Putting It Together: Government and Politics

In this module, you learned about government and the ways that political institutions influence society. Government is an overarching social institution which, through its power and authority, governs the affairs of citizens. Types of government may include a variety of forms, some voluntary and some involuntary. Regardless of the type of political system, we can say that the government strongly impacts society and societal interactions, particularly in regards to economic issues, which we cover in more detail in another module.

One example of the interconnectedness between government, politics, and economics is the emphasis on raising the minimum wage in recent years. In 2016, California became the first state to adopt legislation that gradually raised the minimum wage to $15 per hour. New York City, Seattle, and Washington D.C. also established plans to phase in a $15-per-hour wage floor. Other states raised wages above the federally mandated rate, according to the National Conference of State Legislators. On August 1, 2016, for example, Minnesota’s minimum wage rose to $9.50 per hour at the state’s largest companies. As of December of 2018, 29 states and D.C. had minimum wages above the federally-established minimum wage of $7.25.[1]

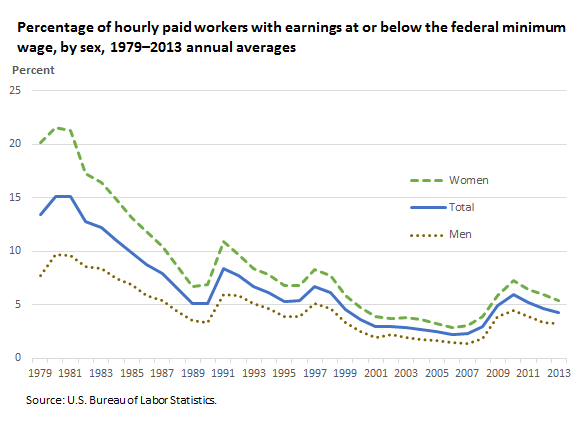

The changes come after years of national debate about the need to raise pay so families can earn a living wage. The U.S. federal minimum wage was first established during the Depression, and it has risen from 25 cents to $7.25 per hour since it was first instituted in 1938 as part of the Fair Labor Standards Act. Despite the increases, inflation has eroded its value; returning it to the value it held in 1968 would require an increase to nearly $10 per hour. In his 2013 State of the Union address, President Obama called for raising the minimum wage to $9 per hour, which in adjusted terms would put it back at its early 1980s level. According to administration estimates, this would boost the wages of some 15 million people. Supporters of these efforts note that women and racial/ethnic minorities in particular are likely to benefit significantly.

But increasing the minimum wage may have impacts beyond adding more money to employees’ pockets. A Purdue University study released in July 2015 suggests that paying fast-food restaurant employees $15 an hour could lead to higher prices, as any economist would argue. Prices at those businesses could increase by an estimated 4.3 percent, according to the report.

Earlier studies have indicated that some businesses will cut jobs to pay employees more. In February 2014, the nonpartisan Congressional Budget Office issued a report, “The Effects of a Minimum-Wage Increase on Employment and Family Income,” that explores two scenarios: Raising the minimum wage to $10.10 or to $9.00. The report concludes that there are distinct trade-offs. Under the $10.10 scenario, there would likely be a reduction of about 500,000 workers across the labor market, as businesses shed jobs, but about 16.5 million low-wage workers would see substantial gains in their earnings in an average week. Under the $9.00 scenario, the labor force would see a reduction of 100,000 jobs, but an estimated 7.6 million low-wage workers would see a boost in their weekly earnings. This is one example of the role of government and politics on economics and how policy influences directly— and further illustrates the complexity of policymaking. What would you do if you had the political power to make a decision about minimum wage?

Critics assert that the real effects of minimum-wage increases are negative: they hurt businesses, raise prices and ultimately are counterproductive for the working poor, as they can lead to unemployment. For a good sense of the partisan argument — and the statistics and studies that are often cited — see these position pieces from the right-leaning American Enterprise Institute and the left-leaning Center for American Progress. At the macro level, a substantial increase in the federal minimum wage is likely to have broad effects, with some studies predicting that it could “ripple” across the economy, boosting the wages of nearly 30 percent of the American workforce.

The best starting point for understanding the debate may be a factual picture of minimum-wage earners, as there are many myths. The U.S. Bureau of Labor Statistics (BLS) reported the following for the year of 2017:[2]

- 542,000 workers earned federal minimum wage.

- 1.3 million workers earned below the federal minimum wage.

- Combined, those earning at or below minimum wage constituted 2.3 percent of all hourly paid workers.

- Minimum wage workers were generally young, and half of those paid the federal minimum wage or less were under 25.

- Those with fewer years of education were more likely to earn federal minimum wage or below it.

<a style="margin-left: 16px;" target="_blank" href="https://docs.google.com/document/d/1vy-T6DtTF-BbMfpVEI7VP_R7w2A4anzYZLXR8Pk4Fu4"

- Center on Budget and Policy Priorities (December 2018)."Policy Basics: The Minimum Wage." Retrieved from https://www.cbpp.org/research/economy/policy-basics-the-minimum-wage. ↵

- BLS Reports (March 2018). Characteristics of minimum wage workers, 2017. Retrieved from https://www.bls.gov/opub/reports/minimum-wage/2017/pdf/home.pdf. ↵