12.6 Putting It Together: Place: Distribution Channels

Let’s return to our earlier example of Whole Foods’ and Trader Joe’s distribution strategies now that we understand much more about marketing channels and supply chains. Whole Foods and Trader Joe’s use very different approaches to source their products, place stores, and get the products to the stores. Both companies have developed these strategies because of their missions and their focus on delivering value to target customers. Is one of the distribution strategies better than the other, or are they both using successful but different strategies?

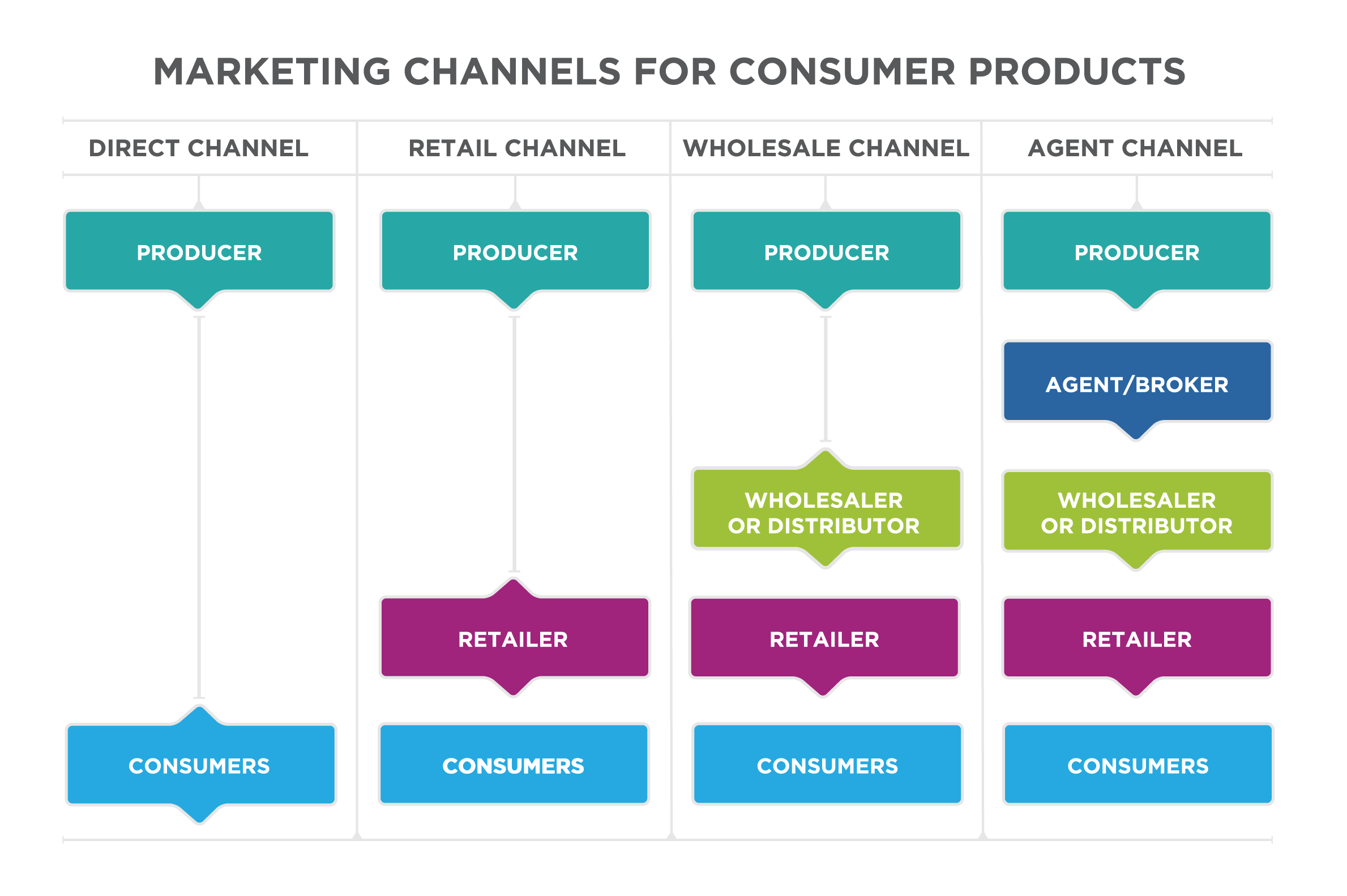

Marketing Channels

Both companies use the retail channel and deal directly with suppliers.

Both companies use the retail channel and deal directly with suppliers.

In the case of fruits and vegetables, Whole Foods has buying relationships with local farmers (producers) who supply the store with seasonal produce. Thus, if one farmer is unable to produce a sufficient amount of yellow corn or heirloom tomatoes, the shortfall can be made up by another farmer. Although challenging to perfect, these short supply chains are agile and difficult for other big retailers to duplicate.

Trader Joe’s also buys directly from producers. It offers manufacturers detailed specifications for new products along with the price it will pay, but then it leaves it up to the vendors to create innovative high-quality items. In return, Trader Joe’s expects a high level of secrecy from its suppliers, even going so far as to force them to not publicly acknowledge their business relationship. Trader Joe’s does this because it doesn’t want other vendors, customers, or competitors to know where it gets its products. In most cases vendors agree to this cloak of secrecy because they are typically producing a lower-cost version of a product for Trader Joe’s than for their other customers, and they do not want to create pricing pressure with other customers by disclosing this.

Sourcing

Whole Foods emphasizes the quality of its products, requiring that stores must not stock products with artificial flavors, preservatives, colours, sweeteners, or hydrogenated oils.[1] Due to this focus on quality, customers pay a premium for Whole Foods’ one-of-a-kind produce selection and quality. Because of its high prices, Whole Foods has been dubbed “Whole Paycheck.” Nonetheless, loyal customers are happy to pay them. Whole Foods does not compete with other grocers on price and has no intention of ever competing in that arena. And since many of its products cannot be found anywhere else, Whole Foods exerts enormous leverage in terms of its pricing power. Furthermore, Whole Foods filters its product offerings and only carries pure, unadulterated foods. This is a strong differentiator, which adds value from the customer’s perspective. Historically, Whole Foods has been able to sell this high-quality merchandise at a price that provides strong profits, in spite of the higher costs.

Trader Joe’s manages its supply chain by relying on its successful private-label brands. Eighty percent of Trader Joe’s products are developed either in-house or are created by suppliers exclusively for Trader Joe’s; average stores carry only 16 percent local products. This strategy allows Trader Joe’s to differentiate from its competitors and reduce its marketing costs, and selling its own in-house brands reduces the number of SKUs in its stores. This collapses the number of supplier relationships and leads to a more efficient and controllable supply chain.[2]

Distribution Networks and Inventory Management

As Whole Foods has increased the number of retail centers it operates, it has suffered growing pains in efficiently managing distribution of products to its stores. The chain is growing at such a fast rate that it struggles to keep up with demand for products and keep shelves stocked. The single biggest reason for inefficiency is Whole Foods’ almost completely decentralized back end. It has twelve geographic divisions, a national headquarters in Austin, regional distribution centers, bakery facilities, kitchens, seafood processing facilities, meat and produce procurement centers, and a specialty-coffee/tea procurement operation.[3] Each geographic division has its own office, regional president, and oversees its own store network. Many outsiders scoff at its supply chain and consider it amateurish and lacking in professionalism. But with the ample margins that Whole Foods commands for its products, it doesn’t face immediate pressure to improve efficiencies.

The stores operate under minimal governance and are given maximum freedom to source a product mix that is appropriate for their location. Whole Foods stores operate under the premise that they need these freedoms to meet the unique buying needs of its local customers. The only governing rule put in place by the corporate office is that stores must not stock products with artificial flavors, preservatives, colours, sweeteners, or hydrogenated oils. A down side to this local purchasing policy is that consistency is compromised across the chain. Every retail location carries a variety of products that distinguishes it from other stores in the same chain. Not surprisingly, it is difficult to achieve economies of scale.

Trader Joe’s manages its distribution networks by minimizing the number of hands that touch the product, thereby reducing costs and making products quickly available to their customers. You’ll recall that Trader Joe’s orders directly from the manufacturer. The manufacturer, in turn, is responsible for bringing the product to a Trader Joe’s distribution center. At the distribution center, trucks leave on daily resupply trips to local stores. Because of the average store’s small size, there is little room for excess inventory, and orders from distribution centers need to be incredibly accurate.

Trader Joe’s primary success factor has been its inventory-sourcing and pricing model: it limits its stock to specialty products that it can sell at very low prices. This is accomplished by purchasing large quantities of specialty goods (that do not interest conventional supermarkets), thereby securing low prices. Customers are able to purchase unique products that guarantee value. This strategy also means that customers buy more because Trader Joe’s sells twice as much per square foot compared to other supermarkets. It achieves these quantities by focusing on a smaller range of products—typically carrying around 2,000 SKUs, whereas the typical grocery store carries upwards of 30,000.[4] This small figure is likely exacerbated by the size of the store (one-third the square footage of an average supermarket) and cramped aisles.

The Results

Whole Foods’ stock price has declined sharply since February 2015, while Trader Joe’s continues to thrive. Lower-cost competitors like Walmart and Kroger’s saw Whole Foods’ high prices and margins and have been able to add high-quality organic products to their offerings at a lower price because of supply chain and distribution efficiencies. In other words, Whole Foods’ sourcing strategy, once thought to be a sustainable competitive advantage, can in fact be replicated more efficiently by competitors. The press coverage of some of the challenges is highlighted below:

Whole Foods Market Inc., which has long given its local managers and regional bosses broad discretion over everything from buying cheese to store design, is whittling away at some of that autonomy in an effort to reduce costs and boost its clout with suppliers.

As stiffer competition erodes its profit growth, the natural and organic foods retailer is tweaking its management style by centralizing and streamlining some functions. The changes could be risky for the company as it tries to wring more efficiency from its stores without sacrificing the local flavor and specialty offerings that have been a cornerstone of its success.

Whole Foods is shifting more responsibility for buying packaged foods, detergents, and other nonperishable items for the more than 430 stores to its Austin, Texas, headquarters. It is deploying software to simplify labor-intensive tasks like scheduling staff and replenishing shelves.[5]

In the meantime, Trader Joe’s continues to lead the industry in sales per square foot and has carefully accelerated the addition of new stores. The graph below shows sales per square foot and new store openings for both chains and their competitors.

| Grocery Store | Average sales per square foot | Planned store openings |

|---|---|---|

| Trader Joe’s | $1,723 | 30 |

| Whole Foods | $937 | 38 |

| Publix | $552 | 30 |

| Kroger | $496 | 15 |

| Sprouts Farmers Market | $490 | 20 |

| The Fresh Market | $490 | 20 |

| Harris Teeter | $442 | 20 |

| Natural Grocers | $419 | 5 |

| Roundy’s | $393 | 2 |

| Weis Markets | $335 | 3 |

| Ingles | $325 | 10 |

When consumers are asked, “When you are next in the market to purchase products in this specific category, from which of the following would you consider purchasing?” many more consumers turn to Trader Joe’s than Whole Foods. The graph below charts consumer responses to this question.

Trader Joe’s emphasis on sustained differentiation in its sourcing and a highly efficient supply chain and distribution network have proven to be the winning combination. Whole Foods is now trying to replicate that, but with intense competitive pressure and industry scrutiny.

- "Quality Standards." Whole Foods Market. March 04, 2019. Accessed March 04, 2019. https://www.wholefoodsmarket.com/quality-standards. ↵

- Lutz, Ashley. "How Trader Joe's Sells Twice As Much As Whole Foods." Business Insider. October 07, 2014. Accessed March 04, 2019. http://www.businessinsider.com/trader-joes-sales-strategy-2014-10. ↵

- Whole Foods Market Annual Report (2009), pg. 10 ↵

- Kowitt, Beth. “Inside the Secret World of Trader Joes.” Fortune Magazine. http://money.cnn.com/2010/08/20/news/companies/inside_trader_joes_full_version.fortune/ August 2010 ↵

- Brat, Ilan. "Whole Foods Works to Reduce Costs and Boost Clout with Suppliers." The Wall Street Journal. February 14, 2016. Accessed September 16, 2019. https://www.wsj.com/articles/whole-foods-works-to-reduce-costs-and-boost-clout-with-suppliers-1455445803 ↵