Wrong Way” that bore a strong resemblance to Subway.

Within fragmented industries, it is almost inevitable that over time some firms will try to steal customers from other firms, such as by lowering prices, and that any competitive move by one firm will be matched by others. In the wake of Subway’s success in offering foot-long subs for $5, for example, Quiznos has matched Subway’s price. Such price jockeying is delightful to customers, of course, but it tends to reduce prices (and profit margins) within an industry. Indeed, Quiznos later escalated its attempt to attract budget-minded consumers by introducing a flatbread sandwich that cost only $2. Overall, when choosing strategic moves, Subway’s presence in a fragmented industry forces the firm to try to anticipate not only how fellow restaurant giants such as McDonald’s and Burger King will react but also how smaller sub shop chains like Quiznos and various regional and local players will respond.

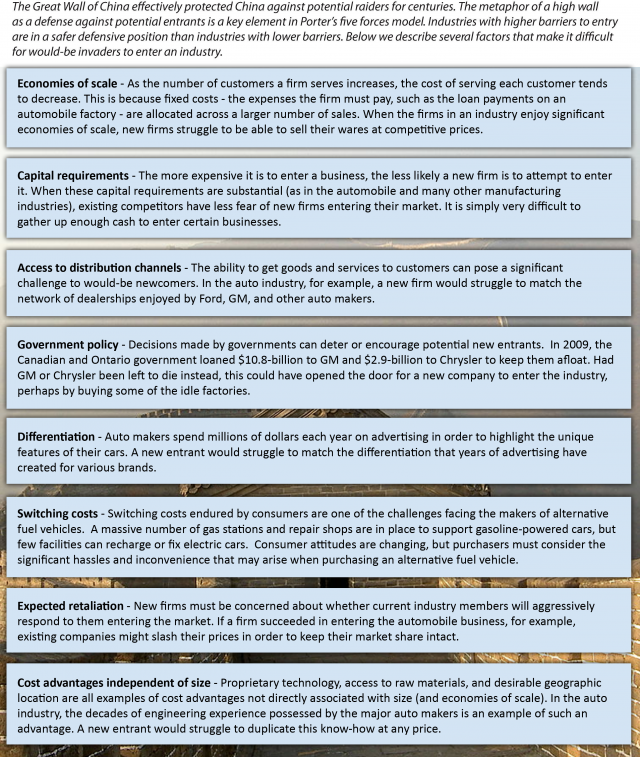

The Threat of Potential New Entrants to an Industry

Competing within a highly profitable industry is desirable, but it can also attract unwanted attention from outside the industry. Potential new entrants are firms that do not currently compete in an industry but might join the industry in the future. (Figure 3.17 “New Entrants”). New entrants tend to reduce the profit potential of an industry by increasing its competitiveness. If, for example, two new firms enter an industry consisting of five firms, this means that seven rather than five firms are now trying to attract the same general pool of customers. Thus executives need to analyze how likely it is that one or more new entrants will enter their industry as part of their effort to understand the profit potential that their industry offers.

New entrants can join the fray within an industry in several different ways. New entrants can be start-up companies created by entrepreneurs, foreign firms that decide to enter a new geographic area, supplier firms that choose to enter their customers’ business, or buyer firms that choose to enter their suppliers’ business. The likelihood of these four paths being taken varies across industries. Restaurant firms such as Subway, for example, do not need to worry about their buyers entering the industry because they sell directly to individuals, not to firms. It is also unlikely that Subway’s suppliers, such as farmers, will make a big splash in the restaurant industry.

On the other hand, entrepreneurs launch new restaurant concepts every year, and one or more of these concepts may evolve into a fearsome competitor. Also, competitors based overseas sometimes enter Subway’s core markets. In 2008, U.S.-based Panera Bread opened its first Canadian stores in Ontario. Panera Bread operates more than 1,500 restaurants in the United States and over a dozen in Canada. Time will tell whether this new entrant has a significant effect on Subway and other restaurant firms. Because a smokehouse turkey panini closely resembles a hamburger, McDonald’s and Burger King may have more to fear from Panera than Subway does.

Every industry is unique to some degree, but some general characteristics help to predict the likelihood that new entrants will join an industry. New entry is less likely, for example, to the extent that existing competitors enjoy economies of scale (because new entrants struggle to match incumbents’ prices), capital requirements to enter the industry are high (because new entrants struggle to gather enough cash to get started), access to distribution channels is limited (because new entrants struggle to get their offerings to customers), governmental policy discourages new entry, differentiation among existing competitors is high (because each incumbent has a group of loyal customers that enjoy its unique features), switching costs are high (because this discourages customers from buying a new entrant’s offerings), expected retaliation from existing competitors is high, and cost advantages independent of size exist.

The Threat of Substitutes for an Industry’s Offerings

Executives need to take stock not only of their direct competition but also of players in other industries that can steal their customers. Substitutes are offerings that differ from the goods and services provided by the competitors in an industry but that fill similar needs to what competitors offer (Figure 3.19 “Substitutes”). How strong a threat substitutes are depends on how effective substitutes are in serving an industry’s customers.

At first glance, it could appear that the satellite television business is a tranquil one because there are only two significant U.S. competitors—DIRECTV and DISH Network. These two industry giants, however, face a daunting challenge from substitutes. The closest substitute for satellite television is provided by cable television firms, such as Comcast and Charter Communications. DIRECTV and DISH Network also need to be wary of streaming video services, such as Netflix, and video rental services, such as Redbox. The availability of viable substitutes places stringent limits on what DIRECTV and DISH Network can charge for their services. If the satellite television firms raise their prices, customers will be tempted to obtain video programs from alternative sources. This limits the profit potential of the satellite television business.

In other settings, viable substitutes are not available, and this helps an industry’s competitors enjoy profits. Like lightbulbs, candles can provide lighting within a home. Few consumers, however, would be willing to use candles instead of lightbulbs. Candles simply do not provide as much light as lightbulbs. Also, the risk of starting a fire when using candles is far greater than the fire risk when using lightbulbs. Because candles are a poor substitute, lightbulb makers such as General Electric and Siemens do not need to fear candle makers stealing their customers and undermining their profits.

The dividing line between which firms are competitors and which firms offer substitutes is a challenging issue for executives. Most observers would agree that, from Subway’s perspective, sandwich-maker Quiznos should be considered a competitor and that grocery stores such as Safeway offer a substitute for Subway’s offerings. But what about full-service restaurants, such as The Keg, and “fast casual” outlets, such as Panera Bread? Whether firms such as these are considered competitors or substitutes depends on how the industry is defined. Under a broad definition—Subway competes in the restaurant business—The Keg and Panera should be considered competitors. Under a narrower definition—Subway competes in the sandwich business—Panera is a competitor and The Keg is a substitute. Under a very narrow definition—Subway competes in the sub sandwich business—both The Keg and Panera provide substitute offerings. Thus clearly defining a firm’s industry is an important step for executives who are performing a five forces analysis.

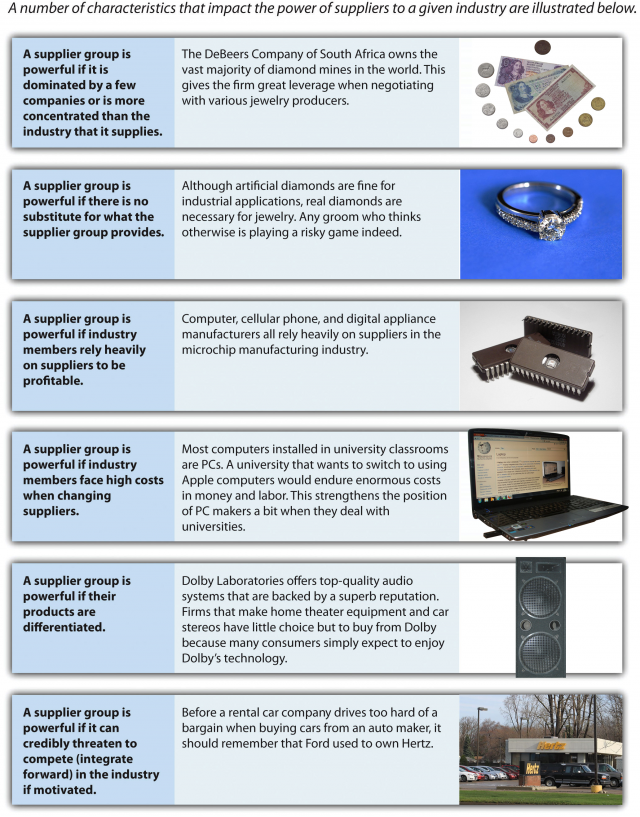

The Power of Suppliers to an Industry

Suppliers provide inputs that the firms in an industry need to create the goods and services that they in turn sell to their buyers. A variety of supplies are important to companies, including raw materials, financial resources, and labor (Figure 3.21 “Suppliers”). For restaurant firms such as Subway, key suppliers include such firms as Sysco that bring various foods to their doors, restaurant supply stores that sell kitchen equipment, and employees that provide labor.

The relative bargaining power between an industry’s competitors and its suppliers helps shape the profit potential of the industry. If suppliers have greater leverage over the competitors than the competitors have over the suppliers, then suppliers can increase their prices over time. This cuts into competitors’ profit margins and makes them less likely to be prosperous. On the other hand, if suppliers have less leverage over the competitors than the competitors have over the suppliers, then suppliers may be forced to lower their prices over time. This strengthens competitors’ profit margins and makes them more likely to be prosperous. Thus when analyzing the profit potential of their industry, executives must carefully consider whether suppliers have the ability to demand higher prices.

Every industry is unique to some degree, but some general characteristics help to predict the likelihood that suppliers will be powerful relative to the firms to which they sell their goods and services. Suppliers tend to be powerful, for example, to the extent that the suppliers’ industry is dominated by a few companies, it is more concentrated than the industry that it supplies and/or there is no effective substitute for what the supplier group provides. These circumstances restrict industry competitors’ ability to shop around for better prices and put suppliers in a position of strength.

Supplier power is also stronger to the extent that industry members rely heavily on suppliers to be profitable, industry members face high costs when changing suppliers, and suppliers’ products are differentiated. Finally, suppliers possess power to the extent that they have the ability to become a new entrant to the industry if they wish. This is a strategy called forward vertical integration a strategy, a strategy that involves a supplier entering the industry to which it supplies product. Ford, for example, used a forward vertical integration strategy when it purchased rental car company (and Ford customer) Hertz. A difficult financial situation forced Ford to sell Hertz for $5.6 billion in 2005. But before rental car companies such as Avis and Thrifty drive too hard a bargain when buying cars from an automaker, their executives should remember that automakers are much bigger firms than rental car companies are. The executives running the automaker might simply decide that they want to enjoy the rental car company’s profits themselves and acquire the firm.

Strategy at the Movies

Flash of Genius

When dealing with a large company, a small supplier can get squashed like a bug on a windshield. That is what college professor and inventor Dr. Robert Kearns found out when he invented intermittent windshield wipers in the 1960s and attempted to supply them to Ford Motor Company. As depicted in the 2008 movie Flash of Genius, Kearns dreamed of manufacturing the wipers and selling them to Detroit automakers. Rather than buy the wipers from Kearns, Ford replicated the design. An angry Kearns then spent many years trying to hold the firm accountable for infringing on his patent. Kearns eventually won in court, but he paid a terrible personal price along the way, including a nervous breakdown and estrangement from his family. Kearns’s lengthy battle with Ford illustrates the concept of bargaining power that is central to Porter’s five forces model. Even though Kearns created an exceptional new product, he had little leverage when dealing with a massive, well-financed automobile manufacturer.

The Power of an Industry’s Buyers

Buyers purchase the goods and services that the firms in an industry produce (Figure 3.23 “Buyers”). For Subway and other restaurants, buyers are individual people. In contrast, the buyers for some firms are other firms rather than end users. For Procter & Gamble, for example, buyers are retailers such as Walmart and Target who stock Procter & Gamble’s pharmaceuticals, hair care products, pet supplies, cleaning products, and other household goods on their shelves.

Figure 3.23 Buyers.

A number of characteristics that impact the power of buyers to a given industry are illustrated below.

| A buyer group is powerful when there are relatively few buyers compared to the number of firms supplying the industry. | Buyers that purchase a large percentage of the seller’s goods and services are more powerful, as Walmart demonstrated by aggressively negotiating with suppliers over the years. |

| A buyer group is powerful when the industry’s goods or services are standardized or undifferentiated. | Subway can drive a hard bargain when purchasing commodities such as wheat and yeast because one vendor’s wheat and yeast is typically identical to another vendor’s. |

| A buyer group is powerful when they face little or no switching costs in changing vendors. | Circuses can find elephants, clowns, and trapeze artists from any source possible. This allows circus managers to shop around for the best prices. |

| A buyer group is powerful when the good or service purchased by the buyers represents a high percentage of the buyer’s costs, encouraging ongoing searches for lower-priced suppliers. | Most consumers pay little attention to prices when buying toothpaste, but many spend hours exhaustively searching the Internet for information on automobile prices. |

| A buyer group is powerful if it can credibly threaten to compete (integrate backward) in the industry if motivated. | Ford and General Motors are well known for threatening to self-manufacture auto parts if suppliers do not provide goods and services at acceptable prices. |

| A buyer group is powerful when the good or service purchased by buyer groups is of limited importance to the quality or price of the buyer’s offerings. | While stereo systems and tires are components that car buyers may be sensitive to when making a purchase decision, auto manufacturers can purchase glass and spark plugs from any vendor as long as they meet quality standards. This gives automakers leverage when negotiating with glass and spark plugs companies. |

The relative bargaining power between an industry’s competitors and its buyers helps shape the profit potential of the industry. If buyers have greater leverage over the competitors than the competitors have over the buyers, then the competitors may be forced to lower their prices over time. This weakens competitors’ profit margins and makes them less likely to be prosperous. Walmart is a good example. The mammoth retailer is notorious among manufacturers of goods for demanding lower and lower prices over time (Bianco & Zellner, 2003). Walmart also launched an aggressive push to have marketers divert their consumer media and marketing budgets into the giant retailer’s growing ad budget and in-store marketing programs, using a simultaneous push to clear underperforming brands off its shelves as extra leverage. Walmart has the power to insist on price concessions because its sales volume is huge (Neff, 2009). One product from one brand makes up a small portion of Walmart’s overall sales, so a product exiting the market would not hurt Walmart. From the perspective of the supplier, however, Walmart is their biggest buyer. If the supplier were to refuse to do business with Walmart, they would miss out on access to a large portion of consumers.

On the other hand, if buyers have less leverage over the competitors than the competitors have over the buyers, then competitors can raise their prices and enjoy greater profits. This description fits the textbook industry quite well. University and college students are often dismayed to learn that an assigned textbook costs $150 or more. Historically, textbook publishers have been able to charge high prices because buyers had no leverage. A student enrolled in a class must purchase the specific book that the professor has selected. Used copies are sometimes a lower-cost option, but textbook publishers have cleverly worked to undermine the used textbook market by releasing new editions after very short periods of time.

Of course, the presence of a very high profit industry is attractive to potential new entrants. Some publishers have entered the textbook market with lower-priced offerings. As well as open educational resources and open textbooks are additional low-cost alternatives to the textbook market. Time will tell whether such offerings bring down textbook prices. Like any new entrant, upstarts in the textbook business must prove that they can execute their strategies before they can gain widespread acceptance. Overall, when analyzing the profit potential of their industry, executives must carefully consider whether buyers have the ability to demand lower prices. In the textbook market at the moment, most buyers do not.

Every industry is unique to some degree, but some general characteristics help to predict the likelihood that buyers will be powerful relative to the firms from which they purchase goods and services. Buyers tend to be powerful, for example, to the extent that there are relatively few buyers compared with the number of firms that supply the industry, the industry’s goods or services are standardized or undifferentiated, buyers face little or no switching costs in changing vendors, the good or service purchased by the buyers represents a high percentage of the buyer’s costs, and the good or service is of limited importance to the quality or price of the buyer’s offerings.

Finally, buyers possess power to the extent that they have the ability to become a new entrant to the industry if they wish. This strategy is called backward vertical integration, a strategy that involves a buyer entering the industry that it purchases goods or services from. TiVo was the pioneer of digital video recorders. This situation changed, however, when media providers grew weary of their relationship with TiVo. The media companies then used a backward vertical integration strategy and started offering their own branded digital video recorders, often bundled with a range of services. Profits that used to be enjoyed by TiVo were transferred at that point to the media companies.

The Limitations of Five Forces Analysis

Five forces analysis is useful, but it has some limitations too. The description of five forces analysis provided by its creator, Michael Porter, seems to assume that competition is a zero-sum game, meaning that the amount of profit potential in an industry is fixed. One implication is that if a firm is to make more profit, it must take that profit from a rival, a supplier, or a buyer. In some settings, however, collaboration can create a larger pool of profit that benefits everyone involved in the collaboration. In general, collaboration is a possibility that five forces analysis tends to downplay. The relationships among the rivals in an industry, for example, are depicted as adversarial. In reality, these relationships are sometimes adversarial and sometimes collaborative. General Motors and Toyota compete fiercely all around the world, for example, but they also have worked together in joint ventures. Similarly, five forces analysis tends to portray a firm’s relationships with its suppliers and buyers as adversarial, but many firms find ways to collaborate with these parties for mutual benefit. Indeed, concepts such as just-in-time inventory systems depend heavily on a firm working as a partner with its suppliers and buyers.

Key Takeaway

“How much profit potential exists in our industry?” is a key question for executives. Five forces analysis provides an answer to this question. It does this by considering the interactions among the competitors in an industry, potential new entrants to the industry, substitutes for the industry’s offerings, suppliers to the industry, and the industry’s buyers.

Exercises

- What are the five forces?

- Is there an aspect of industry activity that five forces analysis seems to leave out?

- Imagine you are the president of your college or university. Which of the five forces would be most important to you? Why?

References

Bianco, B., & Zellner, W. (2003, October 6). Is Wal-Mart too powerful? Bloomberg Businessweek. Retrieved from http://www.businessweek.com/magazine/content/03_40/b3852001_mz001.htm

Neff, J. (2009). Walmart Threatens Suppliers to Gain Their Promotion Dollars. Advertising Age. Retrieved from http://reclaimdemocracy.org/walmart_threatens_suppliers_for_marketing_dollars/

Porter, M. E. (1979, March–April). How competitive forces shape strategy. Harvard Business Review, 137–156.

Image descriptions

Figure 3.13 image description: Industry Analysis.

Understanding the dynamics that shape how much profit potential exists within an industry is key to knowing how likely a particular firm is to succeed within the industry. There are five key forces that determine the profitability of a particular industry.

- Potential entrants are firms that are not currently considered viable competitors in the industry but that may become viable competitors in the future. For example, Tesla Motors’ production of electric vehicles poses a threat to displace traditional powers in the auto industry, and Chinese auto makers are rumoured to be eyeing the American market.

- Suppliers to auto industry include firms such as Lear Corporation who produces auto interior systems.

- Industry competitors in the auto industry include firms such as Ford, Chrysler, and GM.

- Buyers are those firms that but directly from the industry such as automobile dealerships. Automakers also have to pay careful attention to end users, of course, such as individual drivers and rental car agencies.

- Substitutes for the auto industry’s products include bicycles and mass transit. Luckily for automakers competing in the US market, Americans are notoriously reluctant to embrace substitute.

Figure 3.16 image description: Industry Concentration.

Industry concentration refers to the extent to which large firms dominate an industry. Buyers and suppliers generally have more bargaining power when they are from concentrated industries. This is because the firms that do business with them have fewer options when seeking buyer and suppliers. One popular way to measure industry concentration is via the percentage of total industry output that is produced by the four biggest competitors. Below are examples of industries that have high (80 percent to 100 percent), medium (50 percent to 79 percent), and low (below 50 percent) levels of concentration.

- High-concentration industries

- circuses – 89 percent

- breakfast cereal manufacturing 85 percent

- Medium-concentration industries

- flight training – 50 percent

- sugar manufacturing 60 percent

- Low-concentration (or fragmented) industries

- full-service restaurant – 9 percent

- legal service – 3 percent

- truck driving schools – 27 percent

- telephone call centres – 22 percent

Figure 3.17 image description: New Entrants.

The Great Wall of China effectively protected China against potential raiders for centuries. The metaphor of a high wall as a defence against potential entrants is a key element in Porter’s five forces model. Industries with higher barriers to entry are in a safer defensive position than industries with lower barriers. Below we describe several factors that make it difficult for would-be invaders to enter an industry.

- Economies of scale – As the number of customers a firm serves increases, the cost of serving each customer tends to decrease. This is because fixed costs – the expenses the firm must pay, such as the loan payments on an automobile factory – are allocated across a larger number of sales. When the firms in an industry enjoy significant economies of scale, new firms struggle to be able to sell their wares at competitive prices.

- Capital requirements – The more expensive it is to enter a business, the less likely a new firm is to attempt to enter it. When these capital requirements are substantial (as in the automobile and many other manufacturing industries), existing competitors have less fear of new firms entering their market. It is simply very difficult together up enough cash to enter certain businesses.

- Access to distribution channels – The ability to get goods and services to customers can pose a significant challenge to would-be newcomers. In the auto industry, for example, a new firm would struggle to match the network of dealerships enjoyed by Ford, GM, and other auto makers.

- Government policy – made governments can deter or encourage potential new entrants. In 2009, the Canadian and Ontario government loaned SIDS-billion to GM and S2.9•billion to Chrysler to keep them afloat. Had GM or Chrysler been left to die instead, this could have opened the door for a new company to enter the industry, perhaps buying some of the idle factories.

- Differentiation – Auto makers spend millions of dollars each year on advertising in order to highlight the unique features of their cars. A new entrant would struggle to match the differentiation that years of advertising have created for various brands.

- Switching costs – Switching costs endured by consumers are one of the challenges facing the makers of alternative fuel vehicles. A massive number of gas stations and repair shops are in place to support gasoline-powered cars, but few facilities can recharge or fix electric cars. Consumer attitudes are changing, but purchasers must consider the significant hassles and inconvenience that may arise when purchasing an alternative fuel vehicles.

- Expected retaliation – New firms must be concerned about whether current industry members will aggressively respond to them entering the market. If a firm succeeded in entering the automobile business, for example, existing companies might slash their price in order to keep their market share intact.

- Cost advantages independent of size – Proprietary technology, access to raw material, and desirable geographic location are all examples of cost advantages not directly associated with size (and economies of scale). In the auto industry, the decades of engineering experience possessed by the major auto makers is an example of such an advantage. A new entrant would struggle to duplicate this know-how at any price.

Figure 3.19 image description: Substitutes.

A substitute teacher is a person who fills in for a teacher. Some substitute teachers are almost as good as the “real” teacher while others are woefully inadequate. In business the competitors in an industry not only must watch each other, they firms in other industries whose products or services can serve as effective substitutes for their offerings. In some cases, substitutes are so effective that they are said to “disrupt” the industry, meaning they kill most or all industry demand. Below we note a number of effective substitutes for particular industries.

- Cooking at home can be an effective substitute for eating at restaurants, especially in challenging economic times.

- Emails and faxes are less expensive substitutes for some of Canada Post’s offerings. Meanwhile, text messages can serve as substitutes for many e-mails.

- Typewriting classes were once common in schools. But once personal computers and printer became widely accepted, the typewriter industry declined dramatically.

- Railroads once held almost a monopoly position on freight transportation. However, the rise of the trucking industry reduced demand for the railroad industry services.

- Bell TV’s commercials compare the firm’s offerings not only to what its fellow satellite television providers, Shaw Direct and Telus TV provide, but also to those of a close substitute – cable television companies.

Figure 3.21 image description: Suppliers.

A number of characteristics that impact the power of suppliers to a given industry are illustrated

- A supplier group is powerful if it is dominated by a few companies or is more concentrated than the industry that it supplies. The DeBeers Company of South Africa owns the vast majority of diamond mines in the world. This gives the firm great leverage when negotiating with various jewelry producers.

- A supplier group is powerful if there is no substitute for what the supplier group provides. Although artificial diamonds are fine for industrial applications, real diamonds are necessary for jewelry. Any groom who thinks otherwise is playing a risky game indeed.

- A supplier group is powerful if industry members rely heavily on suppliers to be profitable. Computer, cellular phone, and digital appliance manufacturers all rely heavily on suppliers in the microchip manufacturing industry.

- A supplier group is powerful if industry members face high costs when changing suppliers. Most computers installed in university classrooms are PCs. A university that wants to switch to using Apple computers would endure enormous costs in money and labor. This strengthens the position of PC makers a bit when they deal with universities.

- A supplier group is powerful if their products are differentiated. Dolby Laboratories offers top-quality audio systems that are backed by a superb reputation. Firms that make home theatres equipment and car stereos have little choice but to buy from Dolby because many consumers simple expect Dolby’s technology.

- A supplier group is powerful if it can credibly threaten to compete (integrate forward) in the industry if motivated. Before a rental car company drives too hard of a bargain when buying cars from an auto maker, it should remember that Ford used to own Hertz.

A technique for understanding an industry by examining the interactions among competitors, potential new entrants, substitutes for the industry’s offerings, suppliers to the industry, and the industry’s buyers.

The set of firms that produces goods or services within an industry.

Factors that make it difficult for a firm to stop competing in an industry.

Firms that do not currently compete in an industry but might join the industry in the future.

Offerings from other industries that fulfill the same need or a very similar need as an industry’s products or services.

Providers of inputs that the competitors in an industry need to create goods or services.

Involves a supplier entering the industry to which it supplies product.

Purchasers of the goods or services that the competitors in an industry create.

a strategy that involves a buyer entering the industry that it purchases goods or services from